Get More Information on Agriculture Sensor Market - Request Sample Report

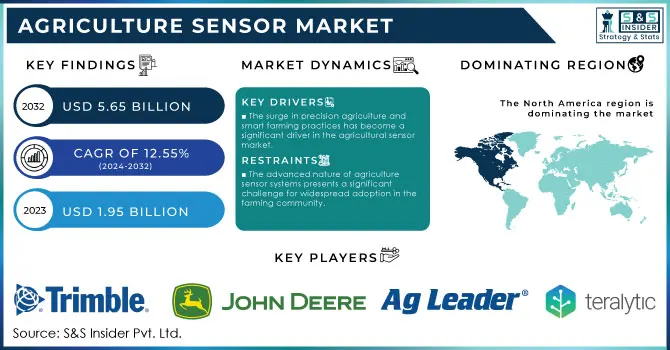

The Agriculture Sensor Market Size was valued at USD 1.95 Billion in 2023 and is supposed to arrive at USD 5.65 billion by 2032, and grow at a CAGR of 12.55% over the forecast period 2024-2032.

The agriculture sensor market is expected to experience robust growth from 2024 to 2032, propelled by rising demand for agricultural output and the integration of advanced technologies like precision farming and low-till management. These innovations are essential for real-time decision-making in yield monitoring, crop health assessments, and efficient irrigation scheduling, helping farmers tackle modern agricultural challenges. Agritech companies are increasingly implementing wireless platforms that empower farmers to improve productivity and manage price volatility. North America leads the market, driven by substantial investments in agricultural technology and environmental regulations that encourage sustainable farming practices. Innovations such as location sensors for precise positioning in agriculture are further enhancing operational efficiency. Agricultural sensors are instrumental in maximizing crop yields and managing resources more sustainably, underscoring the market's growth potential. With climate change intensifying, the demand for smart agriculture solutions, such as IoT-enabled soil moisture sensors for precision irrigation, is set to rise significantly, especially in areas with declining groundwater levels.

Family-operated farms, which make up 95% of the 1.9 million U.S. farms, benefit greatly from these advancements, meeting rising food demands with each farm now feeding about 169 people annually. Environmental stewardship is also prioritized, with many farms adopting renewable energy solutions, resulting in a 167% increase in renewable systems over the past decade. Collectively, these advancements in agricultural sensors support sustainable farming practices and enhance productivity, making them essential tools for the future of agriculture. The market is well positioned to play a vital role in promoting global food security by equipping farmers with technology to meet the demands of a growing population and changing environmental conditions.

Market Dynamics

Drivers

The surge in precision agriculture and smart farming practices has become a significant driver in the agricultural sensor market.

As farmers increasingly adopt technology-driven methods to monitor and manage crops at a granular level, sensors play a pivotal role in gathering real-time data on essential factors like soil moisture, nutrient levels, and crop health. This granular approach leads to optimized crop management, reduced input costs, and higher crop yields, ultimately making farming more sustainable and profitable. According to reports, the adoption of precision farming methods is projected to increase by 12% annually, as farmers look to leverage technology to counteract challenges such as water scarcity and labor shortages. In Texas, for instance, technology in agriculture has been instrumental in overcoming drought conditions, with farmers employing sensors and drones to monitor crop hydration levels. The use of drones for mapping and spraying significantly enhances resource efficiency and reduces water waste by up to 25%. Additionally, innovations in artificial intelligence (AI) and machine learning allow farmers to predict crop growth and harvest timing accurately. Such advancements in AI-driven autonomous solutions are set to transform traditional farming, enabling farms to operate with greater autonomy and productivity. Precision agriculture practices also significantly reduce environmental impact by ensuring precise resource application. By utilizing sensors to monitor crop and soil health, farmers can apply only the necessary amount of water and nutrients, reducing waste and environmental strain. Precision agriculture could help reduce agricultural runoff by 30%, thus preserving surrounding ecosystems. With agricultural output critical to global food security, the demand for precision agriculture technologies, particularly sensors, is expected to continue growing. As technology evolves and becomes more accessible, the adoption of precision farming will likely drive substantial growth in the agricultural sensor market over the next decade.

Restraints

The advanced nature of agriculture sensor systems presents a significant challenge for widespread adoption in the farming community.

These sophisticated technologies require a high level of technical knowledge for effective implementation and operation, which can be a barrier for many farmers, particularly those in family-run or small-scale operations. The integration of advanced sensors, including soil moisture monitors, nutrient sensors, and climate control devices, often necessitates specialized training and expertise that many farmers may lack. As a result, farmers might struggle to fully utilize the capabilities of these technologies, which can lead to suboptimal results and a reluctance to invest in such systems. Additionally, the rapid pace of technological advancements can make it difficult for farmers to keep up; creating a knowledge gap that can hinder their ability to adopt innovative farming practices. This complexity not only affects individual farmers but can also slow down the overall growth of the agriculture sensor market, as potential users may hesitate to invest in technology that they do not fully understand or feel confident in managing. Consequently, addressing this restraint requires comprehensive training programs and support systems to empower farmers, ensuring they can effectively leverage agriculture sensor technology to enhance productivity and sustainability in their operations. By simplifying technology and improving accessibility, the agriculture sensor market can unlock its full potential and drive greater adoption across diverse farming sectors.

Segment Analysis

By Sensor Type

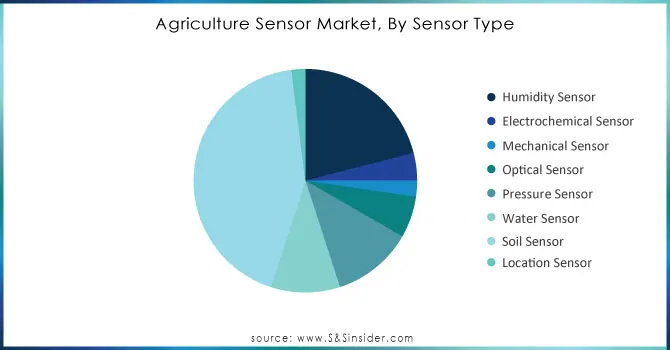

The soil sensor segment has established itself as a leading player in the agriculture sensor market, capturing around 43% of total revenue in 2023. This notable share emphasizes the vital role of soil health and moisture management in optimizing agricultural output. Soil sensors are engineered to deliver real-time insights into key soil parameters, such as moisture levels, pH, nutrient availability, and temperature, empowering farmers to make informed decisions that enhance crop yields and resource management. A significant advantage of soil sensors is their support for precision agriculture, enabling farmers to monitor soil conditions closely. This level of precision allows for targeted irrigation and fertilization, ensuring crops receive the exact amount of water and nutrients when needed, which is particularly beneficial in drought-prone regions. The rising focus on sustainable farming practices further propels the demand for soil sensors, as they help reduce chemical runoff and improve soil health—essential factors for meeting the needs of a projected global population of 9.7 billion by 2050. With the integration of IoT technology, soil sensors also offer enhanced connectivity and analytics, providing farmers with a comprehensive view of their operations. As digital solutions gain traction, soil sensors will continue to play a critical role in advancing agricultural productivity and sustainability.

Need Any Customization Research On Agriculture Sensor market - Inquiry Now

By Application

The soil monitoring application has emerged as a pivotal segment in the agriculture sensor market, capturing approximately 42% of total revenue in 2023. This significant share underscores the essential role of soil health and management in farming practices. By utilizing advanced sensor technologies, soil monitoring assesses critical parameters such as moisture levels, nutrient content, pH, and temperature. These sensors provide real-time data, empowering farmers to make informed decisions that enhance crop yields and optimize resource efficiency. A major advantage of soil monitoring is its contribution to precision agriculture. With accurate insights into soil conditions, farmers can tailor irrigation and fertilization strategies to meet the specific needs of their crops. This targeted approach not only increases productivity but also reduces waste, especially in water-scarce regions where efficient resource management is crucial. Leading companies in the sector are actively launching innovative products and upgrading existing solutions, emphasizing IoT integration and smart soil sensors that enable real-time data transmission. This enhanced connectivity improves decision-making and allows farmers to remotely monitor soil conditions.

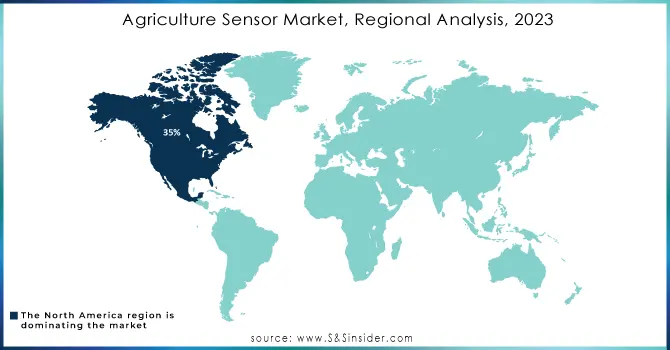

Regional Analysis

North America dominates the agriculture sensor market, representing approximately 35% of total revenue in 2023. This leading position stems from substantial investments in smart farming technologies, a strong emphasis on precision agriculture, and the presence of major industry players. The United States and Canada are at the forefront of adopting advanced agricultural technologies, driven by the need for enhanced productivity and sustainability. In the U.S., the agricultural sector is increasingly utilizing sensor-based solutions to tackle challenges like climate variability and labor shortages, supported by government initiatives promoting innovative technologies and sustainable practices. The integration of IoT technology enables real-time data collection, improving operational efficiency and encouraging data-driven decision-making among farmers. Canada is also advancing in the agriculture sensor market, focusing on sustainable practices and innovative crop management solutions.

Asia-Pacific is emerging as the fastest-growing region in the agriculture sensor market, driven by rapid technological advancements and rising agricultural demands. Countries like China and India are heavily investing in advanced technologies to enhance crop yields and ensure food security, supported by government policies promoting precision agriculture. The increasing adoption of IoT-enabled sensors and drones is enabling farmers to make informed decisions on irrigation, fertilization, and pest management. Companies like Drone deploy and Trimble are leading product innovations, launching advanced sensor systems to optimize farming practices. Overall, this region's growth trajectory reflects its critical role in the global agricultural technology landscape

Key Players

Some of the Major Key Players in Agriculture Sensor market with their product:

Trimble Inc. (Soil moisture sensors, Yield monitoring systems)

John Deere (Precision ag technology, Crop sensors)

AG Leader Technology (Yield monitoring systems, Soil sensors)

Teralytic (Soil health sensors, Wireless soil sensors)

Sentera (Crop health sensors, Drone technology)

Sierra Wireless (IoT solutions for agriculture, Environmental sensors)

The Climate Corporation (FieldView platform, Climate Pro)

Raven Industries (Raven SCS, Smart Sensor Technology)

Valley Irrigation (FieldNet, Irrigation management sensors)

Decagon Devices (Soil moisture sensors, Environmental monitoring)

Aker Technologies (Harvest sensors, Crop monitoring systems)

Yara International (N-sensor, Precision nutrient management)

Farmers Edge (Precision agriculture software, Soil and weather sensors)

EcoCare (Water quality sensors, Environmental monitoring)

Dahua Technology (Smart agriculture solutions, IoT devices)

Lindsay Corporation (FieldNET, Precision irrigation sensors)

AgJunction (Guidance and steering solutions, Crop sensors)

Ag Leader Technology (Planter monitors, Yield mapping tools)

Netafim (Drip irrigation systems, Soil moisture sensors)

Smart Fertilizer Management (Nutrient management solutions, Soil nutrient sensors)

List of companies are integral to the agriculture sector, providing the necessary sensor technology to enhance precision farming, optimize resource use, and improve crop yields.

Decagon Devices (METER Group)

Teralytic

Sentera

Sierra Wireless

Ag Leader Technology

Yara International

Aker Technologies

Farmers Edge

EcoCare

Heliotrope Technologies

Netafim

Trimble Inc.

John Deere

Raven Industries

Valley Irrigation

Dahua Technology

AgJunction

Lindsay Corporation

InstaPro International

The Climate Corporation

Recent Development

On June 13, 2024, advancements in Variable Rate Technology (VRT) were highlighted, emphasizing its role in precision agriculture. New mapping tools are enabling farmers to utilize real-time soil data for tailored applications of seeds and fertilizers, maximizing crop yields while minimizing resource waste. This innovation represents a significant step toward sustainable farming practices.

On November 1, 2024, a near-zero power gas sensor designed for agricultural IoT applications during the ECE Seminar. This innovative sensor consumes less than 100 pW while in sleep mode and activates upon detecting target gas molecules, significantly extending battery life and enabling effective monitoring in resource-limited farm settings.

On August 7, 2024, a partnership among NC State University’s Institute for Connected Sensor Systems, the N.C. Plant Sciences Initiative, and the Kenan Institute was announced to fund two agricultural sensor projects. One project focuses on enhancing solar energy generation on crop fields, while the other utilizes field robots and sensors for underground vegetable detection and measurement.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.95 Billion |

| Market Size by 2032 | USD 5.65 Billion |

| CAGR | CAGR of 12.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type: Humidity Sensor, Electrochemical Sensor, Mechanical Sensor, Optical Sensor, Pressure Sensor, Water Sensor, Soil Sensor, Location Sensor • By Application: Soil Monitoring, Yield Mapping and Monitoring, Disease Detection and Control, Weed Mapping, Other Applications |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trimble Inc., John Deere, AG Leader Technology, Teralytic, Sentera, Sierra Wireless, The Climate Corporation, Raven Industries, Valley Irrigation, Decagon Devices, Aker Technologies, Yara International, Farmers Edge, EcoCare, Dahua Technology, Lindsay Corporation, AgJunction, Netafim, and Smart Fertilizer Management are key players in the agriculture sensor market. |

| Key Drivers | • The surge in precision agriculture and smart farming practices has become a significant driver in the agricultural sensor market. |

| Restraints | • The advanced nature of agriculture sensor systems presents a significant challenge for widespread adoption in the farming community. |

Ans: The Agriculture Sensor Market Size was valued at USD 1.95 Billion in 2023 and is supposed to arrive at USD 5.65 billion by 2032, and grow at a CAGR of 12.55% over the forecast period 2024-2032.

Ans: Increasing demand for precision agriculture technologies that enhance crop yield, optimize resource usage, and promote sustainable farming practices.

Ans: North America is dominating in Agriculture sensor Market in 2023

Ans: Soil Sensor segment is dominating in Agriculture Sensor Market in 2023

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Agriculture Sensor Production and Sales Volumes (2020-2032), by Region

5.2 Agriculture Sensor Technology Adoption, by Region

5.3 Consumer Preferences in Agriculture Technology, by Region

5.4 Aftermarket Trends for Agriculture Sensors (Data on Maintenance, Parts, and Services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Agriculture Sensor Market Segmentation, by Sensor Type

7.1 Chapter Overview

7.2 Humidity Sensor

7.2.1 Humidity Sensor Market Trends Analysis (2020-2032)

7.2.2 Humidity Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Electrochemical Sensor

7.3.1 Electrochemical Sensor Market Trends Analysis (2020-2032)

7.3.2 Electrochemical Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Mechanical Sensor

7.4.1 Mechanical Sensor Market Trends Analysis (2020-2032)

7.4.2 Mechanical Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Optical Sensor

7.5.1 Optical Sensor Market Trends Analysis (2020-2032)

7.5.2 Optical Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Pressure Sensor

7.6.1 Pressure Sensor Market Trends Analysis (2020-2032)

7.6.2 Pressure Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Water Sensor

7.7.1 Water Sensor Market Trends Analysis (2020-2032)

7.7.2 Water Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Soil Sensor

7.8.1 Soil Sensor Market Trends Analysis (2020-2032)

7.8.2 Soil Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Location Sensor

7.9.1 Location Sensor Market Trends Analysis (2020-2032)

7.9.2 Location Sensor Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Agriculture Sensor Market Segmentation, by End User

8.1 Chapter Overview

8.2 Soil Monitoring

8.2.1 Soil Monitoring Market Trends Analysis (2020-2032)

8.2.2 Soil Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Yield Mapping and Monitoring

8.3.1 Yield Mapping and Monitoring Market Trends Analysis (2020-2032)

8.3.2 Yield Mapping and Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Disease Detection and Control

8.4.1 Disease Detection and Control Market Trends Analysis (2020-2032)

8.4.2 Disease Detection and Control Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Weed Mapping

8.5.1 Weed Mapping Market Trends Analysis (2020-2032)

8.5.2 Weed Mapping Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Other Sensor Type s

8.6.1 Other Sensor Type s Market Trends Analysis (2020-2032)

8.6.2 Other Sensor Type s Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Agriculture Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.2.4 North America Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.2.5.2 USA Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.2.6.2 Canada Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Agriculture Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Agriculture Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.6.2 France Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Agriculture Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.5.2 China Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.5.2 India Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.5.2 Japan Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.9.2 Australia Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Agriculture Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Agriculture Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.2.4 Africa Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Agriculture Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.6.4 Latin America Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Agriculture Sensor Market Estimates and Forecasts, by Sensor Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Agriculture Sensor Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10. Company Profiles

10.1 Trimble Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 John Deere

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 AG Leader Technology

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Teralytic

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Sentera

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Sierra Wireless

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 The Climate Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Raven Industries

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Valley Irrigation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Decagon Devices

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Sensor Type

Humidity Sensor

Electrochemical Sensor

Mechanical Sensor

Optical Sensor

Pressure Sensor

Water Sensor

Soil Sensor

Location Sensor

By Application

Soil Monitoring

Yield Mapping and Monitoring

Disease Detection and Control

Weed Mapping

Other Applications

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Volatile Organic Compound Gas Sensor Market Size was valued at USD 163.81 million in 2023, and is expected to reach USD 278.19 million by 2032, and grow at a CAGR of 6.07% over the forecast period 2024-2032.

The Full-body Scanners Market Size was valued at USD 351.23 million in 2023 and is expected to reach USD 973.9 million by 2032, growing at a CAGR of 12% over the forecast period 2024-2032.

The Circuit Protection Market Size was valued at USD 49.28 Billion in 2023 and is expected to grow at a CAGR of 5.79% to reach USD 81.52 Billion by 2032.

The Reed Sensor Market Size was valued at USD 1.74 Billion in 2023 and is expected to reach USD 3.04 Billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

The Wireless Home Security Camera Market Size was valued at USD 8.25 Bn in 2023, and will reach $28.94 Bn by 2032, and grow at a CAGR of 15.09% by 2024-2032

The Industrial Lighting Market size was valued at USD 8.16 billion in 2023 and is expected to grow to USD 15.38 billion by 2032 and grow at a CAGR of 7.30% over the forecast period of 2024-2032

Hi! Click one of our member below to chat on Phone