Get More Information on Agricultural Adjuvants Market - Request Sample Report

The Agricultural Adjuvants Market Size was valued at USD 3.8 billion in 2023, and is expected to reach USD 5.8 Billion by 2032, and grow at a CAGR of 4.8% over the forecast period 2024-2032.

The need to enhance the efficiency of agrochemicals herbicides, insecticides, and fungicides also makes the agricultural adjuvants market a critical component of modern farming. Adjuvants are substances that alter the behavior of pesticides, enhancing the performance of pesticides by increasing their effectiveness, stability, and application efficiency. It is a very dynamic market driven by such factors as technological advancements, changes in legislation, and changing consumer preference to more sustainable agriculture.

Recently, there have been impressive breakthroughs in the development and use of adjuvants for agricultural purposes. For instance, one significant innovation took place early this year in March 2022 when Clariant officially launched a new adjuvant called ADJUWEX. The new adjuvant is an additive intended to boost the effectiveness of glufosinate herbicides, meant to control weeds on various crops. This formulation is targeted towards improvement in herbicide performance since it maximizes the intake of active ingredients, hence better crop protection overall. It is one of the latest developments in a trend toward more efficient and focused agricultural solutions. Similarly, in April 2024, CHS Inc. presented pragmatic advice on adjuvant selection, reminding the public to choose the right adjuvants to maximize pesticide performance. The keys pointed out as far as selecting appropriate adjuvants in place are better crop yield and reduced chemical usage, the advisory reminded the public that this is where the focus is going more and more on optimizing adjuvant use to cultivate more sustainable agricultural practices. Furthermore, May 2024 was witness to a landmark moment in the marrying of adjuvants with yeast-based vaccines. This may well revolutionize the nature of vaccines available in agriculture, going forward. From that, it is clear that the role of adjuvants in applications beyond their use in pesticides can only grow. Another great development was the announcement in October 2023 of a partnership between Inimmune and Boston Children's Hospital toward developing novel adjuvants. Novel adjuvants could make vaccines more effective. This development is human health-oriented, but the findings made may impact the agricultural sector in the future as it will depend on how to enhance the formulation of the vaccine and pesticide formulations.

Additionally, January 2023 has to do with the proper application of adjuvants, which enables the herbicide to do an effective job. Such information enhances the proper execution of weed control and would thereby enhance crop management and productivity. The agricultural adjuvants market is evolving, and constant innovation and adaptation are taking place. The new developments point toward the improvement in the performance and versatility of adjuvants toward the universal aim of agricultural efficiency and sustainability.

Drivers:

Innovations in adjuvant formulations enhance the efficacy and stability of agrochemicals, improving overall crop protection.

Formulations of adjuvants have greatly enhanced the efficiency and stability of agrochemicals for broader crop protection. For instance, new surfactants and emulsifiers help in making more effective delivery systems for pesticides and herbicides. New adjuvants, for example, provide a better wetting and spreading of herbicide solutions to herbicides, resulting in uniform deposition on plant surfaces. This upsurges uptake into leaves and enhances the efficiency of herbicides in controlling weeds. Beyond this, advances in adjuvant technology have led to the development of stable adjuvants that are insensitive to extreme conditions of the environment like elevated temperatures and pH fluctuations. These conditions ensure efficacy during their application period using a reduced number of treatments and chemicals. Advanced adjuvants based on nanotechnology are a good example, which can help increase the precision of pesticide application to control specific pest species so that off-target effects will be reduced. These new technologies enhance not only pest and disease management but also contribute to more sustainable farming practices since their incorporation brings minimal environmental impacts from the application of agrochemicals. In general, such technological advancements in adjuvant formulations are important so that crop protection methods can be optimized to be much more effective and reliable in modern agriculture.

Growing demand for sustainable farming practices boosts the adoption of adjuvants that increase the efficiency and environmental benefits of pesticides.

Increased demand for sustainable farming, with sustainable pesticide application using the help of improved adjuvants, increases efficiency and environmental advantage in the use of pesticides. As farmers and agricultural interests become more environmental conscious, seeking to minimize adverse impacts while realizing maximum output, pesticide adjuvants present a need for improvement in pesticide performance and diminish adverse impacts. For instance, the utilization of adjuvants that enhance pesticide adhesion and penetration enables the application of pesticides at low rates while reducing chemical load in the environment. Biodegradable and environment-friendly adjuvants have been developed in place of traditional formulations that can linger in the environment and cause harm to non-target organisms. Among the notable advancements is the application of adjuvants that act synergistically with an integrated pest management approach. These enhance pesticide selectivity-pesticides that kill pests and spare all beneficial insects and pollinators. Other adjuvants improve nutrient and agrochemical absorption, reduce runoff and leaching, and thus contribute to healthier soils and waters. However the embracing of such advanced adjuvants shows a large movement to agricultural methods that balance productivity and environmental stewardship, thereby overcoming both economic and ecological concerns in modern agriculture.

Restraint:

Stringent regulations and approval processes for new adjuvants can delay market entry and increase development costs.

Strict regulations and complicated processes of approval for new adjuvants may increase their entry time to the market and also influence cost development. In general, regulatory authorities always impose strict requirements regarding the safety of new adjuvants for users and the environment so more tests and documentation are required for new adjuvants. For instance, several clinical trials should be conducted before a newly discovered adjuvant could be sold on the market to determine its safety, environmental acceptability, and even risk to the health of human and animal subjects. These requirements translate into long approval times and investments from the companies. For example, a development company for a new adjuvant could end up spending much time and cost on several rounds of testing and data submissions. This regulatory burden might be specific enough to choke the smaller firms or market entrants, potentially restraining innovation and slowing the adoption of advanced adjuvant technologies.

Opportunity:

Expanding agricultural sectors in developing regions present opportunities for growth in adjuvant adoption to improve crop yields and pest control.

The growth of agriculture sectors in developing regions is one of the biggest opportunities for adjuvants, given that these areas look for ways to improve their crop yields and find better systems for pest control. Improved cropping systems have a growing requirement for more effective technologies that can boost productivity, and this demand should create an opportunity for advanced adjuvants. For instance, with countries under rapid agricultural growth whether in Sub-Saharan Africa or Southeast Asiapo, farmers embrace modern techniques to increase food production and take better care of pests. The transformation would be all that much easier if adjuvants were able to enhance the performance of pesticides and fertilizers, thus more effective crop protection and nutrient use. This trend therefore portrays a highly lucrative market for the firms that have successfully developed innovative adjuvant products specifically designed for these unique needs and challenges in these developing regions. This, on the other hand, goes to improve agricultural productivity and food security.

Challenge:

The need for highly specialized and compatible adjuvant formulations can complicate product development and market differentiation.

Highly specialized and compatible adjuvant formulations in the agricultural adjuvants market are a major challenge because they complicate product development as well as market differentiation. Because these effective adjuvants interact with various pesticides while responding to crop-specific requirements, adjuvants involve intricate formulation science and rigorous testing. For instance, developing an adjuvant for a particular herbicide formulation should be compatible so as not to harm the herbicide performance or crop safety. Such complexity calls for extensive research and development to create tailor-fit solutions-which would be both time and resource-consuming. The marketplace also gets filled up with divergent adjuvant products, making it even harder to identify what is unique from the crowd. But as this happens, there is an even greater need for innovation and optimal marketing strategies to differentiate and remain competitive. This reflects the importance of specialized knowledge and strategic planning to successfully penetrate and expand in the competitive marketplace of adjuvant formulation with a competitive edge.

By Source

The petroleum-based segment dominated the agricultural adjuvants market in 2023, accounting for an estimated 65% share. This is because petroleum-based adjuvants have been widely used today due to their cost-effectiveness and proven reliability for performance in agrochemical applications. Petroleum-based adjuvants remain a favorite due to their variety and effectiveness in impeding and promoting a wide range of pesticides and herbicides. For instance, these adjuvants are used and formulated to increase the spreadability and absorption of chemicals on the leaves and surfaces of the plant in enhancement of pest control and crop protection. Though interest in bio-based alternatives is getting larger, infrastructure and proven benefits built up using petroleum-based adjuvants will secure their leading position in the market.

By Product

In 2023, activator adjuvants dominated the market by holding approximately a share of about 55%. The segment of activator adjuvants is at the top because activator adjuvants, primarily surfactants and oil-based adjuvants, have an indispensable function in improving the performance of agrochemicals. Surfactants, for instance, enhance the wetting, spreading, and penetration of pesticides and herbicides to create a more thorough coverage and better absorption by plant surfaces. Oil-based adjuvants also help agrochemicals to improve their wetting ability and ability to penetrate deeper into the plant tissue. Through maximization of the utility of chemical application effectiveness, activator adjuvants have enjoyed a strong preference, thus entrenching them as market leaders.

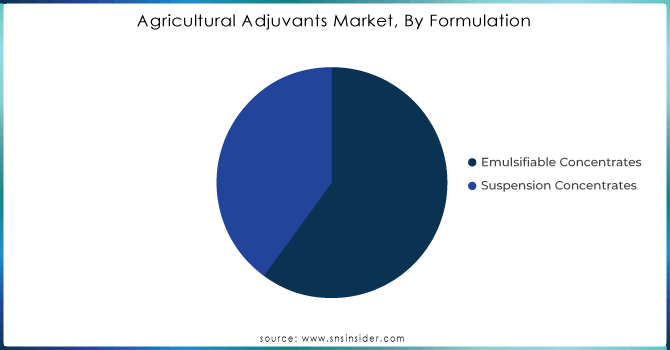

By Formulation

The emulsifiable concentrates segment dominated the agricultural adjuvants market in 2023, accounting for approximately 60%. This can be primarily attributed to the versatile application and effectiveness of emulsifiable concentrates in agrochemical formulations of various sizes. These products consist of active ingredients dissolved in oil, with water being mixed to create an emulsion and exhibit superior performance in spreading and penetration on plant surfaces. For example, emulsifiable concentrates are extensively used in herbicides and insecticides, which enhance coverage and effectiveness; they are more effective when it comes to controlling pests and crop protection. Due to them being easy to use and compatible with a wide range of agrochemicals, their leading market position has been contributed.

Get Customised Report as per Your Business Requirement - Enquiry Now

By Crop Type

In 2023, the fruits & vegetables segment dominated and accounted for a market share of about 50% in the agricultural adjuvants market. Its leadership status owes to the high requirement of fruit and vegetable crops for intensive pest management and protection, needing special adjuvants to ensure proper application and favorable quality of the yield. For example, on the ingredient part, adjuvants enhance the attachment and penetration of fungicides and insecticides on delicate surfaces of fruits and vegetables, thereby improving disease control and pest resistance. Consequently, factors like crop value and perishable nature stimulate considerable demand for advanced adjuvant solutions that can provide precise protection thus maintaining the dominant market for this ingredient segment.

By Application

The herbicides segment dominated and accounted for a market share of around 45% in the agricultural adjuvants market in 2023. This is due to the wide usage of herbicides in weed management, where active adjuvants take an important role in enhancing herbicide effectiveness against unwanted vegetation. Herbicide adjuvants improve adhesion and spreadability and enhance the absorption of herbicides on the leaf surfaces of plants. Examples include surfactants and oil-based adjuvants. They are usually applied with herbicides. These adjuvants enable the action of the herbicides by reducing the surface tension and increasing penetration into the weed tissues. The largest driving force for this market is the colossal demand by most crops like cereals and vegetables for effective weed control solutions.

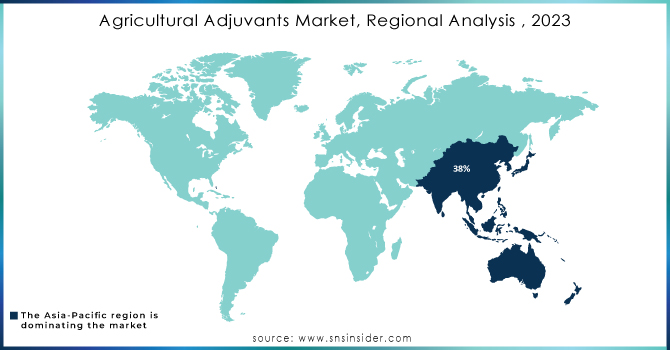

The Asia-Pacific region dominated the Agricultural Adjuvants Market with a revenue share of approximately 38% in 2023. The agricultural landscape in the region accommodates a wide variety of crops and farming practices. A considerable part of the world's population resides in this region, so the demand for food and agricultural products is always high. Hence, Asian-Pacific farmers and agricultural professionals are constantly seeking innovative ways to increase the yields of their crops to address this escalating demand. In addition, the Asian Development Bank has invested heavily in the program to help alleviate a worsening food crisis in Asia. The Asian Development Bank recently launched its ambitious allocation plan of at least $14 billion between 2022 and 2025 because of the intensifying food crisis in the Asia-Pacific region. This support program not only deals with short-term problems but also strives to build long-term food security by strengthening food systems against the impacts of climate change and biodiversity loss. It represents a major expansion of ADB's current efforts to address the imperative of food security in the region. Astonishingly, there are now about 1.1 billion people in Asia and the Pacific without access to adequate diets, as the twin burdens of poverty and sky-high food prices have reached unprecedented heights in 2022.

BASF SE (Dash HC, Agnique, Break-Thru)

Brandt Consolidated, Inc. (Brandt 5 Star, Brandt Smart System, Brandt TriTek)

Clariant AG (Synergen OS, Genagen, Hostapon)

Corteva Agriscience (VaporGrip, Surpass NXT, Keystone NXT)

Croda International PLC (Atplus, Renex, Hypermer)

Dow Chemical Company (Verdict, Intrepid Edge, Surpass)

Evonik Industries AG (BREAK-THRU S240, BREAK-THRU DF, BREAK-THRU SD 260)

GarrCo Products, Inc. (Snap, Surfate, Tenacity)

Helena Chemical Company (Induce, Grounded, Delta Gold)

Huntsman International LLC (Agrimax, Teric, Ethylan)

KALO, Inc. (RainDrop, Aqua-Zorb, Hydro-Wet)

Miller Chemical & Fertilizer (Induce, Tank and Tracker, Millerplex)

Nufarm Ltd. (Nuance, LI 700, WeedMaster)

Precision Laboratories (Border Xtra, Protyx, Jet Shield)

Solvay SA (Rhodafac, Geronol, Actizone)

Stepan Company (STEPGROW, STEPOSOL, MAKON)

Tanatex Chemicals B.V. (Baytan, Verbenone, Dropp)

UPL Limited (DewAqua, Lifeline, Interline)

Wilbur-Ellis Holdings, Inc. (Brimstone, Kudos, Destiny)

Winfield United (MasterLock, Interlock, Strike Force)

July 2024: SPI Pharma and Inimmune Corp. collaborated to research and market novel adjuvant systems for vaccines, by utilizing the key advantages to boost vaccine performance further.

March 2024: Croda International collaborated with AAHI to provide some of the most impactful vaccine adjuvant technologies and to assist in the development of next-generation vaccines around the globe for vaccination.

February 2024: Ginkgo Bioworks and SaponiQx were awarded a contract to design next-generation vaccine adjuvants using generative molecular design to enhance vaccine performance.

January 2023: Lavoro Acquires Cromo Química in a Bid to Extend Its Offerings and Boost Its Sales Positioning within Latin American Agriculture while Strengthening Crop Protection Products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.8 Billion |

| Market Size by 2032 | US$ 5.8 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Bio-based, Petroleum-based) •By Product (Utility Adjuvants [Compatibility Agents, Buffering Agents, Water Conditioning Agents, Drift Control Agents, Antifoaming Agents, Others], Activator Adjuvants [Oil-based Adjuvants, Surfactants]) •By Formulation (Emulsifiable Concentrates, Suspension Concentrates) •By Crop Type (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Others) •By Application (Insecticides, Herbicides, Fungicides, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Clariant AG, Croda International PLC, Dow Chemical Company, Evonik Industries AG, Huntsman International LLC, Miller Chemical & Fertilizer, Nufarm Ltd., Solvay SA, Stepan Company and other key players |

| Key Drivers | • Innovations in adjuvant formulations enhance the efficacy and stability of agrochemicals, improving overall crop protection • Growing demand for sustainable farming practices boosts the adoption of adjuvants that increase the efficiency and environmental benefits of pesticides |

| RESTRAINTS | • Stringent regulations and approval processes for new adjuvants can delay market entry and increase development costs |

Ans: The market size of Agricultural Adjuvants was valued at USD 3.79 billion in 2023.

Ans: The Agricultural Adjuvants Market is growing at a CAGR of 4.8% during the forecast period of 2024-2032.

Ans: Stringent regulations and approval processes for new adjuvants can delay market entry and increase development costs hinder the growth of the Agricultural Adjuvants Market.

Ans: The activator adjuvants segment dominated the Agricultural Adjuvants Market with a revenue share of about 71.3% in 2023.

Ans: The herbicide segment holds the highest revenue share of about 49.2% for the Agricultural Adjuvants Market in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Agricultural Adjuvants Market Segmentation, by Source

7.1 Chapter Overview

7.2 Bio-based

7.2.1 Bio-based Market Trends Analysis (2020-2032)

7.2.2 Bio-based Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Petroleum-based

7.3.1 Petroleum-based Market Trends Analysis (2020-2032)

7.3.2 Petroleum-based Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Agricultural Adjuvants Market Segmentation, by Product

8.1 Chapter Overview

8.2 Utility Adjuvants

8.2.1 Utility Adjuvants Market Trends Analysis (2020-2032)

8.2.2 Utility Adjuvants Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.3 Compatibility Agents

8.2.3.1 Compatibility Agents Market Trends Analysis (2020-2032)

8.2.3.2 Compatibility Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.4 Buffering Agents

8.2.4.1 Buffering Agents Market Trends Analysis (2020-2032)

8.2.4.2 Buffering Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.5 Water Conditioning Agents

8.2.5.1 Water Conditioning Agents Market Trends Analysis (2020-2032)

8.2.5.2 Water Conditioning Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.6 Drift Control Agents

8.2.6.1 Drift Control Agents Market Trends Analysis (2020-2032)

8.2.6.2 Drift Control Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.7 Antifoaming Agents

8.2.7.1 Antifoaming Agents Market Trends Analysis (2020-2032)

8.2.7.2 Antifoaming Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.2.8 Others

8.2.8.1 Others Market Trends Analysis (2020-2032)

8.2.8.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Activator Adjuvants

8.3.1 Activator Adjuvants Market Trends Analysis (2020-2032)

8.3.2 Activator Adjuvants Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.3 Compatibility Agents

8.3.3.1 Compatibility Agents Market Trends Analysis (2020-2032)

8.3.3.2 Compatibility Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.4 Buffering Agents

8.3.4.1 Buffering Agents Market Trends Analysis (2020-2032)

8.3.4.2 Buffering Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.5 Water Conditioning Agents

8.3.5.1 Water Conditioning Agents Market Trends Analysis (2020-2032)

8.3.5.2 Water Conditioning Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.6 Drift Control Agents

8.3.6.1 Drift Control Agents Market Trends Analysis (2020-2032)

8.3.6.2 Drift Control Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.7 Antifoaming Agents

8.3.7.1 Antifoaming Agents Market Trends Analysis (2020-2032)

8.3.7.2 Antifoaming Agents Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3.8 Others

8.3.8.1 Others Market Trends Analysis (2020-2032)

8.3.8.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Agricultural Adjuvants Market Segmentation, By Formulation

9.1 Chapter Overview

9.2 Emulsifiable Concentrates

9.2.1 Emulsifiable Concentrates Market Trends Analysis (2020-2032)

9.2.2 Emulsifiable Concentrates Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Suspension Concentrates

9.3.1 Suspension Concentrates Market Trends Analysis (2020-2032)

9.3.2 Suspension Concentrates Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Agricultural Adjuvants Market Segmentation, By Crop Type

10.1 Chapter Overview

10.2 Fruits & Vegetables

10.2.1 Fruits & Vegetables Market Trends Analysis (2020-2032)

10.2.2 Fruits & Vegetables Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Cereals & Grains

10.3.1 Cereals & Grains Market Trends Analysis (2020-2032)

10.3.2 Cereals & Grains Market Size Estimates And Forecasts To 2032 (USD Billion)

10.4 Oilseeds & Pulses

10.4.1 Oilseeds & Pulses Market Trends Analysis (2020-2032)

10.4.2 Oilseeds & Pulses Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 Others

10.5.1 Others Market Trends Analysis (2020-2032)

10.5.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Agricultural Adjuvants Market Segmentation, By Application

11.1 Chapter Overview

11.2 Insecticides

11.2.1 Insecticides Market Trends Analysis (2020-2032)

11.2.2 Insecticides Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Herbicides

11.3.1 Herbicides Market Trends Analysis (2020-2032)

11.3.2 Herbicides Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Fungicides

11.4.1 Fungicides Market Trends Analysis (2020-2032)

11.4.2 Fungicides Market Size Estimates And Forecasts To 2032 (USD Billion)

11.5 Others

11.5.1 Others Market Trends Analysis (2020-2032)

11.5.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Agricultural Adjuvants Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.2.4 North America Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.2.5 North America Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.2.6 North America Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.2.7 North America Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.2.8.2 USA Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.2.8.3 USA Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.2.8.4 USA Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.2.8.5 USA Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.2.9.2 Canada Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.2.9.3 Canada Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.2.9.4 Canada Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.2.9.5 Canada Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.2.10.2 Mexico Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.2.10.3 Mexico Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.2.10.4 Mexico Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.2.10.5 Mexico Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.1.8.2 Poland Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.8.3 Poland Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.1.8.4 Poland Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.1.8.5 Poland Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.1.9.2 Romania Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.9.3 Romania Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.1.9.4 Romania Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.1.9.5 Romania Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.4 Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.5 Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.6 Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.7 Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.8.2 Germany Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.8.3 Germany Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.8.4 Germany Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.8.5 Germany Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.9.2 France Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.9.3 France Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.9.4 France Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.9.5 France Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.10.2 UK Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.10.3 UK Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.10.4 UK Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.10.5 UK Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.11.2 Italy Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.11.3 Italy Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.11.4 Italy Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.11.5 Italy Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.12.2 Spain Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.12.3 Spain Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.12.4 Spain Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.12.5 Spain Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.15.2 Austria Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.15.3 Austria Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.15.4 Austria Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.15.5 Austria Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.4 Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.5 Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.6 Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.7 Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.8.2 China Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.8.3 China Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.8.4 China Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.8.5 China Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.9.2 India Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.9.3 India Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.9.4 India Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.9.5 India Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.10.2 Japan Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.10.3 Japan Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.10.4 Japan Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.10.5 Japan Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.11.2 South Korea Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.11.3 South Korea Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.11.4 South Korea Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.11.5 South Korea Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.12.2 Vietnam Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.12.3 Vietnam Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.12.4 Vietnam Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.12.5 Vietnam Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.13.2 Singapore Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.13.3 Singapore Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.13.4 Singapore Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.13.5 Singapore Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.14.2 Australia Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.14.3 Australia Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.14.4 Australia Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.14.5 Australia Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.1.4 Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.5 Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.1.6 Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.1.7 Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.1.8.2 UAE Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.8.3 UAE Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.1.8.4 UAE Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.1.8.5 UAE Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Agricultural Adjuvants Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.2.4 Africa Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.5 Africa Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.2.6 Africa Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.2.7 Africa Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.6.4 Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.6.5 Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.6.6 Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.6.7 Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.6.8.2 Brazil Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.6.8.3 Brazil Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.6.8.4 Brazil Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.6.8.5 Brazil Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.6.9.2 Argentina Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.6.9.3 Argentina Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.6.9.4 Argentina Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.6.9.5 Argentina Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.6.10.2 Colombia Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.6.10.3 Colombia Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.6.10.4 Colombia Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.6.10.5 Colombia Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Source (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Product (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Formulation (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Crop Type (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Agricultural Adjuvants Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

13. Company Profiles

13.1 Fiserv, Inc.

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Temenos Headquarters SA

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Fidelity National Information Services, Inc.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Profile Software

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 SS&C Technologies Holdings, Inc.

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 SEI Investments Company

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Finantix

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Comarch SA

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Objectway S.P.A.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Dorsum Ltd.

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Source

Bio-based

Petroleum-based

By Product

Utility Adjuvants

Compatibility Agents

Buffering Agents

Water Conditioning Agents

Drift Control Agents

Antifoaming Agents

Others

Activator Adjuvants

Oil-based Adjuvants

Surfactants

By Formulation

Emulsifiable Concentrates

Suspension Concentrates

By Crop Type

Fruits & Vegetables

Cereals & Grains

Oilseeds & Pulses

Others

By Application

Insecticides

Herbicides

Fungicides

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Lignin Market Size was valued at USD 1.10 billion in 2023, and is expected to reach USD 1.60 billion by 2032, and grow at a CAGR of 4.3% over the forecast period 2024-2032.

The Bioadhesives market size was USD 7.01 Billion in 2023 and is expected to reach USD 15.15 Billion by 2032, growing at a CAGR of 8.93 % from 2024 to 2032.

The Algae Biofuel Market Size was valued at USD 9.08 billion in 2023 and is expected to reach USD 18.66 billion by 2032 and grow at a CAGR of 9.58% over the forecast period 2024-2032.

The Photoinitiator Market size was USD 2.40 billion in 2023 and is expected to reach USD 4.39 billion by 2032 and grow at a CAGR of 6.92% over the forecast period of 2024-2032.

The Plastic To Fuel Market Size was valued at USD 520.10 million in 2023 and is expected to reach USD 4,097.76 million by 2032 and grow at a CAGR of 25.78% over the forecast period 2024-2032.

Copper Mining Market size was valued at USD 8.9 billion in 2023 and is expected to reach USD 12.1 billion by 2032, growing at a CAGR of 3.5% from 2024-2032.

Hi! Click one of our member below to chat on Phone