Aerospace Bearings Market Report Scope & Overview:

To get more information on Aerospace Bearings Market - Request Free Sample Report

The Aerospace Bearings Market Size was valued at USD 9.80 billion in 2023 and is expected to reach USD 19.8 billion by 2032 with a growing CAGR of 7.5% over the forecast period 2024-2032.

A bearing is a machine component used to maintain relative motion and reduce friction between moving parts. Bearings are utilized in many different industries, including automobiles, aeroplanes, wind turbines, construction and mining machinery, agricultural equipment, machine tools, and so on. It is used in aircraft to guarantee that engines, shafts, propellers, and other types of aviation equipment run smoothly. As the use of bearing goods in various end-use industries, rolling mills, and aircrafts rises, so does the worldwide aerospace bearing market. Technological developments have boosted the overall efficiency and shelf life of bearing items in the aviation sector. NSK, for example, has developed a low-maintenance gearbox bearing. increased engine reliability in heavy duty engines.

Furthermore, factors such as increased emphasis on vehicle weight reduction, growth of the global space industry & technical advances, and emphasis on green aerospace sector & its impact on bearing supply chain contribute to the global growth of the Aerospace Bearings market. However, obstacles such as high raw material costs, increases in operational costs followed by seasonal serviceability, and delays in acquiring accreditations impede global market growth. In addition, factors such as the expansion of the urban air flow platform (UAM), the emergence of sensor-carrying units, and the growing growth of additional production technologies and building materials for the production of bearings create greater market growth opportunities during forecasting.

MARKET DYNAMICS

KEY DRIVERS

-

Lightweight helicopter

-

Air medical services

RESTRAINTS

-

High cost

-

Steel price fluctuating

OPPORTUNITIES

-

Zero-emission aircraft

-

Lightweight bearing & fuel efficient

CHALLENGES

-

Enhanced stiffness

-

Durability

IMPACT OF COVID-19

The COVID 19 pandemic affected every business. People are not allowed to travel from one country to another, which has badly harmed the aviation and transportation businesses. The pandemic had a severe impact on the Aerospace bearing industry since it halted supply chains and numerous distribution channels, making it impossible for the market to profit. Transportation of non-essential items was halted, causing the Aerospace bearing market to contract during the pandemic. Businesses suffered greatly as a result of the pandemic, and numerous countries are still suffering and attempting to cope with the situation.

by Material

Engineered Plastics Segment to Exhibit Significant Growth Improved by Its Lightweight and Solid Material Based on the material, the market is divided into stainless steel, fiber-reinforced composites, engineering plastics, aluminum alloys, and metal-backed. The increasing use of engineering plastics in aviation control systems and aerostructure components will drive market expansion. It offers advantages like light weight and durability. Therefore, engineer plastics will be the fastest growing component during forecasting.Stainless steel is the most widely used aircraft carrier as it is widely available at a lower cost compared to other carrier materials. Therefore, the stainless-steel component can contribute to holding the largest market share during the forecast period.

Fiber-reinforced composites are often used in bear to strengthen its properties, such as ductility and reliability. Similarly, aluminum-based bearings are lightweight and strong compared to stainless steel and fiber-reinforced composites.

by Bearing Type

Based on the type of product, the market is divided into plain, roller, and ball bearings and roller screws, and ball screws. The ball-bearing segments and rollers play an important role in transferring power from one shaft to another shaft with minimal friction and minimal loss of net power output. The use of ball and roller bearings in aircraft parts and systems is equally important. The share of roller screws is expected to increase significantly during the forecast period. Partial growth is due to the widespread use of flexible systems, such as wing openings, driveshaft, and other parts of the tailbone in the aircraft. Rotary and direct rotation of the roller screws helps to provide the required movement in a limited space.

by Aircraft Type

Based on the platform, the market is divided into fixed-wing, rotary-wing, and LAV

The fixed-wing segment is expected to be the largest segment by 2020 due to the growing demand for commercial aircraft in the coming years. According to Airbus SAS, over the next decade, there will be a huge demand for about 40,000 new aircraft. This will create new opportunities for aerospace manufacturers to establish strong relationships with new companies, as well as to provide services to existing customers.

Triumph is an important provider of water systems and locks and components for all Boeing systems. This plan will boost market growth in the coming years The rotary-wing component is expected to be the fastest growing component during forecasting. Partial growth is due to the high demand for airborne ambulances.

by Application

By application, the global bearing market has been segmented into, military aviation, business & general aviation and unmanned aerial vehicle, commercial aviation.

by Platform

Based on the segment platform, the aerospace bearing market is divided into commercial and military segments. The increase in bearing in commercial aircraft during the predicted period will accelerate the growth rate of the commercial segment.

KEY MARKET SEGMENTATION

By Material

-

Stainless Steel

-

Fiber-Reinforced Composites

-

Aluminum Alloys

-

others

By Bearing Type

-

Plain Bearing

-

Roller Bearing

-

Ball Bearing

-

Others

By Aircraft Type

-

Fixed Wings

-

Rotorcraft

-

Others

By Application

-

Commercial Aviation

-

Military Aviation

-

Business & General Aviation

By Platform

-

Commercial

-

Military

REGIONAL ANALYSIS

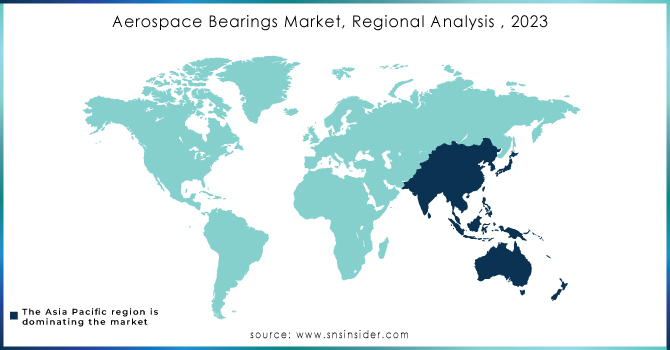

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa have all entered the aerospace bearing market. The Asia Pacific area has the greatest CAGR during the forecast period due to a rise in the number of commercial aircraft and aeroplane maintenance providers.

Many bearing manufacturers and suppliers in the North American region contribute to the region's market growth. Increased MRO facilities and air traffic management in countries such as the UAE and Saudi Arabia would greatly boost the Middle East and Africa region's growth pace. According to the prognosis for the Aerospace bearing market, each region will contribute to the industry's growth.

Need any customization research on Aerospace Bearings Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are SKF, JTEKT Corporation, Schaeffler AG, The Timken Company, RBC Bearings Inc, NSK Ltd. and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.80 Billion |

| Market Size by 2032 | US$ 19.8 Billion |

| CAGR | CAGR of 12.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Stainless Steel, Fiber-Reinforced Composites, Engineered Plastics, Aluminum Alloys and others) • By Bearing Type (Plain Bearing, Roller Bearing, Ball Bearing and Others) • By Aircraft Type (Fixed Wings, Rotorcraft and Others) • By Application (Commercial Aviation, Military Aviation, Business & General Aviation and Unmanned Aerial Vehicle) • By Platform (Commercial and Military) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SKF, JTEKT Corporation, Schaeffler AG, The Timken Company, RBC Bearings Inc, and NSK Ltd. |

| DRIVERS | • Lightweight helicopter • Air medical services |

| RESTRAINTS | • High cost • Steel price fluctuating |