Aerosol Market Key Insights:

To get more information on Aerosol Market - Request Sample Report

The Aerosol Market Size was valued at USD 85.4 Billion in 2023 and is expected to reach USD 150.2 billion by 2032, growing at a CAGR of 6.5% over the forecast period 2024-2032.

The aerosol market has been witnessing substantial growth driven by the increasing consumer preference for convenient and effective solutions across several sectors such as personal care, household products, and industrial applications. A key reason is the government's increasing emphasis on sustainability and environmental responsibility. Recently, many governments around the world have implemented stringent regulations on packaging and manufacturing processes, which are forcing manufacturers to adopt green aerosol products. The Circular Economy Action Plan introduced by the European Union in 2023 is expected to mitigate the environmental burden of aerosols by backing recyclability and reducing the use of single-use plastics.

According to the U.S. Environmental Protection Agency (EPA), aerosols made from recyclable materials, such as aluminum and steel, are prioritized, thus benefiting the aluminum segment of the market. The U.S. government has also set ambitious goals to reduce carbon emissions, which has encouraged manufacturers to adopt more sustainable practices. Moreover, a higher disposable income and increase in spending on good quality, easy-to-use products has indirectly increased the need for aerosol-based personal care and household products resulting in market growth. Continuous innovation and development of new formulations and delivery mechanisms are also boosting the market growth. This is backed by government data, which reports a year-over-year increase in the aerosol market across various segments, particularly in regions like North America and Europe, where environmentally conscious consumer behavior and regulatory frameworks are shaping the market dynamics. Demand is being driven by innovations such as products exclusively marketed to gender and higher contributions of propellants in styling and deodorant products. Brands such as S.C. Johnson & Son, Inc. are advertising repellents, thus its adoption in households. However, regulations like the Montreal Protocol and restrictions on VOC emissions may limit demand. Furthermore, the increasing utilization of sanitizer sprays and disinfectants, impelling the growth of the market.

Aerosol Market Dynamics

Drivers

-

The growing consumption of personal care products like deodorants, body sprays, and hair care products significantly boosts aerosol usage, particularly in emerging markets where the population is expanding rapidly.

-

Aerosol packaging is favored for its ease of use and controlled dispensing, making it popular in various sectors like food, beverages, and household cleaning.

-

The expanding automotive industry, particularly in emerging economies, increases the demand for aerosol products like spray paints and maintenance products.

-

Companies are increasingly developing eco-friendly aerosols with reduced environmental impact, such as those with smaller packaging and longer shelf lives.

The growing demand for personal care products like deodorants, hair sprays, shaving foams, skincare items, etc., has driven the growth of the aerosol market. The phenomenon is especially pronounced in emerging markets, where urbanization coupled with changing lifestyles among consumers has propelled the rate of adoption higher. A report highlights that personal care aerosols are experiencing increasing use due to convenience and precision in application. For example, hair sprays and thermal water aerosols are gaining popularity among urban professionals for their ease of use in daily grooming routines. According to statistical data & market reports, regions namely Asia-Pacific is leading this upsurge owing to a larger middle-class population and higher disposable income in the regions. For instance, in India, the personal care sector has been growing by more than 10% per annum in recent years alone, playing a major role in the uptake of aerosol-packaged products.

Moreover, brands are introducing innovative aerosol-based personal care solutions that appeal to environmentally conscious consumers. For instance, Unilever has launched a line of compressed deodorants that reduce packaging by up to 50%, aligning with sustainability goals while offering the same usability. Such innovations are enhancing the appeal of aerosols, particularly among younger demographics who prioritize both functionality and eco-friendly solutions. This driver reflects the interplay of consumer preferences, innovation, and lifestyle changes in shaping the growth trajectory of the aerosol market.

Restraints:

-

Strict regulations around the use of propellants and chemicals in aerosol products, especially concerning environmental impact, can limit growth.

-

The environmental effects of aerosol propellants and the disposable nature of aerosol cans continue to be a significant restraint, pushing companies toward more sustainable practices.

One significant restraint for the aerosol market is the regulatory challenges associated with its products, because of this, authorities and environmental agencies all around the world have drafted extensive regulations relating to the use of VOCs as a propellant in aerosols. Those chemicals are key air pollutants and health risks, thus attracting scrutiny from regulators, such as the bans and restrictions on some chemicals such as chlorofluorocarbons (CFCs) and hydrofluorocarbons (HFCs), which have required manufacturers to commit resources to producing safer alternatives. However, this transition is to some extent, costlier and may slightly lead to a delay in the acceptance of new formulations and sustainability. In addition, the unequal regulations across regions bring obstacles to global manufacturers that need to adapt their products to suit alternative compliance requirements. The landscape of international law is often challenging to navigate and will impact local market dynamics, potentially hampering growth in certain regions.

Aerosol Market Segmentation Analysis

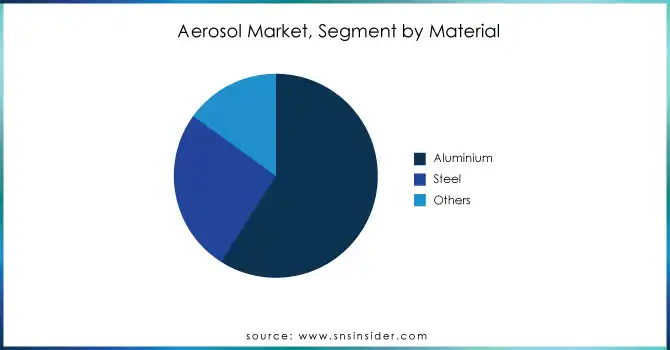

By Material

In 2023, the aerosol market was dominated by aluminum with a maximum revenue share of 59%. Such dominance is attributed to the cost-effectiveness, recyclability, and lightweight properties of aluminum, making it the ideal aerosol packaging material. Governments across the globe have emphasized sustainability and waste reduction, encouraging the use of materials like aluminum that are easier to recycle compared to other packaging materials. The U.S. Aluminum Association has found that more than 90% of aluminum used in aerosol cans gets recycled, which can help reduce emissions in aerosol production. Furthermore, rising consumer inclination towards eco-friendly products has driven the market for aluminum aerosols. The availability of aluminum in varying sizes, which caters to a wide range of applications, from personal care to household cleaning products, also adds to the material’s market dominance. Moreover, the regulations in the European Union and the U.S. are forcing manufacturers to minimize the environmental footprint of goods propelling the demand for aluminum packaging as part of the CSR strategy. In addition to the recyclability advantages, these regulatory pressures have driven higher production and demand for aluminum aerosol products and solidified aluminum as the market leader.

By Application

In 2023, the personal care segment was the largest application segment, accounting for the highest revenue share. This growth is supported by increasing demand for personal care products such as deodorants, hairsprays, shaving foams, and body sprays. Buoyed by record growth in grooming and hygiene product spending, 2023 saw major expansion in the personal care goods space, as highlighted by the U.S. Bureau of Labor Statistics. This trend increased the growth of the market even faster towards premium personal care products, which typically come in an aerosol format for user's convenience and more uniform coverage. Personal care products in aerosol form are perceived as more hygienic and easier to use than other forms, which is further influencing their demand across the consumer landscape. Furthermore, with the increasing trend for sustainable beauty products, eco-friendly aerosol cans produced from recyclable materials like aluminum have been introduced, keeping in line with increasing consumer inclination towards environmental protection. Aerosol packages are not only becoming more common in the personal care market, but government statistics indicate that the personal care sector is also growing at a significant growth rate.

By Type

In 2023, the standard-type aerosol segment held the largest revenue share 59%, leading the market, such dominance is due to the versatile applications of common aerosol products such as personal care, cleaning, and industrial applications. Standard aerosols are usually simple, high efficiency, and cheap this approach is dominant for the manufacturer and the consumer. More than 70% of aerosol produced in North America is in standard aerosol cans, and demand is growing at a consistent rate due to the various applications they can be used for, states the U.S. Consumer Product Safety Commission (CPSC). Moreover, government regulations encourage the use of standardized aerosol systems that adhere to safety and environmental codes. Standard aerosols are generally less complicated to make and distribute, and also well-established production processes offer lower cost of production in comparison to more specialized aerosol types.

Additionally, this segment is further accelerated by consumer preference for dependable and well-tested items. The ready availability of standard aerosol products in different sizes and forms has led to their sustained market share. Standard aerosols have similarly responded to the advancing demand for greener products, introducing sustainable practices and recycling initiatives to stay competitive in the market.

Aerosol Market Regional Analysis

In 2023, Europe emerged as the dominant region in the aerosol market, capturing the largest revenue share of 35%. This growth is primarily driven by the region's strict environmental regulations and consumer preference for sustainable and recyclable packaging materials. The European Union’s initiatives, such as the Circular Economy Action Plan, have encouraged the adoption of eco-friendly aerosol products, boosting demand for aluminum-based and recyclable packaging solutions. Additionally, Europe's well-established personal care and cosmetics industry significantly contributes to the market, with high consumer demand for premium aerosol products like deodorants, hairsprays, and shaving foams. Countries like Germany, France, and the UK lead in consumption, supported by strong manufacturing capabilities and technological advancements in aerosol production. Moreover, increased awareness of hygiene and the rise in household product usage have further bolstered market growth. With ongoing innovation and a focus on sustainability, Europe is expected to maintain its leading position.

North America region held significant market share owing to strong demand across several sectors including personal care, household, and automotive applications. Here, high consumer spending, especially between the U.S. and Canada, where consumers are enjoying increased disposable income and targeting products that cater to their desire for convenience, works in its favor. Sustainability-driven consumer awareness is additionally propelling regional dominance, which is increasingly adopting aerosol packaging in recyclable materials such as aluminum.

In contrast, Asia-Pacific is anticipated to witness the highest growth rate during the forecast period, registering the highest CAGR from 2024 to 2032. In addition, the demand for aerosol products for personal care along with household applications in China, India, and other countries due to rapid economic expansion, urbanization, and a growing middle-class population is fueling the market of propellant gases. The demand for eco-friendly aerosols in the region is also being driven by government initiatives focusing on green packaging and environmental awareness. Demand for aerosol products in Asia-Pacific will grow faster than any other region, driven by increasing industrialization and urbanization.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments:

-

March 2024 - Procter & Gamble (P&G) launched a new line of eco-friendly aerosol products, utilizing recyclable packaging and natural ingredients. This new launch aligns with the national company goal to support sustainability as well as helping to lessen the overall environmental impact that follows in the wake of recent U.S. Environmental Protection Agency (EPA) guidelines establishing packaging waste reduction.

-

In October 2023, Colep Packaging partnered with Envases Group to establish an aerosol packaging plant in Mexico. The facility will feature three aluminum aerosol production lines to serve customers in Mexico and Central America.

-

December 2023, Unilever introduced a new vertical of sustainable aerosol packaging in Europe with aluminum cans that are fully recyclable for its personal care brands. His firm believes the initiative will help align with the European Union's Circular Economy Action Plan which aims to minimize packaging waste.

Key Players

Key Service Providers/Manufacturers in the Aerosol Market

-

Unilever (Axe Body Spray, Dove Deodorant Spray)

-

Procter & Gamble (P&G) (Gillette Shaving Foam, Old Spice Body Spray)

-

Beiersdorf AG (Nivea Men Shaving Foam, Nivea Deodorant Spray)

-

Reckitt Benckiser Group (Lysol Disinfectant Spray, Air Wick Freshmatic Spray)

-

SC Johnson & Son (Glade Automatic Spray, OFF! Insect Repellent Spray)

-

Crown Holdings Inc. (Aluminum Aerosol Cans, Standard Aerosol Cans)

-

Ball Corporation (Recyclable Aluminum Cans, Lightweight Aerosol Packaging)

-

Henkel AG & Co. KGaA (Schwarzkopf Hairspray, Loctite Aerosol Adhesives)

-

LINDAL Group (Valve Systems, Actuators for Aerosols)

-

Colep (Custom Aerosol Packaging, Private Label Aerosols)

Key Users of Aerosol Products

-

L'Oréal

-

Johnson & Johnson

-

The Estée Lauder Companies Inc.

-

Colgate-Palmolive

-

Kimberly-Clark Corporation

-

Nestlé Purina PetCare

-

General Motors

-

Ford Motor Company

-

3M Company

-

Sherwin-Williams Company

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 85.4 Billion |

| Market Size by 2032 | USD 150.2 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Steel, Aluminium, Others) • By Type (Bag-in-valve, Standard) • By Application (Personal Care, Household, Automotive & Industrial, Food, Paints, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Unilever, Procter & Gamble (P&G), Beiersdorf AG, Reckitt Benckiser Group, SC Johnson & Son, Crown Holdings Inc., Ball Corporation, Henkel AG & Co. KGaA, LINDAL Group, Colep |

| Key Drivers | • The growing consumption of personal care products like deodorants, body sprays, and hair care products significantly boosts aerosol usage, particularly in emerging markets where the population is expanding rapidly. • Aerosol packaging is favored for its ease of use and controlled dispensing, making it popular in various sectors like food, beverages, and household cleaning. |

| Restraints | • Strict regulations around the use of propellants and chemicals in aerosol products, especially concerning environmental impact, can limit growth. |