To Get More Information on AI In Medical Imaging Market - Request Sample Report

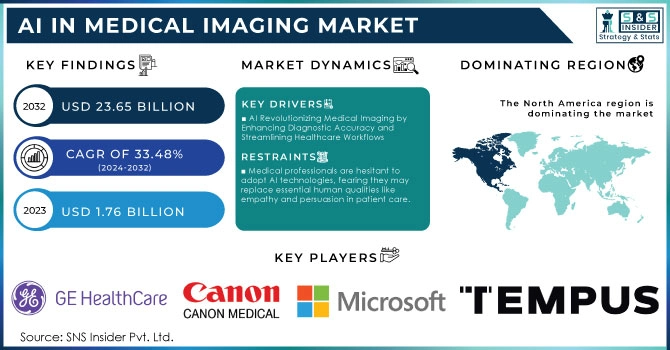

The AI In Medical Imaging Market was USD 1.76 billion in 2023 and is expected to Reach USD 23.65 billion by 2032 and grow at a CAGR of 33.48% over the forecast period of 2024-2032.

The AI in medical imaging market is expected to grow with great momentum due to the increasing requirement to deal with complex and large datasets. Other factors include the reduction in the workloads of radiologists, as well as increased cross-industry collaborations. Private sector funding for AI-based start-ups and government initiatives to incorporate AI into the healthcare sector will be key growth drivers. For instance, this June 2021, VUNO Inc. reported that it will partner with Samsung Electronics to integrate VUNO's AI-powered chest X-ray diagnostic tool on Samsung's GM85 mobile digital X-ray the kind of product that builds on industry adoption of AI-driven solutions. The need for effective management of big medical data has hastened the consumption of AI in medical imaging because it enhances diagnostic accuracy, speeds up image analysis, and enables improved healthcare efficiency. Koninklijke Philips N.V. announced in November 2023 an expansion of its HealthSuite Imaging AI offerings on Amazon Web Services to speed access, optimize workflows with artificial intelligence, and advance patient care.

Advances in AI technology, deep learning, convolutional neural networks, and generative adversarial networks have enhanced the accuracy of medical image analysis. According to a study by Microsoft and IDC, in March 2024, 79% of healthcare organizations are using AI technology with an ROI of USD 3.20 for each USD 1 invested. This is mainly because of the required accuracy in diagnosis and the complexity of medical imaging data.

There are also deep financials that the market has behind it. For example, in June 2023, Carta Healthcare announced that it had raised USD 25 million in Series B financing from Memorial Hermann Health System and UnityPoint Health for advancing AI-powered clinical data solutions. The Governments also spending heavily on AI. For example, in 2022, the NIH invested USD 130 million to speed AI adoption in biomedical research. It transforms the workflow of radiology to work on automation while making the tedious task of image analysis and report generation more efficient, even reducing turnaround time. This should help improve patient care through AI-based diagnostic imaging.

| Region | Regulatory Body | Key Regulations | Approval Process |

| North America | FDA | Digital Health Innovation Action Plan | Pre-market approval |

| Europe | EMA, MDR | EU Medical Device Regulation | CE marking process |

| Asia-Pacific | PMDA (Japan), NMPA (China) | Japan Pharmaceuticals and Medical Devices Act | National approval process |

| Latin America | ANVISA (Brazil) | Brazilian Health Regulatory Norms | Risk-based classification |

| Global | WHO, ISO | International standards for AI | Collaborative standards |

Drivers

AI Revolutionizing Medical Imaging by Enhancing Diagnostic Accuracy and Streamlining Healthcare Workflows

AI's adoption within medical imaging greatly influences the healthcare market as it provides diagnostic procedures that are much more accurate and time-effective. AI's ability to read complex data, particularly X-rays, MRIs, and CT scans, produces a huge amount of data. The use of AI algorithms, especially in diagnostic imaging, enables practitioners and professionals in the health sector to potentially detect and quantify clinical disorders even more precisely. Such systems have proven to be very sensitive and accurate, hence essential in detecting very minute abnormalities not even noticeable by a human radiologist. For example, deep learning is applied in segmenting the left ventricle in cardiac MRI as well as detecting diabetic retinopathy from the retinal images, thus increasing the diagnostics' precision.

The inclusion of AI into healthcare workflows also streamlines operations. With the automation of mundane tasks, AI minimizes the time spent on examinations, and consequently, more time is spent by the healthcare staff on the patients. This expedites emergency diagnoses and also improves patient satisfaction. Furthermore, AI allows for the processing of huge volumes of medical images to determine markers for diseases that may not be detected through other forms of diagnostics. For example, AI can read a CT scan with 200-400 images in just 20 seconds. Otherwise, it would take a senior radiologist about 20 minutes to do so. Such speed and accuracy have extremely fueled the adoption of AI globally in medical imaging, making it the outcome of improving patient health conditions and market growth.

As the technology further advances and is now expected to handle even more big data sets, provide an improved level of accuracy in diagnoses, and boost efficiency in workflow, this will drive the AI in medical imaging market forward in the next few years.

Restraints

Medical professionals are hesitant to adopt AI technologies, fearing they may replace essential human qualities like empathy and persuasion in patient care.

There is skepticism about AI's diagnostic accuracy, making it difficult to convince healthcare providers of the affordability and effectiveness of AI solutions.

By Technology

The deep learning segment held the highest market share of 57.9% in 2023 because it is advanced enough to analyze complex medical images properly and render precise diagnoses. Deep learning algorithms, particularly CNN, have been phenomenal in image recognition and therefore represent a core technology in the domain of medical imaging. Medical image analysis is the core of this approach, which is widely adopted at such a rapid pace because it supports quicker and more precise readings; the treatment plans become better and more personalized in a smooth flow of health operations. Its development will continue to flourish through interdisciplinary collaborations and ongoing research, revamping medical imaging in years to come with its sophisticated algorithms that will be playing a vital role in healthcare. For example, in November 2023 OpenAI announced the OpenAI Data Partnerships a program aimed to engage different kinds of organizations in producing high-quality datasets to use for training AI quality will have a lot to say about the improvement of neural networks' reliability and accuracy, for example, on a medical image analysis task.

The Natural Language Processing (NLP) segment is also anticipated to grow at the highest compound annual growth rate in the forecast period. This is because NLP can turn unstructured textual data into actionable insights improve workflows and support clinical decision-making by extracting and analyzing unstructured data from medical records and radiology reports among others.

By Application

In 2023, the neurology segment dominated the market primarily due to the rise in the adoption of AI in neurology for better and more efficient patient care. AI can handle immense imaging data and can become an effective tool in detecting neurological conditions while providing a timely and accurate diagnosis. Some examples include brain tumors, which are the most prevalent of the misdiagnosed conditions in neuro-oncology. This is mainly because the symptoms may have been misconstrued or wrongly analyzed reports. AI implementation will significantly increase the detection and diagnosis of brain tumors and other neurological cancers, with tremendous accuracy and consistency, which in turn lead to growth within the segment. Optical imaging with deep convolutional neural networks can predict brain tumors in less than 150 seconds, and therefore, encourages the use of AI in neurological disorder diagnosis.

On the other hand, the breast screening segment is expected to witness the fastest CAGR during the forecast period. However, there are rising instances of breast cancer and a growing need for early-stage diagnosis to manage its treatment sooner and more accurately. According to the World Health Organization, in 2022, breast cancer was responsible for 670,000 global deaths. Early detection is the way to better survival chances, and AI does enhance accuracy and efficiency in screening processes.

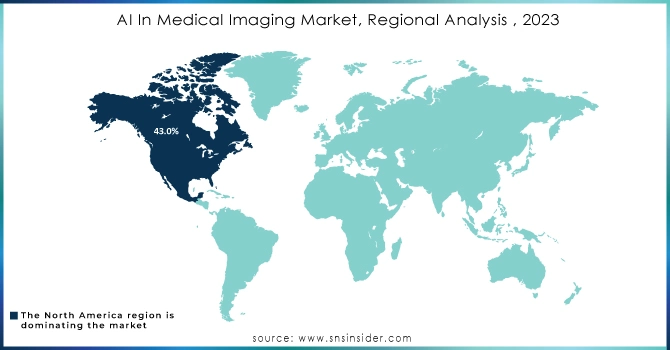

North America dominated the AI in medical imaging market in 2023, accounting for more than 43.0% of revenue. This is largely due to extensive R&D, particularly in the U.S., where AI applications in medical imaging are transforming diagnostics. Strong regulatory support, coupled with various collaborations between technology firms and healthcare providers, is a major driver and is also supported by the growing demand for early disease detection.

Europe is also growing significantly, because of collaborative research projects like CERN and Horizon 2020. The European Union has the Medical Device Regulation (MDR), ensuring there is a clear roadmap to the approval of AI technologies, which drives the adoption and innovation of new technologies. The UK has the most prospects for profitable growth, especially with government-led initiatives such as the AI Sector Deal and with strong participation by the NHS in AI deployment.

The Asia Pacific market is likely to grow rapidly, led by the likes of China and Japan. The ambition of China to take the lead in AI globally by 2032 is underpinned by huge government investments; it drives the market. Since AI will replace some of these traditional healthcare professionals, an industry with a more acute shortage in this region, this industry sector is likely to be one of the major drivers of the market. Another massive country is Japan, whose market leaders, including Fujifilm and Canon, are at the embryonic stage of advanced AI development. Simultaneously, smaller players like NOVIUS shall launch innovations, for instance, N-Vision 3D, which has the potential to raise medical imaging performances. All this shall drive regional growth in the forecast period.

Do You Need any Customization Research on AI In Medical Imaging Market - Inquire Now

Imaging Hardware and Software Providers

GE HealthCare- Edison Platform

Canon Medical Systems USA, Inc.-Aplio i-series

AI Software and Diagnostics Companies

Microsoft-Azure Machine Learning

Digital Diagnostics Inc.-Iris AI

TEMPUS-Tempus Labs

Butterfly Network, Inc.-Butterfly iQ

HeartFlow, Inc.-HeartFlow FFRct

Enlitic, Inc.-Enlitic Deep Learning Platform

Innovative Imaging Technologies

Viz.ai, Inc.-Viz Stroke

EchoNous, Inc.-EchoNous Vein and EchoNous Bladder

HeartVista, Inc.-HeartVista MRI platform

Exo Imaging, Inc.-Exo ultrasound system

Nano-X Imaging Ltd.-Nano-X imaging system

In January 2024, GE HealthCare announced an agreement to acquire MIM Software, a global leader in medical imaging analysis and AI solutions based in Cleveland. This acquisition aims to integrate MIM Software's advanced imaging analytics and digital workflow capabilities across multiple care areas, including molecular radiotherapy, radiation oncology, urology, and diagnostic imaging, enhancing GE HealthCare's innovative offerings to improve patient outcomes and healthcare systems worldwide.

In November 2023, GE HealthCare unveiled its AI suite, MyBreastAI, at the RSNA 2023 conference. This cutting-edge product is designed to streamline radiologists' workflows by providing advanced tools for earlier detection and diagnosis of breast cancer, ultimately contributing to improved patient care and outcomes.

In November 2023, Canon Medical Systems launched two new computed tomography (CT) scanners, built on the upgraded Aquilion CT platform. These scanners utilize artificial intelligence algorithms to enhance image quality and simplify scanning workflows, marking a significant advancement in CT technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.76 Billion |

| Market Size by 2032 | US$ 23.65 Billion |

| CAGR | CAGR of 33.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Deep Learning, Natural Language Processing (NLP), Others) • By Application (Neurology, Respiratory and Pulmonary, Cardiology, Breast Screening, Orthopedics, Others) • By Modalities (CT Scan, MRI, X-rays, Ultrasound, Nuclear Imaging) • By End-Use (Hospitals, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Microsoft, Digital Diagnostics Inc., TEMPUS, Butterfly Network, Inc., Advanced Micro Devices, Inc., HeartFlow, Inc., Enlitic, Inc., Canon Medical Systems USA, Inc., Viz.ai, Inc., EchoNous, Inc., HeartVista Inc., Exo Imaging, Inc, Nano-X Imaging Ltd. |

| Key Drivers | • AI Revolutionizing Medical Imaging by Enhancing Diagnostic Accuracy and Streamlining Healthcare Workflows |

| Restraints | •Medical professionals are hesitant to adopt AI technologies, fearing they may replace essential human qualities like empathy and persuasion in patient care. •There is skepticism about AI's diagnostic accuracy, making it difficult to convince healthcare providers of the affordability and effectiveness of AI solutions. |

Ans: The estimated compound annual growth rate is 33.48% during the forecast period for the AI In Medical Imaging market.

Ans: The projected market value of the AI In Medical Imaging market is estimated at USD 1.76 billion in 2023 and is expected to reach USD 23.65 billion by 2032.

Ans: AI revolutionizing medical imaging by enhancing diagnostic accuracy and streamlining healthcare workflows.

Ans: Medical professionals are hesitant to adopt AI technologies, fearing they may replace essential human qualities like empathy and persuasion in patient care.

Ans: North America is the dominant region with a 43.0% share in the AI In Medical Imaging market.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Feature Analysis, by Feature Type

5.4 Cost Analysis, by Modalities

5.5 Integration Capabilities

5.6 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. AI In Medical Imaging Market Segmentation, by Technology

7.1 Chapter Overview

7.2 Deep Learning

7.2.1 Deep Learning Market Trends Analysis (2020-2032)

7.2.2 Deep Learning Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Natural Language Processing (NLP)

7.3.1 Natural Language Processing (NLP) Market Trends Analysis (2020-2032)

7.3.2 Natural Language Processing (NLP) Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. AI In Medical Imaging Market Segmentation, By Application

8.1 Chapter Overview

8.2 Neurology

8.2.1 Neurology Market Trends Analysis (2020-2032)

8.2.2 Neurology Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Respiratory and Pulmonary

8.3.1 Respiratory and Pulmonary Market Trends Analysis (2020-2032)

8.3.2 Respiratory and Pulmonary Market Size Estimates And Forecasts To 2032 (USD Million)

8.4 Cardiology

8.4.1 Cardiology Market Trends Analysis (2020-2032)

8.4.2 Cardiology Market Size Estimates And Forecasts To 2032 (USD Million)

8.5 Breast Screening

8.4.1 Breast Screening Market Trends Analysis (2020-2032)

8.4.2 Breast Screening Market Size Estimates And Forecasts To 2032 (USD Million)

8.7 Orthopedics

8.7.1 Orthopedics Market Trends Analysis (2020-2032)

8.7.2 Orthopedics Market Size Estimates And Forecasts To 2032 (USD Million)

8.8 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates And Forecasts To 2032 (USD Million)

9. AI In Medical Imaging Market Segmentation, by Modalities

9.1 Chapter Overview

9.2 CT Scan

9.2.1 CT Scan Market Trends Analysis (2020-2032)

9.2.2 CT Scan Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 MRI

9.3.1 MRI Market Trends Analysis (2020-2032)

9.3.2 MRI Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 X-rays

9.4.1 X-rays Market Trends Analysis (2020-2032)

9.4.2 X-rays Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Ultrasound

9.5.1 Ultrasound Market Trends Analysis (2020-2032)

9.5.2 Ultrasound Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Nuclear Imaging

9.6.1 Nuclear Imaging Market Trends Analysis (2020-2032)

9.6.2 Nuclear Imaging Market Size Estimates and Forecasts to 2032 (USD Million)

10. AI In Medical Imaging Market Segmentation, By End-Use

10.1 Chapter Overview

10.2 Hospitals

10.2.1 Hospitals Market Trends Analysis (2020-2032)

10.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Diagnostic Imaging Centers

10.3.1 Diagnostic Imaging Centers Market Trends Analysis (2020-2032)

10.3.2 Diagnostic Imaging Centers Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Others

10.4.1 Others Market Trends Analysis (2020-2032)

10.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America AI In Medical Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.4 North America AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.2.5 North America AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.2.6 North America AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.7.2 USA AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.2.7.3 USA AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.2.7.4 USA AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.8.2 Canada AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.2.8.3 Canada AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.2.8.4 Canada AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.2.9.2 Mexico AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.2.9.3 Mexico AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.2.9.4 Mexico AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.4 Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.1.5 Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.1.6 Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.7.2 Poland AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.1.7.3 Poland AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.1.7.4 Poland AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.8.2 Romania AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.1.8.3 Romania AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.1.8.4 Romania AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.9.2 Hungary AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.1.9.3 Hungary AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.1.9.4 Hungary AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.10.2 Turkey AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.1.10.3 Turkey AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.1.10.4 Turkey AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe AI In Medical Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.4 Western Europe AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.5 Western Europe AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.6 Western Europe AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.7.2 Germany AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.7.3 Germany AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.7.4 Germany AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.8.2 France AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.8.3 France AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.8.4 France AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.9.2 UK AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.9.3 UK AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.9.4 UK AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.10.2 Italy AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.10.3 Italy AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.10.4 Italy AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.11.2 Spain AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.11.3 Spain AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.11.4 Spain AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.12.2 Netherlands AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.12.3 Netherlands AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.12.4 Netherlands AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.13.2 Switzerland AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.13.3 Switzerland AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.13.4 Switzerland AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.14.2 Austria AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.14.3 Austria AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.14.4 Austria AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.4 Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.5 Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.6 Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.7.2 China AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.7.3 China AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.7.4 China AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.8.2 India AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.8.3 India AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.8.4 India AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.9.2 Japan AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.9.3 Japan AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.9.4 Japan AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.10.2 South Korea AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.10.3 South Korea AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.10.4 South Korea AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.11.2 Vietnam AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.11.3 Vietnam AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.11.4 Vietnam AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.12.2 Singapore AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.12.3 Singapore AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.12.4 Singapore AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.13.2 Australia AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.13.3 Australia AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.13.4 Australia AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East AI In Medical Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.4 Middle East AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.1.5 Middle East AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.1.6 Middle East AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.7.2 UAE AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.1.7.3 UAE AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.1.7.4 UAE AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.8.2 Egypt AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.1.8.3 Egypt AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.1.8.4 Egypt AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.10.2 Qatar AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.1.10.3 Qatar AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.1.10.4 Qatar AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa AI In Medical Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.4 Africa AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.2.5 Africa AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.2.6 Africa AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.7.2 South Africa AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.2.7.3 South Africa AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.2.7.4 South Africa AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.8.2 Nigeria AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.2.8.3 Nigeria AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.2.8.4 Nigeria AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America AI In Medical Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America AI In Medical Imaging Market Estimates and Forecasts, by Technology(2020-2032) (USD Million)

11.6.4 Latin America AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.6.5 Latin America AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.6.6 Latin America AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil AI In Medical Imaging Market Estimates and Forecasts, by Technology(2020-2032) (USD Million)

11.6.7.2 Brazil AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.6.7.3 Brazil AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.6.7.4 Brazil AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.8.2 Argentina AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.6.8.3 Argentina AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.6.8.4 Argentina AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.9.2 Colombia AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.6.9.3 Colombia AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.6.9.4 Colombia AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America AI In Medical Imaging Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America AI In Medical Imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America AI In Medical Imaging Market Estimates and Forecasts, by Modalities (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America AI In Medical Imaging Market Estimates and Forecasts, By End-Use (2020-2032) (USD Million)

12. Company Profiles

12.1 GE HealthCare

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Canon Medical Systems USA, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Microsoft

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Digital Diagnostics Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 TEMPUS

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Butterfly Network, Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 HeartFlow, Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Enlitic, Inc.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Viz.ai, Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 EchoNous, Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technology

Deep Learning

Natural Language Processing (NLP)

Others

By Application

Neurology

Respiratory and Pulmonary

Cardiology

Breast Screening

Orthopedics

Others

By Modalities

CT Scan

MRI

X-rays

Ultrasound

Nuclear Imaging

By End-Use

Hospitals

Diagnostic Imaging Centers

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Biopreservation Market size was estimated at USD 3.5 billion in 2023 and is expected to reach USD 14.3 billion by 2032 at a CAGR of 17.0% during the forecast period of 2024-2032.

The Cone Beam Computer Tomography (CBCT) Market Size was valued at USD 541.93 million in 2023, and is expected to reach USD 1342.77 million by 2031, and grow at a CAGR of 12.01% over the forecast period 2024-2031.

The Neurovascular Devices Market Size was valued at USD 3.35 Billion in 2023 and is expected to reach USD 6.60 Billion by 2032 and grow at a CAGR of 7.85% over the forecast period 2024-2032.

Sports Medicine Market size was valued at USD 5.69 billion in 2023, and is expected to grow to USD 10.05 billion by 2032 at a CAGR of 6.54% from 2024-2032.

The Teledentistry Market size was valued at USD 1.58 billion in 2023, expected to reach USD 6.03 billion by 2032, growing at a CAGR of 16.07% from 2024-2032.

Subdermal Contraceptive Implants Market was valued at USD 1.03 billion in 2023 and is expected to reach USD 2.01 billion by 2032, growing at a CAGR of 7.76% from 2024-2032.

Hi! Click one of our member below to chat on Phone