AI-Enabled Global Capability Centers (GCC) Market Size:

Get More Information on AI-Enabled Global Capability Center (GCC) Market - Request Sample Report

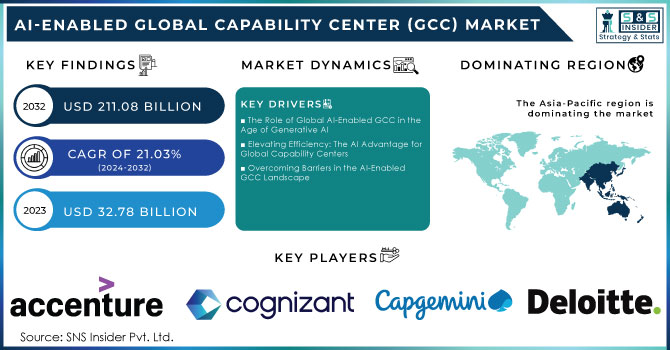

The AI-Enabled Global Capability Center (GCC) Market size was valued at USD 32.78 billion in 2023 and estimated at USD 211.08 billion in 2032, and grow at a CAGR is 21.03% for 2024-2032.

AI-Enabled Global Capability Center Market Overview

The AI-enabled Global Capability Center (GCC) market is rapidly evolving, driven by the increasing demand for digital transformation across various sectors. GCCs serve as strategic hubs for multinational corporations, leveraging artificial intelligence (AI) to enhance operational efficiency and innovate business processes. India leads the global GCC market, commanding over 50% of the centers, while Southeast Asia is emerging as a prominent data center hotspot. The economic potential of AI technologies is significant, with estimates suggesting that generative AI could contribute an additional USD 2.6 trillion to the global economy by improving productivity. This growth is further supported by substantial investments from tech giants like Microsoft and Amazon, who are committing billions to build robust data infrastructures.

-

The Role of Global AI-Enabled GCC in the Age of Generative AI

The age of generative AI promises to dramatically amplify the capabilities and impact of artificial intelligence (AI) across all technology sectors. To realize this potential and thrive in the next decade, companies must fundamentally reinvent their operations. A crucial element of this transformation involves rethinking every part of the business-from innovation and customer interaction to product development and research. Furthermore, organizations need the right talent to strategically apply technology, data, and AI to transform their business effectively. This necessitates reshaping company culture and ensuring that employee skills develop in tandem with the organization, thereby creating a workplace that maximizes employee potential.

Global AI-Enabled GCC (GCCs) have emerged as critical drivers of this transformation, acting as true business reinvention engines. GCCs provide access to a global pool of top-tier talent equipped with the latest technology and training necessary for organizations to stay ahead of industry trends. These centers often function as extensions of corporate headquarters, with senior leaders managing global teams and spearheading international strategies. By focusing on areas such as technology innovation, product design, and engineering, GCCs streamline corporate functions, enhancing efficiency and innovation through integrated help desks and operational command hubs.

Moreover, research indicates significant expected growth in Global Business Services (GBS), especially in marketing (113% increase), supply chain and logistics (88% increase), and transformation capabilities (64%). This surge demonstrates that GCCs and GBS can work in tandem to create maximum value for organizations, allowing them to access best-in-class talent and services that enhance efficiency and innovation without starting from scratch.

The pandemic highlighted GCCs' broader potential, showcasing their agility and resilience. For example, a global pharmaceutical and healthcare company has optimized operations using a GCC network that harnesses digital-first talent across various functions such as R&D, IT, manufacturing, and finance. This realignment is set to reduce operational costs while accelerating the development of groundbreaking treatments.

In mature markets, finding highly skilled workers can be challenging, but many emerging markets offer a rich talent pool. By 2030, 606 million skilled workers are expected to be available in 19 countries across Asia-Pacific, Africa, and Latin America. Countries like India are particularly attractive, with the number of employees in Indian GCCs expected to double in the next three years, reaching over 3 million and occupying over 50 million square feet of office space.

To maximize the value of GCCs, organizations must continuously invest in technology and cultivate a culture that fosters cross-functional collaboration. GCCs can drive a cultural reset within organizations, ensuring that employees feel connected regardless of their physical location. This omni-connected approach has been shown to generate a 7.4% increase in revenue growth, enhancing both employee satisfaction and business outcomes.

In summary, GCCs are crucial in the age of generative AI, enabling companies to access top talent, streamline operations, and drive innovation. By integrating GCCs into their business strategies, organizations can unlock the full potential of AI and transform their operations for sustained growth.

-

Elevating Efficiency: The AI Advantage for Global Capability Centers

The AI-enabled Global AI-Enabled GCC (GCC) market represents a significant opportunity for businesses to leverage cutting-edge technologies for operational excellence. As organizations increasingly adopt AI and machine learning capabilities, 65% of enterprises report that leveraging AI has led to improved customer experiences and 64% note enhanced operational efficiency. This trend underscores the importance of GCCs as vital partners in digital transformation, enabling businesses to integrate AI-driven solutions that streamline processes and foster innovation. Furthermore, with the rise of remote work and the need for agility in business operations, 70% of GCCs are focusing on automation to enhance productivity and adapt to changing market dynamics. By positioning themselves as leaders in advanced analytics and data management, GCCs can help organizations extract actionable insights from vast data sets, driving better decision-making and ultimately increasing profitability. As the demand for AI solutions grows, GCCs that specialize in these areas will not only enhance their competitive edge but also solidify their role as indispensable partners in navigating the complexities of an AI-driven landscape.

Rapid expansion of AI technologies in the region. This growth trend is mirrored across Southeast Asia, which is becoming a significant data center hotspot due to increasing investments and the proliferation of AI technologies. The AI products and services market is expected to reach up to USD 990 billion by 2027, indicating a growing reliance on AI-driven solutions for addressing business challenges, enhancing customer experiences, and improving decision-making processes. Additionally, the overall AI market is poised for exponential growth, with substantial demand for AI and automation backed by significant investments in data infrastructure. Notably, 80% of new GCCs prioritize AI and machine learning capabilities, reflecting the increasing recognition of AI’s potential to transform business operations. The integration of AI within GCCs is generating a surge in demand for advanced analytics and data management solutions, allowing companies to extract valuable insights from large data sets and enabling swift, informed decision-making. This trend not only optimizes operational efficiency but also drives revenue growth through enhanced customer engagement and satisfaction.

-

Overcoming Barriers in the AI-Enabled GCC Landscape

The AI-enabled Global AI-Enabled GCC (GCC) market faces several restraints that could hinder its growth. One of the primary challenges is the shortage of skilled talent in AI and machine learning, which limits the ability of GCCs to implement advanced technologies effectively. As organizations increasingly prioritize automation and AI integration, the demand for skilled professionals outpaces supply, creating a competitive hiring environment. Additionally, the high costs associated with developing and maintaining sophisticated AI systems can deter smaller companies from entering the market. Moreover, data privacy and regulatory compliance present significant hurdles, as organizations must navigate complex legal frameworks to ensure responsible AI usage.

Concerns over data security further complicate the landscape, as companies need to protect sensitive information while leveraging data analytics for decision-making. Furthermore, the rapid pace of technological advancement can lead to obsolescence, making it challenging for GCCs to keep their infrastructure and skills up to date. As reported, 70% of GCCs emphasize the need for agility in operations, yet adapting to these changes often requires significant investments in training and technology, adding another layer of complexity to the operational environment. Thus, while the potential for growth in the AI-enabled GCC market is substantial, these restraints must be addressed to ensure sustainable development.

AI-Enabled Global Capability Center (GCC) Market Segmentation Overview

By Services Type

Information Technology (IT) services dominate the market with approximately 40% share, driven by the growing reliance on digital transformation, cloud computing, and cybersecurity, making it the most significant sector.

Business Process Management (BPM) follows, capturing around 25% of the market due to its ability to enhance efficiency, reduce costs, and improve customer service within organizations. Knowledge Process Outsourcing (KPO) accounts for 15% of the market, offering specialized services such as data analytics, financial research, and legal procedures to meet the nuanced needs of global markets. Engineering and R&D Services represent the smallest segment with a 20% market share, focusing on critical innovation and product development in sectors like automotive, healthcare, and aerospace. The substantial share of IT services reflects the global shift toward digital business operations, while the notable portion held by BPM emphasizes the growing need for operational efficiency and outsourcing. The smaller KPO segment highlights the demand for specialized knowledge and expertise, while engineering services underscore the importance of innovation in competitive industries.

By Organization Size

Large Enterprises dominate the market, holding 69% of the share, largely due to their capacity to invest significantly in infrastructure, technology, and talent. These corporations typically leverage Global Capability Centers (GCCs) to streamline complex business processes, manage costs, and centralize functions such as IT, HR, and finance. Given that large organizations often operate across borders, they require the sophisticated coordination and support that GCCs are designed to provide.

In contrast, Small and Medium Enterprises (SMEs) account for 32% of the market share. While this figure is smaller, the use of GCCs among SMEs is steadily increasing. At a macro level, SMEs benefit from access to specialized skills and improved efficiency, enabling them to reduce operational costs that would otherwise necessitate large in-house teams. As digital transformation and cloud services become more prevalent, SMEs are finding it easier to enter the GCC market, as these innovations lower the barriers to entry.

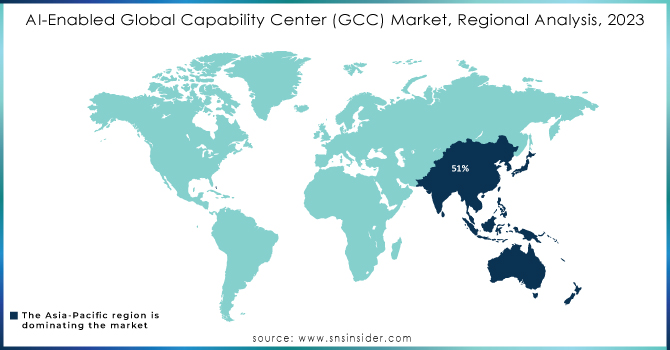

AI-Enabled Global Capability Center Market Regional Analysis

The Asia-Pacific region leads the market, holding a significant share, with India and the Philippines emerging as key growth drivers for Global Capability Centers (GCCs). These countries have captured a substantial market share due to their low labor costs and highly skilled workforce, coupled with favorable government policies that have positioned India to account for nearly 51% of global GCCs. As a result, many large American and European companies are expanding their capability centers in the Asia-Pacific to enhance operational efficiency and maintain strategic proximity to emerging markets.

North America follows as the second-largest market, representing about 14% of the global share. In this region, multinational companies aim to address operational inefficiencies through GCCs, with the increasing demand for advanced technologies such as AI, automation, and cloud services driving growth for innovation and research and development.

Europe holds around 15% of the market, with countries like Poland and Ireland becoming popular GCC destinations for organizations targeting the broader European market. Supportive regulatory environments and access to multilingual talent have bolstered Europe’s growth in this sector.

The remaining 20% of the market is made up of Latin America and the Middle East & Africa, which are gradually establishing themselves as emerging GCC hubs as more organizations explore opportunities in these untapped regions.

Need Any Customization Research On AI-Enabled Global Capability Center (GCC) market - Inquiry Now

Key Players in AI-Enabled Global Capability Center Market

Some Of Major Key Players in AI-Enabled Global Capability Center (GCC) market who provide product and offering:

-

Accenture (AI Consulting Services)

-

Tata Consultancy Services (TCS) (TCS Cognix)

-

Wipro (Wipro HOLMES)

-

Infosys (Infosys Nia)

-

Cognizant (Cognizant AI)

-

IBM (IBM Watson)

-

Deloitte (Deloitte AI Services)

-

Capgemini (Capgemini AI Solutions)

-

Tech Mahindra (Tech Mahindra AI)

-

HCL Technologies (HCL AI Services)

-

Genpact (Genpact AI Solutions)

-

LTI (Larsen & Toubro Infotech) (LTI Mindtree AI)

-

Zensar Technologies (Zensar AI)

-

Mphasis (Mphasis Digital Risk)

-

NTT Data (NTT Data AI Solutions)

-

Cimpress (Cimpress AI)

-

Syntel (Syntel AI Solutions)

-

Zebra Technologies (Zebra AI Solutions)

-

C3.ai (C3 AI Suite)

-

Qualcomm (Qualcomm AI Engine)

List of notable AI-enabled data suppliers in the GCC market without mentioning specific products:

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud

-

IBM

-

Salesforce

-

SAP

-

Oracle

-

Cloudera

-

Teradata

-

Snowflake

-

Palantir Technologies

-

DataRobot

-

TIBCO Software

-

Alteryx

-

Qlik

-

Domo

-

Databricks

-

SAS

-

MicroStrategy

-

ThoughtSpot

Recent Development

-

Pfizer Establishes Global Capability Center: Pfizer has set up a Global Capability Center in India to enhance operational efficiency and access specialized talent.

-

Gatewai Launches AI-Powered Solutions: Gatewai introduced AI-powered solutions targeting India’s GCC market, emphasizing the growing trend of AI utilization.

-

Southeast Asia as a Data Center Hotspot: The region is increasingly recognized as a global data center hotspot due to the rising usage of AI technologies.

-

Microsoft and Amazon Investments: Major corporations like Microsoft and Amazon are investing billions in data infrastructure and technology to bolster the AI-enabled GCC market.

-

Economic Potential of Generative AI: According to McKinsey, generative AI could add an estimated $2.6 trillion to the global economy by enhancing productivity.

-

Growing Demand for Advanced Analytics: The adoption of AI-driven technologies in GCCs is expected to rise significantly, with a focus on advanced analytics and cloud infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.78 billion |

| Market Size by 2032 | USD 211.08 Billion |

| CAGR | CAGR of 21.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Information Technology (IT) Services, Business Process Management (BPM), Knowledge Process Outsourcing (KPO), Engineering and R&D Services) • By Industry Vertical(Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and Consumer Goods, Manufacturing and Automotive, Telecom & IT) • By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Tata Consultancy Services, Wipro, Infosys, Cognizant, IBM, Deloitte, Capgemini, Tech Mahindra, HCL Technologies, Genpact, LTI, Zensar Technologies, Mphasis, NTT Data, Cimpress, Syntel, Zebra Technologies, C3.ai, and Qualcomm. |

| Key Drivers | The Role of Global AI-Enabled GCC in the Age of Generative AI |

| RESTRAINTS | Overcoming Barriers in the AI-Enabled GCC Landscape |