AI In Telecommunication Market Report Scope & Overview:

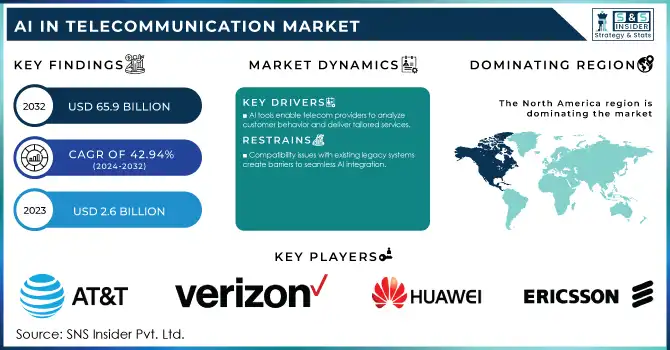

The AI In Telecommunication Market was valued at USD 2.6 Billion in 2023 and is expected to reach USD 65.9 Billion by 2032, growing at a CAGR of 42.94% from 2024-2032.

To get more information on AI In Telecommunication Market - Request Free Sample Report

AI in the telecommunication market is experiencing a massive change, having a revolutionary impact on telecom operations concerning network management, customer experience enhancement, and operations optimization. Artificial Intelligence is the next big thing to automate their network, proactively identify and resolve practice issues, and help deliver personalized customer experience. Enabled by natural language processing and machine learning, telecom companies can ensure seamless, efficient, and effective customer support through AI-powered chatbots and virtual assistants. One notable illustration of AI's impact is in predictive maintenance—AI algorithms assess data captured from network devices to forecast possible malfunctions, reducing downtime and minimizing repair expenditures. For example, one of the largest telecom operators saved 30% in operational expenses through predictive maintenance powered by AI in 2024. A few extremely important factors drive the swift adoption of AI in the telecommunications industry. With the deployment of 5G across various networks, the volume of data traffic has drastically increased, thus requiring intelligent solutions to address the high level of functional and performance diversity and rapid variability of the complex network. To tackle these challenges, the optimization of bandwidth usage and improved network performance enables AI to be an integral aspect of computer networks. In addition, the increasing focus on individualized customer experiences has driven telecom operators to implement AI solutions for analyzing customer conduct and providing tailored services. Increased demand for fraud detection and prevention is another important growth driver; AI-based systems are great at tracking anomalies and identifying suspicious behaviors promptly, providing heightened network security against various cyber threats.

Another factor contributing to market growth is the merger of AI with IoT devices in terms of smart cities and connected ecosystem.

AI In Telecommunication Market Dynamics

Drivers

-

AI tools enable telecom providers to analyze customer behavior and deliver tailored services.

AI-powered tools analyze customer behavior to provide more individualized services to users, thereby increasing customer satisfaction and customer loyalty in the AI Telecommunication market. Telecom providers can leverage advanced machine learning algorithms and data analytics to analyze large volumes of customer data, including usage patterns, preferences, and feedback. This allows operators to get insights into individual customer needs and behaviors for actionable insights. Based on ever-evolving datasets, AI can pinpoint high-value customers or customers about to churn, so that companies can proactively provide customized promotions, service upgrades, or retention efforts.

Dynamic Service Personalization AI-powered customer behavior analysis is also an asset for dynamic service personalization. Based on a customer’s past tendencies and their current usage, telecom providers can offer tailored data plans, entertainment packages, or other additional services. Also, AI-powered predictive analytics helps operators predict the future requirements of customers and serve them at the right time, right away. One of the great examples of AI is using it to facilitate customer support. By using AI-driven chatbots and virtual assistants that also have access to the profiles of the customers and history of interactions with them, accurate yet personalized replies to queries of customers can be provided in an effective manner. This improves the response times and greatly improves the overall customer journey. This, not only saves a significant amount of time and improves customer satisfaction, but also gives telecom companies the ability to drive revenue growth while increasing operational and business efficiency. The growing number of clients searching for personalization means that the telecommunications sector will continue to advance with AI tools for examining customer preferences.

Restraints

-

Compatibility issues with existing legacy systems create barriers to seamless AI integration.

One of the major challenges in deploying AI in the Telecommunication market with smooth integration is the compatibility with the existing legacy systems. Most telecom operators are stuck on legacy infrastructure and software not designed for the AI economy. Such legacy solutions are often inflexible, non-scalable, and incompatible with AI-enabled next-gen applications. As a result, bringing AI into those environments is difficult and resource-intensive, usually requiring significant changes or an entire system overall. One of the main issues is the discrepancy between the format or protocols of the legacy systems to that of AI platforms. AI solutions require large amounts of structured and unstructured data to process, but legacy systems might produce data in formats incompatible with AI algorithms. This means that multiple steps need to be taken for transforming, preprocessing, and integrating data which in turn would increase time and cost of implementation.

Legacy systems are also often hosted on outdated hardware or software, providing low computational capacity, and finding it hard to implement the resource-demanding characteristics of AI applications. This leads to performance bottlenecks, and hence less efficient, effective AI deployments. Another challenge for service providers is the integration of existing network management tools with AI, which could ultimately result in siloed operations and a decrease in network productivity as a whole. These compatibility issues often require substantial system upgrades or replacements, which may not be feasible for all telecom operators, particularly smaller, budget-constrained ones. Such challenges pose an obstacle to AI scaling in the telecom sector. Overcoming these challenges is important to leverage the full potential of AI as a disruptor for telecom operations and industry growth.

AI In Telecommunication Market Segment Analysis

By Deployment

On-premises segment dominated the market and represented a significant revenue share of more than 61% in 2023, Due to the stringent data privacy and security regulations, many telecom providers are also leaning towards on-premises deployments as it allows them to retain direct control over their AI infrastructure. It also allows for increased tailoring of AI solutions to the unique operational requirements of legacy systems. Moreover, on-premises solutions ensure access to high performance and reduced latency which are essential for telecom real-time applications. With the increasing need for robust, secure AI applications, we expect the On-Premises segment to maintain region-wise highest revenue share, especially in case of huge telecom revenues with the capability to invest in adequate infrastructure.

The cloud segment is expected to register the fastest CAGR during the forecast period, as it offers scalability, flexibility, and cost-effectiveness. Cloud-Based AI Solutions Cloud-based solutions will help telecom operators with advanced technology with reduced heavy upfront investments in infrastructure. Cloud deployments also make updates and maintenance easier, making them appealing to companies wanting to stay nimble as their service evolves. Now, cloud-driven AI solutions are making strides as telecom providers fully embrace digital transformation and search for opportunities to cut operational costs. Looking ahead, the Cloud is expected to grow rapidly, especially as 5G and IoT convergence further release pent-up demand for scalable AI applications in telecom.

By Technology

The Big Data segment dominated AI in the telecommunications market and accounted for a revenue share of more than 46%, owing to the increasing volume as well as the complexity of data that is produced on the telecom networks. Big Data technologies are used to record, process, and analyze massive amounts of data generated from network traffic, customer interactions, and IoT devices by telecom operators. Using Big Data analytics, operators can obtain deep insights into customer behavior, optimize network performance, and improve service features. In a data-centric market, telecom companies must store, manage, and analyze vast amounts of data to remain competitive. The big data segment is projected to hold the largest share of the market as the data will keep increasing and continuous data generation will fuel AI applications like predictive maintenance, customer experience, and fraud detection.

The Machine Learning segment is expected to grow at the fastest CAGR during the forecast period, owing to its capability to automate decision-making and enhance network efficiency. ML algorithms enable telecom operators to analyze huge amounts of data, uncover patterns, predict network problems, optimize resources, and provide personalized customer services. The increasing need for real-time analytics along with automated network management is expected to drive the adoption of ML capabilities in the telecom space With technology advancing and enhancing the ability of AI and ML, we now see many telecom providers leveraging AI and ML to plan predictive maintenance, fraud detection, and dynamic bandwidth management. Short-term growth rates for this segment are likely to be much higher, as Machine Learning evolves to become one of the major drivers of telecom innovation and operational efficiency of the future.

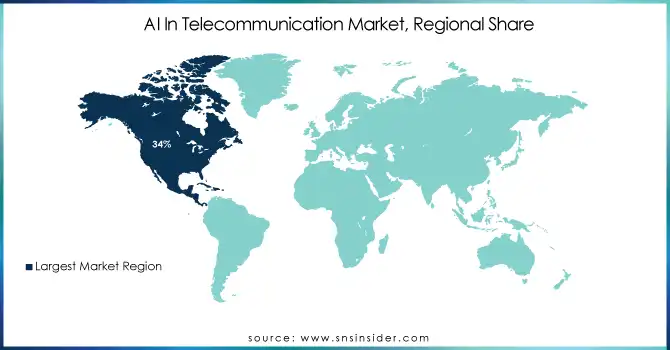

Regional Analysis

North America dominated the market and accounted for a revenue share of more than 34% in 2023, Driven by an advanced telecom infrastructure, high technology adoption, and significant investments in AI research and development, AI in the telecommunications market has been consistently. In North America at large, telecom operators are progressively implementing AI-enhanced solutions for network optimization, predictive maintenance, and customer experience improvement. This can be attributed to its robust regulatory regimes that, combined with standards for data privacy and security, facilitate the stronger integration of AI technologies into business. Also, the increasing need for 5G networks and the high adoption of IoT applications will lead the region to dominate the AI market. North America is projected to retain its leadership in the market during the forecast period due to ongoing improvements in more adaptable AI technologies and the ease of doing business.

The Asia-Pacific region is expected to exhibit the highest CAGR during the forecast period with significant growth, attributed to the rapid growth of telecom networks, high penetration of smartphones, and high adoption of various AI technologies. China, India, and Japan are also investing heavily in AI and 5G infrastructure, facilitating an ecosystem for AI-based telecom solutions. AI use cases in the region are accelerated by its vast, diverse population and the increasing need for personalized services. Also, the growing integration of AI with IoT devices and smart city initiatives is propelling regional growth. The Asia-Pacific market is projected to witness significant growth owing to the telecom operators utilizing AI to improve network performances, customer experience, and handling of complex data traffic.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

AT&T - AI-based Network Optimization

-

Verizon Communications - Virtual Assistant for Customer Service

-

Huawei Technologies - AI-powered Cloud Computing Solutions

-

Nokia - Nokia AVA Cognitive Services

-

Ericsson - Ericsson AI Operations Engine

-

Cisco Systems - Cisco Cognitive Collaboration

-

Qualcomm - AI-powered 5G Chipsets

-

IBM - Watson AI for Telecom

-

Intel Corporation - Intel AI for Network Optimization

-

ZTE Corporation - ZTE AI-Driven Network Solutions

-

T-Mobile - T-Mobile’s AI Chatbot for Customer Support

-

Orange S.A. - Orange AI-Powered Customer Insights

-

Vodafone Group - Vodafone’s AI for Predictive Maintenance

Recent Developments

In 2024, NVIDIA released a report highlighting the growing role of AI in telecommunications, emphasizing its impact on customer experience, process automation, productivity, and network operations

In April 2024, Interactions Corporation introduced Task Orchestration, an AI-powered agent assist solution designed to transform customer experience and operational efficiency in contact centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.6 Billion |

| Market Size by 2032 | USD 65.9 Billion |

| CAGR | CAGR of 42.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Machine Learning, Natural Language Processing, Big Data, Others) • By Deployment (Cloud, On-Premises) • By Application (Network/IT Operations Management, Customer Service and Marketing VDAS, CRM Management, Radio Access Network, Customer Experience Management, Predictive Maintenance, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AT&T, Verizon Communications, Huawei Technologies, Nokia, Ericsson, Cisco Systems, Qualcomm, IBM, Intel Corporation, ZTE Corporation, T-Mobile |

| Key Drivers | • AI tools enable telecom providers to analyze customer behavior and deliver tailored services. |

| RESTRAINTS | • Compatibility issues with existing legacy systems create barriers to seamless AI integration. |