Get PDF Sample Report on AI Camera Market - Request Sample Report

The AI Camera Market size was valued at USD 11.32 billion in 2023 and is expected to grow to USD 70.89 billion by 2032 and grow at a CAGR of 22.61% over the forecast period of 2024-2032.

The rapid growth of the AI camera market is fueled by the advancements in artificial intelligence and machine learning technologies, allowing cameras to undertake tasks beyond standard imaging. AI cameras come with smart algorithms that enable them to identify objects, faces, gestures, and emotions, making them crucial for various uses. These consist of surveillance, driverless cars, mobile phones, healthcare, and retail data analysis. AI cameras in surveillance increase security by offering instant facial recognition and behavior analysis, enhancing threat detection effectively. The car market plays a crucial role by utilizing AI cameras in ADAS and autonomous driving to enhance safety and effectiveness. In the realm of smartphones, AI cameras have transformed the photography experience by introducing capabilities like scene recognition, portrait enhancement, and improving low-light photography. AI cameras in the healthcare market provide advantages in patient monitoring and diagnostics by helping to identify abnormalities or monitor patient vital signs. Retailers use AI cameras to analyze consumer behavior, enhance customer interaction, and optimize store designs. The increase of smart cities and the increasing need for automation in various sectors continue to drive the market.

The AI camera market is experiencing notable growth due to the incorporation of AI cameras in traffic management and road safety, as seen in their detection of seat belt violations in Devon and Cornwall, UK. AI cameras are being used more and more on roads to improve traffic safety by detecting unsafe behaviors like not wearing seatbelts, using mobile phones, and other risky actions while driving. This technology is capable of effectively analyzing large volumes of data, pinpointing infractions that could go unnoticed by human officers. The situation where more than 2,200 violations of seat belt laws were noted, including 109 cases with children, showcases the important contribution of AI cameras in improving road safety. By utilizing AI technology, law enforcement can identify specific infractions such as unsecured children, even in fast-moving situations, through advanced image analysis and recognition features. The increasing number of crimes reported highlights the rise in need for smart surveillance systems, particularly in areas focusing on traffic safety. Moreover, the possible implementation of harsher penalties for not wearing seat belts, supported by professionals such as Adrian Leisk, may also boost the use of AI cameras for enforcing regulations. The increase in need for AI cameras is fueling the growth of the market, especially in industries such as transportation and public safety. Governments and police forces globally are increasingly acknowledging the impact of AI in decreasing traffic incidents and improving the efficiency of law enforcement, which is projected to lead to increased investments in these technologies. In addition, AI cameras are currently being utilized to tackle important safety concerns like unsecured children in cars, leading to a market growth towards non-traditional surveillance Types affecting public health and well-being. The increasing use of AI cameras for road safety is in line with the overall trend of automation and AI incorporation in various sectors, which will contribute to continuous market expansion in the future.

| Report Attributes | Details |

|---|---|

| Key Segments | • By Type (Smartphone Cameras, Surveillance Cameras, DSLRs) • By Technology (Image/Face Recognition, Speech/Voice Recognition, Computer Vision) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

AV Costar, Axis Communications AB ,Bosch Sicherheitssysteme GmbH ,Canon Inc. ,Hangzhou Hikvision Digital Technology Co., Ltd. ,Honeywell International Inc. ,Huawei Technologies Co., Ltd. ,Johnson Controls ,LG Electronics ,Nikon Corporation ,Panasonic Holdings Corporation ,Samsung Electronics Co., Ltd. ,Sony Corporation ,Teledyne FLIR LLC ,Others |

AI-powered security cameras are changing the landscape of physical security in the modern age.

The use of AI in security camera monitoring is transforming the traditional approach to physical security, which has historically relied on gates, guards, and firearms. AI-driven cameras are changing security by shifting from analyzing events after they occur to being able to stop incidents before they worsen. AI cameras can offer continuous, accurate surveillance, unlike human operators who might overlook important signals. They are proficient in identifying objects, spotting potential dangers like unattended items or weapons, and can improve night vision and thermal imaging, enabling surveillance in difficult environments like dimly lit areas or identifying differences in temperature. AI also provides analysis of behavior, recognizing questionable actions or lingering, and crowd analysis aids in identifying dangers such as crowded situations. Technologies such as facial recognition and license plate recognition enhance security by improving vehicle tracking and access control efficiency. These developments pose difficulties when it comes to implementation. Privacy issues, particularly in relation to facial recognition, prompt ethical inquiries regarding consent and the improper use of data. Moreover, the obstacle of AI accuracy persists, as an abundance of false positives can inundate security personnel, resulting in the disabling of AI functionalities. Incorrect identification or lack of context can lead to overlook dangerous situations, whereas unreliable data can reduce the system's efficiency. Additionally, the significant expense of implementation, combined with difficulties in integrating with current security infrastructure, hinders widespread acceptance. Even with these obstacles, the advantages are fueling the expansion of the AI camera market. Governments and businesses are putting money into AI cameras to improve security in public areas, crucial infrastructure, and smart cities, leading to a fast growth of the global AI camera market. The growing importance of AI in developing security systems is underscored by its increasing presence in the market, as continuous advancements are anticipated to drive adoption in different industries.

Increasing interest from consumers for smart devices is driving expansion in the AI Camera Market.

The rise in consumer fascination with smart gadgets is a major factor influencing the AI camera market, fueled by a rising desire for enhanced functionalities and automated processes in residential and commercial settings. AI-powered cameras provide services such as identifying objects, monitoring security, and automating processes, meeting the desires of today's consumers for convenience and effectiveness. AI cameras are becoming essential tools for businesses in different sectors as they aim to enhance operational efficiency, cut expenses, and obtain valuable insights. These are commonly utilized in tasks like anomaly detection, quality control, and predictive maintenance, playing a crucial role for industries that value automation and databased decision-making. The increasing popularity of smart cities and connected infrastructure intensifies the need for collecting and analyzing real-time data, in which AI cameras stand out for their capability to process large amounts of data instantly. Market participants are reacting to this trend by creating solutions that integrate sophisticated AI features to satisfy changing consumer demands. Hanwha Vision displayed a four-channel mini AI multidirectional camera, the PNM-C16013RVQ, in December 2023, perfect for use in smart, compact settings. This camera offers operators a 360° field of view and includes AI analytics, such as virtual line and area detection, providing an efficient and robust solution at a low cost. These advancements demonstrate how AI cameras are changing to cater to the demands of both companies and Technology, stimulating market expansion. AI-powered cameras will have a crucial impact on the growth of smart devices, aiding in the ongoing progress of smart homes, cities, and industries. Due to this, it is anticipated that the AI camera market will see substantial growth, driven by increasing consumer fascination with smart technologies and the need for intelligent, automated options.

Restraints

Challenges related to data security in AI Camera surveillance.

AI cameras, which come with sophisticated sensors for identifying faces, detecting objects, and recognizing actions, produce and handle large amounts of data instantaneously, causing major data security hurdles. Storing and protecting video data requires strong infrastructure like secure servers, data centers, and cloud solutions. Data protection necessitates choosing suitable storage technologies and enforcing strict security measures to avoid data leakage. Transmitting data remotely from AI cameras to monitoring or analysis sites comes with extra dangers, since inadequate encryption while transferring data can result in interception or unauthorized access. Securing data requires careful control of database entry points and ensuring only approved individuals are granted access. Outdated technology or weak security protocols can make it easier for unauthorized breaches to occur in access control systems. Cybercriminals able to obtain security codes or other confidential data can breach databases in a matter of minutes. Hence, it is important to have current access controls and strong encryption methods in place to protect data from possible dangers. It is crucial to tackle these data security issues in order to safeguard the reliability of AI camera systems and prevent security weaknesses from compromising the advantages of advanced surveillance technologies.

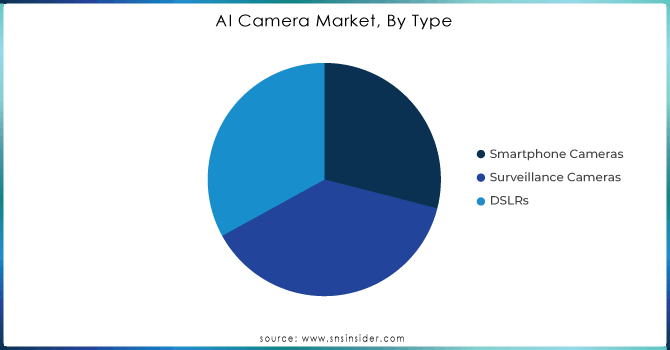

By Type

By 2023, surveillance cameras were at the forefront of the AI camera market, claiming the majority of revenue at 38%. This substantial portion highlights the important function of AI-driven surveillance technology in contemporary security measures. Surveillance cameras with artificial intelligence have enhanced features like instant object identification, tracking motion, and sending automated notifications, vital for all-encompassing security control in public and private domains. Key players in the market have achieved significant progress in this area. In January 2023, Hikvision released a new line of AI-powered surveillance cameras, the DS-2CD7A26G0/P-IZHS, which includes advanced facial recognition and intrusion detection capabilities. In the same way, Axis Communications unveiled the Axis Q1656-D in March 2023, a surveillance camera with AI capabilities, created for advanced imaging and smart video analysis. These advancements demonstrate the increasing need for advanced surveillance systems that utilize AI to improve security procedures. As the market grows, incorporating AI into surveillance cameras is predicted to lead to more advancements, providing better monitoring solutions for different uses.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Technology

In 2023, the biggest portion of the AI camera market revenue was secured by image and face recognition technology, making up 38% of the total. This shows the increasing dependence on advanced AI for security and identification needs. Image and facial recognition technologies boost surveillance systems by offering precise identification and authentication capabilities, vital for various uses such as access control and public safety. Significant developments in the market demonstrate this pattern. In February 2023, Dahua Technology introduced the DH-IPC-HF81230F, an AI camera with advanced face recognition features for improved security and user authentication. Likewise, in July 2023, NEC Corporation introduced its NeoFace technology incorporated into the new NeoFace X series, with the goal of offering precise face recognition for a range of security and customer service uses. More globally, nations are making substantial investments in security infrastructure powered by artificial intelligence. An example is the United Arab Emirates integrating cutting-edge facial recognition technology into their smart city initiatives, improving urban management and public safety. These advancements highlight the crucial importance of image and facial recognition in the AI camera market, fueling both technological progress and improvements in global security.

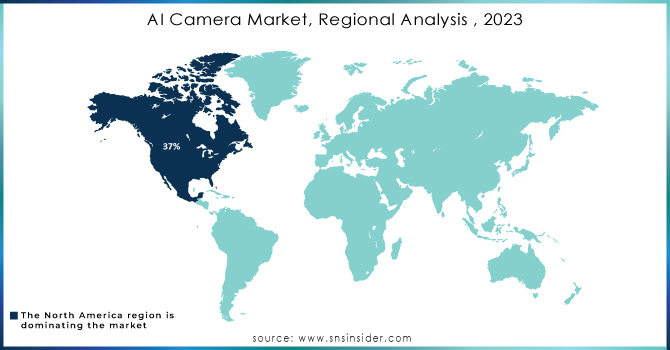

In 2023, North America dominated the AI camera market, accounting for 37% of the revenue. The region has experienced substantial regulatory and technological advancements, which are key factors contributing to this dominance. The enactment of the Foreign Intelligence Surveillance Act (FISA) by the U.S. government is a crucial factor, establishing strict guidelines for electronic surveillance operations. This law has increased the use of AI surveillance tools by creating specific regulations and legal structures that endorse their usage. There has been a significant increase in the need for advanced AI cameras that can fulfill these regulatory standards. Large companies in North America have met this demand by introducing new and creative products. In March 2023, Cisco Systems unveiled the new Cisco Meraki MV93, an AI-driven security camera with advanced analytics and improved image recognition to help meet federal surveillance rules. Likewise, in September 2023, Motorola Solutions introduced the WatchGuard V300 body-worn camera with AI capabilities, live video analysis, and automatic license plate identification, designed specifically for use in law enforcement. The progress demonstrates North America's dominant position in the AI camera market, fueled by regulatory backing and a commitment to technological progress. Incorporating AI into surveillance systems improves security and efficiency while also complying with legal standards for electronic monitoring solidifying the region is leading position in the worldwide AI camera market.

By 2023, Asia-Pacific had become the second most rapidly growing region in the AI camera market, with a high CAGR expected to drive further growth in the coming years. The region's significant population, which makes up almost half of the worldwide total, and its quickly growing economies in countries like India, South Korea, Japan, and Australia, are driving this expansion. Growing investments in advanced technology-based electronic devices and supportive government programs are pushing the use of AI cameras in different Types. An example worth mentioning is the launch of AI-powered cameras for traffic control by the Delhi government in January 2024. The purpose of these cameras is to identify 19 different traffic infractions, such as using a mobile phone while driving, having multiple passengers on a two-wheeler, and driving without a valid Pollution Under Control Certificate (PUCC). The demand for AI-powered cameras in connected devices is predicted to increase in Asia-Pacific as economies develop and urbanize, driven by government projects and private sector investments. The incorporation of AI technologies in this area highlights its increasing influence on the global AI camera market, emphasizing its dedication to using innovative solutions for better safety and productivity.

Some of key players of AI Camera Market who offer Product and Offering

AV Costar (Costar VMS)

Axis Communications AB (Axis Q1656-D AI Camera)

Bosch Sicherheitssysteme GmbH (Bosch AUTODOME IP starlight 7000i)

Canon Inc. (Canon VB-H43 AI Camera)

Hangzhou Hikvision Digital Technology Co., Ltd. (Hikvision DS-2CD7A26G0/P-IZHS)

Honeywell International Inc. (Honeywell Pro-Watch® Integrated Security Suite)

Huawei Technologies Co., Ltd. (Huawei OceanStor Dorado AI Camera)

Johnson Controls (Tyco Illustra Pro Gen 3 AI Camera)

LG Electronics (LG AI Video Surveillance Solutions)

Nikon Corporation (Nikon DS-Fi3 AI Camera)

Panasonic Holdings Corporation (Panasonic i-PRO Extreme AI Camera)

Samsung Electronics Co., Ltd. (Samsung Wisenet P Series AI Cameras)

Sony Corporation (Sony SNC-VB770 AI Camera)

Teledyne FLIR LLC (FLIR A500/A700 AI Thermal Cameras)

Others

On June 23, 2024, Nikon announced it is developing new technology to authenticate images and differentiate them from AI-generated fakes. This innovation aims to combat the growing issue of AI-created disinformation, a challenge that highlights the increasing importance of reliable imaging technologies in the AI camera market.

In February 2024, NWSL and Google Pixel revealed the introduction of the Program for Pitchside Content featuring AI Cameras. Through the long-term collaboration, Google Pixel is now the official sponsor of the NWSL Championship and Playoffs, in addition to introducing the Pixel program to enhance fan engagement with the sport.

In October 2023, Panasonic incorporated AI-driven automatic tracking into its PTZ cameras. The system is ideal for news studios, enabling users to capture all necessary content with only one operator needed to handle cameras.

In October 2023, Teledyne FLIR announced the launch of Visible Security Cameras integrated with artificial intelligence at ISC West 2023, enhancing its product range. The FLIR Quasar Premium Mini-Dome AI comes in three versions: 4K Wide, 5 MP, and 4K Narrow. Each option includes 12 analytics for detecting individuals, items, cars, occurrences, and characteristics.

| Report Attributes | Details |

|

Market Size in 2023 |

USD 11.32 billion |

|

Market Size by 2032 |

USD 70.89 billion |

|

CAGR |

CAGR of 22.61 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Market Opportunities |

• AI-powered security cameras are changing the landscape of physical security in the modern age. |

|

Market Restraints |

• Challenges related to data security in AI Camera surveillance. |

Ans: The AI Camera Market grow at a CAGR of 22.61% over the forecast period of 2024-2032.

Ans: The AI Camera Market size was valued at USD 11.32 billion in 2023 and is expected to grow to USD 70.89 billion by 2032 and grow at a CAGR of 22.61% over the forecast period of 2024-2032.

Ans: The major growth factor of the AI camera market is the increasing demand for advanced security and surveillance solutions driven by technological advancements and the rise of smart cities.

Ans: The Surveillance Cameras segment dominated the AI Camera Market.

Ans: North America dominated the AI Camera Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. AI Camera Market Segmentation, by Type

7.1 Chapter Overview

7.2 Smartphone Cameras

7.2.1 Smartphone Cameras Market Trends Analysis (2020-2032)

7.2.2 Smartphone Cameras Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Surveillance Cameras

7.3.1 Surveillance Cameras Market Trends Analysis (2020-2032)

7.3.2 Surveillance Cameras Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 DSLRs

7.4.1 DSLRs Market Trends Analysis (2020-2032)

7.4.2 DSLRs Market Size Estimates and Forecasts to 2032 (USD Billion)

8. AI Camera Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Image/Face Recognition

8.2.1 Image/Face Recognition Market Trends Analysis (2020-2032)

8.2.2 Image/Face Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Speech/Voice Recognition

8.3.1 Speech/Voice Recognition Market Trends Analysis (2020-2032)

8.3.2 Speech/Voice Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Computer Vision

8.4.1 Computer Vision Market Trends Analysis (2020-2032)

8.4.2 Computer Vision Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America AI Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe AI Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe AI Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific AI Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East AI Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa AI Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America AI Camera Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America AI Camera Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America AI Camera Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10. Company Profiles

10.1 AV Costar

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Axis Communications AB

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Canon Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Hangzhou Hikvision Digital Technology Co., Ltd.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Honeywell International Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Huawei Technologies Co., Ltd.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Johnson Controls

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 LG Electronics

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Nikon Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Panasonic Holdings Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Smartphone Cameras

Surveillance Cameras

DSLRs

By Technology

Image/Face Recognition

Speech/Voice Recognition

Computer Vision

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia-Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Precision Aquaculture Market Size was valued at USD 529.47 million in 2023 and is expected to grow at 14.38% CAGR to reach USD 1767.15 million by 2032

The Embedded Security Market Size was valued at USD 7.07 Billion in 2023 and is expected to grow at 6.60% CAGR to reach USD 12.52 Billion by 2032.

The Instrument Transformer Market Size was valued at USD 7.21 Billion in 2023 and is expected to grow at a CAGR of 5.94% to reach USD 12.08 Billion by 2032.

The Valve Driver Market was valued at 498.09 Million in 2023 and is projected to reach USD 759.41 Million by 2032, growing at a CAGR of 4.80% from 2024 to 2032.

The Sensor Hub Market was valued at USD 29.17 billion in 2023 and is projected to reach USD 125.23 billion by 2032, growing at a CAGR of 17.58% from 2024 to 2032.

DC Chargers Market Size was valued at USD 95.14 Billion in 2023 and is projected to reach USD 288.08 Billion by 2032, growing at a CAGR of 13.10% by 2024-2032.

Hi! Click one of our member below to chat on Phone