Get More Information on Air Cargo Market - Request Sample Report

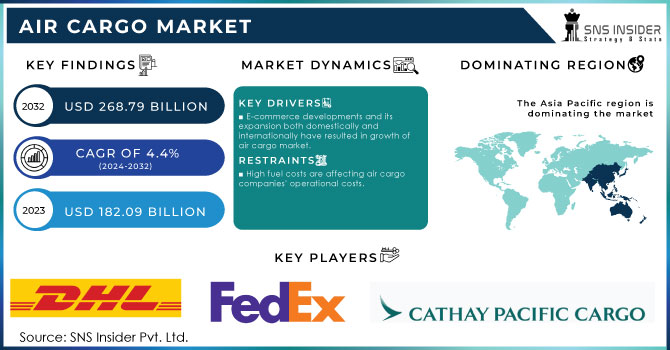

The Air Cargo Market Size was valued at USD 182.09 Billion in 2023 and is expected to reach USD 268.79 Billion by 2032 and grow at a CAGR of 4.4% over the forecast period 2024-2032.

The Air Cargo Market is an aspect that plays a very significant role in global trade and rapid logistics markets. Increased demand for time-sensitive delivery makes the air cargo services necessary for transport goods over long distances effectively. The world market experienced a sharp increase in 2023 due to sustained growth in e-commerce, cross-border trade, and pharmaceutical needs especially post-COVID-19. There are also policies implemented by the governments to ensure that air cargo operations become more efficient and sustainable. For instance, The UK government has unveiled over USD 133.90 Million of funding to support five research and development projects toward reducing the aviation impacts on the environment. As announced by the Department for Business and Trade, the funding was going to be delivered through the Aerospace Technology Institute Programme in a move to pioneer groundbreaking new techs such as zero-emission hydrogen flight and sustainable propulsion systems.

Some of the policies are expressed in the FAA Reauthorization Act by USA, which encourages the employment of technology and green solution aspects such as the promotion of electric aircraft and fuel-efficient planes. Other trade agreements, such as the United States-Mexico-Canada Agreement, which concerns only agricultural, pharmaceutical, and manufactured products, also attract air cargo demand.

The most recent innovations involve the automation of air cargo handling systems to imlprove the process of sorting, loading, and tracking. Companies are embracing drones and unmanned aerial vehicles (UAVs) for smaller deliveries and last-mile logistics. Digitization efforts, for instance, the integration of blockchain for better tracking and tracing, enhanced security, and improved transparency, is revolutionizing the air cargo landscape.

Air cargo sector holds vast opportunities in the future. Electronic Air Waybills (eAWB) is likely to increase, and Sustainable Aviation Fuel (SAF) investment will enhance the operational efficiency of air cargo while reducing carbon emissions. Demand for air cargo service in the U.S. will be robust on the grounds of expedited deliveries, an increasing e-commerce industry, and healthcare requirements. In addition, the growing economies of Asia Pacific countries, especially China and India, besides other emerging economies, are expected to lead to high growth in the air cargo industry. International trade development and advancement in logistical technologies coupled with it will provide a steep increase in the air cargo market between 2024 and 2032.

KEY DRIVERS:

E-commerce developments and its expansion both domestically and internationally have resulted in growth of air cargo market.

The same-day or next-day delivery services provided by the online retailers such as Amazon and Alibaba among others demand fast and reliable logistics. Air cargo is the lifeblood of this supply chain because it facilitates the transportation of time-sensitive and high-value goods, including electronic apparatuses, fashion products, and consumers' goods. Air freight has to remain an important source of replenishment of inventories and replenishment for online businesses because it feeds demand from customers in various markets. Cross-border e-commerce has also seen the rise of using air cargo, which can reach retailers to markets outside the country within several hours or days. These trends are likely to continue with this ever-growing international online retail industry.

Pharmaceutical and related healthcare industries require safe, quick logistics services.

Another reason the air cargo market has been booming recently is the desire by pharmacy and healthcare industries for fast, temperature-controlled deliveries. Many pharmaceutical products - vaccines, medicines, diagnostic kits, among others - have stringent handling and storage conditions, often involving precise temperature control and fast delivery periods. Temperature-controlled compartments, advanced monitoring technologies, and other features of air cargo solutions ensure safe delivery of these products without compromise. The COVID-19 pandemic placed unprecedented pressure on worldwide air cargo systems due to the transport of vaccines and medical supplies. This demand is likely to continue because the healthcare industry continues to introduce new treatments and therapies that require rapid, efficient transportation, especially in remote and underserved areas.

RESTRAINT:

High fuel costs are affecting air cargo companies' operational costs.

The market has one major constraint: the often high and ever-fluctuating price of fuel. Fuel is typically the biggest operating cost for most air cargo carriers and accounts for a quarter of all expenditure. Higher fuel prices push up these costs to an unsustainable level, meaning higher freight charges for the customer. This can further strain the profitability of air cargo operators driven by volatility in oil prices with interplay from geopolitics, supply-demand imbalances, and natural disasters. Companies can try to impose fuel surcharges but this may reduce demand from price-sensitive customers. It is equally challenging because adopting more sustainable practices would require long-term investments in fuel-efficient aircraft or the adoption of SAF, both of which require heavy, upfront investment. This further presents a challenge to managing the costs of fuel while not displacing efficiency in servicing.

BY TYPE

The Air Cargo Market can be broadly bifurcated into two major business segments, namely Air Freight and Air Mail. In 2023, Air Freight captured the highest market share of 61.59%. The remaining market share is mainly due to the steady increase in the demand for the shipment of high-value and time-sensitive goods across borders such as between nations in electronics, pharmaceuticals, and e-commerce sectors. Air Freight offers the speed, security, and efficiency which these industries require to be shipped fast with the entire world; it is the most preferred method of shipping urgent and valuable cargo for its speed. Furthermore, improvement in automated cargo handling systems and tracking technologies have made the air freight service more efficient and transparent.

Air Mail is likely to grow the fastest in the forecasts, reaching a CAGR of 5.0% during 2024-2032. Growth in Air Mail can be attributed to an increase in volume of packages and documents shifted through e-commerce deliveries and cross border trade. The increase in demand in e-commerce has resulted in a higher demand for postal services which guarantee fast delivery, and this increased demand for air mail service. Further growth of Air Mail is expected to increase with the expansion of international trade, especially in growing markets where access to rapid and reliable logistics services is becoming more important.

BY DESTINATION

The Air Cargo Market can be further divided into Domestic and International segments. In the year 2023, International Air Cargo was the market share holder as well, and it accounted for nearly 56.12% market share. International air cargo services are crucial for ensuring transportation across different countries and continents, especially for high-value goods such as electronics, automotive parts, and pharmaceuticals. International air cargo services have increased greatly due to the growth of e-commerce and the improvement of international trade agreements. E-commerce across borders has also highly increased in demand for speed, reliability, and assurance for international shipment.

Air cargo rates on the transpacific trade picked up in August 2024 as busy market conditions continued and companies begin to eye what is expected to be a strong peak season. Newest figures from the Baltic Exchange Airfreight Index (BAI) calculated by TAC Index indicate rates from Hong Kong to North America leaped up to USD 5.96 per kg in August versus USD 5.72 per kg a month ago and stand 22.9% higher than the same month last year. Prices on the trade continued to climb with the passage of the month, and by end of August had surpassed USD 6 per kg.

Though International Air Cargo remains the biggest market, Domestic is forecasted to grow the fastest, with a CAGR of 5.1% from 2024 through 2032. The reason behind it would be a rapid increase in demand for fast domestic delivery services, which is especially crucial for large countries, such as the U.S., China, and India, due to the long distances involved, making air cargo a more efficient way to deliver fast to these large regions. Latest trends of same-day and next-day delivery services through e-commerce websites have fueled the demand for domestic air cargo services to a higher extent.

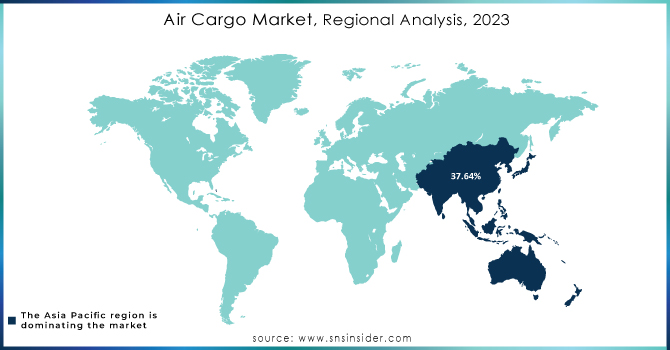

Asia Pacific dominated the 2023 market share with 37.64%. This position was because of rapid industrialization, the booming e-commerce sector, and highly efficient manufacturing in the country. The Asia Pacific region is another global manufacturing hub, especially for electronics, automobiles, and consumer goods. Strong demand from this sector drives a lot of the air cargo business. As cross-border trade within the region continues to grow and exports to Europe and North America increase, the continent's position as a market leader in air cargo has been strengthened.

During the forecast period, 2024-2032, North America is expected to be the second biggest region. The U.S is a global trading giant with a very effective air cargo network within domestic and international markets. Through developments in e-commerce, along with the increased demand for fast and secure transport of high-value goods such as pharmaceuticals and electronics, the region's air cargo market will still keep on thriving in the coming years.

Need any customization research on Air Cargo Market - Enquiry Now

Some of the major players in the Air Cargo Market are:

DHL Aviation (Express shipping, Freight forwarding)

FedEx Express (Express delivery, Logistics solutions)

UPS Airlines (Parcel services, Air freight)

Cathay Pacific Cargo (Freight services, Air charter solutions)

Singapore Airlines Cargo (Freight forwarding, Temperature-controlled cargo)

Emirates SkyCargo (Pharmaceutical cargo, Freight forwarding)

Lufthansa Cargo (Logistics services, E-commerce solutions)

Korean Air Cargo (Perishable cargo, Air freight)

Cargolux Airlines (Outsize cargo, Specialized logistics)

Qatar Airways Cargo (Freight services, Pharmaceutical logistics)

ANA Cargo (Express cargo, Freight forwarding)

Etihad Cargo (Temperature-controlled cargo, E-commerce solutions)

China Airlines Cargo (Freight forwarding, Special cargo handling)

Turkish Cargo (Freight services, Pharmaceutical logistics)

Asiana Cargo (Freight forwarding, Air mail services)

AirBridgeCargo Airlines (Heavy cargo, Temperature-sensitive logistics)

Atlas Air Worldwide (ACMI leasing, Freight forwarding)

Kalitta Air (Charter services, Cargo logistics)

Polar Air Cargo (E-commerce solutions, Air freight)

Amerijet International (Freight services, Specialized logistics)

September 2024: Australia is the third country in the US and Canada to announce more stringent security procedures for cargo originating from countries in Europe and CIS. From September 26, the country will require cargo traveling on passenger aircraft entering into the country to only be tendered from a shipper with which the forwarder has an Established Business Relationship or EBR. The Special Security Direction was published by the Department of Home Affairs and covers in its entirety 55 countries.

July 2024: DHL Express has signed a Letter of Intent to enter into an Operating Agreement with Central Airlines (HLF / I9) to deploy two DHL B777 freighters. It will be the first time for DHL Express to so do with a local Chinese cargo airline.

July 2024: UPS has agreed to purchase the Mexican express delivery company Estafeta, including a fleet of six aircraft. The deal was unveiled when Mexico began to represent strategically and became the strategic country for UPS in importance, while the adoption of nearshoring grew.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 182.09 Billion |

| Market Size by 2032 | US$ 268.79 Billion |

| CAGR | CAGR of 4.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Air Freight and Air Mail) • By Service (Express, standard, economy) • By Destination (Domestic and International) • By End User (Retail, Food & Beverages, Pharmaceutical and Healthcare, Consumer Electronics, Automotive, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DHL Aviation, FedEx Express, UPS Airlines, Cathay Pacific Cargo, Singapore Airlines Cargo, Emirates SkyCargo, Lufthansa Cargo, Korean Air Cargo, Cargolux Airlines, Qatar Airways Cargo, ANA Cargo, Etihad Cargo, China Airlines Cargo, Turkish Cargo, Asiana Cargo, AirBridgeCargo Airlines, Atlas Air Worldwide, Kalitta Air, Polar Air Cargo, Amerijet International. |

| Key Drivers | • E-commerce developments and its expansion both domestically and internationally have resulted in growth of air cargo market. • Pharmaceutical and related healthcare industries require safe, quick logistics services. |

| Restraints | • High fuel costs are affecting air cargo companies' operational costs. |

Ans: The Air Cargo Market is expected to grow at a CAGR of 4.4% during 2024-2032.

Ans: Air Cargo Market size was USD 182.09 Billion in 2023 and is expected to Reach USD 268.79 Billion by 2032.

Ans: The major growth factors of the Air Cargo Market are e-commerce developments, its expansion and the desire by pharmacy and healthcare industries for fast, temperature-controlled deliveries.

Ans: The Air Freight segment dominated the Air Cargo Market.

Ans: Asia Pacific dominated the Air Cargo Market in 2023.

TABLE OF CONTENT:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Air Cargo Market Segmentation, by Type

7.1 Chapter Overview

7.2 Air Freight

7.2.1 Air Freight Market Trends Analysis (2020-2032)

7.2.2 Air Freight Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Air Mail

7.3.1 Air Mail Market Trends Analysis (2020-2032)

7.3.2 Air Mail Market Size Estimates and Forecasts to 2032 (USD Million)

8. Air Cargo Market Segmentation, by Service

8.1 Chapter Overview

8.2 Express

8.2.1 Express Market Trends Analysis (2020-2032)

8.2.2 Express Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Standard

8.3.1 Standard Market Trends Analysis (2020-2032)

8.3.2 Standard Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Economy

8.4.1 Economy Market Trends Analysis (2020-2032)

8.4.2 Economy Market Size Estimates and Forecasts to 2032 (USD Million)

9. Air Cargo Market Segmentation, by End User

9.1 Chapter Overview

9.2 Retail

9.2.1 Retail Market Trends Analysis (2020-2032)

9.2.2 Retail Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 FMCG

9.3.1 FMCG Market Trends Analysis (2020-2032)

9.3.2 FMCG Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Pharmaceutical and Healthcare

9.4.1 Pharmaceutical and Healthcare Market Trends Analysis (2020-2032)

9.4.2 Pharmaceutical and Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Consumer Electronics

9.5.1 Consumer Electronics Market Trends Analysis (2020-2032)

9.5.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Automotive

9.6.1 Automotive Market Trends Analysis (2020-2032)

9.6.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Air Cargo Market Segmentation, by Destination

10.1 Chapter Overview

10.2 Domestic

10.2.1 Domestic Market Trends Analysis (2020-2032)

10.2.2 Domestic Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 International

10.3.1 International Market Trends Analysis (2020-2032)

10.3.2 International Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Air Cargo Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.4 North America Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.2.5 North America Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.6 North America Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.7.2 USA Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.2.7.3 USA Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.7.4 USA Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.8.2 Canada Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.2.8.3 Canada Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.8.4 Canada Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.9.2 Mexico Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.2.9.3 Mexico Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.9.4 Mexico Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Air Cargo Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.7.2 Poland Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.1.7.3 Poland Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.7.4 Poland Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.8.2 Romania Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.1.8.3 Romania Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.8.4 Romania Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.9.2 Hungary Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.1.9.3 Hungary Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.9.4 Hungary Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.10.2 Turkey Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.1.10.3 Turkey Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.10.4 Turkey Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Air Cargo Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.4 Western Europe Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.5 Western Europe Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.6 Western Europe Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.7.2 Germany Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.7.3 Germany Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.7.4 Germany Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.8.2 France Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.8.3 France Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.8.4 France Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.9.2 UK Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.9.3 UK Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.9.4 UK Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.10.2 Italy Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.10.3 Italy Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.10.4 Italy Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.11.2 Spain Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.11.3 Spain Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.11.4 Spain Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.14.2 Austria Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.14.3 Austria Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.14.4 Austria Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Air Cargo Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.4 Asia Pacific Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.5 Asia Pacific Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.6 Asia Pacific Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.7.2 China Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.7.3 China Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.7.4 China Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.8.2 India Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.8.3 India Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.8.4 India Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.9.2 Japan Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.9.3 Japan Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.9.4 Japan Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.10.2 South Korea Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.10.3 South Korea Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.10.4 South Korea Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.11.2 Vietnam Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.11.3 Vietnam Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.11.4 Vietnam Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.12.2 Singapore Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.12.3 Singapore Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.12.4 Singapore Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.13.2 Australia Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.13.3 Australia Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.13.4 Australia Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Air Cargo Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.4 Middle East Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.1.5 Middle East Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.6 Middle East Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.7.2 UAE Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.1.7.3 UAE Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.7.4 UAE Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.8.2 Egypt Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.1.8.3 Egypt Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.8.4 Egypt Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.10.2 Qatar Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.1.10.3 Qatar Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.10.4 Qatar Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Air Cargo Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.4 Africa Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.2.5 Africa Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.6 Africa Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.7.2 South Africa Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.2.7.3 South Africa Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.7.4 South Africa Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Air Cargo Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.4 Latin America Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.6.5 Latin America Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.6 Latin America Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.7.2 Brazil Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.6.7.3 Brazil Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.7.4 Brazil Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.8.2 Argentina Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.6.8.3 Argentina Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.8.4 Argentina Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.9.2 Colombia Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.6.9.3 Colombia Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.9.4 Colombia Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Air Cargo Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Air Cargo Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Air Cargo Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Air Cargo Market Estimates and Forecasts, by Destination (2020-2032) (USD Million)

12. Company Profiles

12.1 DHL Aviation

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 FedEx Express

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 UPS Airlines

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Cathay Pacific Cargo

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Singapore Airlines Cargo

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Emirates SkyCargo

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Lufthansa Cargo

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Korean Air Cargo

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Cargolux Airlines

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Qatar Airways Cargo

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Electric Cargo Bikes Market Size was valued at USD 2.12 billion in 2023 and is expected to reach USD 4.95 billion by 2031 and grow at a CAGR of 11.2% over the forecast period 2024-2031.

The Drive by Wire Market size was valued at USD 19.08 billion in 2023 and is expected to reach USD 32.37 billion by 2032, growing at a CAGR of 6.08% over the forecast period 2024-2032.

The Car Manufacturing Market Size was valued at USD 2.08 Billion in 2023, and is expected to reach USD 10.96 Billion by 2032, and grow at a CAGR of 20.30 % over the forecast period 2024-2032.

The Skid Loaders Market size was valued at USD 10.03 billion in 2023 and is expected to reach USD 14.6 Billion by 2032, growing at a CAGR of 4.25% over the forecast period of 2024-2032.

The Automotive Insurance Market size was valued at USD 680.06 billion in 2023 and is expected to reach USD 935.03 billion by 2031 and grow at a CAGR of 4.05% over the forecast period 2024-2031.

The Rolling Stock Market Size was valued at USD 64 billion in 2023 and is expected to reach USD 105.92 billion by 2031 and grow at a CAGR of 6.5% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone