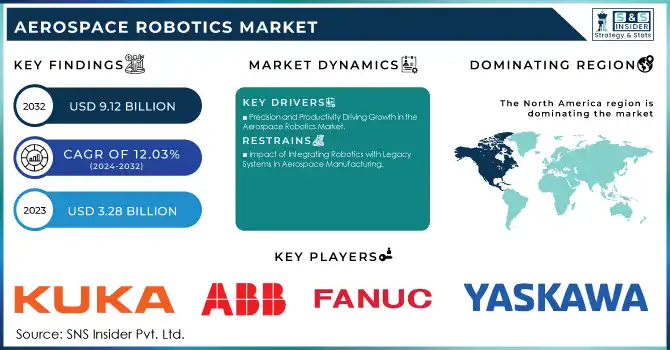

Aerospace Robotics Market Key Insights:

The Aerospace Robotics Market size was valued at USD 3.28 billion in 2023 and is expected to reach USD 9.12 billion by 2032 and grow at a CAGR of 12.03% over the forecast period of 2024-2032.

To Get More Information on Aerospace Robotics Market - Request Sample Report

The aerospace robotics market is witnessing significant growth, driven by the increasing need for automation in aerospace manufacturing. Companies are turning to robotic systems to boost operational efficiency, precision, and safety, all while reducing labor costs. Automation is transforming the aerospace industry by enabling faster production times, more accurate assembly, and improved handling of complex components. In recent years, the labor market's dynamics, including competitive wages and the growing bargaining power of unions, have made automation a more attractive solution for aerospace companies. As a result, many companies are investing in robotics to streamline production and maintain competitiveness. According to the International Federation of Robotics (IFR), in 2020, there were 310,700 industrial robots operating in U.S. factories, marking a 6% increase from the previous year. Automation has significantly affected multiple sectors, including aerospace, where robots are employed in various tasks like drilling, riveting, and non-destructive testing, all contributing to higher production quality. Technological advancements have made industrial robots more accessible, benefiting industries such as aerospace.

Additionally, government initiatives, such as the U.S. Air Force's contract with Reliable Robotics for aircraft automation, highlight the growing adoption of robotics in aerospace. The aerospace robotics market’s growth is further fueled by the desire for greater efficiency, improved quality, and safer working conditions, as companies continue to embrace automation solutions for the future.

Market Dynamics

Drivers

- Precision and Productivity Driving Growth in the Aerospace Robotics Market

The aerospace robotics market is experiencing significant growth, driven by the increasing demand for enhanced precision and quality in manufacturing and maintenance processes. Robotic systems offer unmatched accuracy, which is essential for the complex and stringent requirements of aerospace components. Automation in processes such as sealant application, inspection, and grit blasting is revolutionizing the industry, improving both productivity and safety. For example, automated sealant application has replaced the labor-intensive manual process, resulting in a 150% productivity boost. In inspections, robots can now examine composite parts up to 200 feet long, reducing inspection time by 40%.

Furthermore, advancements in robotic systems like AI-powered inspection and automated painting robots ensure high-quality, uniform coatings and real-time quality control, significantly reducing defects. Robotics also enhances safety, with robotic arms replacing manual tasks such as grit blasting, minimizing health risks for technicians. These systems enable technicians to operate remotely, reducing fatigue and potential accidents. Additionally, innovations like Nano bubble underwater technology in polishing and robotic arms for automated riveting, drilling, and welding have improved the consistency and accuracy of these tasks, further contributing to overall product quality. The increasing adoption of collaborative robots that assist human workers in repetitive tasks is another key trend driving the market, as they reduce human error and enhance safety. As AI, machine learning, and sensor technologies continue to evolve, the precision and adaptability of robotics are expected to increase, allowing aerospace companies to meet rising demands for high-quality, reliable products. This growing emphasis on automation and precision is propelling the aerospace robotics market, which is poised for continued expansion as these technologies become more integrated into aerospace manufacturing processes.

Restraints

- Impact of Integrating Robotics with Legacy Systems in Aerospace Manufacturing

Integrating robotic technologies into legacy aerospace manufacturing systems can be a daunting task, as it requires significant customization, compatibility checks, and thorough training of personnel. Legacy systems, which often rely on traditional manufacturing processes, may not easily interface with modern robotics, necessitating the development of specialized solutions that can be both time-consuming and costly. Furthermore, achieving seamless integration between robotics, automation, and control systems in complex aerospace environments demands high precision to avoid errors that could affect overall manufacturing quality and safety. As highlighted by industry experts, this integration challenge can slow the adoption of robotics in aerospace, particularly for smaller manufacturers with limited resources The need for thorough system testing and the adaptation of existing infrastructure to accommodate advanced robotics further contributes to delays in implementation.

Additionally, the absence of a highly skilled workforce capable of managing and troubleshooting these advanced technologies can exacerbate the issue. According to a study by IEEE, aerospace companies often face hurdles in aligning robotic systems with their established processes, which increases both operational risks and costs. Overcoming these integration barriers requires significant upfront investment, not only in technology but also in training and system upgrades, which can discourage manufacturers from making the leap to automation.

Segment Analysis

By Type

The articulated segment dominated the aerospace robotics market in 2023, capturing around 59% of the revenue share. Articulated robots, known for their flexibility and precision, are ideal for complex aerospace manufacturing tasks such as welding, painting, and assembly. Their ability to mimic human arm movements, with multiple joints and degrees of freedom, allows them to handle intricate tasks in confined spaces, making them highly valuable in aerospace applications. These robots offer significant advantages in terms of accuracy, repeatability, and speed, leading to increased efficiency and reduced labor costs. As the demand for high-quality, precision-engineered aerospace components rises, the adoption of articulated robots is expected to continue driving growth in this segment.

By Technology

In 2023, the traditional segment held the largest share of the aerospace robotics market, accounting for around 69% of the revenue. Traditional robotics, including mechanical arms and fixed automation systems, continues to dominate aerospace manufacturing due to its proven reliability, cost-efficiency, and long-established performance. These robots are particularly effective for critical tasks such as assembly, welding, and material handling, where high precision and consistency are vital. The straightforward design of traditional robotic systems ensures ease of implementation and maintenance, which has contributed to their broad adoption across the aerospace sector. Although newer technologies like AI-driven and collaborative robots are gaining ground, traditional robotics remain a cornerstone of aerospace operations, significantly enhancing productivity and operational efficiency. This dominance underscores the continued importance of traditional robotics in aerospace manufacturing.

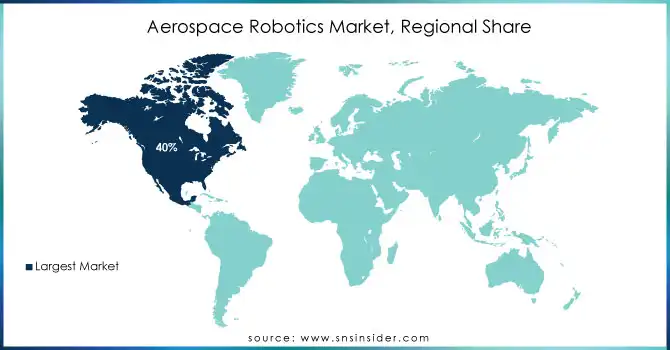

Regional Analysis

In 2023, North America led the aerospace robotics market, capturing approximately 40% of the global revenue share. The region's dominance is driven by the presence of major aerospace manufacturers, such as Boeing, Lockheed Martin, and Northrop Grumman, which heavily invest in robotics for manufacturing and maintenance operations. Additionally, North America benefits from strong research and development in robotics technology, fostering innovations in automation, AI, and collaborative robots. The region's advanced infrastructure, skilled workforce, and favorable government policies also contribute to its market leadership. As aerospace companies focus on improving productivity, precision, and cost-efficiency, the adoption of robotics is expected to continue growing, reinforcing North America's position as a key player in the aerospace robotics market.

Asia-Pacific is poised to be the fastest-growing region in the aerospace robotics market from 2024 to 2032, driven by rapid industrialization, technological advancements, and growing demand for automation in aerospace manufacturing. The region is home to emerging aerospace giants such as China and India, where increasing investments in robotics technology are accelerating automation in both production and maintenance processes. Additionally, countries like Japan and South Korea have long been leaders in robotics innovation, providing a solid foundation for further market expansion. With a rising demand for high-quality, cost-effective aerospace components, Asia-Pacific's adoption of robotics is further fueled by government initiatives, partnerships with global aerospace companies, and a burgeoning skilled labor force. This rapid adoption of aerospace robotics is expected to significantly boost the region's market share over the forecast period.

Do You Need any Customization Research on Aerospace Robotics Market - Inquire Now

Key Players

Some of the Major players in Aerospace Robotics with their product:

-

KUKA AG - [KR QUANTEC Series]

-

ABB Ltd. - [IRB 6700 Series]

-

FANUC Corporation - [M-20iA/35M]

-

Yaskawa Electric Corporation - [MOTOMAN GP-Series]

-

Staubli International AG - [TX2 Series]

-

Universal Robots A/S - [UR10e Collaborative Robot]

-

Comau S.p.A. - [Racer3 Robot]

-

Blue Ocean Robotics - [UVD Robots]

-

Electroimpact Inc. - [Automated Drilling Units]

-

Kawasaki Heavy Industries, Ltd. - [RS-Series Robots]

-

Aerobotix - [Automated Coating Systems]

-

Fanuc Robotics America, Inc. - [Robodrill Series]

-

Honeybee Robotics - [Robotic End-Effectors]

-

Güdel Group AG - [Gantry Robotics]

-

Shibaura Machine Co., Ltd. - [TVM Robot Series]

-

RobotWorx - [Custom Aerospace Robots]

-

Broetje-Automation GmbH - [Fastening Systems]

-

Payload Robotics - [Advanced Robotic Arms]

-

Toshiba Machine Co., Ltd. - [SCARA Robots]

-

Boston Dynamics - [Stretch Robot]

List of potential customers for the aerospace robotics market, including key players from various sectors:

1. Aerospace Manufacturers:

-

Boeing

-

Airbus

-

Lockheed Martin

-

Northrop Grumman

-

Raytheon Technologies

-

Safran

-

GE Aviation

2. Aerospace Component Suppliers:

-

Magna International

-

TRW Automotive

-

Daimler AG (Aerospace division)

-

Honeywell Aerospace

-

Rockwell Collins

3. Defense and Military Contractors:

-

General Dynamics

-

BAE Systems

-

Thales Group

-

L3Harris Technologies

4. Space Agencies and Organizations:

-

NASA

-

ESA (European Space Agency)

-

ISRO (Indian Space Research Organisation)

-

CNSA (China National Space Administration)

5. MRO (Maintenance, Repair, and Overhaul) Providers:

-

AAR Corp

-

ST Aerospace

-

Lufthansa Technik

-

Air France Industries KLM Engineering & Maintenance

6. Robotics Integrators and Automation Providers:

-

Fanuc Corporation

-

ABB Robotics

-

KUKA Robotics

-

Yaskawa Electric Corporation

7. OEMs (Original Equipment Manufacturers) of Robotics:

-

Mecademic Robotics

-

Universal Robots

-

FANUC Robotics

-

KUKA Robotics

-

Robot System Lab (RSL)

8. Advanced Materials and Composites Companies:

-

Hexcel Corporation

-

Toray Industries

-

SABIC

-

Solvay

9. Aircraft and Engine Maintenance Providers:

-

MTU Aero Engines

-

Pratt & Whitney

-

Rolls-Royce

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.28 Billion |

| Market Size by 2032 | USD 9.12 Billion |

| CAGR | CAGR of 12.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Articulated, Cartesian, Others) • By Technology (Traditional, Collaborative) • By Solution (Hardware, Software, Services) • By Application (Drilling, Welding, Painting, Inspection, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KUKA AG, ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Staubli International AG, Universal Robots A/S, Comau S.p.A., Blue Ocean Robotics, Electroimpact Inc., Kawasaki Heavy Industries, Ltd., Aerobotix, Honeybee Robotics, Güdel Group AG, Shibaura Machine Co., Ltd., RobotWorx, Broetje-Automation GmbH, Payload Robotics, Toshiba Machine Co., Ltd., and Boston Dynamics |

| Key Drivers | • Precision and Productivity Driving Growth in the Aerospace Robotics Market |

| Restraints | • Impact of Integrating Robotics with Legacy Systems in Aerospace Manufacturing |