To Get More Information on Aircraft Electric Motors Market - Request Sample Report

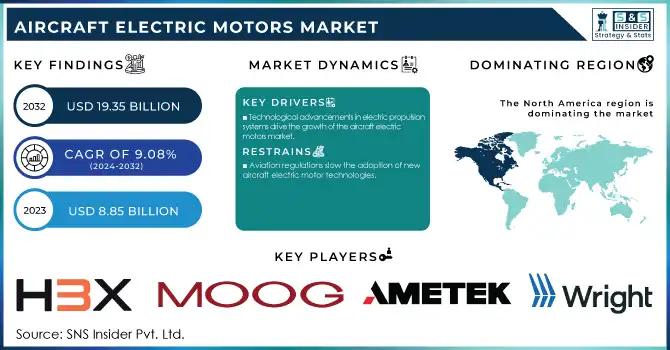

The Aircraft Electric Motors Market size was valued at USD 8.85 billion in 2023 and is expected to reach USD 19.35 billion by 2032 and grow at a CAGR of 9.08% over the forecast period 2024-2032.

The Aircraft Electric Motors Market is rapidly expanding due to the growing demand for sustainable aviation solutions. As airlines and aircraft manufacturers strive to reduce carbon emissions and align with global sustainability goals, electric propulsion systems are becoming a key focus. Innovations in electric aircraft technology, particularly hybrid-electric and fully electric aircraft, are expected to drive significant growth in this sector.

Governments are implementing stringent emissions regulations, pushing for cleaner technologies like electric propulsion. Technological advancements, particularly in electric motors, are essential to this transition. Companies such as Collins Aerospace, MagniX, and Rolls-Royce are leading the charge in developing more efficient and environmentally friendly electric propulsion systems, improving motor efficiency, power output, and reliability. Moreover, the development of high-density batteries and lightweight materials is enhancing the viability of electric motors for commercial aircraft.

Additionally, the rise of Urban Air Mobility (UAM), including electric vertical takeoff and landing (eVTOL) aircraft, is driving demand for electric motors. Companies like Joby Aviation and Vertical Aerospace are at the forefront of this revolution. The hybrid-electric aircraft segment is expected to grow faster, benefiting from government support and the demand for energy-efficient solutions. By 2032, the market is set to experience robust growth, with electric propulsion systems anticipated to play a pivotal role in decarbonizing aviation. Efficiency improvements, such as electric drivetrains achieving over 90% efficiency compared to just 55% for large turbofans, further highlight the critical role of electric motors in shaping the future of aviation.

Drivers

Technological advancements in electric propulsion systems are one of the primary drivers for the growth of the aircraft electric motors market.

The development of megawatt-class motors, such as MIT's megawatt motor for commercial aircraft, represents a groundbreaking innovation in electric aviation. These motors have the potential to significantly cut emissions and fuel consumption while enhancing overall performance. Hydrogen-electric propulsion systems are also emerging as a cleaner alternative to traditional jet engines. By generating electricity through a hydrogen-oxygen reaction, these systems produce only water as a byproduct, offering a sustainable way to reduce carbon emissions. Moreover, hydrogen-electric aircraft can mitigate contrail formation, responsible for up to 40% of aviation's climate impact, by eliminating harmful emissions like CO2 and NOx entirely.

Hybrid-electric propulsion systems are gaining momentum as well. GE Aerospace's successful demonstration of a hybrid system combining the CT7 turboshaft engine with electric power systems for the U.S. Army marks a significant step in optimizing this technology for commercial and military use. These systems promise extended ranges and increased payload capacities.

Ampaire’s hybrid-electric EEL demonstrator has set notable benchmarks, including covering 27,000 miles in flight and achieving a 50% reduction in fuel consumption. With their AMP-H570 hybrid powertrain, Ampaire demonstrated near-zero carbon emissions using 100% sustainable aviation fuel (SAF), achieving double the fuel efficiency while preserving 95-98% of the aircraft's capacity. Fully electric aircraft concepts are also advancing rapidly, further pushing the boundaries of sustainable aviation.

In 2023, Dutch startup Elysian Aircraft unveiled its E9X concept, a 90-passenger regional aircraft with a range of 500 miles (805 km), featuring distributed propulsion with eight electric propellers. Whisper Aero also introduced its Whisper Jetliner, designed for 100 passengers with a range of 769 miles (1,238 km). These developments, along with the hybrid-electric systems, are essential in propelling the aircraft electric motors market toward a more sustainable future.

Restraints

Aviation regulations slow the adoption of new aircraft electric motor technologies.

Electric propulsion systems, including advanced motors and batteries, require entirely new certification frameworks to meet safety, reliability, and environmental standards. Regulatory authorities like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) enforce rigorous airworthiness requirements, including performance under extreme conditions, durability, and fail-safe mechanisms. These processes often involve extensive documentation, testing, and multiple refinements, leading to certification timelines spanning years. Electric propulsion systems face additional scrutiny due to unique challenges like battery thermal management, motor redundancy, and integration with air traffic systems. The nascent stage of these technologies further complicates the process, as both manufacturers and regulators are navigating uncharted territory. This has resulted in delays in the commercialization of electric vertical take-off and landing (eVTOL) aircraft and hybrid-electric regional planes, stalling market expansion. The lack of globally harmonized standards adds to the complexity, with manufacturers needing to comply with varying certification criteria across jurisdictions, driving up costs and delaying market entry. Regions like Asia-Pacific, with evolving regulatory frameworks, amplify these challenges for companies seeking to establish a foothold. Addressing these barriers requires collaboration between regulators and industry stakeholders to streamline approval processes without compromising safety. Accelerated certifications are crucial for fostering innovation, enabling faster market growth, and aligning the aviation industry with its sustainability objectives.

By Type

The AC motor segment dominated the Aircraft Electric Motors Market, accounting for 65% of the revenue in 2023. AC motors are widely preferred in electric aircraft due to their high efficiency, durability, and ability to operate at variable speeds, which are crucial for aircraft propulsion systems. These motors are particularly well-suited for applications in both small and large aircraft, offering a high power-to-weight ratio, a key factor in aviation. Additionally, AC motors are more reliable and require less maintenance compared to other motor types, such as DC motors. The growth of this segment is driven by advancements in motor technology, which improve energy efficiency and reduce operational costs, further boosting their adoption in the aerospace industry.

By Output

The 10 to 200 kW output segment captured the largest share of the Aircraft Electric Motors Market, accounting for around 75% of the revenue in 2023. This range of output is ideal for small to medium-sized electric aircraft and hybrid-electric propulsion systems, which are increasingly being developed for short regional flights and urban air mobility applications. Motors in this range offer an optimal balance between power, weight, and efficiency, making them suitable for aircraft that require reliable performance without compromising fuel efficiency. As electric aviation continues to advance, the 10 to 200 kW motors are increasingly being adopted for various applications, from eVTOL aircraft to regional aircraft, owing to their scalability, cost-effectiveness, and ability to meet stringent aviation safety and performance standards. This segment’s growth is further fueled by innovations in battery technology and propulsion systems, which are enhancing the range and capabilities of electric aircraft.

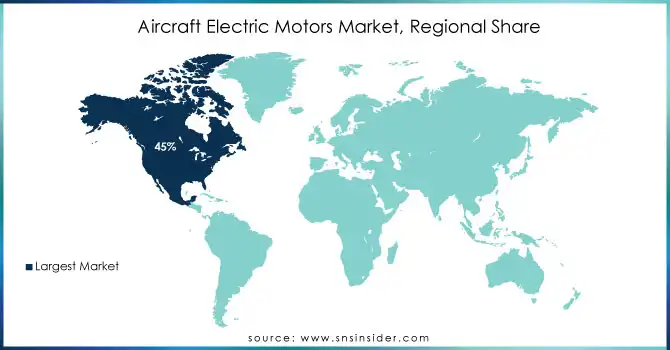

North America held the largest share of the Aircraft Electric Motors Market in 2023, capturing around 45% of the revenue. The region's dominance is attributed to significant investments in electric aviation technology, supported by government incentives and strong environmental policies. The U.S. leads with major players like Joby Aviation, Lilium, and Ampaire, advancing electric and hybrid-electric propulsion systems. The U.S. Department of Defense’s focus on hybrid-electric aircraft for military applications further accelerates innovation. Canada is also contributing with developments in electric vertical takeoff and landing (eVTOL) aircraft. North America’s well-established aerospace infrastructure, research and development efforts, and favorable regulatory environment make it the leading region in the electric aircraft market, positioning it for continued growth.

Asia-Pacific is the fastest-growing region in the Aircraft Electric Motors Market in 2023. This growth is driven by increasing investments in electric aviation technology, government initiatives to promote sustainable transportation, and expanding urban air mobility (UAM) projects. Countries like China, Japan, and India are at the forefront of developing electric aircraft technologies. China is actively investing in electric aviation, with companies like EHang leading in autonomous eVTOL aircraft development. Japan is focusing on hybrid-electric aircraft, with major players like SkyDrive and Terrafugia making significant strides in the eVTOL sector. India is also exploring electric aircraft for regional connectivity and urban mobility. The region benefits from a growing demand for greener alternatives, propelling rapid advancements in electric propulsion systems and infrastructure developments.

Do You Need any Customization Research on Aircraft Electric Motors Market - Inquire Now

Some of the major key Players in Aircraft Electric Motors Market with their product:

H3X Technologies Inc. (Electric Propulsion Motors for Aircraft)

Moog Inc. (Electric Motor Systems for Aerospace)

Ametek, Inc. (Electric Propulsion Motors for Aircraft)

Wright Electric (Electric Propulsion Systems for Aircraft)

MagniX Corporation (Magni500)

Siemens AG (Shaft Power Electric Motors)

Honeywell International Inc. (Hybrid Electric Propulsion Systems)

Safran SA (E-Fan X Hybrid-Electric Motor)

Rolls-Royce Holdings plc (Electric Aircraft Motor System)

GE Aviation (Electric Propulsion Systems)

Raytheon Technologies Corporation (Electric Propulsion Systems)

YASA Limited (High-Power Density Electric Motors)

Pipistrel (Electric Aircraft Motors)

Joby Aviation (Electric Propulsion Motors for eVTOL)

Vertical Aerospace (VA-X4 Electric Propulsion)

Lilium (Lilium Jet Electric Motors)

Eviation Aircraft (Alice Electric Aircraft Motor)

AeroVironment (Electric Motors for UAVs)

Zunum Aero (Hybrid-Electric Aircraft Motors)

Harbour Air (Electric Propulsion Conversion)

List of 25 key suppliers of raw materials for the Aircraft Electric Motors Market, which includes manufacturers of materials used in electric motor production:

Alcoa Corporation – Aluminum and aluminum alloys

Rio Tinto – Aluminum and copper

Sumitomo Metal Mining Co. – Copper, nickel, and precious metals

BASF SE – Specialty chemicals and composite materials

Mitsubishi Materials Corporation – Copper and metal alloys

Glencore International AG – Copper, nickel, and cobalt

ArcelorMittal – Steel and metal alloys

Southwire Company, LLC – Copper and aluminum wire for motor windings

TE Connectivity – Electrical connectors and materials for aerospace motors

Thyssenkrupp AG – Steel and high-performance alloys

Aperam – Stainless steel and alloys

Sumitomo Electric Industries, Ltd. – Conductors and components for electric motors

Kobelco Steel – High-strength steel for motor components

Nippon Steel Corporation – Steel and alloys for electric motor cores

Magna International – Aluminum and metal casting for electric motors

Hitachi Metals Ltd. – Specialty alloys, including magnetic materials

Molybdenum Corp. of China – Molybdenum and high-performance materials for aerospace motors

Volkswagen Group of America – Battery components and rare-earth magnets

China Northern Rare Earth Group High-Tech Co. – Rare earth materials, including neodymium for permanent magnets

Toyota Tsusho Corporation – Cobalt, lithium, and other materials for electric vehicle motors

BASF Catalysts LLC – Rare earth materials and catalysts for magnets

Standard Motor Products, Inc. – Electrical components for aircraft motor manufacturing

Vermilion Energy Inc. – Cobalt and other critical minerals for electric motor manufacturing

Westlake Chemical Corporation – Plastics and polymers used in motor housings

Tronox Limited – Titanium dioxide and other specialty chemicals for insulation materials

August 6, 2024 – H3X, a Denver-based manufacturer of high power density electric motors, secured 20M in Series A funding led by Infinite Capital, with participation from Lockheed Martin Ventures and others. The company plans to expand production of its next-generation integrated motor drives, including megawatt-class machines for electric aircraft, marine, and heavy industrial applications.

June 18, 2024 – Honeywell highlighted its vision for hydrogen-fueled aircraft, predicting the phasing out of conventional jet fuel within 20-30 years and emphasizing hydrogen's potential for zero-emission aviation systems.

September 17, 2024 – NASA and GE Aerospace advanced hybrid-electric propulsion under the HyTEC initiative, integrating electric motors with fuel-burning cores to enhance efficiency and reduce fuel consumption in next-generation airliners.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.85 Billion |

| Market Size by 2032 | USD 19.35 Billion |

| CAGR | CAGR of 9.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (AC Motor, DC Motor) • By Output (Up to 10 kW, 10 to 200 kW) • By Application (Propulsion System, Flight Control System, Engine Control System, Environmental Control System, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | H3X Technologies Inc., Moog Inc., Ametek, Inc., Wright Electric, MagniX Corporation, Siemens AG, Honeywell International Inc., Safran SA, Rolls-Royce Holdings plc, GE Aviation, Raytheon Technologies Corporation, YASA Limited, Pipistrel, Joby Aviation, Vertical Aerospace, Lilium, Eviation Aircraft, AeroVironment, Zunum Aero, and Harbour Air are key players in the Aircraft Electric Motors Market. |

| Key Drivers | • Technological advancements in electric propulsion systems are one of the primary drivers for the growth of the aircraft electric motors market. |

| Restraints | • Aviation regulations slow the adoption of new aircraft electric motor technologies. |

Ans: The Aircraft Electric Motors is to grow at a CAGR of 9.08% Over the Forecast Period 2024-2032.

Ans: The Aircraft Electric Motors Market size was valued at USD 8.85 billion in 2023.

Ans: The key driver for the Aircraft Electric Motors Market is the increasing demand for sustainable and energy-efficient propulsion systems in the aviation Application.

Ans: North America is dominating in of Aircraft Electric Motors Market in 2023.

Ans: AC Motor is dominating in in Aircraft Electric Motors Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Growth in Electrification Programs

5.2 Flight Range and Efficiency Metrics

5.3 Motor Power Output Breakdown

5.4 Technology Adoption Rates

5.5 Regulatory Compliance and Certification

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Aircraft Electric Motors Market Segmentation, by Type

7.1 Chapter Overview

7.2 AC Motor

7.2.1 AC Motor Market Trends Analysis (2020-2032)

7.2.2 AC Motor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 DC Motor

7.3.1 DC Motor Market Trends Analysis (2020-2032)

7.3.2 DC Motor Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Aircraft Electric Motors Market Segmentation, by Output

8.1 Chapter Overview

8.2 Up to 10 kW

8.2.1 Up to 10 kW Market Trends Analysis (2020-2032)

8.2.2 Up to 10 kW Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 10 to 200 kW

8.3.1 10 to 200 kW Market Trends Analysis (2020-2032)

8.3.2 10 to 200 kW Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Aircraft Electric Motors Market Segmentation, by Application

9.1 Chapter Overview

9.2 Propulsion System

9.2.1 Propulsion System Market Trends Analysis (2020-2032)

9.2.2 Propulsion System Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Flight Control System

9.3.1 Flight Control System Market Trends Analysis (2020-2032)

9.3.2 Flight Control System Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Engine Control System

9.4.1 Engine Control System Market Trends Analysis (2020-2032)

9.4.2 Engine Control System Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Environmental Control System

9.5.1 Environmental Control System Market Trends Analysis (2020-2032)

9.5.2 Environmental Control System Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Aircraft Electric Motors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.2.5 North America Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.2.6.3 USA Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.2.7.3 Canada Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.2.8.3 Mexico Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Aircraft Electric Motors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.1.6.3 Poland Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.1.7.3 Romania Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Aircraft Electric Motors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.5 Western Europe Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.6.3 Germany Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.7.3 France Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.8.3 UK Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.9.3 Italy Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.10.3 Spain Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.13.3 Austria Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Aircraft Electric Motors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.6.3 China Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.7.3 India Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.8.3 Japan Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.9.3 South Korea Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.10.3 Vietnam Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.11.3 Singapore Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.12.3 Australia Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Aircraft Electric Motors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.1.5 Middle East Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.1.6.3 UAE Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Aircraft Electric Motors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.2.5 Africa Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Aircraft Electric Motors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.6.5 Latin America Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.6.6.3 Brazil Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.6.7.3 Argentina Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.6.8.3 Colombia Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Aircraft Electric Motors Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Aircraft Electric Motors Market Estimates and Forecasts, by Output (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Aircraft Electric Motors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 H3X Technologies Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Moog Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Ametek, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Wright Electric

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 MagniX Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Siemens AG

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Honeywell International Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Safran SA

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Rolls-Royce Holdings plc

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 GE Aviation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Market Segments:

By Type

AC Motor

DC Motor

By Output

Up to 10 kW

10 to 200 kW

By Application

Propulsion System

Flight Control System

Engine Control System

Environmental Control System

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Aerospace 3D Printing Market Size was valued at USD 3.64 billion in 2023 and is projected to grow to USD 12.11 billion by 2031, with a growing CAGR of 16.2% over the forecast period 2024-2031.

The Aerostructures Market Size was valued at USD 60.8 billion in 2023 and is expected to reach USD 109.9 billion by 2032 and grow at a CAGR of 6.8% over the forecast period 2024-2032.

The Flight Data Monitoring Market Size was valued at USD 2.89 billion in 2023, expected to reach USD 5.82 billion by 2032 with an emerging CAGR of 8.10% over the forecast period 2024-2032.

The Aircraft Engine Nacelle Market size was USD 3.98 billion in 2023 and is expected to reach USD 4.86 billion by 2032, growing at a CAGR of 2.3% over the forecast period of 2024-2032.

The 5G From Space Market Size was valued at USD 291.5 million in 2023 and is expected to reach USD 24003.1 million by 2032 and grow at a CAGR of 63.3% over the forecast period 2024-2032.

The Aircraft Fuel Systems Market size was valued at USD 10.2 billion in 2023 and is expected to reach USD 19.07 billion by 2032, growing at a CAGR of 7.2% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone