To get more information on Agriculture Drone Market - Request Free Sample Report

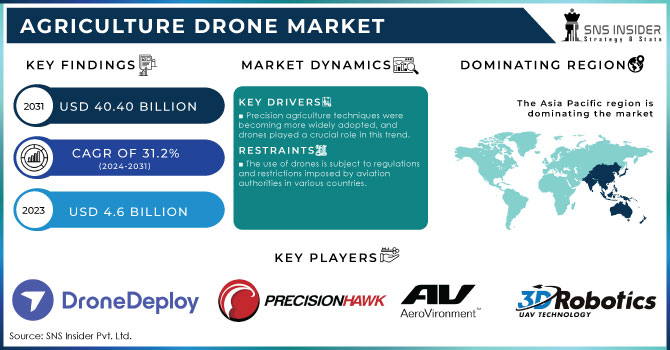

The Agriculture Drone Market size amounted to USD 4.6 Billion in 2023 & is estimated to reach USD 40.40 Billion by 2031 and increase at a compound annual growth rate (CAGR) of 31.2% between 2024 and 2031.

Agri-tech firms have developed innovative models for easing farming practises by focusing more on wireless platforms, such as drone technology, to enable real-time decision-making regarding yield monitoring, crop health monitoring, field mapping, irrigation scheduling, and harvesting management in order to increase agricultural productivity. Agriculture drones are Unmanned Aerial Vehicles (UAVs) used in farming and agricultural applications. These drones are equipped with a wide range of sensors and imaging technologies, e.g. LIDAR, camera or multispectral sensing that enables them to collect data on agriculture's agricultural productivity in addition to other aspects affecting it.

A variety of reasons are driving the global market, including the rising need for precision agriculture, developments in drone technology, government backing, cost-effectiveness, & more awareness and education. Furthermore, UAV data may be utilised for a variety of applications, including crop monitoring, mapping, and analysis, as well as plant counting, irrigation management, and pest control. UAVs can also assist farmers optimise agricultural operations, minimise waste, and enhance yields by delivering precise and timely information on crop health and production. Furthermore, the worldwide market is expected to rise during the projected period due to an increase in the implementation and usage of such technologies.

With growing business activity, research, and investment, North America is one of the most important markets, with the United States being one of the most important marketplaces. The National Institute for Food and Agriculture awarded Kansas City State University more than $100,000 for a drone research programme that has aided in the production of stronger, more wheat and other grains are resistant strains of popular crops. Drones will monitor wheat-breeding facilities in the same way that aerial imaging technology is used in agriculture to identify and cross-breed wheat strains. This discovery will allow certain crops to mature faster and may have an influence on the global seed industry.

Drones equipped with various sensors, such as multispectral, hyperspectral, and thermal cameras, can capture high-resolution images and data that help farmers monitor crop health, detect nutrient deficiencies, and identify areas of stress. This enables the precise application of resources like water, fertilizers, and pesticides. Drones can cover large agricultural areas quickly, reducing the time and labour required for manual inspections. This efficiency results in cost savings and higher production. Drones gather valuable data that can be processed to create maps, models, and analytics for making informed decisions about crop management, irrigation, and overall farm operations.

DRIVERS

Precision agriculture techniques were becoming more widely adopted, and drones played a crucial role in this trend.

Data-Driven Insights are the driver of the Agriculture Drone Market.

Drones collected vast amounts of data from fields, enabling farmers to make informed decisions about planting, irrigation, fertilization, and pest control. This data-driven approach aimed to increase yield while minimizing resource wastage.

RESTRAIN

The use of drones is subject to regulations and restrictions imposed by aviation authorities in various countries.

Skill and Training Requirements are the restraint of the Agriculture Drone Market.

Operating agriculture drones effectively requires a certain level of technical expertise and training. Farmers and operators need to learn how to pilot drones, analyze collected data, and integrate it into their farming practices. The learning curve can be a challenge for some users.

OPPORTUNITY

Incorporating AI and machine learning algorithms into agriculture drones can enhance their capabilities.

Customization for Specific Crops is an opportunity for Agriculture Drone Market.

Developing specialized drones and sensor payloads tailored to the unique needs of different crops and farming practices can provide significant value. This customization can lead to more accurate and effective data collection and analysis.

CHALLENGES:

Most drones have limitations on flight time and range due to battery constraints.

Data Overload and Interpretation are the challenges of the Agriculture Drone Market.

Drones collect large amounts of data, and farmers may struggle with processing and interpreting this data effectively. Without proper data analysis tools and expertise, the collected data may not translate into actionable insights.

Ukraine, famed for agriculture and other heavy industries, is an unlikely location for drone innovation. However, the constraints of war, more than 200 Ukrainian drone manufacturers are now collaborating with front-line military units to adjust and upgrade drones to better their capacity to kill and spy on the enemy. Over the previous year, the initiative has assisted commercial firms in training over 10,000 drone operators, with the goal of training an additional 10,000 in the next six months. Russia's air force is considered to be 10 times larger than Ukraine's, and it has grounded most of it after shooting down multiple fighter jets early in the conflict. With the help of drones, Ukraine has been able to watch and hit critical targets more than a kilometre beyond enemy lines, while also improving its conventional artillery's accuracy. Agriculture Drone Market has gained profits up to 3.2-4.1% due to the Russia-Ukraine war.

Drones, or unmanned aerial vehicles, are increasingly being used in a wide range of businesses, from personal use to military purposes, but they may also help a country's economic production. According to a World Economic Forum study, drones have the potential to be at the core of a technology-led revolution in Indian agriculture, raising the country's GDP by 1-1.5% while creating at least five lakh jobs in the next years. The agriculture business in Asia is crucial to the economy since it employs 8-10% of the population and feeds 1.5 billion people in the world's second most populous country. In actuality, Asian agriculture is vital not just for the domestic market, but also for the global food supply chain. In the ongoing recession, Agriculture Drone Market has increased its product & service prices up to 2-3.1%.

Asia Pacific: During the projection period, Asia Pacific will be the dominating region. The Asia Pacific market is predicted to develop rapidly due to increased agricultural output and worldwide agricultural exports. The demand for agriculture unmanned aerial vehicles is likely to be increased by major farming countries, like China, India, Indonesia and several others in Asia. Furthermore, regional market players are extensively spending in product development, which will drive up demand for agricultural UAV services throughout the projection period.

North America: The second-largest market share was held by North America. The region's growth is due to different government programmes and investments to improve the sector. The Department of Transportation (DOT) and the Federal Aviation Administration (FAA), for example, have created favourable legislation to encourage commercial and small unmanned aerial systems by eliminating the need for a pilot licence. Furthermore, commercial agricultural enterprises operating enormous acres across the country have a significant and loyal client base in the United States. This, together with the availability of appropriate manufacturing businesses in the United States and Canada, explains North America's dominance in the worldwide agriculture drone market share.

Need any customization research on Agriculture Drone Market - Enquiry Now

The major Players are Drone Deploy, Precision Hawk Inc, DIL, AeroVironment Inc., 3D Robotics, Trimble Navigation Ltd., Parrot Drone, Sintera LLC, Ag Eagle, Delair Tech SAS and other players.

In 2022: Trimble announced a next-generation 3D paving control system for asphalt compactors, which is intended to increase the compactors' speed and accuracy.

In 2022: The Pininfarina Shanghai EA-30X is a professional agriculture spraying drone that can cover all terrains, all hours, and all plant protection application scenarios. The next-generation night autonomous operation of the EA-30X dual-eye environment sensing technology provides dynamic continuous obstacle avoidance as well as complete coverage of terrain below 90 degrees.

In 2021: DJI unveiled its latest crop protection drone, the AGRAS T20, in its crop protection series for agriculture. It has a maximum payload of 20 kg and a 20% improvement in spray uniformity of about seven metres.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.6 Billion |

| Market Size by 2031 | US$ 40.40 Billion |

| CAGR | CAGR of 31.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hybrid Wing, Rotary Wing, Fixed Wing) • By Component (Navigation Systems, Batteries, Cameras, others), and By Application (Livestock Monitoring, Precision Agriculture, Precision Fish Farming, Irrigation, Smart Greenhouse) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Drone Deploy, Precision Hawk Inc, DIL, AeroVironment Inc., 3D Robotics, Trimble Navigation Ltd., Parrot Drone, Sintera LLC, Ag Eagle, Delair Tech SAS |

| Key Drivers | • Precision agriculture techniques were becoming more widely adopted, and drones played a crucial role in this trend. • Data-Driven Insights are the driver of the Agriculture Drone Market. |

| Market Restraints | • The use of drones is subject to regulations and restrictions imposed by aviation authorities in various countries. • Skill and Training Requirements are the restraint of the Agriculture Drone Market. |

Ans. The Compound Annual Growth rate for the Agriculture Drone Market over the forecast period is 31.2%.

Ans. USD 40.40 Billion is the projected agriculture drone market size of the market by 2031.

Ans. The Agriculture Drones Market is anticipated to reach USD 4.6 billion by 2023.

Ans. Europe is expected to expand at the fastest rate throughout the projected period (2024-2031).

Ans. North America will have the greatest market share in the Agriculture Drones Market by 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Agriculture Drone Market Segmentation, By Offering

8.1 Hybrid Wing

8.2 Rotary Wing

8.3 Fixed Wing

9. Agriculture Drone Market Segmentation, By Component

9.1 Navigation Systems

9.2 Batteries

9.3 Cameras

9.4 others

10. Agriculture Drone Market Segmentation, By Application

10.1 Livestock Monitoring

10.2 Precision Agriculture

10.3 Precision Fish Farming

10.4 Irrigation

10.5 Smart Greenhouse

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Agriculture Drone Market by Country

11.2.2 North America Agriculture Drone Market by Offering

11.2.3 North America Agriculture Drone Market by Component

11.2.4 North America Agriculture Drone Market by Application

11.2.5 USA

11.2.5.1 USA Agriculture Drone Market by Offering

11.2.5.2 USA Agriculture Drone Market by Component

11.2.5.3 USA Agriculture Drone Market by Application

11.2.6 Canada

11.2.6.1 Canada Agriculture Drone Market by Offering

11.2.6.2 Canada Agriculture Drone Market by Component

11.2.6.3 Canada Agriculture Drone Market by Application

11.2.7 Mexico

11.2.7.1 Mexico Agriculture Drone Market by Offering

11.2.7.2 Mexico Agriculture Drone Market by Component

11.2.7.3 Mexico Agriculture Drone Market by Application

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Agriculture Drone Market by Country

11.3.1.2 Eastern Europe Agriculture Drone Market by Offering

11.3.1.3 Eastern Europe Agriculture Drone Market by Component

11.3.1.4 Eastern Europe Agriculture Drone Market by Application

11.3.1.5 Poland

11.3.1.5.1 Poland Agriculture Drone Market by Offering

11.3.1.5.2 Poland Agriculture Drone Market by Component

11.3.1.5.3 Poland Agriculture Drone Market by Application

11.3.1.6 Romania

11.3.1.6.1 Romania Agriculture Drone Market by Offering

11.3.1.6.2 Romania Agriculture Drone Market by Component

11.3.1.6.4 Romania Agriculture Drone Market by Application

11.3.1.7 Turkey

11.3.1.7.1 Turkey Agriculture Drone Market by Offering

11.3.1.7.2 Turkey Agriculture Drone Market by Component

11.3.1.7.3 Turkey Agriculture Drone Market by Application

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Agriculture Drone Market by Offering

11.3.1.8.2 Rest of Eastern Europe Agriculture Drone Market by Component

11.3.1.8.3 Rest of Eastern Europe Agriculture Drone Market by Application

11.3.2 Western Europe

11.3.2.1 Western Europe Agriculture Drone Market by Country

11.3.2.2 Western Europe Agriculture Drone Market by Offering

11.3.2.3 Western Europe Agriculture Drone Market by Component

11.3.2.4 Western Europe Agriculture Drone Market by Application

11.3.2.5 Germany

11.3.2.5.1 Germany Agriculture Drone Market by Offering

11.3.2.5.2 Germany Agriculture Drone Market by Component

11.3.2.5.3 Germany Agriculture Drone Market by Application

11.3.2.6 France

11.3.2.6.1 France Agriculture Drone Market by Offering

11.3.2.6.2 France Agriculture Drone Market by Component

11.3.2.6.3 France Agriculture Drone Market by Application

11.3.2.7 UK

11.3.2.7.1 UK Agriculture Drone Market by Offering

11.3.2.7.2 UK Agriculture Drone Market by Component

11.3.2.7.3 UK Agriculture Drone Market by Application

11.3.2.8 Italy

11.3.2.8.1 Italy Agriculture Drone Market by Offering

11.3.2.8.2 Italy Agriculture Drone Market by Component

11.3.2.8.3 Italy Agriculture Drone Market by Application

11.3.2.9 Spain

11.3.2.9.1 Spain Agriculture Drone Market by Offering

11.3.2.9.2 Spain Agriculture Drone Market by Component

11.3.2.9.3 Spain Agriculture Drone Market by Application

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Agriculture Drone Market by Offering

11.3.2.10.2 Netherlands Agriculture Drone Market by Component

11.3.2.10.3 Netherlands Agriculture Drone Market by Application

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Agriculture Drone Market by Offering

11.3.2.11.2 Switzerland Agriculture Drone Market by Component

11.3.2.11.3 Switzerland Agriculture Drone Market by Application

11.3.2.1.12 Austria

11.3.2.12.1 Austria Agriculture Drone Market by Offering

11.3.2.12.2 Austria Agriculture Drone Market by Component

11.3.2.12.3 Austria Agriculture Drone Market by Application

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Agriculture Drone Market by Offering

11.3.2.13.2 Rest of Western Europe Agriculture Drone Market by Component

11.3.2.13.3 Rest of Western Europe Agriculture Drone Market by Application

11.4 Asia-Pacific

11.4.1 Asia-Pacific Agriculture Drone Market by Country

11.4.2 Asia-Pacific Agriculture Drone Market by Offering

11.4.3 Asia-Pacific Agriculture Drone Market by Component

11.4.4 Asia-Pacific Agriculture Drone Market by Application

11.4.5 China

11.4.5.1 China Agriculture Drone Market by Offering

11.4.5.2 China Agriculture Drone Market by Application

11.4.5.3 China Agriculture Drone Market by Component

11.4.6 India

11.4.6.1 India Agriculture Drone Market by Offering

11.4.6.2 India Agriculture Drone Market by Component

11.4.6.3 India Agriculture Drone Market by Application

11.4.7 japan

11.4.7.1 Japan Agriculture Drone Market by Offering

11.4.7.2 Japan Agriculture Drone Market by Component

11.4.7.3 Japan Agriculture Drone Market by Application

11.4.8 South Korea

11.4.8.1 South Korea Agriculture Drone Market by Offering

11.4.8.2 South Korea Agriculture Drone Market by Component

11.4.8.3 South Korea Agriculture Drone Market by Application

11.4.9 Vietnam

11.4.9.1 Vietnam Agriculture Drone Market by Offering

11.4.9.2 Vietnam Agriculture Drone Market by Component

11.4.9.3 Vietnam Agriculture Drone Market by Application

11.4.10 Singapore

11.4.10.1 Singapore Agriculture Drone Market by Offering

11.4.10.2 Singapore Agriculture Drone Market by Component

11.4.10.3 Singapore Agriculture Drone Market by Application

11.4.11 Australia

11.4.11.1 Australia Agriculture Drone Market by Offering

11.4.11.2 Australia Agriculture Drone Market by Component

11.4.11.3 Australia Agriculture Drone Market by Application

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Agriculture Drone Market by Offering

11.4.12.2 Rest of Asia-Pacific Agriculture Drone Market by Component

11.4.12.3 Rest of Asia-Pacific Agriculture Drone Market by Application

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Agriculture Drone Market by Country

11.5.1.2 Middle East Agriculture Drone Market by Offering

11.5.1.3 Middle East Agriculture Drone Market by Component

11.5.1.4 Middle East Agriculture Drone Market by Application

11.5.1.5 UAE

11.5.1.5.1 UAE Agriculture Drone Market by Offering

11.5.1.5.2 UAE Agriculture Drone Market by Component

11.5.1.5.3 UAE Agriculture Drone Market by Application

11.5.1.6 Egypt

11.5.1.6.1 Egypt Agriculture Drone Market by Offering

11.5.1.6.2 Egypt Agriculture Drone Market by Component

11.5.1.6.3 Egypt Agriculture Drone Market by Application

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Agriculture Drone Market by Offering

11.5.1.7.2 Saudi Arabia Agriculture Drone Market by Component

11.5.1.7.3 Saudi Arabia Agriculture Drone Market by Application

11.5.1.8 Qatar

11.5.1.8.1 Qatar Agriculture Drone Market by Offering

11.5.1.8.2 Qatar Agriculture Drone Market by Component

11.5.1.8.3 Qatar Agriculture Drone Market by Application

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Agriculture Drone Market by Offering

11.5.1.9.2 Rest of Middle East Agriculture Drone Market by Component

11.5.1.9.3 Rest of Middle East Agriculture Drone Market by Application

11.5.2 Africa

11.5.2.1 Africa Agriculture Drone Market by Country

11.5.2.2 Africa Agriculture Drone Market by Offering

11.5.2.3 Africa Agriculture Drone Market by Component

11.5.2.4 Africa Agriculture Drone Market by Application

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Agriculture Drone Market by Offering

11.5.2.5.2 Nigeria Agriculture Drone Market by Component

11.5.2.5.3 Nigeria Agriculture Drone Market by Application

11.5.2.6 South Africa

11.5.2.6.1 South Africa Agriculture Drone Market by Offering

11.5.2.6.2 South Africa Agriculture Drone Market by Component

11.5.2.6.3 South Africa Agriculture Drone Market by Application

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Agriculture Drone Market by Offering

11.5.2.7.2 Rest of Africa Agriculture Drone Market by Component

11.5.2.7.3 Rest of Africa Agriculture Drone Market by Application

11.6 Latin America

11.6.1 Latin America Agriculture Drone Market by Country

11.6.2 Latin America Agriculture Drone Market by Offering

11.6.3 Latin America Agriculture Drone Market by Component

11.6.4 Latin America Agriculture Drone Market by Application

11.6.5 Brazil

11.6.5.1 Brazil Agriculture Drone Market by Offering

11.6.5.2 Brazil Agriculture Drone Market by Component

11.6.5.3 Brazil Agriculture Drone Market by Application

11.6.6 Argentina

11.6.6.1 Argentina Agriculture Drone Market by Offering

11.6.6.2 Argentina Agriculture Drone Market by Component

11.6.6.3 Argentina Agriculture Drone Market by Application

11.6.7 Colombia

11.6.7.1 Colombia Agriculture Drone Market by Offering

11.6.7.2 Colombia Agriculture Drone Market by Component

11.6.7.3 Colombia Agriculture Drone Market by Application

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Agriculture Drone Market by Offering

11.6.8.2 Rest of Latin America Agriculture Drone Market by Component

11.6.8.3 Rest of Latin America Agriculture Drone Market by Application

12 Company profile

12.1 Drone Deploy

12.1.1 Company Overview

12.1.2 Financials

12.1.3 Product/Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Precision Hawk Inc

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 DIL

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 AeroVironment Inc

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 3D Robotics

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Trimble Navigation Ltd

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Parrot Drone

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Sintera LLC

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Ag Eagle

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Delair Tech SAS

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Offering

Hybrid Wing

Rotary Wing

Fixed Wing

By Component

Navigation Systems

Batteries

Cameras

others

By Application

Precision Agriculture

Precision Fish Farming

Irrigation

Smart Greenhouse

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The C5ISR Market Size was valued at USD 131.5 billion in 2023, expected to reach USD 167.5 billion by 2031 with a growing CAGR of 3.07% over the forecast period 2024-2031.

The Live Laser-Based Training and Simulation Platforms Market Size was valued at USD 1.02 Billion in 2023 and is expected to reach USD 1.86 Billion by 2032 and grow at a CAGR of 6.9% over the forecast period 2024-2032.

The Aircraft Wire and Cable Market size was valued at USD 1.70 billion in 2023 and is projected to reach USD 2.90 billion by 2032, growing at a CAGR of 6.2% over the forecast period of 2024–2032.

The Aircraft Lighting Market size was valued at USD 2.64 billion in 2023 and is expected to reach USD 6.00 billion by 2032 and grow at a CAGR of 9.56% over the forecast period 2024-2032.

The Soldier Modernization Market Size was valued at USD 14.60 billion in 2023 and is expected to reach USD 19.8 billion by 2032, growing at a CAGR of 5.7% from 2024-2032.

The Passenger Security Market Size was valued at USD 6.52 billion in 2023 and is expected to reach USD 12.40 billion by 2032 with a growing CAGR of 7.41% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone