Agrochemicals Market Size & Overview:

The Agrochemicals Market was USD 253.6 billion in 2023 and is expected to reach USD 354.8 billion by 2032, growing at a CAGR of 3.8% over the forecast period of 2024-2032. The increasing global population, projected to reach 10 billion by 2050, has significantly escalated the demand for food production. This growth, coupled with shrinking arable land due to urbanization and industrial expansion, poses a challenge to food security worldwide. Agrochemicals, including fertilizers, pesticides, and herbicides, play a pivotal role in enhancing crop yields and ensuring efficient utilization of available agricultural land. With farmers under pressure to produce more food from limited resources, agrochemicals provide solutions by protecting crops from pests, diseases, and nutrient deficiencies. Additionally, changing dietary preferences, particularly in developing regions where protein consumption is rising, further amplify the need for high-yield and quality crops. As a result, the rising global food demand continues to act as a major driver for the growth of the agrochemicals market, fostering innovation and adoption of advanced agricultural solutions.

Get more information on Agrochemicals Market - Request Sample Report

The Food and Agriculture Organization (FAO) reports that in 2022, agricultural land covered about 4.8 billion hectares, accounting for more than one-third of the global land area.

There has been a very significant growth in organic farming across the globe owing to its adoption of sustainable agriculture and environmentally friendly practices. With a rise in health consciousness and a focus on sustainability, consumers are gravitating towards organic produce that has been grown without interfering and intrusive substances such as synthetic chemicals or pesticides. That is bolstered further by government programs and subsidies encouraging soil-friendly, biodiversity-enhancing organic farming strategies. For instance, the European Union via its Common Agricultural Policy (CAP) encourages farmers through financial aid, which in turn leads to organic agriculture. Likewise, in India, initiatives such as the Paramparagat Krishi Vikas Yojana (PKVY) promote organic practices as catchment areas for small and marginal farmers.

In the United States, the Department of Agriculture's National Institute of Food and Agriculture (USDA NIFA) supports organic agriculture through programs like the Organic Agriculture Research and Extension Initiative (OREI) and the Organic Transitions (ORG) program.

Agrochemicals Market Dynamics

Drivers

-

Increasing demand for crop protection products in agriculture drives market growth.

The growing need to safeguard crops from pests, diseases, and weeds is a significant driver of the agrochemicals market. With rising global food demand, farmers are under immense pressure to ensure higher yields and protect crops from losses caused by biotic stressors. Crop protection products, including herbicides, insecticides, and fungicides, play a crucial role in minimizing crop damage and enhancing productivity. According to the Food and Agriculture Organization (FAO), approximately 20-40% of global crop yields are lost annually to pests and diseases, making crop protection essential for food security. Additionally, climate change has led to the proliferation of invasive pests and diseases, further driving the demand for effective crop protection solutions. Governments worldwide are supporting the adoption of advanced crop protection technologies through subsidies and awareness programs, ensuring that farmers have access to these critical products. As a result, the increasing reliance on crop protection products continues to bolster market growth, fostering innovation and sustainable agricultural practices.

For instance, in 2022, the U.S. federal government provided farms with USD 15.6 billion in subsidies, including direct farm program payments, to support agricultural practices, including crop protection measures.

Restraint

Lack of knowledge about proper uses of agrochemicals which may hamper the market growth.

The low awareness relating to the incorrect application and usage of agrochemicals among farmers is one of the major restraints of the agrochemicals market. Using agrochemicals without following the recommended dosage or application time may cause soil erosion, poor crop quality, and environmental degradation. In developing regions where small and marginal farmers are not well trained or have access to extension services enhanced by technology, this issue is more pronounced. In addition, this misuse could endanger crops by building up pest resistance against it with time. Governments and agricultural organizations are beginning awareness campaigns and training programs to inform farmers about appropriate agrochemical use. Despite this, the ongoing information scarcity is still hindering market growth and highlights the necessity for larger educational programs and easier access to resources for farmers around the world.

Agrochemicals Market Segmentation

By Product

Fertilizers held the largest revenue share 64% in 2023. The agrochemicals market is led primarily by fertilizers, which are crucial for improving crop productivity and thus addressing the growing worldwide food demand. Whether they are fermented, steamed, or sprouted, these products supply key nutrients like nitrogen, phosphorus, and potassium critical for plant growth and building soil fertility. In countries experiencing rapid urbanization and facing land constraints, the increasing necessity to intensify agriculture on available arable land has also supported the demand for fertilizers. Furthermore, advances in farming practices and precision agriculture have further initiated the growth in the use of custom-made fertilizers for specific soils and crops.

By Application

Cereals & Grains held a significant revenue share of around 62% in 2023. This is owing to their importance as global staple food crops, and the rising requirement for food security due to the rising population. Wheat, rice, or maize are the principal dietary components, and calories supplying crops around the world, and in many developing areas of the globe, they supply the bulk of daily food consumption. More than half of agricultural production worldwide is cereals, with 2.7 billion metric tons produced each year Increased need for production to satisfy the rising demand for these essential crops leads mainly to increasing the usage of agrochemicals (fertilizers, herbicides, and pesticides) to enhance the harvest of the crop and shield crops from microbes, weeds, and diseases.

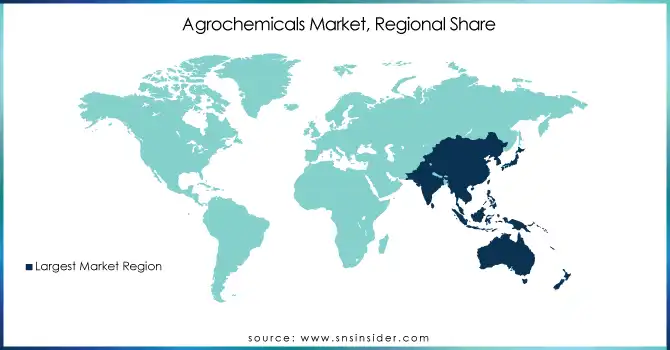

Agrochemicals Market Regional Analysis

Asia Pacific held the largest market share around 46% in 2023. The population density, and dependency of the population on agriculture for a large part of livelihood and food security. It is also the associated world's leading instruction of agricultural products like China, India, and Indonesia, where major crops like there is like rice, wheat, and maize are produced in location enormous quantities. The Food and Agriculture Organization (FAO) reports that rice production in Asia alone makes up over 90% of the total while almost half of global wheat production is done in Asia, indicating the indispensable nature of agriculture in the region. With the world population growing at an alarming pace, there is a demand for food to sustain the population, and contributing to the same is the limited availability of cultivable land, all of which has led to the extensive use of agrochemicals for improving crop yield. A significant help to market growth is also provided to governments of the region through subsidies and programs.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Clariant AG (Hostacor IT, Dispersogen PL 30)

-

The DOW Chemical Company (Acusol 445N, Ecosurf EH-9)

-

Solvay (Rhodapex ESB-70 NAT, Mirapol Surf S 900)

-

Bayer AG (Desmodur N 75, Bayferrox 130)

-

Huntsman International LLC (JEFFCAT DPA, Surfonic N-95)

-

Helena Agri-Enterprises LLC (Hel-Fire, Dyne-A-Pak)

-

Ashland, Inc. (Drewplus L-191, Flexcryl 1625)

-

Land O’ Lakes, Inc. (Winfield Max-In Ultra ZMB, InterLock)

-

FMC Corporation (Rynaxypyr, Talstar Professional)

-

Croda International Plc (Cithrol DPHS, Prisorine 3515)

-

BASF SE (Tinuvin 123, Pluronic F-127)

-

Evonik Industries AG (AEROSIL 200, TEGO Glide 410)

-

Akzo Nobel N.V. (Berol 260, Dissolvine M-40)

-

Arkema (Kynar 500, Rilsan Clear G850 Rnew)

-

Henkel AG & Co. KGaA (Technomelt AS 8998, Loctite 406)

-

DuPont (Zytel HTN, Sorona EP)

-

Momentive Performance Materials Inc. (Silsoft AX, CoatOSil DRI)

-

Eastman Chemical Company (Eastman AQ 38S, Tritan TX1001)

-

Lanxess (Bayhibit AM, Preventol D 7)

-

Kemira (FennoClean P, Superfloc C-491)

Recent Development:

-

In 2023, Corteva Agriscience announced the publishing of research that confirms the spontaneous migration of disease-resistance genes through the genome of a maize plant. The findings have implications for the use of new breeding approaches to lessen the harmful effects of plant diseases while increasing production potential and crop resilience.

-

In 2023, Corteva Agriscience announced the commercial launch of AdaveltTM active, which has recently received product approvals in Australia, Canada, and the Republic of South Korea. Adavelt Active is a revolutionary fungicide with a novel mode of effect that prevents a wide spectrum of crop-damaging diseases.

-

In 2023, Yara Growth Ventures will invest in Ecorobotix, a leader in high-precision crop input applications. By allowing plant-by-plant treatment with a smart sprayer system, Ecorobotix significantly minimizes the adverse environmental effects of crop inputs such as herbicides.

| Report Attributes | Details |

| Market Size in 2023 | USD 253.6 Bn |

| Market Size by 2032 | USD 354.8 Bn |

| CAGR | CAGR of 3.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Crop Protection Chemicals, Fertilizers, Plant Growth Regulators, Others) •By Application (Oilseeds & Pulses, Cereal & Grains, Fruits & Vegetables, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Clariant AG, The DOW Chemical Company, Solvay, Bayer AG, Huntsman International LLC, Helena Agri-Enterprises LLC, Ashland, Inc., Land O’ Lakes, Inc., FMC Corp., Croda International Plc, BASF SE |

| Key Drivers | •Increasing demand for crop protection products in agriculture drives market growth. |

| Market Restraints | •Lack of knowledge about proper uses of agrochemicals which may hamper the market growth. |