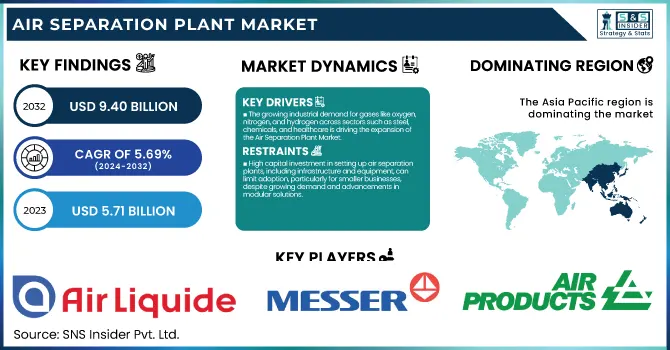

The Air Separation Plant Market Size was esteemed at USD 5.71 billion in 2023 and is supposed to arrive at USD 9.40 billion by 2032 with a growing CAGR of 5.69% over the forecast period 2024-2032. This report offers a comprehensive analysis of production capacity, utilization rates, and maintenance metrics within the Air Separation Plant Market. It highlights technological adoption trends across different regions and examines the dynamics of global trade through export/import data. The report also looks into the impact of downtime on operational efficiency and cost management, providing a unique insight into market optimization. Trends show a growing focus on automation and energy-efficient solutions in the industry.

To Get more information on Air Separation Plant Market - Request Free Sample Report

Drivers

The growing industrial demand for gases like oxygen, nitrogen, and hydrogen across sectors such as steel, chemicals, and healthcare is driving the expansion of the Air Separation Plant Market.

The growing industrial demand for gases such as oxygen, nitrogen, and hydrogen is a major driver of the Air Separation Plant Market. These gases are widely used in industries such as steel (for its properties), chemicals (for reactions), and healthcare (as medical treatments), with their applications including manufacturing, refining, and medical applications. Oxygen is needed in the steel industry to enhance combustion efficiency in blast furnaces, while nitrogen plays an important role in inerting and cooling applications. The growing demand for oxygen from the healthcare sector, especially after the pandemic, has also created demand. Moreover, moving beyond natural gas and towards clean energy technology such as hydrogen is witnessing significant traction in the transportation and energy generation industries, aiding the overall market growth. That growth is fueled by the demand for industrial gases because industrialization is quickly advancing in emerging economies. Market growth is also facilitated by trends like increased demand for sustainable energy solutions and advancements in air separation technologies that provide innovative and energy-efficient solutions for these industries.

Restraint

High capital investment in setting up air separation plants, including infrastructure and equipment, can limit adoption, particularly for smaller businesses, despite growing demand and advancements in modular solutions.

High capital investment is a significant restraint in the air separation plant market. As is common with production facilities, establishing such plants entails substantial capital expenditure, particularly for equipment like compressors, cryogenic units, and supporting infrastructure. Such high costs can be a barrier for smaller businesses or startups. Additionally, the expenditures are often associated with human resources and the continued upkeep that further increases operational costs. The market is expanding, however, due to the increasing rate of industrialization, the need for industrial gases, and technological advancements in air separation processes. As new market industries develop and require more efficient and sustainable solutions, suppliers are turning to innovations to help reduce costs and improve efficiency. Air separation trends are the growth of modular and compact air separation plants, providing more affordable air separation plant options for smaller more decentralized production that enables cross-industry adoption.

Opportunities

Small-scale and modular air separation systems offer flexible, cost-effective, and scalable solutions, driving growth in decentralized industrial operations and energy-efficient applications.

Small-scale and modular air separation systems are gaining traction in the Air Separation Plant market due to their flexibility and cost-effectiveness. As industries move more and more towards decentralized operations, these are a good way to avoid large-scale plants. They can be customized for smaller applications to help minimize capital outlay and operating costs but with high efficiency. Additionally, with the increasing emphasis on sustainability and energy efficiency, modular systems are in high demand, as they enable better resource utilization while reducing energy usage. Also, they are very scalable as their capacity can be expanded on demand without any kind of major infrastructure changes. Emerging markets are the leaders in this trend, as cost-effective and adaptable solutions are essential to their industrial growth. As air separation technology continues to advance, the market is expected to see a rise in innovation in modular systems that will make them even more energy-efficient and cost-effective, hence driving their adoption at a greater pace.

Challenges

Technological integration in air separation plants involves costly and complex upgrades to improve efficiency, with growing adoption driven by sustainability trends and energy demands.

Technological integration in air separation plants involves incorporating advanced, more efficient technologies into existing systems. While some of these upgrades can pay dividends in terms of improved plant performance, energy efficiency, and output, the task can prove difficult and costly. However, implementation of these newer technologies (membrane separation, pressure swing adsorption (PSA), and vacuum swing adsorption (VSA)) would need a significant investment in infrastructure, skilled labor, and a considerable amount of time for the optimization of these systems. Furthermore, retrofitting existing plants with cutting-edge technologies can be difficult as compatibility issues, operational interruptions, and the need for specialized equipment can pose obstacles. This complexity and high upfront cost can prevent a lot of operators from implementing these innovations in the short term. However, as energy efficiency becomes a greater priority in the context of sustainability goals, there is a clear and palpable movement toward adopting new technologies. But gradually, these innovations will incur significant growth in the market as they enhance cost-effectiveness by reducing operational expenses and the environmental footprint of air separation plants.

By Process

The Cryogenic segment dominated with a market share of over 65% in 2023. This process employs very low temperatures to fractionate air into its constituent gases, including nitrogen, oxygen, and argon, making it highly effective for bulk manufacture. The proven reliability and effectiveness of gas chromatography methods will ensure their continued widespread adoption, particularly in industries that require example high-purity gases for chemical, petrochemical, and energy processes. Cryogenic air separation plants are the preferred choice for large volumes and consistent gas purity for many critical industrial applications. Technological advancements coupled with consistent demand from the industrial sectors are anticipated to aid this dominance over the projected timeframe.

By Gas

The Nitrogen segment dominated with a market share of over 38% in 2023, due to its extensive use across various industries. Nitrogen is an important ingredient in many chemical productions, where it forms an inert atmosphere to prevent unwanted reactions. As a gas, nitrogen is often used in the food and beverage industry for food preservation and packaging, keeping foods fresh longer and extending shelf life. Moreover, manufacturing semiconductors and a controlled atmosphere in processes like soldering in electronics manufacturing are also some of the applications of nitrogen. The nitrogen segment is the largest and is the most widely used product segment in air separation plants, owing to the consistent demand for nitrogen from these industries during production as well as safety processes.

By End-Use

The Iron & Steel segment dominated with a market share of over 34% in 2023, due to its substantial demand for industrial gases like oxygen, nitrogen, and argon. In the production of steel, for example, these gases are of significant importance in such processes as blast furnace operation, electric arc furnaces, and steel refining. Oxygen is critical for burning and boosting the efficiency of steelmaking, while nitrogen is used to purge and generate inert environments. Due to the large amount of these gases used in the process of iron and steel production, this industry has become the largest consumer of products from air separation plants. Moreover, the increase in infrastructure and construction also drives the steel demand and leads to the continuing domination of the Iron & Steel category in the market.

Asia-Pacific region dominated with a market share of over 42% in 2023, because of rapid industrialization, especially in China, India, and Japan. Oxygen, nitrogen, and hydrogen are among the industrial gases that are in heavy demand in the region, driven by its growing manufacturing, steel production, and chemical sectors. Moreover, the increasing emphasis on healthcare, particularly in the wake of the pandemic, has also contributed to rising demand for the product in hospitals and medical centers thereby bolstering the market position. The region's overwhelming market share can be attributed to the rise of major infrastructure projects and burgeoning investments in the energy and steel production sectors. Furthermore, government initiatives to promote industrial growth along with policies to encourage their usage in countries such as China and India are further fueling the demand for advanced air separation technologies, allowing Asia-Pacific to maintain dominance in the market.

North America is the fastest-growing region in the Air Separation Plant Market, fueled by significant technological advancements and an increasing emphasis on energy efficiency. Demand for efficient and more sustainable air separation technologies is driven by the region’s strong industrial base (chemicals, healthcare, oil & gas). Furthermore, the increasing focus on hydrogen generation as a clean energy source is another primary driver influencing the market growth. The U.S. and Canada are placing large bets on their hydrogen infrastructure, which means there should be room for air separation plants that produce hydrogen by electrolysis and other methods. In addition, the use of advanced automation, IoT, and AI in the nutrition plants is increasing efficiency and minimising operational cost, which is expected to propel growth of the North America growth in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Air Separation Plant Market

Air Liquide S.A. (Oxygen, Nitrogen, Argon, Hydrogen)

Linde AG (Oxygen, Nitrogen, Argon, Carbon Dioxide)

Messer Group GmbH (Oxygen, Nitrogen, Argon, Hydrogen)

Air Products and Chemicals, Inc. (Oxygen, Nitrogen, Argon, Hydrogen, Helium)

E Taiyo Nippon Sanso Corporation (Oxygen, Nitrogen, Argon, Carbon Dioxide)

Praxair, Inc. (Oxygen, Nitrogen, Argon, Hydrogen)

Oxyplants (Oxygen, Nitrogen, Argon)

AMCS Corporation (Oxygen, Nitrogen, Argon, Hydrogen)

Enerflex Ltd (Oxygen, Nitrogen, Hydrogen, Helium)

Technex Ltd. (Oxygen, Nitrogen, Argon)

Atlas Copco (Nitrogen Generators, Oxygen Generators)

Airgas Inc. (Oxygen, Nitrogen, Argon, Helium)

Inox Air Products (Oxygen, Nitrogen, Argon, Hydrogen)

Southern Ionics (Oxygen, Nitrogen, Argon)

Worley (Oxygen, Nitrogen, Hydrogen, Helium)

Tianjin Tianhai (Oxygen, Nitrogen)

Cryogenic Equipment Manufacturing Company (Oxygen, Nitrogen, Argon)

Messer Group (Oxygen, Nitrogen, Argon, Hydrogen)

Gulf Cryo (Oxygen, Nitrogen, Argon, Hydrogen)

China National Petroleum Corporation (CNPC) (Oxygen, Nitrogen, Hydrogen)

Suppliers for (large-scale gas production and delivery systems, including innovative cryogenic technology) on Air Separation Plant Market

Air Liquide S.A.

Linde AG

Messer Group GmbH

Air Products and Chemicals, Inc.

E Taiyo Nippon Sanso Corporation

Praxair, Inc.

Oxyplants

AMCS Corporation

Enerflex Ltd

Technex Ltd.

Recent Development

In May 2023: Air Products and Chemicals Inc. entered into an investment agreement with the Government of the Republic of Uzbekistan and Uzbekneftegaz JSC to acquire, own, and manage an industrial gas complex.

In January 2024: EuroChem completed the construction of an air separation unit at Nevinnomysskiy. The unit, featuring over 1,000 tons of major process equipment delivered to Nevinnomysskiy Azot, produces gaseous oxygen, nitrogen, liquid oxygen, nitrogen, and argon, improving operational efficiency while minimizing environmental impact.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.71 Billion |

| Market Size by 2032 | USD 9.40 Billion |

| CAGR | CAGR of 5.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process (Cryogenic, Non-cryogenic) • By Gas (Nitrogen, Oxygen, Argon, Others) • By End-use (Iron & Steel, Oil & Gas, Chemical, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Air Liquide S.A., Linde AG, Messer Group GmbH, Air Products and Chemicals, Inc., E Taiyo Nippon Sanso Corporation, Praxair, Inc., Oxyplants, AMCS Corporation, Enerflex Ltd, Technex Ltd., Atlas Copco, Airgas Inc., Inox Air Products, Southern Ionics, Worley, Tianjin Tianhai, Cryogenic Equipment Manufacturing Company, Messer Group, Gulf Cryo, China National Petroleum Corporation (CNPC). |

Ans: The Air Separation Plant Market is expected to grow at a CAGR of 5.69% during 2024-2032.

Ans: The Air Separation Plant Market was USD 5.71 billion in 2023 and is expected to Reach USD 9.40 billion by 2032.

Ans: The growing industrial demand for gases like oxygen, nitrogen, and hydrogen across sectors such as steel, chemicals, and healthcare is driving the expansion of the Air Separation Plant Market.

Ans: The “Cryogenic” segment dominated the Air Separation Plant Market.

Ans: Asia-Pacific dominated the Air Separation Plant Market in 2023

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity, by Region (2020-2023)

5.2 Utilization Rates, by Region (2020-2023)

5.3 Maintenance and Downtime Metrics

5.4 Technological Adoption Rates, by Region

5.5 Export/Import Data, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Air Separation Plant Market Segmentation, By Process

7.1 Chapter Overview

7.2 Cryogenic

7.2.1 Cryogenic Market Trends Analysis (2020-2032)

7.2.2 Cryogenic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Non-cryogenic

7.3.1 Non-cryogenic Market Trends Analysis (2020-2032)

7.3.2 Non-cryogenic Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Air Separation Plant Market Segmentation, By Gas

8.1 Chapter Overview

8.2 Nitrogen

8.2.1 Nitrogen Market Trends Analysis (2020-2032)

8.2.2 Nitrogen Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Oxygen

8.3.1Oxygen Market Trends Analysis (2020-2032)

8.3.2 Oxygen Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Argon

8.4.1 Argon Market Trends Analysis (2020-2032)

8.4.2 Argon Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Air Separation Plant Market Segmentation, By End-use

9.1 Chapter Overview

9.2 Iron & Steel

9.2.1 Iron & Steel Market Trends Analysis (2020-2032)

9.2.2 Iron & Steel Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Oil & Gas

9.3.1 Oil & Gas Market Trends Analysis (2020-2032)

9.3.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Chemical

9.4.1 Chemical Market Trends Analysis (2020-2032)

9.4.2 Chemical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Healthcare

9.5.1 Healthcare Market Trends Analysis (2020-2032)

9.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Air Separation Plant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.2.4 North America Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.2.5 North America Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.2.6.2 USA Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.2.6.3 USA Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.2.7.2 Canada Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.2.7.3 Canada Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.2.8.2 Mexico Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.2.8.3 Mexico Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Air Separation Plant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.1.6.2 Poland Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.1.6.3 Poland Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.1.7.2 Romania Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.1.7.3 Romania Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Air Separation Plant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.4 Western Europe Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.5 Western Europe Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.6.2 Germany Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.6.3 Germany Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.7.2 France Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.7.3 France Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.8.2 UK Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.8.3 UK Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.9.2 Italy Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.9.3 Italy Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.10.2 Spain Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.10.3 Spain Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.13.2 Austria Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.13.3 Austria Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Air Separation Plant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.6.2 China Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.6.3 China Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.7.2 India Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.7.3 India Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.8.2 Japan Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.8.3 Japan Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.9.2 South Korea Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.9.3 South Korea Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.10.2 Vietnam Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.10.3 Vietnam Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.11.2 Singapore Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.11.3 Singapore Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.12.2 Australia Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.12.3 Australia Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Air Separation Plant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.1.4 Middle East Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.1.5 Middle East Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.1.6.2 UAE Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.1.6.3 UAE Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Air Separation Plant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.2.4 Africa Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.2.5 Africa Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Air Separation Plant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.6.4 Latin America Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.6.5 Latin America Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.6.6.2 Brazil Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.6.6.3 Brazil Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.6.7.2 Argentina Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.6.7.3 Argentina Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.6.8.2 Colombia Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.6.8.3 Colombia Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Air Separation Plant Market Estimates and Forecasts, By Process (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Air Separation Plant Market Estimates and Forecasts, By Gas (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Air Separation Plant Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Enerflex Ltd

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 AMCS Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Oxyplants

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Air Products and Chemicals, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Air Liquide S.A.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Messer Group GmbH

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Linde AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 E Taiyo Nippon Sanso Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Praxair, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Technex Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Process

Cryogenic

Non-cryogenic

By Gas

Nitrogen

Oxygen

Argon

Others

By End-use

Iron & Steel

Oil & Gas

Chemical

Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Vacuum Valve Market Size was esteemed at USD 1.37 billion in 2023 and is supposed to arrive at USD 2.80 billion by 2031 and develop at a CAGR of 9.3% over the forecast period 2024-2031.

The Cold Chain Equipment Market was valued at USD 21.40 billion in 2023, and it is expected to reach USD 110.41 billion by 2032, registering a CAGR of 20.06% from 2024 to 2032.

The Carbonization Furnace Market Size was valued at USD 238.96 Million in 2023 and is expected to reach USD 564.19 Million by 2032 and grow at a CAGR of 10.07% over the forecast period 2024-2032.

CNC Tool & Cutter Grinding Machine Market was valued at USD 3.96 Bn in 2023 and is expected to reach USD 5.42 Bn by 2032, at a CAGR of 3.54% from 2024 to 2032.

Air Separation Plant Market was esteemed at USD 5.71 billion in 2023 and is supposed to arrive at USD 9.40 billion by 2032, at a CAGR of 5.69% from 2024-2032.

The Ventilation System Market size was USD 29.74 billion in 2023 and is expected to reach USD 53.84 billion by 2031 and grow at a CAGR of 7.7% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone