Agriculture Films Market Report Scope & Overview:

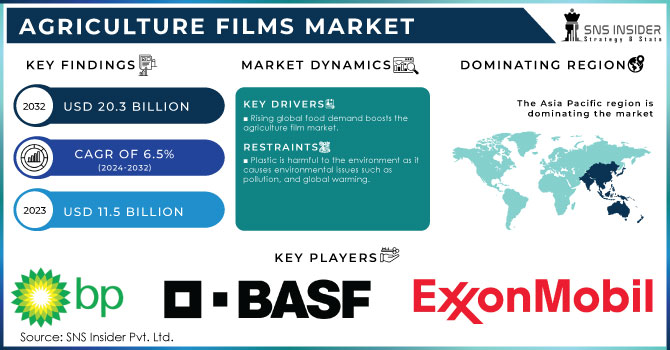

The Agriculture Films Market Size was valued at USD 11.5 Billion in 2023 and is expected to reach USD 20.3 Billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

Advancements in the technology of film materials have been an inseparable part of the growing use of agricultural films. The ones that are making the biggest effect on this process are more durable, UV-resistant, and biodegradable types, which enable people to rethink the history of traditional agriculture and replace the practices that were effective yet resulted in the degradation of the environment. For example, one of such technologies is replacing the application of commonly used plastic films with a biodegradable version that decomposes in the soil. It effectively allows for eliminating the accumulation of plastic, which is a top waste issue, and enriching the soil with nutrients instead of pollutants. Another innovation is the creation of a UV-resistant variety that does not grow weaker when exposed to sunlight for a longer period. The companies that created such films in 2023 were BASF and Dow, also known for their previous achievements. They contributed to this field once more by presenting innovative designs aimed at improving the performance of films in different climatic conditions.

Get E-PDF Sample Report on Agriculture Films Market - Request Sample Report

The transition to the new type of material is also strengthened by government support. For example, the Common Agricultural Policy of the European Union contributed the appropriate financial support to the use of better film materials, categorized as agri-tech solutions represented by the biodegradable option. In China, the Ministry of Agriculture officially addressed this issue in detail in 2023, revealing that the use of agricultural films in this country has increased by 15% due to government support for water conservation and modern agriculture issues. Thus, the new and improved film technology has its recognition around the world, transferring agriculture to being more eco-oriented and effective.

Moreover, if films are made of biopolymer, then they are completely biodegraded by microorganisms like bacteria and fungi that exist naturally in the soil. Mulch film's major application is to protect and prevent weed growth from impeding plant development. It also shields crops and soil from harsh weather conditions. They improve crop quality in general and lessen the risk of crop spoilage brought on by weather, pests, and weeds. Biodegradable Mulch Films are mostly employed in horticulture and agriculture to increase productivity, speed up harvesting, and save water and chemicals.

The expansion of greenhouse cultivation is significantly boosting the demand for agriculture films, as greenhouses provide controlled environments for year-round crop production. This method is increasingly popular due to its ability to optimize growing conditions, ensuring higher yields and better-quality crops, even during off-seasons. Agriculture films play a crucial role in maintaining ideal light, temperature, and moisture levels within greenhouses. With the rising global focus on efficient land use and maximizing food production, greenhouse farming has become a key driver for the agriculture film market.

In 2023, Dow introduced a new range of UV-resistant agricultural films under its ELITE™ brand, which enhances durability and performance in extreme sunlight conditions. These films extend the life of greenhouse coverings, helping farmers reduce replacement costs and increase crop productivity.

Agriculture Films Market Dynamics

Drivers

- Rising global food demand boosts the agriculture film market.

Due to the increase in population, the demand for daily needs such as food with minimal expenditure has driven the agriculture film market. New advanced agriculture practices such as using mulch film, silage film, and greenhouse films which protect crops and soil from harsh weather conditions, and insects, will increase the yield of food. Farmers can simply plow the mulch films into the ground after harvest. This will save time and money, and it helps to avoid insects. Many Films used in farming are biodegradable means they will be degraded by microorganisms and fungi these have also helped farmers with disposal and dumping issues keeping the environment clean. So, all these advantages make the use of technologies like greenhouse films, Silage films, and Mulch Films necessary in agriculture fields.

In 2023, advanced multilayer greenhouse films, which provide better light diffusion and temperature control, will help farmers maximize productivity. These films support off-season crop production, meeting the increasing food demand without compromising the growing environment.

Moreover, in China, the Ministry of Agriculture reported a 20% rise in the use of greenhouse films between 2021 and 2023, fueled by government incentives for adopting modern farming technologies to boost food security. Similarly, the European Union's Common Agricultural Policy (CAP) allocated substantial funding for sustainable agriculture, including biodegradable films, to enhance productivity while addressing environmental concerns.

Restrain

- Plastic is harmful to the environment as it causes environmental issues such as pollution, and global warming.

Plastic’s harmful impact on the environment is a significant restraint in the agriculture film market. Traditional plastic films, often used in farming, contribute to various environmental issues like pollution and global warming. Non-biodegradable plastics can persist in the soil for decades, leading to soil contamination, reduced fertility, and harm to microorganisms essential for soil health. Additionally, plastic waste often finds its way into water bodies, harming marine life and ecosystems. The production of plastic also contributes to global warming due to the energy-intensive processes involved, which release significant amounts of greenhouse gases. As a result, increasing awareness of these environmental concerns is pushing farmers, governments, and businesses to seek more sustainable alternatives, such as biodegradable films, to mitigate the negative impacts of plastic use.

Agriculture Films Market Segmentation

By Raw Material

Linear Low-Density Polyethylene held the largest market share around 50% in 2023. Considering their characteristics such as high tensile strength, crack resistance, UV ray resistance, moisture barrier, and adjustable temperature range, the films made up of LLDPE are commonly used in agriculture. It is extensively used as it is accessible, cheap, resistant to impact, has good electrical insulation, and has excellent chemical resistance. It costs less and gives better performance compared to the traditional films are some of the properties due to which these films are increasingly used over the conventional films.

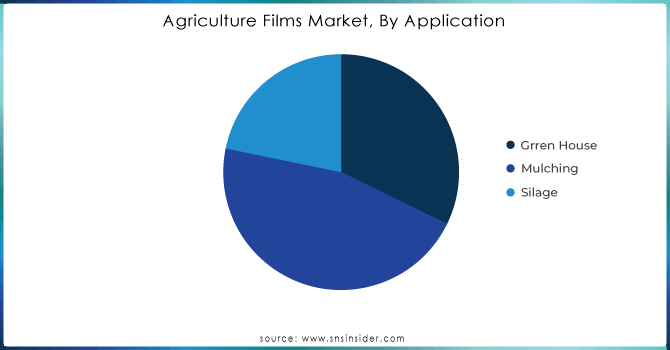

By Application

Mulching held the largest market share around 46% in 2023. These films, primarily made from plastic or biodegradable materials, are laid over the soil to create a protective layer that conserves moisture, suppresses weeds, and regulates soil temperature. This leads to more efficient water use, improved soil structure, and better crop yields. Mulching films are particularly valued for their role in reducing irrigation needs and protecting crops from pests and diseases, which aligns with the increasing demand for efficient and sustainable agricultural practices. Their widespread application across various crops, including vegetables and fruits, and their ability to support both conventional and organic farming methods further solidify their dominant position in the market.

Need any customization research on Agriculture Films Market - Enquiry Now

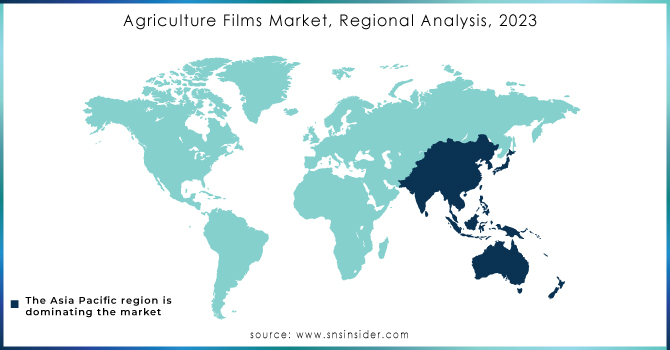

Agriculture Films Market Regional Analysis

Asia Pacific dominates the market due to the growing use of greenhouse films and mulch films. China is the largest user of these films as it produces large agricultural products. Countries like China and India have large film demand as it has to cater to large food demand due to the high population. The availability of raw materials and high demand are increasing the demand for films in the market.

North America is showing moderate growth in the market as increasing consumer's preference towards plant-based foods, and a shift in eating patterns from processed food to organic vegetables. The Europe market has a higher growth rate as the increasing use of biodegradable materials in farming boosts the market. The major shift is due to government policies on ban on plastic usage and disposal due to environmental concerns.

Latin America and Middle East & Africa region are at a progressive stage. Growing concern for organic foods, developing and adopting agriculture techniques. Advanced methodologies are being adapted to produce large agriculture products and are anticipating the growth of agriculture film markets.

Key Players

The major Key Players are AbRaniPlastOy, BP Industries, Britton Group, BASF SE, Berry Global Inc, Exxon Mobil Corporation, Group Barbier, Novamont, Dow Inc, RPC Group PLC, Trioplast Industries AB, Coveris Flexibles Austria GmbH, and other key players will be included in the final report.

Key Developments:

Berry Global Inc- In 2023 Berry Global company has adopted an approach towards the development of sustainable solutions for agriculture films that are affordable to customers. This approach focuses on the production and recycling of agricultural films by reduction of plastic waste in the world.

RKW Group- In 2023 the RKW group has expanded to include mono-axially stretched Polyethylene films (MDO PE) which are known as RKW Horizon® and can be used mainly in packaging. These RKW Horizon® products were created with the goals of reducing carbon emissions, enhancing recycling, and using recycled plastics more frequently.

Berry Global Inc- In 2022 Berry Global Inc began a collaboration with PolyAg Recycling Ltd and Cleanfarms in Canada to produce a new product from complete recycling of grain bag material and Agriculture films with a close-loop method.

| Report Attributes | Details |

| Market Size in 2023 | US$ 11.5 Bn |

| Market Size by 2032 | US$ 20.3 Bn |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw material (Linear low-density polyethylene (LLDPE), Low density polyethylene (LDPE), High density polyethylene (HDPE), Ethyl vinyl acetate/ethyl butyl acrylate (EVA/EBA), Reclaims, Others) • By Application (Green House, Mulching,Silage) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbRaniPlastOy, BP Industries, Britton Group, BASF SE, Berry Global Inc, Exxon Mobil Corporation, Group Barbier, Novamont, Dow Inc, RPC Group PLC, Trioplast Industries AB, Coveris Flexibles Austria GmbH |

| Key Drivers | • The use of agriculture Films is beneficial for converting unproductive lands into agricultural lands. • Rising global Food demand boosts the Agriculture films market. |

| Market Opportunities | • The innovation in films such as ultraviolet ray blocking, Fluorescent, ultra-thermic films, and biodegradable films has increased the popularity of the agriculture film market. • The rise in the use of films may increase the quantity and quality of agricultural products. |