AI in Fintech Market Report Scope & Overview:

Get more informationj on AI in Fintech Market - Request Sample Report

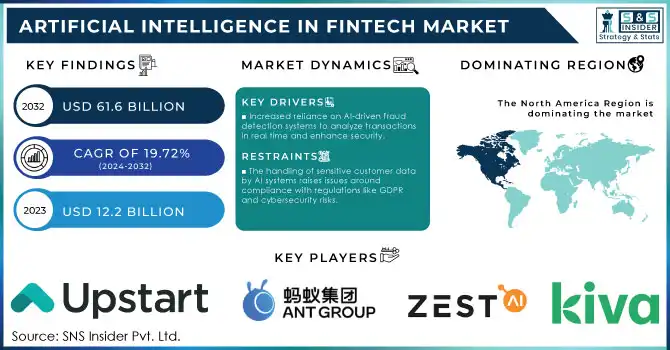

Artificial Intelligence In Fintech Market was valued at USD 12.2 Billion in 2023 and is expected to reach USD 61.6 Billion by 2032, growing at a CAGR of 19.72% from 2024-2032.

The Artificial Intelligence (AI) in Fintech Market is experiencing significant growth, fueled by the rising adoption of AI technologies to streamline financial services, enhance customer satisfaction, and strengthen risk management. Financial institutions and fintech firms are increasingly utilizing AI-driven tools such as machine learning, natural language processing, and predictive analytics for diverse applications, including fraud detection, credit assessment, algorithmic trading, and personalized financial recommendations. The pandemic-driven shift toward digital banking and online financial services has further accelerated the demand for AI-powered fintech solutions. One key factor driving this growth is the escalating threat of financial fraud and cyberattacks, prompting institutions to implement sophisticated AI-based fraud detection and prevention systems. These solutions process vast amounts of transactional data in real-time, identifying irregularities and potential fraudulent activities while reducing false positives and enhancing operational efficiency. For instance, Mastercard has incorporated AI into its fraud detection systems, reporting a notable reduction in fraudulent transactions.

Another major driver is the emphasis on financial inclusion. AI-powered chatbots and virtual assistants are expanding access to financial services for underserved populations by offering cost-effective and intuitive platforms. In collaboration with AI providers, companies like Kiva use machine learning to evaluate creditworthiness in developing regions, enabling millions of individuals to secure microloans. AI is also revolutionizing credit risk management by leveraging non-traditional data sources, such as payment habits and social media activity, to deliver more precise credit evaluations. This not only reduces default risks for lenders but also broadens access to credit for previously unbanked populations. For example, Upstart, an AI-driven lending platform, has achieved significantly lower default rates through machine learning models compared to conventional methods.

Additionally, AI integration has transformed wealth management through robo-advisors like Betterment and Wealthfront, which offer personalized investment strategies at reduced costs. By 2023, such platforms collectively managed over USD 1 trillion in global assets, highlighting their growing adoption.

Regulatory compliance has become more efficient with AI tools automating critical processes such as anti-money laundering (AML) checks and Know Your Customer (KYC) verification. These technologies reduce operational expenses, streamline compliance, and enhance transparency. These factors collectively underscore AI's transformative role in fintech, driving its robust expansion and innovation trajectory in the years ahead.

AI in Fintech Market Dynamics

Drivers

-

Increased reliance on AI-driven fraud detection systems to analyze transactions in real time and enhance security.

-

Shift toward digital financial services accelerated by the pandemic and customer preferences for online solutions.

-

Adoption of machine learning to analyze alternative data sources for accurate credit assessments and reduced defaults.

The integration of machine learning (ML) in Artificial Intelligence (AI) in the Fintech Market offers the potential to revolutionize credit risk assessment by allowing for the use of non-traditional data sources. Conventional credit scoring systems are based mostly on a few metrics such as credit history, income, etc., and they exclude millions of people from consideration (the credit is invisible) because they do not have history.

ML addresses this problem with non-traditional data, including utility payment history, rent payment history, e-commerce purchase history, social media activity, and smartphone usage logs. ML algorithms analyze these disparate datasets to uncover valuable patterns and insights that cannot be replicated by traditional methods, providing a more nuanced and accurate assessment of an individual’s financial behavior. Not only does this method improve the accuracy of credit assessments, but it also makes credit more reachable to underserved and unbanked communities, enabling higher levels of financial inclusion. Fintech platforms such as Upstart apply machine learning to thousands of data points–education and employment history, for example–to lend more responsibly. It has resulted in lower default rates and new avenues to credit for previously excluded borrowers.

In addition to this, ML can also enable real-time data analysis and better real-time risk assessments, making it a powerful solution to mitigate risks in rapidly changing economic conditions or disruptive financial scenarios. For financial institutions and borrowers alike, machine learning also cuts the cost of operations and improves the speed of decision-making by automating the evaluation process. ML does so much more than just improve accuracy and inclusion, it also drastically increases the overall customer experience. This enables speedier decision-making and creates a more equitable appraisal for borrowers, whilst lenders may achieve better portfolio quality and manage risk exposure more efficiently. The use of ML in credit risk management will remain a catalyst for innovation and progress as AI technology evolves over time and across sectors in the fintech industry. These different eras highlight the transformation potential of AI to fundamentally reshape the traditional financial services industry, developing a more human, efficient, and equitable financial system.

Restraints

-

The handling of sensitive customer data by AI systems raises issues around compliance with regulations like GDPR and cybersecurity risks.

-

A shortage of professionals skilled in AI and machine learning technologies hampers the adoption and effective implementation of AI in fintech.

-

Reluctance among customers to rely on AI-driven financial decisions due to lack of transparency or understanding.

Customer reluctance to trust AI-driven financial decisions is mainly because of a lack of transparency and a lack of knowledge of how these systems work. Compared to financial processes that already have a standard, AI works with complex algorithms and machine learning models that analyze large overall data to produce predictions, suggestions, or decisions. The "black box" nature of these models, in which users cannot discern how the desired outcome is arrived at, can induce skepticism and distrust. In particular, financial services involve decisions that can dramatically affect each individual's financial well-being, and therefore transparency is essential for building trust with customers. As most customers are unfamiliar with the level of criteria, or logic that drives the outcomes, they are reluctant to rely on AI-driven tools for critical decisions regarding financing like loan approvals, credit validations, or even investment recommendations. When an AI system rejects a loan application and fails to give an understandable reason, it can create frustration and undermine faith in the technology.

Furthermore, the issue is only worsened due to the concern regarding biases in AI models. If customers suspect that decisions with significant consequences are being made based on limited, biased, or erroneous data, they could find AI-fueled decisions arbitrary or untrustworthy. This is especially critical in domains like credit scoring, where algorithmic bias may unintentionally lead to the disadvantage of specific demographics, and eroding trust in fairness in the system.

Fintech companies should invest in explainable AI (xAI) solutions that provide clarity and transparency on decisions. Providing a top-level explanation of how specific factors affect a loan approval or credit score, for example, can facilitate transparency and confidence in customers. And, companies also need to find ways to make sure that their data is accurate, doesn't utilize biased data, and meets ethical standards. By introducing user-friendly interfaces and transparent communication about the strengths and functions of AI, fintech can also enhance user adoption. Solving these trust issues will help the fintech industry accelerate AI adoption on a larger scale, as consumers will feel more comfortable using AI-based solutions in making their financial decisions.

AI in Fintech Market Segment Analysis

By Component

In 2023, the solution segment dominated the market and represented a significant revenue share of 78.28%, Driven by software tools that help deploy AI-enabled solutions in the banking sector to internalize correct and complete data with bulk data at the right time. The solutions of a few organizations help businesses accomplish stuff like next-best-action programming for growing retail banking businesses, financial fraud discovery & fight, multichannel client experience answers for business to enhance their connections, and so forth.

The services segment is expected to see substantial growth during the forecast period. This managed service is predicted to grow rapidly because it helps in managing AI-powered apps in the fintech vertical. Professional services – we believe AI will continue to drive the development of the segment with all that we are seeing among fintech startups. Losing customers due to bad customer service or wrong advice Consumers have immediate access to real-time data via virtual assistants and chatbots that provide tailored recommendations and help in optimizing their sustainability-saving behaviours. This would allow fintech to offer customized round-the-clock support to their consumers, yet with a lower probability of wrong advice, mistakes, or poor consumer service.

By Application

In 2023, the business analytics and reporting segment dominated the market, contributing to more than 33.5% of global revenue. Regulatory and compliance management, and customer behavior analysis are some of the areas where business analytics and reporting help. The resulting segment growth can be tied to several factors, including greater operational efficiencies, better-informed decision-making, and an increase in revenue. A lot of Organizations use business exercises, AI & enormous data with an end purpose to get better enterprise decision-making. Hence the colossal advances in the fintech market are imparting a ripple of expansion in this domain of AI in turn, as well. We will see a meteoric rise in analytics around customer behavior.

It covers all the risks associated with the customers. Moreover, along with regulatory and compliance management, business analytics, and reporting help in analyzing customer behavior, positively influencing the growth of AI in the fintech market. By enabling multiple AIs and ML algorithms to talk to one another through an interface, it can predict a user’s behavior, as well as provide comprehensive insights into their data.

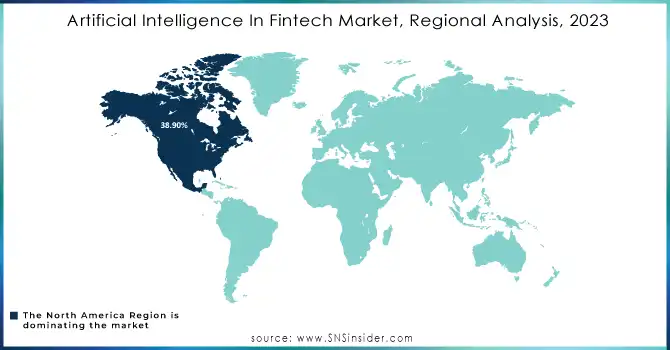

Regional Analysis

In 2023, North America dominated the market with more than 38.90% share of the global revenue. The high share reflects the importance of the advanced economies of the U.S. and Canada to inventions originating in R&D. They're among the most competitive and rapidly developing regions in the world related to fintech AI technology. Numerous startups and emerging corporations offering AI solutions to the finance industry are also fueling it.

Asia Pacific is expected to grow at the fastest CAGR from 2024-2032. The upward trend can be linked as a result of the fast shift towards digital payments and an uptrend in internet services in the area. Due to increased technical improvement in APAC, this region has come out as a potential market. Moreover, the rapid growth of domestic companies along with favorable government policies presents many possibilities for AI development in the fintech industry. Moreover, regional market growth is supplemented as key players are investing in new markets of the region as a part of their business strategy.

Do you need any custom research on AI in Fintech Market - Enquiry Now

Key Players

The major key players along with their products are

-

Upstart - AI-driven loan origination platform

-

Ant Group - Ant Financial's credit scoring system

-

Zest AI - AI-based credit underwriting software

-

Cognitivescale - AI-powered financial services platform

-

Kiva - AI-powered micro-lending platform

-

PayPal - AI-based fraud detection system

-

Mastercard - AI-driven fraud prevention solutions

-

Credit Karma - AI-driven credit score and financial advice tool

-

Stripe - AI-powered payment processing and fraud detection

-

Square - AI-based payment and point-of-sale solutions

-

SoFi - AI-driven personal finance and investment platform

-

LenddoEFL - AI-based credit scoring system using alternative data

-

Betterment - AI-powered robo-advisor platform

-

Wealthfront - Automated AI-driven investment management

-

Kabbage - AI-powered small business lending platform

-

Onfido - AI-based identity verification and fraud detection

-

IBM - Watson for Financial Services

-

Nuance Communications - AI-powered voice biometric authentication

-

Clarity Money - AI-based personal finance management app

-

Finbox - AI-driven data-driven financial analysis platform

Recent Developments

April 2024: Zest AI introduced new machine learning models designed to improve credit risk assessment by using hundreds of variables instead of traditional credit scoring, helping lenders make more accurate and inclusive lending decisions.

May 2024: Lemonade applied advanced AI in its claims processing, using machine learning models to expedite claims and enhance fraud detection, aiming to reduce operational costs.

| Report Attributes | Details |

| Market Size in 2023 | USD 12.2 Billion |

| Market Size by 2032 | USD 61.6 Million |

| CAGR | CAGR of 19.72% from 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment Mode (Cloud, On-premises) • By Application (Virtual Assistant (Chatbots), Business Analytics and Reporting, Customer Behavioral Analytic, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Google, Salesforce.com, IBM, Intel , Amazon Web Services, Inbenta Technologies, IPsoft, Nuance Communications, and ComplyAdvantage.com |

| Key Drivers | •Increased reliance on AI-driven fraud detection systems to analyze transactions in real time and enhance security •Shift toward digital financial services accelerated by the pandemic and customer preferences for online solutions. •Adoption of machine learning to analyze alternative data sources for accurate credit assessments and reduced defaults. |

| Market Restraints | •The handling of sensitive customer data by AI systems raises issues around compliance with regulations like GDPR and cybersecurity risks. •A shortage of professionals skilled in AI and machine learning technologies hampers the adoption and effective implementation of AI in fintech •Reluctance among customers to rely on AI-driven financial decisions due to lack of transparency or understanding. |