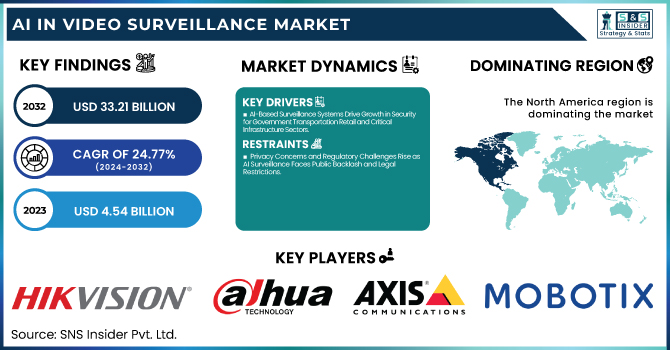

The AI in Video Surveillance Market Size was valued at USD 4.54 Billion in 2023 and is expected to reach USD 33.21 Billion by 2032 and grow at a CAGR of 24.77% over the forecast period 2024-2032. The AI in video surveillance technology is nurturing faster due to the rise of government laws that imitate AI-based analytics for enhanced monitoring and decision-making. Additionally, the integration of IoT devices further broadens the potential of surveillance systems, allowing for instant data transfer and more intelligent responses.

To Get more information on AI in Video Surveillance Market - Request Free Sample Report

Threat detection and prevention with real-time perimeter security is also made possible through AI. Moreover, AI-powered event detection systems also automatically detect and alert teams regarding security breaches or suspicious activities. In the Bay Area of California, shops such as Laurel Ace Hardware have implemented AI programs from companies like Veesion to sift through camera video, leading to drastically lowered rates of theft. Such developments highlight the increasing popularity and influence of AI in video surveillance in the U.S. across sectors.

The U.S. AI in Video Surveillance Market is estimated to be USD 1.03 Billion in 2023 and is projected to grow at a CAGR of 24.53%. With AI analytics, Internet of Things (IoT) integration, perimeter security, and event detection, the U.S. AI in the video surveillance market is highly growing across various sectors.

Key Drivers:

AI-Based Surveillance Systems Drive Growth in Security for Government Transportation Retail and Critical Infrastructure Sectors

Rising security threats from the government, transportation, retail, and critical infrastructure sectors have led to the increasing deployment of AI-based surveillance systems. Due to the pressing need for improved urban area security and increasing incidence of crime, demand for advanced surveillance technologies is increasing for organizations across the globe. Recent developments in AI with machine learning algorithms to provide better accuracy and efficiency for video analytics, make real-time surveillance even more powerful. The growing trend of automation and smart city projects is another reason for the growth of the market.

Restrain:

Privacy Concerns and Regulatory Challenges Rise as AI Surveillance Faces Public Backlash and Legal Restrictions

Another key issue is the use of surveillance technology, especially facial recognition, risking mass invasion of privacy. But when AI systems detect people on both the street and in the office, the potential for malicious use/misuse becomes more tentacled, triggering regulatory attention and public outcry. Many countries and areas are passing or considering laws that may limit or regulate AI surveillance, making it increasingly challenging for companies to deploy these kinds of systems at scale in the future. At the same time, public backlash against AI-driven surveillance systems, particularly around the use of data collection, storage, and the risk of biased results, has increased.

Opportunity:

AI Video Surveillance Market Expands with Opportunities in Facial Recognition Intrusion Detection and IoT Integration

AI video surveillance market has plenty of opportunities including facial recognition, intrusion detection, and traffic flow analysis. Artificial Intelligence & Internet of Things (IoT) AI and IoT objects have enormous scalability and scope for potential application development. That would not be unexpected, considering now governments and enterprises are more willing to deploy some kinds of AI-powered surveillance in the name of public safety, crime reduction, as well as operational effectiveness. The emergence of smart homes and self-driving cars also creates new frontiers for AI surveillance applications, including for things like parking management and vehicle recognition. As the tech matures, more industries will introduce AI-powered surveillance for increased security and greater functional advantages.

Challenges:

Integration Complexity and Skill Gaps Challenge Widespread Adoption of AI-Powered Surveillance Systems Across Industries

The main problem is the complexity of implementation and integration. Integrating AI-powered surveillance systems with existing infrastructures proves difficult for many organizations. Adding to the complexity of adoption is a lack of specialized skills to manage and glean insights from AI analytics. In addition, achieving accuracy and mitigating bias in AI models is technically challenging, requiring significant training and fine-tuning of the systems. Such difficulties can delay the adoption process, particularly in areas or industries lacking in technological know-how, and represent an obstacle to wider market growth.

By Offering

Hardware accounted for the largest share of AI in the video surveillance market, at 39.7%, in 2023. Hardware has been a leader in video surveillance systems since infrastructure components like cameras, sensors, and processors are vitally needed. Refers to the hardware components required to power video capture, real-time data processing, and AI analytics integration. Consequently, there is a continued appetite for high-end surveillance hardware, particularly where physical security is seen as an absolute necessity.

Software is anticipated to experience the highest CAGR from 2024-2032. The growth is attributed to rising demand for high-end video analytics with cloud storage solutions and AI-powered software systems that provide an upgrade to surveillance systems. With the evolution of AI algorithms, the software will be used as a vital tool to automate surveillance tasks such as facial recognition, intrusion detection, and real-time analysis, stimulate innovation, and bring a substantial level of efficiency and scalability to video surveillance. The transformation of market delivery mechanisms to QA-powered software solutions may seem like a gradual process, however, this is where we are heading shortly.

By Deployment

The AI in video surveillance market by deployment in 2023 was dominated by cloud-based solutions, accounting for a market share of 60.2%. This is due to the benefits that cloud solutions provide, including elasticity, remote access, and video storage space without the physical storage infrastructure. Particularly for businesses with distributed sites or multi-location operations, cloud platforms also facilitate real-time data processing, smooth integration with artificial intelligence analytics, and centralized management.

From 2024 to 2032, the on-premises solutions growth rate will be the highest. Rising doubts about data security and privacy are compelling organizations to favor on-premises systems with greater control over sensitive information. In addition, on-premises systems are ideal for use cases where there is no reliable internet connection or low-latency processing is necessary. The move to on-premises deployments is predicted to support market growth, especially in sectors with high-security demands.

By Use Cases

Intrusion detection captured a significant share of AI in the video surveillance market and accounted for 28.4% in 2023. This is primarily due to its extensive use in residential, commercial, and industrial places, where security is one of the priorities. In addition to the criticality of being a property or asset-invasive system with intrusion detection operating with AI naturally provides alerts in the real term and can detect unauthorized access.

Facial recognition is projected to have the highest CAGR from 2024 to 2032. The growth of facial recognition technologies is attributed to the high precision and accuracy of algorithms over the years and increased attention towards security and authentication-based systems. The technology is being widely adopted in public safety, law enforcement, retail, and access control because of its capability of identifying and verifying persons with improved accuracy, speed, and throughput in crowded places. Facial recognition is likely to change the surveillance landscape by providing higher security and automation as the technology matures and privacy issues are resolved.

By End-use

The commercial vertical segment accounted for the largest share of 31.4% of the artificial intelligence in the video surveillance market in 2023. The increasing need for high security in commercial places like retail shops, offices, and warehouses has area the adoption of AI-enabled surveillance methods. Retail is an important commercial market for AI surveillance, with real-time monitoring leading to the prevention of theft and enhanced safety for customers and workers alike.

The military and defense sector is anticipated to have the highest CAGR from 2024 to 2032. This growth is primarily fueled by the increasing demand for advanced surveillance and intelligence gathering in defense applications. Surveillance systems with AI capabilities provide greater advantages when it comes to border defense, diagnosing threats, and reconnaissance applications in military operations. The proliferation of AI surveillance technologies in the military and defense will also be driven by an increased emphasis on national security and the emergence of smart defense systems, which will impact security mechanisms in the military and defense domain as well.

North America held the highest AI in video Surveillance Market share of 31.7% for 2023 and is expected to dominate with a growth rate through the forecast period. This dominance can be largely credited to the availability of technically advanced infrastructure, the presence of robust security policies & regulations, and the early adoption of AI-powered surveillance solutions in the region. The United States and Canada are leaders in implementing artificial intelligence (AI) technology for commercial, residential, and, government facilities. For example, AI surveillance systems are spreading globally in cities such as New York under the guise of public safety through the use of facial recognition and in corporate environments, such as Silicon Valley that are surveilling workers using AI-powered systems for building entry and employee monitoring for health and safety.

The region that is anticipated to show the highest CAGR rate during forecast years 2024 to 2032 is Asia Pacific. This growth is being driven by the rapid expansion of urbanization in the region, increasing investment in smart city initiatives, and a focus on security technologies. With growing security threats now taking center stage in most countries, nations like China and India are embracing AI in surveillance for a safer future. For example, in cities such as Beijing and Shanghai, the Chinese Communist Party has rolled out AI-based surveillance and facial recognition and behavior analysis technologies integrated into infrastructure so that public spaces and transportation systems are monitored to maintain security. In the case of India where urban centers are booming and safety is a necessity in fast-track developing cities. The AI-based surveillance system is gaining interest due to such benefits.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the AI in Video Surveillance Market are:

Hikvision (DeepinView Series)

Dahua Technology (AI-powered PTZ Camera)

Axis Communications (Axis Perimeter Defender)

Bosch Security Systems (Autodome IP Starlight 7000i)

Hanwha Techwin (Wisenet P Series)

FLIR Systems (FC-Series ID)

Vivotek (MD8560)

Samsung Techwin (Wisenet X Series)

Geovision (GV-VMS AI Surveillance Software)

PureTech Systems (PureActiv AI)

Avigilon (H4 Fisheye Camera)

Mobotix (M73)

Uniview (IPC3624LR3-ADS)

Netvue (AI Video Doorbell)

BriefCam (Video Synopsis Platform)

In April 2024, Hikvision launched its next-generation NVR 5.0 Series, integrating advanced AI and IoT for enhanced video surveillance capabilities.

In October 2024, Dahua launched five AI-powered solutions designed to enhance security monitoring for small and medium-sized businesses (SMBs). These solutions include fire lane parking detection, overspeed detection, and advanced loss prevention, revolutionizing SMB security operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.54 Billion |

| Market Size by 2032 | USD 33.21 Billion |

| CAGR | CAGR of 24.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Software, Hardware, Services) • By Deployment (On-premises, Cloud) • By Use Cases (Weapon Detection, Facial Recognition, Intrusion Detection, Smoke & Fire Detection, Traffic Flow Analysis, Parking Monitoring, Vehicle Identification, Others) • By End-use (Commercial, Residential, Military & Defense, Government & Public Facilities, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Hanwha Techwin, FLIR Systems, Vivotek, Samsung Techwin, Geovision, PureTech Systems, Avigilon, Mobotix, Uniview, Netvue, BriefCam. |

Ans: The AI in Video Surveillance Market is expected to grow at a CAGR of 24.77%.

Ans: The AI in Video Surveillance Market size was USD 4.54 billion in 2023 and is expected to Reach USD 33.21 billion by 2032.

Ans: The major key drivers for the growth of the AI in Video Surveillance Market include increasing security concerns, advancements in AI technology, and the growing adoption of smart city initiatives.

Ans: The Hardware segment dominated the AI in Video Surveillance market in 2023.

Ans: In 2023, the North American region led the AI in Video Surveillance market, capturing approximately 31.74% of the total market share.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption of AI-based Analytics

5.2 Integration with IoT Devices

5.3 AI in Perimeter Security

5.4 AI in Event Detection and Alerting

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. AI in Video Surveillance Market Segmentation, By Offering

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Hardware

7.3.1 Hardware Market Trends Analysis (2020-2032)

7.3.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. AI in Video Surveillance Market Segmentation, By Deployment

8.1 Chapter Overview

8.2 On-premises

8.2.1 On-premises Market Trends Analysis (2020-2032)

8.2.2 On-premises Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cloud

8.3.1 Cloud Market Trends Analysis (2020-2032)

8.3.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9. AI in Video Surveillance Market Segmentation, By Use Cases

9.1 Chapter Overview

9.2 Weapon Detection

9.2.1 Weapon Detection Market Trends Analysis (2020-2032)

9.2.2 Weapon Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Facial Recognition

9.3.1 Facial Recognition Market Trends Analysis (2020-2032)

9.3.2 Facial Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Intrusion Detection

9.4.1 Intrusion Detection Market Trends Analysis (2020-2032)

9.4.2 Intrusion Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Smoke & Fire Detection

9.5.1 Smoke & Fire Detection Market Trends Analysis (2020-2032)

9.5.2 Smoke & Fire Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Traffic Flow Analysis

9.6.1 Traffic Flow Analysis Market Trends Analysis (2020-2032)

9.6.2 Traffic Flow Analysis Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Parking Monitoring

9.7.1 Parking Monitoring Market Trends Analysis (2020-2032)

9.7.2 Parking Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Vehicle Identification

9.8.1 Vehicle Identification Market Trends Analysis (2020-2032)

9.8.2 Vehicle Identification Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Others

9.9.1 Others Market Trends Analysis (2020-2032)

9.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. AI in Video Surveillance Market Segmentation, By End-use

10.1 Chapter Overview

10.2 Commercial

10.2.1 Commercial Market Trends Analysis (2020-2032)

10.2.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Residential

10.3.1 Residential Market Trends Analysis (2020-2032)

10.3.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Military & Defense

10.4.1 Military & Defense Market Trends Analysis (2020-2032)

10.4.2 Military & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Government & Public Facilities

10.5.1 Government & Public Facilities Market Trends Analysis (2020-2032)

10.5.2 Government & Public Facilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Industrial

10.6.1 Industrial Market Trends Analysis (2020-2032)

10.6.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America AI in Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.2.4 North America AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.5 North America AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.2.6 North America AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.2.7.2 USA AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7.3 USA AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.2.7.4 USA AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.2.8.2 Canada AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8.3 Canada AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.2.8.4 Canada AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.2.9.2 Mexico AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9.3 Mexico AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.2.9.4 Mexico AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.1.7.2 Poland AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7.3 Poland AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.1.7.4 Poland AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.1.8.2 Romania AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8.3 Romania AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.1.8.4 Romania AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.1.9.2 Hungary AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9.3 Hungary AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.1.9.4 Hungary AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.1.10.2 Turkey AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10.3 Turkey AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.1.10.4 Turkey AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe AI in Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.4 Western Europe AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.5 Western Europe AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.6 Western Europe AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.7.2 Germany AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7.3 Germany AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.7.4 Germany AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.8.2 France AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8.3 France AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.8.4 France AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.9.2 UK AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9.3 UK AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.9.4 UK AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.10.2 Italy AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10.3 Italy AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.10.4 Italy AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.11.2 Spain AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11.3 Spain AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.11.4 Spain AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.14.2 Austria AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14.3 Austria AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.14.4 Austria AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.4 Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.5 Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.6 Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.7.2 China AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7.3 China AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.7.4 China AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.8.2 India AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8.3 India AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.8.4 India AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.9.2 Japan AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9.3 Japan AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.9.4 Japan AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.10.2 South Korea AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10.3 South Korea AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.10.4 South Korea AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.11.2 Vietnam AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11.3 Vietnam AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.11.4 Vietnam AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.12.2 Singapore AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12.3 Singapore AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.12.4 Singapore AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.13.2 Australia AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13.3 Australia AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.13.4 Australia AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia-Pacific AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East AI in Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.1.4 Middle East AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.5 Middle East AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.1.6 Middle East AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.1.7.2 UAE AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7.3 UAE AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.1.7.4 UAE AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.1.8.2 Egypt AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8.3 Egypt AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.1.8.4 Egypt AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.1.10.2 Qatar AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10.3 Qatar AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.1.10.4 Qatar AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa AI in Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.2.4 Africa AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.5 Africa AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.2.6 Africa AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.2.7.2 South Africa AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7.3 South Africa AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.2.7.4 South Africa AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America AI in Video Surveillance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.6.4 Latin America AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.5 Latin America AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.6.6 Latin America AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.6.7.2 Brazil AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7.3 Brazil AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.6.7.4 Brazil AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.6.8.2 Argentina AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8.3 Argentina AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.6.8.4 Argentina AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.6.9.2 Colombia AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9.3 Colombia AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.6.9.4 Colombia AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America AI in Video Surveillance Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America AI in Video Surveillance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America AI in Video Surveillance Market Estimates and Forecasts, By Use Cases (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America AI in Video Surveillance Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Hikvision

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Dahua Technology

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Axis Communications

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Bosch Security Systems

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Hanwha Techwin

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 FLIR Systems

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Vivotek

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Samsung Techwin.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Geovision

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 PureTech Systems

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Offering

Software

Hardware

Services

By Deployment

On-premises

Cloud

By Use Cases

Weapon Detection

Facial Recognition

Intrusion Detection

Smoke & Fire Detection

Traffic Flow Analysis

Parking Monitoring

Vehicle Identification

Others

By End-use

Commercial

Residential

Military & Defense

Government & Public Facilities

Industrial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Thermal Management Technologies Market Size was valued at $13.49 Billion in 2023 and expected to grow at 8.24% CAGR to reach $27.50 Billion by 2032.

The Analog Integrated Circuit Market Size was valued at USD 79.33 billion in 2023 and is expected to reach USD 147.74 Billion by 2032 and grow at a CAGR of 7.16% over the forecast period 2024-2032.

The Water-based Heating & Cooling Systems Market Size was valued at USD 37.10 Billion in 2023 and is expected to reach USD 73.53 Billion by 2032 and grow at a CAGR of 7.94% over the forecast period 2024-2032

The Pet Wearable Market Size was valued at USD 3.27 billion in 2023 and is expected to grow at a CAGR of 14.77% to reach USD 11.25 billion by 2032.

The IP Camera Market was valued at USD 1.42 Billion in 2023 and is expected to reach USD 2.49 Billion by 2032 and grow at a CAGR of 6.51% over the forecast period 2024-2032.

The Interactive Voice Response Market was valued at USD 5.23 billion in 2023 and is projected to reach USD 8.99 billion by 2032, growing at a CAGR of 6.20% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone