Get More Information on Agricultural Enzymes Market - Request Sample Report

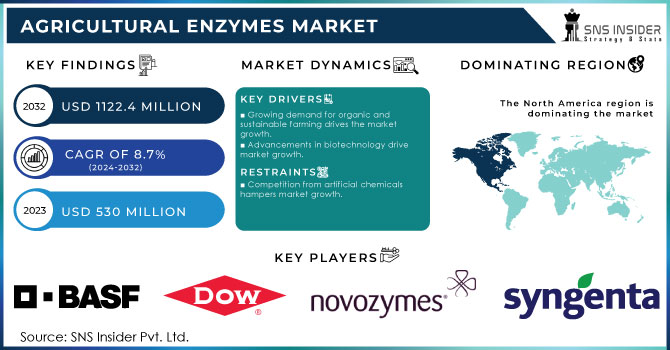

The Agricultural Enzymes Market Size was valued at USD 530 Million in 2023. It is expected to grow to USD 1122.4 Million by 2032 and grow at a CAGR of 8.7% over the forecast period of 2024-2032.

An increase in the interfacing of antibiotics or organic chemical compounds has led to a rising preference for agricultural enzymes, driving the agriculture enzymes market in diverse regions. Enzymes boost various biological processes of plants, soil, and animals these products which are termed as agricultural enzymes, are growth-regulator products for crops. Various kinds of agricultural enzymes can be produced through biotechnological methods, as well as natural sources.

According to the U.S. Department of Agriculture (USDA), over 16 million acres of U.S. farmland were dedicated to organic production in 2022, reflecting a strong push towards natural solutions like agricultural enzymes to enhance crop yield and soil health. This aligns with global trends toward reducing chemical inputs and fostering more biotechnological methods in agriculture.

Additionally, some of these products have outstanding features and functionalities that can help in raising the activity of enzymes. Presently, enzymes are also used to increase the efficiency of agricultural activities and reduce the usage of operational costs on some procedures. Some enzymes also support the process of soil conditioning, seed treatment, and digestion of food for consumption by animals. In order to cope with the rising commercial activities, farmers are majorly interested in adopting cost-effective solutions, which may not hike the operational cost and yet give a good finish to yield higher productivity.

Research and development are driving the growth of enzyme technology, resulting in the innovative development of novel products. Agricultural enzymes have improved features and provide enzyme stability, which is why they can carry out specific functions with higher efficiency. As a result, the increase in processes and applications determines and increases the range of applications of these products.

Environmental challenges that cause soil degradation, pollution of water bodies, and loss of biodiversity are reasons for driving more interest in looking for alternatives that do not harm the environment. Enzymes offer alternatives to traditional applications of chemicals for farmland. However, enzyme production and formulation are not cheap, especially in the case of specialized products or the genetic designing of these enzyme products which are more expensive. The costly production determines the cost of enzymes that come out with the production costs. Hence, the relatively high cost of these products has restrained their rise in usage among small-scale farmers as well as farmers within low-income regions. They are only sold in markets that are well-situated for market purposes. These products, which are sold in chemical markets, find it difficult to get through the sales of enzyme agriculture products. There is no entry into the interior because of the distance as well as the unavailability of adequate places for storage.

Drivers

Growing demand for organic and sustainable farming drives the market growth.

Advancements in biotechnology drive market growth.

The evolution in biotechnology techniques has remarkably improved the effectiveness and affordability of chemical enzymes across the agricultural industry, substantiating their rising prevalence among farmers. More specifically, the introduction of various enzyme production methods, such as genetic modification and efficient fermentation procedures, has facilitated the creation of powerful chemicals that are especially suitable for a particular target. For instance, with the introduction of a novel line of nutrients, activators, and fungicides, BASF has developed a product that enhances the general health of the soil and the presence of essential substances as of 2023. To manufacture this product, BASF uses cutting-edge fermentation technology, which enables extensive enzyme production. As another illustrative case, in 2022, Novozymes adopted biotechnological techniques to manufacture a set of bio-based enzyme products, promoting the productivity of nutrient absorption in plants. In this way, advances in biotechnology have allowed the creation of more productive solutions that result in higher crop yields. At the same time, the examples provided above prove that the latest progress in agricultural enzymes enhances the sustainability of the already indispensable trend.

Restraint

Competition from artificial chemicals hampers market growth.

One of the major limiting factors for the agricultural enzymes market is competition from synthetic chemicals. Synthetic fertilizers and pesticides are more readily available and are in widespread use in conventional farming. While they are no longer viewed as environmentally friendly, they are considered to be more efficient by most farmers. Synthetic pesticides allow the killing of all parasites on the farm within a day, while the effect of natural ones may take days or weeks to transpire, which further cements their current preference. At the same time, supply chains are already established, traditional products are marketed and re-sold, and the initial potential return rate on investment in synthetic chemicals is lower. For natural enzyme products, the main limitation is the fact that farmers, while showing a growing demand among their consumer base, remain leery of them. Not as easy to work with and maintain, as well as potentially requiring different land management practices, they face a barrier to market entry based on the comfort of existing systems.

Opportunity

Integration with smart farming technologies

Innovative Delivery Mechanisms

By Product

The market for phosphatase accounted for a share of roughly 38% in the year 2023. Phosphatase enzymes facilitate the hydrolysis of organic phosphates, releasing phosphate ions that are more accessible to the plant. Increasing the availability of phosphorous through these products will enhance plant nutrient uptake and subsequently crop yield. Furthermore, phosphorus fertilizers are extensively used in agriculture to promote soil phosphorous content. However, a significant percentage of the applied phosphorous may become bound to the soil particles or immobilized in an organic form, making it unavailable to the plant. Phosphatase enzymes can mobilize and mineralize organic phosphorus, enhancing phosphorus fertilizer efficiency and reducing the need for excessive phosphorous application on soil.

The dehydrogenase enzymes are useful biomarkers that indicate soil microbial activity and general soil health. The dehydrogenase enzyme catalyzes the transfer of hydrogen atoms that occurs during the metabolic process of soil microorganisms. The product’s activity level mirrors the microbial biomass and the number of living cells in the soil. As a significant concern in agriculture is soil health, farmers and other industrial experts will increase the use of such products on soil fertility, quality, and sustainability assessment. Moreover, the dehydrogenase enzyme is also dominant in the decomposition of organic matter and pollutants present in the soil. Hence, these products may increase as they are used during the microbial decomposition of organic compounds such as pesticides, herbicides, and hydrocarbons, and agriculture as a whole is struggling with soil remediation and pollution problems.

By Crop Type

Cereals & grains took over the market and held a share of about 38% in 2023. Amylases and proteases and some of the enzymes used that enhance the digestibility of cereal grains. By incorporating enzymes into animal feed, enzymes break down complex carbohydrates and the proteins of cereals into simpler forms that are absorbed in the body of the animals. This enhances the improvement in nutrient utilization and the feed conversion rate, implying better performance in livestock production and poultry. Cereal grains are affected by fungal contamination hence producing mycotoxins which include; aflatoxins, ochratoxins, and fumonisins. The aflatoxins are very toxic substances to animals causing liver cancer. Esterases break down the ester bond in the fungal cell wall degrading it. The enzyme in the fungal cell wall helps in averting the production of mycotoxins. Products like cellucanes and glucans help in catalyzing the breakdown of the fungal cell wall hence they reduce mycotoxin contamination and the food or feed will be safe when consumed. Proteases and cellulase enzymes have been efficient in the extraction of oil in oilseeds and protein from pulses respectively.

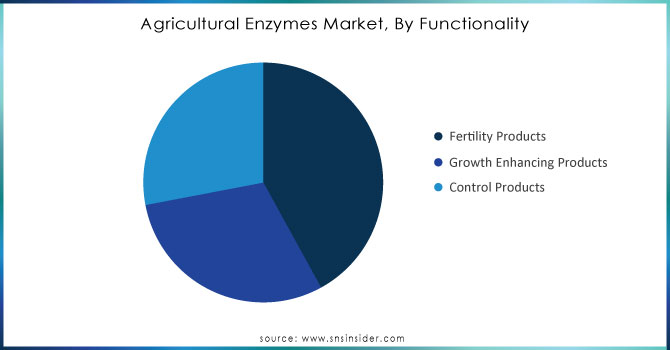

By Functionality

Fertility function held the largest market share around 42% in 2023. The enzymes facilitate soil health by promoting microbial activity, nutrient cycling, and organic matter decomposition which drive the market growth. As a result, when soils are healthy and when microbial populations are balanced, plants are more likely to grow and stand up better to environmental stress. Agricultural enzymes, in turn, reduce the reliance on chemical fertilizers since they are able to enhance the efficiency of nutrient usage. In other words, by boosting the availability of nutrients that can be found in passages of the soil or organic amendments, these goods provide the capability to decrease the usage of artificial fertilizers, together with the overall economic and environmental burdens that are associated with their application.

Need Any Customization Research On Agricultural Enzymes Market - Inquiry Now

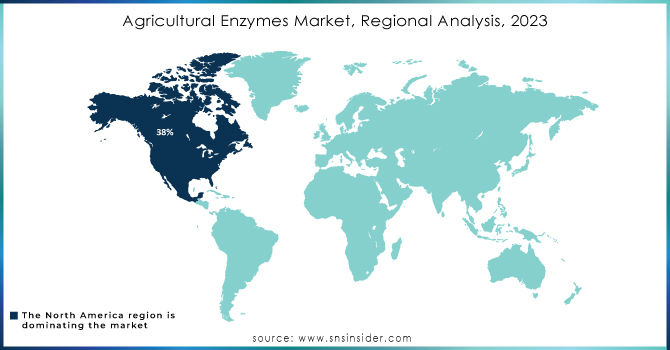

North America held the largest market share around 38% in 2023. The North American market has become a pioneering region for the development and large-scale implementation of advanced agricultural solutions based on ENZYMES. This situation is mainly caused by its well-developed agricultural sector that is highly oriented on innovation and technology advancement. Modern North America-based farmers and agricultural producers tend to focus on the use of sustainable approaches that would allow them to increase their crop yield and minimize environmental influence. Therefore, the interest in the use of agricultural enzymes has considerably increased owing to the strong sides that this solution may bring.

The simultaneous existence of large investments into research, development, and partial prefabrication results in a number of highly specific, efficient, and innovative enzyme products that can effectively meet the needs of the region’s agricultural sector. The rapidly developing interest in the use of sustainable, organic products places additional pressure on manufacturers that favor the use of synthetic chemicals in their production and promotes the use of enzyme-based alternatives. It is also crucial to note that the Governments of such large North American countries as the USA and Canada tend to actively promote the comprehensive development of sustainable agriculture and soil health. In general, these factors ensure the further development of the North American region as the leading geographical area of the market whose potential for growth in this market segment is currently the highest in the world.

Novozymes A/S (BioAg Symbiosis)

BASF SE (BASF ComCat)

DuPont de Nemours, Inc. (Axtra PHY)

Syngenta AG (EnzOx)

Bayer CropScience AG (BioAct)

Aries Agro Limited (Rhizozome)

Monsanto Company (Acceleron B-300 SAT)

Bioworks, Inc. (RootShield)

Agrinos AS (HYT A)

Stoller USA Inc. (Bio-Forge)

AB Enzymes GmbH (Ronozyme)

Nutraferma Inc. (Nutraferm)

GreenMax AgroTech (Greenzyme)

American Biosystems Inc. (Enz-A-Bac)

BioAtlantis Ltd. (Super Fifty)

Enzyme India Pvt. Ltd. (Agrizyme)

Specialty Enzymes & Biotechnologies Co. (Enzyme Solutions)

Advanced Enzyme Technologies Ltd. (DigeGrain)

Creative Enzymes (Cellulase Pro)

Kemin Industries, Inc. (Kemzyme)

In 2024, Novozymes launched BioGrowth Plus, an advanced enzyme-based product targeting soil regeneration and nutrient uptake efficiency, aiming to enhance yield sustainability in crops amid changing climate conditions.

In 2024, BASF introduced EnviroZyme 360, an enzyme solution developed to optimize nutrient release in low-quality soils, focusing on increasing agricultural output while reducing dependency on chemical fertilizers.

In 2023, Creative Enzymes introduced Cellulase Pro, targeting improved plant biomass breakdown in the soil, which leads to better soil structure and nutrient recycling for crops.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 530 Million |

| Market Size by 2032 | US$ 1122.4 Million |

| CAGR | CAGR of 8.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Phosphatases, Dehydrogenases, Sulfatases, Other) • By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals, Others), • By Functionality (Fertility Products, Growth Enhancing Products, Control Products) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novozymes A/S, BASF SE, DuPont de Nemours, Inc., Syngenta AG, Bayer CropScience AG, Aries Agro Limited, Monsanto Company, Bioworks, Inc., Agrinos AS, Stoller USA Inc., AB Enzymes GmbH, Nutraferma Inc., GreenMax AgroTech, American Biosystems Inc., BioAtlantis Ltd., Enzyme India Pvt. Ltd., Specialty Enzymes & Biotechnologies Co., Advanced Enzyme Technologies Ltd., Creative Enzymes, Kemin Industries, Inc. and Others |

| Key Drivers | • Growing demand for organic and sustainable farming drives the market growth. • Advancements in biotechnology drive market growth. |

| RESTRAINTS | • Competition from artificial chemicals hampers market growth. |

Ans: The Agricultural Enzymes Market was valued at USD 530 Million in 2023.

Ans: The expected CAGR of the global Agricultural Enzymes Market during the forecast period is 8.7%.

Ans: The Cereals & Grains grow rapidly in the Agricultural Enzymes Market from 2024-2032.

Ans: Integration with smart farming technologies create the opportunity in agricultural enzymes market.

Ans: The U.S. led the Agricultural Enzymes Market in North America region with the highest revenue share in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Agricultural Enzymes Market Segmentation, by Product

7.1 Chapter Overview

7.2 Propylene Glycol

7.2.1 Propylene Glycol Market Trends Analysis (2020-2032)

7.2.2 Propylene Glycol Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Ethylene Glycol

7.3.1 Ethylene Glycol Market Trends Analysis (2020-2032)

7.3.2 Ethylene Glycol Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Glycerin

7.4.1 Glycerin Market Trends Analysis (2020-2032)

7.4.2 Glycerin Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Agricultural Enzymes Market Segmentation, by Technology

8.1 Chapter Overview

8.2 IAT

8.2.1 IAT Market Trends Analysis (2020-2032)

8.2.2 IAT Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 OAT

8.3.1 OAT Market Trends Analysis (2020-2032)

8.3.2 OAT Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 HOAT

8.4.1 HOAT Market Trends Analysis (2020-2032)

8.4.2 HOAT Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Agricultural Enzymes Market Segmentation, by Application

9.1 Chapter Overview

9.2 Aerospace

9.2.1 Aerospace Market Trends Analysis (2020-2032)

9.2.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Automobile

9.3.1 Automobile Market Trends Analysis (2020-2032)

9.3.2 Automobile Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Industrial Heat Transfer and Cooling Systems

9.4.1 Industrial Heat Transfer and Cooling Systems Market Trends Analysis (2020-2032)

9.4.2 Industrial Heat Transfer and Cooling Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Agricultural Enzymes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Agricultural Enzymes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Agricultural Enzymes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Agricultural Enzymes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Agricultural Enzymes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Agricultural Enzymes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Agricultural Enzymes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Agricultural Enzymes Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Agricultural Enzymes Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Agricultural Enzymes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 BASF SE

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Royal Dutch Shell

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 TotalEnergies

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 PARAS Lubricants

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 CCI Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Chevron Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 KOST USA, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Old World Industries Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Gulf Oil International

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 SONAX Gmbh

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Phosphatases

Dehydrogenases

Sulfatases

Other

By Crop Type

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Turf & Ornamentals

Others

By Functionality

Fertility Products

Growth Enhancing Products

Control Products

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Synthetic Rubber Market Size was valued at USD 33.70 Billion in 2023 and is expected to reach USD 51.39 Billion by 2032, growing at a CAGR of 4.80% over the forecast period of 2024-2032.

The Ceramic Matrix Composites Market Size was valued at USD 9.6 Billion in 2023. It is expected to grow to USD 23.8 Billion by 2032 and grow at a CAGR of 10.7% over the forecast period of 2024-2032.

Nanofiltration Membranes Market size was valued at USD 1.1 billion in 2023 and is expected to reach USD 2.6 billion by 2032, at a CAGR of 10.1% from 2024-2032.

The Hexamethylenediamine Market size was USD 8.41 billion in 2023 and is expected to reach USD 14.93 billion by 2032 and grow at a CAGR of 6.58% over the forecast period of 2024-2032.

Silicone Surfactants Market was valued at USD 1.9 Billion in 2023 and is expected to grow to USD 2.8 Billion by 2032, growing at a CAGR of 4.5% from 2024-2032.

Ethyl Lactate Market size was USD 1.9 Billion in 2023 and is estimated to reach USD 3.8 Billion by 2032, growing at a CAGR of 7.4 % from 2024-2032.

Hi! Click one of our member below to chat on Phone