To get more information on AI CCTV Market - Request Sample Report

The AI CCTV Market size was valued at USD 19.95 Billion in 2023. It is estimated to reach USD 70.73 Billion by 2032, growing at a CAGR of 15.12% during 2024-2032.

The rapid expansion of the AI CCTV market is driven by the growing need for advanced surveillance solutions in different sectors. Conventional CCTV cameras have been historically utilized for security reasons however, the incorporation of artificial intelligence (AI) has changed their capabilities, resulting in enhanced intelligence, effectiveness, and adaptability to advanced security requirements. Furthermore, AI surveillance systems are being more frequently utilized in different industries such as retail, healthcare, transportation, and government infrastructure. In the retail sector, AI-enabled surveillance cameras are utilized for monitoring customer behavior, studying foot traffic trends, and deterring theft. Around 70% of retail stores in the United States use CCTV systems for security purposes and to monitor customers. These systems have been proven to decrease theft incidents by 30%, making them an essential tool for preventing losses. Around 60% of shoppers believe they are safer in stores that have CCTV, showcasing the important role of consumer perception. The cost of installing these systems can vary from USD 1,000 to USD 5,000, based on the store's size and the complexity of the system. Moreover, about 45% of stores are embracing advanced technologies such as AI and facial recognition to improve security and collect customer data.

An important use of AI CCTV is in smart cities, where the technology is essential for ensuring public safety and managing traffic effectively. AI-powered CCTV systems can identify and monitor potentially suspicious behavior, assisting law enforcement in crime prevention efforts. In 2023, more than 60% of US cities have implemented CCTV surveillance for traffic lights, greatly improving traffic control. Research shows that this application resulted in a 20% decrease in accidents and enhanced traffic movement by around 15%, especially during busy times. For instance, Cubic Corporation and Siemens Mobility have created sophisticated solutions that combine CCTV with intelligent traffic management systems. By integrating AI, these functions help enhance urban safety by taking proactive security steps that decrease the chances of incidents occurring.

Drivers

Improved monitoring abilities achieved by integrating artificial intelligence.

AI-enhanced security cameras greatly enhance surveillance abilities by incorporating features like facial recognition, object detection, and pattern recognition. Conventional CCTV systems only record video, while AI improves them with sophisticated analytic capabilities. Artificial intelligence surveillance cameras are capable of identifying abnormalities, monitoring questionable actions in the present moment, and forecasting possible security violations. AI cameras can detect abandoned items in busy areas, notify officials, and assess crowd actions to anticipate potential disturbances. This proactive method assists in avoiding crimes instead of responding after they happen, making AI CCTV a revolutionary tool in the security sector. AI surveillance systems also offer previously unattainable insights. For example, they can identify particular people using facial recognition technology, simplifying the process of spotting individuals of interest in public areas, airports, or important facilities. This is especially advantageous for police officers as it can be laborious to identify suspects in extensive datasets. AI significantly reduces the length of this process. Moreover, AI improves image clarity and is efficient in challenging lighting and weather conditions. Conventional systems struggle in such situations, whereas AI systems rely on machine learning algorithms to remove distractions and enhance images, enabling constant surveillance with precision 24/7.

Enhancing public safety by using AI CCTV systems in modern surveillance.

With the growth of urban populations, an increasing need for improved public safety is being observed. Metropolitan areas globally are experiencing increased levels of crime, risks of terrorism, and difficulties in ensuring compliance with laws. AI CCTV systems provide a remedy by offering improved real-time surveillance in crucial public locations such as airports, government facilities, public squares, and transportation hubs. Governments and cities are investing more in surveillance systems enhanced with AI to stop crimes, identify suspicious behavior, and enhance reaction times. This pattern is being driven by various well-known occurrences in which conventional surveillance systems did not succeed in identifying or stopping criminal behavior. In these situations, AI could have recognized suspicious actions or assisted in identifying people behaving abnormally. In addition, smart cities are projected to heavily depend on AI-driven surveillance for managing crowds, controlling traffic, and ensuring security. Implementing public safety measures frequently requires the use of widespread surveillance techniques, with AI CCTV systems being crucial in handling the large amounts of data involved. AI can analyze video quicker than human operators, leading to faster response times in emergencies and allowing law enforcement to be more preventative.

Restraints

Navigating the ethical and privacy challenges of AI-powered surveillance systems.

The extensive use of AI-powered surveillance cameras brings up major issues regarding privacy and ethics. Facial recognition, behavior analysis, and tracking AI systems raise concerns about widespread surveillance and potential abuse. Furthermore, incorporating AI into surveillance systems may result in bias in the algorithms utilized, possibly resulting in discrimination against certain ethnic groups or communities. If biased training data causes facial recognition technologies to make mistakes, innocent individuals may be unfairly accused or singled out. Governments all around the world are struggling with these moral dilemmas. Regulatory authorities in regions like the European Union have implemented strict data protection regulations, including the General Data Protection Regulation (GDPR), that may hinder the widespread implementation of AI CCTV systems. Businesses must make sure they follow these rules, which may increase implementation expenses and prolong project timelines.

By Camera Type

Dome cameras led the market in 2023 with a 36% market share because of their flexible design, broad field of vision, and strong security components. These cameras are commonly used for monitoring indoor and outdoor areas in commercial and public settings like shopping malls, airports, and offices because their stylish design camouflages well with the surroundings, reducing their visibility to potential trespassers. Dome cameras frequently utilize AI features such as facial recognition and motion detection to improve real-time surveillance abilities. Hikvision's dome cameras are extensively used in smart city initiatives, providing high-quality video and AI-driven analysis for monitoring traffic and managing crowds.

PTZ cameras are going to experience a rapid growth rate during the forecast period 2024-2032 because they can effectively monitor large areas and provide precise zoom and movement control. This makes them perfect for dynamic settings like stadiums, city surveillance, and expansive outdoor spaces. The ability to control these cameras from a distance is enhanced by AI functions such as object tracking and automated alerts, making them more adaptable in various scenarios. Axis Communications provides PTZ cameras designed for real-time monitoring and tracking of large crowds at sports arenas.

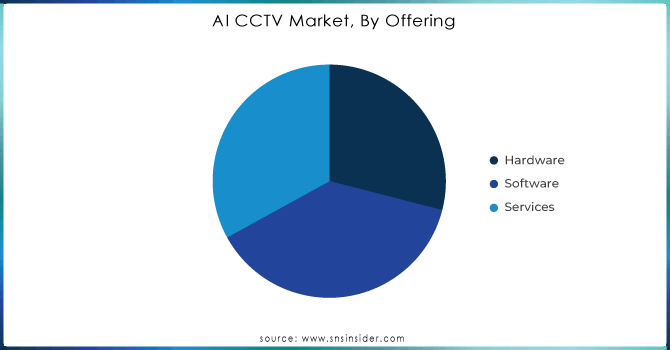

By Offering

The software segment held the most influencing market share i.e. 41% in 2023, leading the way in innovation and upgrades for surveillance systems. Sophisticated software solutions incorporate AI, ML, and analytics, allowing for immediate data processing and smart decision-making. These systems can detect irregularities, identify individuals by their faces, and anticipate possible security risks, offering organizations important knowledge. For example, Hikvision and Dahua Technology provide advanced AI technology that improves video analysis, making security systems more preemptive.

The hardware segment is accounted to have the fastest CAGR during 2024-2032 due to technological advancements and the rising use of high-definition cameras with AI features. With the focus on security increasing in organizations, the need for strong surveillance equipment like smart cameras and IoT devices is rising. The declining costs of AI hardware are aiding in the expansion of AI usage, allowing a wider variety of users to access the technology, including both small businesses and large enterprises.

To Get Customized Report as per your Business Requirement - Request For Customized Report

By Deployment

The cloud segment dominated in 2023 with a 56% market share. The rise is fueled by the growing need for security solutions that are scalable and flexible. Cloud-based systems make it simple to reach video feeds and store data without requiring a large amount of on-site hardware. For example, Amazon Web Services (AWS) offers cloud infrastructure for AI-powered CCTV solutions, allowing for real-time analysis and alerts, boosting situational awareness, and advancing response times.

The on-premise segment is expected to grow at the fastest rate during 2024-2032. On-site systems demand a significant amount of investment in tangible infrastructure, yet they offer improved security for sensitive data and adherence to strict regulations. Axis Communications provides strong on-site AI CCTV solutions that work with current security systems. These solutions offer advanced capabilities such as facial recognition and behavior analysis at the location itself, allowing easy access to important data without the need for external servers.

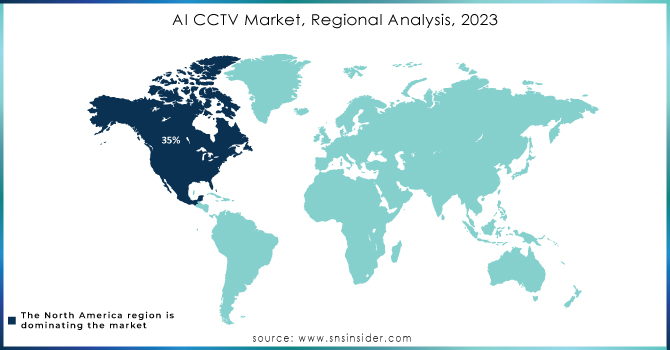

North America captured a market share of over 35% in 2023 and led the market as it was an early adopter of advanced surveillance technologies, possesses a robust infrastructure, and has made significant investments in AI-driven security solutions. Substantial government efforts in the U.S. and Canada are driving the region's leadership in improving public safety. Artificial intelligence CCTV systems are commonly utilized to monitor traffic, detect crimes, and maintain workplace safety in various industries such as transportation, retail, and healthcare.

The APAC is accounted for experiencing a rapid growth rate during the forecast period 2024-2032 due to quick urbanization, higher government spending on smart city projects, and growing worries about public safety. China, Japan, and India lead in implementing AI surveillance, especially in managing cities and monitoring traffic. APAC is becoming a thriving hub for AI CCTV applications due to the increasing digital infrastructure, as well as a focus on improving traffic control and reducing crime.

The key players in the AI CCTV market are:

Eagle Eye Networks (Eagle Eye Cloud VMS, Eagle Eye Camera Manager)

Axis Communications AB (Axis P32 Network Camera Series, Axis Camera Station)

D-Link Corporation (DCS-8526LH Full HD Pan & Tilt Pro Wi-Fi Camera, DCS-8302LH Full HD Outdoor Wi-Fi Camera)

Hangzhou Hikvision Digital Technology Co., Ltd. (DeepinMind NVR, Turbo HD Camera Series)

Panasonic Corporation (i-PRO X-Series Cameras, WV-SW458 Network Camera)

FLIR Systems, Inc. (FLIR FX Security Camera, FLIR Saros DH-390 Dome Camera)

VIVOTEK Inc. (IB9387-HT Bullet Network Camera, FD9167-HT Indoor Dome Camera)

Hanwha Techwin America (Wisenet P Series AI Cameras, Wisenet WAVE VMS)

Swann (Swann Enforcer 4K Ultra HD DVR, Swann Xtreem Wireless Security Camera)

Hikvision (DeepinView Series Cameras, AcuSense NVRs)

Dahua Technology (WizMind Cameras, AI-powered NVR)

Honeywell (MAXPRO NVR, Pro-Watch Video Management System)

Bosch Security Systems (Intelligent Video Analytics Cameras, DIVAR IP 6000)

Avigilon (a Motorola Solutions company) (H5A Camera Line, Avigilon Control Center)

Sony Corporation (6th Gen 4K AI Cameras, Edge Analytics Appliance)

CP Plus (AI-enabled Bullet Cameras, Intelligent VDP)

Cisco Meraki (MV22 Smart Camera, MV32 Fisheye Camera)

Tyco (Johnson Controls) (Illustra Pro Gen4 Cameras, exacqVision NVR)

Genetec (Omnicast Video Surveillance, Streamvault Appliances)

Pelco (Sarix Enhanced Cameras, VideoXpert VMS)

Mobotix (Mx6 Camera Line, MOBOTIX HUB VMS)

Uniview (UltraSmart Cameras, EZView VMS)

Fujitsu (AI-powered Surveillance Solutions, IP Surveillance Cameras)

September 17, 2024: Artificial Intelligence Technology Solutions, Inc. is pleased to announce the launch of RADCam, a cutting-edge residential security product developed by its subsidiary RAD-R or Robotic Assistance Devices Residential, Inc.

June 28, 2024: 3xLOGIC launched its four new AI-based cameras and imagers, including the VISIX Dual Thermal Imager and VISIX 5MP Ball Turret Camera. While the former provides in-depth learning analytics for the enhanced security of the retail, education, and commercial sectors, the latter can be used as a security camera in different fields.

April 2024: Axis Communications launched Q1656-LE, a box camera that enforces AI and uses a deep learning processing unit to ensure real-time object detection and improved analytics. Moreover, the camera is created for the most demanding outdoor security applications.

January 2023: Hikvision launched its 7 Series ColorVu Dual Light Cameras featuring AI analytics for better security performance in low-light conditions. The light that the cameras provide is sufficient even under complete darkness, while AI deployed in cameras is also regarded as one of the best solutions used for these video surveillance applications.

| Report Attributes | Details |

| Market Size in 2023 | USD 19.95 Billion |

| Market Size by 2032 | USD 70.73 Billion |

| CAGR | CAGR of 15.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Camera Type (PTZ Camera, Dome Camera, Bullet Camera, Box Camera, Others) • By Offering (Hardware, Software, Services) • By Deployment (Cloud, On-premises) • By End User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eagle Eye Networks, Axis Communications AB, D-Link Corporation, Hangzhou Hikvision Digital Technology Co., Ltd., Panasonic Corporation, FLIR Systems, Inc., VIVOTEK Inc., Hanwha Techwin America, Swann, Hikvision, Dahua Technology, Honeywell, Bosch Security Systems, Avigilon (a Motorola Solutions company), Sony Corporation, CP Plus, Cisco Meraki, Tyco (Johnson Controls), Genetec, Pelco, Mobotix, Uniview, Fujitsu. |

| Key Drivers | • Improved monitoring abilities achieved by integrating artificial intelligence. • Enhancing public safety by using AI CCTV systems in modern surveillance. |

| RESTRAINTS | • Navigating the ethical and privacy challenges of AI-powered surveillance systems. |

Ans: The AI CCTV Market is expected to grow at a CAGR of 15.12% during 2024-2032.

Ans: AI CCTV Market size was USD 19.95 billion in 2023 and is expected to Reach USD 70.73 billion by 2032.

Ans: Enhancing public safety by using AI CCTV systems in modern surveillance is the major growth factor of the AI CCTV Market.

Ans: The Dome Camera segment dominated the AI CCTV Market.

Ans: North America dominated the AI CCTV Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 AI CCTV Key Vendors and Feature Analysis, 2023

5.2 AI CCTV Performance Benchmarks, 2023

5.3 AI CCTV Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. AI CCTV Market Segmentation, by Camera Type

7.1 Chapter Overview

7.2 PTZ Camera

7.2.1 PTZ Camera Market Trends Analysis (2020-2032)

7.2.2 PTZ Camera Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Dome Camera

7.3.1 Dome Camera Market Trends Analysis (2020-2032)

7.3.2 Dome Camera Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Bullet Camera

7.4.1 Bullet Camera Market Trends Analysis (2020-2032)

7.4.2 Bullet Camera Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Box Camera

7.5.1 Box Camera Market Trends Analysis (2020-2032)

7.5.2 Box Camera Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. AI CCTV Market Segmentation, by Offering

8.1 Chapter Overview

8.2 Hardware

8.2.1 Hardware Market Trends Analysis (2020-2032)

8.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Software

8.3.1 Software Market Trends Analysis (2020-2032)

8.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Services

8.4.1 Services Market Trends Analysis (2020-2032)

8.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Million)

9. AI CCTV Market Segmentation, by Deployment

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 On-premises

9.3.1 On-premises Market Trends Analysis (2020-2032)

9.3.2 On-premises Market Size Estimates and Forecasts to 2032 (USD Million)

10. AI CCTV Market Segmentation, by End User

10.1 Chapter Overview

10.2 Residential

10.2.1 Residential Market Trends Analysis (2020-2032)

10.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Commercial

10.3.1 Commercial Market Trends Analysis (2020-2032)

10.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Industrial

10.4.1 Industrial Market Trends Analysis (2020-2032)

10.4.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America AI CCTV Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.2.4 North America AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.2.5 North America AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.6 North America AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.2.7.2 USA AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.2.7.3 USA AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.7.4 USA AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.2.8.2 Canada AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.2.8.3 Canada AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.8.4 Canada AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.2.9.2 Mexico AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.2.9.3 Mexico AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.9.4 Mexico AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe AI CCTV Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.1.5 Eastern Europe AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.6 Eastern Europe AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.1.7.2 Poland AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.1.7.3 Poland AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.7.4 Poland AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.1.8.2 Romania AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.1.8.3 Romania AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.8.4 Romania AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.1.9.2 Hungary AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.1.9.3 Hungary AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.9.4 Hungary AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.1.10.2 Turkey AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.1.10.3 Turkey AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.10.4 Turkey AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe AI CCTV Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.4 Western Europe AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.5 Western Europe AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.6 Western Europe AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.7.2 Germany AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.7.3 Germany AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.7.4 Germany AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.8.2 France AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.8.3 France AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.8.4 France AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.9.2 UK AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.9.3 UK AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.9.4 UK AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.10.2 Italy AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.10.3 Italy AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.10.4 Italy AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.11.2 Spain AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.11.3 Spain AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.11.4 Spain AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.12.2 Netherlands AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.12.3 Netherlands AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.12.4 Netherlands AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.13.2 Switzerland AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.13.3 Switzerland AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.13.4 Switzerland AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.14.2 Austria AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.14.3 Austria AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.14.4 Austria AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific AI CCTV Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia-Pacific AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.4 Asia-Pacific AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.5 Asia-Pacific AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.6 Asia-Pacific AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.7.2 China AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.7.3 China AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.7.4 China AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.8.2 India AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.8.3 India AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.8.4 India AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.9.2 Japan AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.9.3 Japan AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.9.4 Japan AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.10.2 South Korea AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.10.3 South Korea AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.10.4 South Korea AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.11.2 Vietnam AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.11.3 Vietnam AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.11.4 Vietnam AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.12.2 Singapore AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.12.3 Singapore AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.12.4 Singapore AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.13.2 Australia AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.13.3 Australia AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.13.4 Australia AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.4.14.2 Rest of Asia-Pacific AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.4.14.3 Rest of Asia-Pacific AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.14.4 Rest of Asia-Pacific AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East AI CCTV Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.1.4 Middle East AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.1.5 Middle East AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.6 Middle East AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.1.7.2 UAE AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.1.7.3 UAE AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.7.4 UAE AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.1.8.2 Egypt AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.1.8.3 Egypt AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.8.4 Egypt AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.1.10.2 Qatar AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.1.10.3 Qatar AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.10.4 Qatar AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa AI CCTV Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.2.4 Africa AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.2.5 Africa AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.6 Africa AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.2.7.2 South Africa AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.2.7.3 South Africa AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.7.4 South Africa AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.2.8.2 Nigeria AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.2.8.3 Nigeria AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.8.4 Nigeria AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America AI CCTV Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.6.4 Latin America AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.6.5 Latin America AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.6 Latin America AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.6.7.2 Brazil AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.6.7.3 Brazil AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.7.4 Brazil AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.6.8.2 Argentina AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.6.8.3 Argentina AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.8.4 Argentina AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.6.9.2 Colombia AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.6.9.3 Colombia AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.9.4 Colombia AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America AI CCTV Market Estimates and Forecasts, by Camera Type (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America AI CCTV Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America AI CCTV Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America AI CCTV Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

12. Company Profiles

12.1 Eagle Eye Networks

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Axis Communications AB

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 D-Link Corporation

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Hangzhou Hikvision Digital Technology Co., Ltd.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Panasonic Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 FLIR Systems, Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 VIVOTEK Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Hanwha Techwin America

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Swann

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Hikvision

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Camera Type

PTZ Camera

Dome Camera

Bullet Camera

Box Camera

Others

By Offering

Hardware

Software

Services

By Deployment

Cloud-based

On-premise

By End User

Residential

Commercial

Industrial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The AI CCTV Market size was valued at USD 19.95 Billion in 2023. It is estimated to reach USD 70.73 Billion by 2032, growing at a CAGR of 15.12% during 2024-2032.

The Hazardous Area Equipment Market was valued at USD 11.9 billion in 2023 and is expected to reach USD 20.9 billion by 2032, growing at a CAGR of 6.48% from 2024-2032.

The Foot Ulcer Sensors Market size was valued at USD 163.03 Million in 2023 and expected to reach USD 224.46 Million by 2032 with a growing CAGR of 3.62% over the forecast period of 2024-2032.

The Solar Lighting System Market Size was valued at USD 8.32 billion in 2023 and is growing at a CAGR of 14.96% to reach USD 29.17 billion by 2032.

The Cellular Modem Market was valued at USD 4.93 billion in 2023 and is expected to reach USD 19.60 billion by 2032, growing at a CAGR of 16.61% over the forecast period 2024-2032.

The 3D Projector Market was valued at USD 3.8 Billion in 2023 and is expected to reach USD 7.6 Billion by 2032, growing at a CAGR of 7.88%% from 2024-2032.

Hi! Click one of our member below to chat on Phone