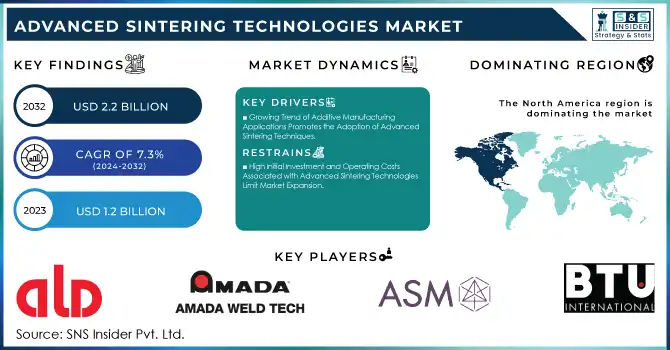

The Advanced Sintering Technologies Market Size was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.2 billion by 2032 and grow at a CAGR of 7.3% over the forecast period 2024-2032.

Get More Information on Activated Carbon Market - Request Sample Report

Advanced sintering technologies, including Spark Plasma Sintering (SPS), have seen significant advancements, driven by the demand for higher-quality materials across multiple industries. California Nanotechnologies, in October 2024, unveiled a cutting-edge SPS facility aimed at supporting innovations in aerospace, automotive, and medical fields. This new facility will allow the company to develop advanced materials with superior properties, offering rapid prototyping and manufacturing capabilities for complex components. Additionally, companies such as DSB Technologies (formerly SSI Sintered Specialties) have rebranded to reflect a renewed focus on the integration of advanced sintering technologies with new material innovations. The rebranding, completed in May 2022, underscores the company’s commitment to advancing powder metallurgy and sintering methods, marking a significant step in its strategy to optimize manufacturing solutions and expand into new markets. This shift aligns with broader industry trends that emphasize performance, precision, and sustainability.

In the collaborative effort for sintering optimization, HP and Elnik, in November 2023, focused on improving sintering processes for the HPS S100 metal jet printer. This collaboration highlights the ongoing drive to refine sintering processes for additive manufacturing applications, ensuring optimal properties and reliability in final printed metal components. Such developments demonstrate the industry's focus on enhancing the sintering process for a range of materials, from high-performance alloys to complex composites. These strides are indicative of the broader trends of innovation and expansion in advanced sintering technologies, reflecting the industry's continuous effort to push the boundaries of what can be achieved in manufacturing high-quality components for diverse applications.

Market Dynamics:

Drivers:

Increasing Investment in Research and Development of Advanced Sintering Technologies Enhances Market Potential

With the rapid development of new materials and techniques, research and development (R&D) investments have become a key driver for advanced sintering technologies. Companies and research institutions are focusing on enhancing the performance and efficiency of sintering processes, such as Spark Plasma Sintering (SPS) and Hot Isostatic Pressing (HIP), to meet the growing demand for high-performance materials. The aerospace, automotive, and medical sectors require materials that can withstand extreme conditions, and sintering technologies provide solutions for these applications. Additionally, advancements in R&D help in lowering production costs and improving the precision of the materials produced, thus enhancing the overall competitiveness of sintering techniques in the global market. This continuous innovation is critical to ensuring the market's long-term growth potential, as companies strive to meet the evolving needs of industrial applications.

Rising Demand for High-Performance Materials in Aerospace and Automotive Sectors Fuels Market Growth

Growing Trend of Additive Manufacturing Applications Promotes the Adoption of Advanced Sintering Techniques

Additive manufacturing, or 3D printing, has experienced significant growth across various industries, prompting the increased adoption of advanced sintering technologies. These technologies are vital for achieving the material properties necessary for high-performance 3D-printed components. Sintering processes such as Microwave Sintering and Field-Assisted Sintering are integral to creating components with high strength, fine details, and material homogeneity, which are essential for industries like aerospace, automotive, and healthcare. As the demand for 3D-printed parts continues to grow, particularly in sectors that require customized solutions or complex geometries, sintering technologies are expected to play an increasingly important role in enhancing the quality of additive manufacturing products. This growing trend of integrating sintering methods with additive manufacturing is expected to significantly contribute to the market’s expansion

Restraint:

High Initial Investment and Operating Costs Associated with Advanced Sintering Technologies Limit Market Expansion

Opportunity:

Integration of Artificial Intelligence and Automation in Sintering Processes Enhances Efficiency and Productivity

The integration of artificial intelligence (AI) and automation into sintering processes offers significant opportunities for improving operational efficiency and reducing costs. AI can be used to optimize sintering parameters, monitor the quality of products in real-time, and enhance the overall control of the production process. Automation can streamline the manufacturing workflow, reduce human error, and improve overall consistency and productivity. These technological advancements allow manufacturers to achieve better outcomes in terms of material quality and production speed. By adopting AI and automation, companies can also lower operational costs, making advanced sintering technologies more accessible and cost-effective for a broader range of industries. This technological integration presents a clear opportunity for advancing sintering techniques and expanding their market share.

Development of Customized Solutions for Specific Applications Expands Market Reach

As industries demand more tailored solutions, there is a growing opportunity for developing customized sintering technologies to meet specific application requirements. Advanced sintering methods can be adjusted to produce components with unique properties, such as enhanced thermal conductivity, strength, and resistance to wear. This customization is particularly valuable in industries like aerospace, automotive, and healthcare, where the performance of materials can significantly impact the end product's reliability and efficiency. By offering bespoke sintering solutions for niche markets, companies can differentiate themselves in the competitive landscape and capture a more diverse customer base. As more industries seek specialized solutions, the market for customized advanced sintering technologies will continue to grow.

Sustainability and Environmental Impact of Advanced Sintering Technologies

|

Sustainability Aspect |

Description |

|

Energy Efficiency |

Advanced sintering technologies, like Spark Plasma Sintering, consume less energy than traditional methods, reducing overall carbon emissions. |

|

Material Waste Reduction |

Sintering processes often lead to higher material utilization rates, minimizing scrap and waste in manufacturing. |

|

Use of Recyclable Materials |

Many sintering applications utilize recycled metals and powders, promoting circular economy principles. |

|

Lower Emission Technologies |

Innovations in sintering equipment have led to systems that emit fewer pollutants, enhancing air quality and compliance with environmental regulations. |

|

Sustainable Production Practices |

Companies are adopting sustainable practices, such as using eco-friendly materials and renewable energy sources in their operations. |

Advanced sintering technologies are increasingly focused on sustainability, addressing environmental concerns while optimizing manufacturing processes. By improving energy efficiency and reducing material waste, these technologies minimize the ecological footprint associated with production. The use of recyclable materials further promotes sustainability by supporting circular economy practices. Additionally, lower emission technologies contribute to better air quality, ensuring compliance with stringent environmental regulations. As the industry embraces sustainable production practices, it not only benefits the environment but also enhances its overall market viability.

Key Market Segments

By Type

In 2023, the Spark Plasma Sintering (SPS) segment dominated the advanced sintering technologies market, achieving a market share of 45%. This technology has gained significant traction due to its ability to produce high-density materials rapidly while maintaining superior mechanical properties. SPS operates by applying a pulsed electric current directly to the powder material, resulting in fast heating and sintering, which minimizes grain growth and preserves the desired microstructure. Industries like aerospace and automotive benefit immensely from SPS because it allows for the creation of complex geometries and enhances performance characteristics, such as strength and toughness. For example, titanium alloys used in aerospace components are often processed through SPS, achieving optimal performance with reduced production time. Additionally, ongoing innovations and investments in SPS technology by key players, alongside its environmentally friendly approach compared to traditional sintering methods, further solidify its dominance in the market. As industries increasingly prioritize high-performance materials, SPS is expected to continue leading the advanced sintering technologies landscape.

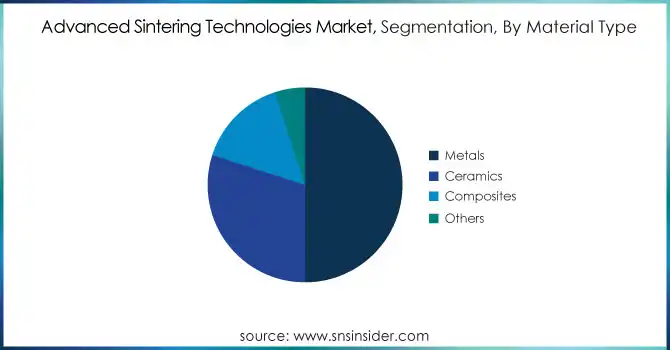

By Material Type

In 2023, the metals segment dominated the advanced sintering technologies market, holding a market share of 50%. The extensive application of metals in high-performance sectors such as aerospace, automotive, and medical drives this dominance. Metals, particularly titanium, cobalt, and stainless steel, are critical for applications requiring excellent mechanical strength, corrosion resistance, and durability. Advanced sintering technologies like Spark Plasma Sintering (SPS) and Hot Isostatic Pressing (HIP) are commonly employed to achieve high-density metal components with desirable properties, essential for rigorous operating conditions. For instance, titanium components manufactured for aerospace applications need to withstand extreme temperatures and pressures while remaining lightweight, making advanced sintering techniques vital. Furthermore, the automotive industry increasingly utilizes sintered metal parts to enhance vehicle performance and fuel efficiency, especially as the sector shifts toward electric and hybrid vehicles. The continuous innovation in metal sintering processes and the growing trend of utilizing advanced materials ensure that the metals segment will maintain its leadership in the advanced sintering technologies market for the foreseeable future.

By Application

In 2023, the automotive application segment dominated the advanced sintering technologies market, with a market share of 35%. The automotive industry's pursuit of lightweight and durable materials is a significant driver behind this growth. Advanced sintering technologies are integral in producing high-strength, low-weight components that enhance vehicle performance and fuel efficiency. For example, critical automotive parts, such as engine components, structural elements, and transmission parts, are increasingly manufactured using advanced sintering techniques like Spark Plasma Sintering (SPS) and Hot Pressing. These processes allow manufacturers to create complex geometries that traditional manufacturing methods may struggle with, providing a competitive advantage. The ongoing transition toward electric vehicles (EVs) further amplifies the demand for sintered materials, as lightweight components are essential for optimizing battery performance and overall vehicle efficiency. Additionally, advancements in sintering technologies continue to expand their application range within the automotive sector, ensuring that this segment remains a key driver of growth in the advanced sintering technologies market. As the industry evolves, the automotive segment's reliance on advanced sintering will likely increase, fostering continued innovation and development.

Regional Analysis

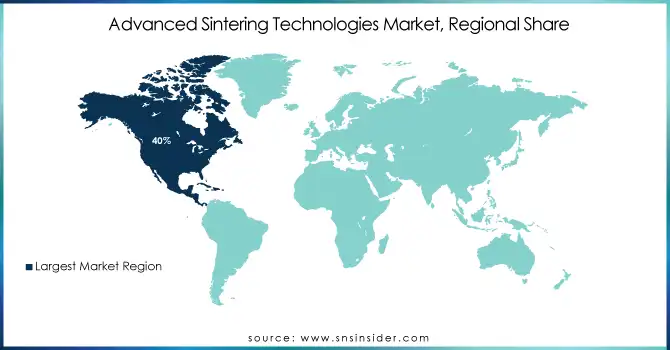

In 2023, North America dominated the advanced sintering technologies market with a market share of 40%. This dominance is attributed to the presence of key industry players and a robust manufacturing infrastructure, particularly in the aerospace, automotive, and electronics sectors. The U.S. is a significant contributor to this market, driven by the growing demand for high-performance materials in industries requiring advanced sintering technologies. Companies like General Electric and NASA are investing heavily in advanced materials for aerospace and defense applications, propelling the adoption of Spark Plasma Sintering (SPS) and other sintering technologies. Additionally, the strong research and development (R&D) ecosystem in the region, coupled with increasing government support for innovation in manufacturing processes, further solidifies North America's leadership. In the U.S., advanced sintering technologies are increasingly used for producing metal components in critical sectors like automotive, where lightweight materials are essential for improving fuel efficiency and meeting emission standards. Canada also contributes to the growth of the market, with advancements in additive manufacturing and material science. The region’s dominance is expected to continue, with continued investments in automation, sustainability, and performance-based material solutions driving the market forward.

In 2023, Asia-Pacific (APAC) emerged as the fastest-growing region in the advanced sintering technologies market, with a CAGR of 7.5%. This rapid growth is fueled by the region's expanding industrial base, particularly in countries like China, Japan, and South Korea, which are major hubs for electronics, automotive, and manufacturing industries. China, for instance, has been investing heavily in advanced manufacturing technologies to support its shift toward high-tech industries and reduce its reliance on foreign technologies. The automotive sector in China is witnessing a surge in the use of advanced sintering processes for producing components such as electric vehicle (EV) batteries and structural parts. Japan also plays a key role in the growth of advanced sintering technologies, particularly in producing high-performance ceramic and metal materials for electronics and aerospace applications. With its strong semiconductor and electronics manufacturing base, South Korea is rapidly adopting advanced sintering techniques to produce high-precision components. The expanding industrialization, coupled with an increasing focus on sustainability and innovation, ensures that the APAC region will continue to experience substantial growth in the advanced sintering technologies market, with this momentum expected to accelerate in the coming years.

Get Customized Report as per Your Business Requirement - Request For Customized Report

ALD Vacuum Technologies (Vacuum Sintering Furnaces, Hot Isostatic Pressing Systems, Spark Plasma Sintering Systems)

AMADA Weld Tech (Resistance Sintering Systems, Laser Welding Equipment, Bonding Systems)

ASM International N.V. (Epitaxial Deposition Tools, Thermal Processing Systems, Atomic Layer Deposition Equipment)

BTU International (Controlled Atmosphere Furnaces, High-Temperature Belt Furnaces, Batch Sintering Systems)

Carpenter Technology Corporation (Additive Manufacturing Powders, High-Performance Metal Alloys, Precision Metal Components)

ChinaSavvy (Powder Metallurgy Components, Sintered Metal Parts, Custom Metal Injection Molding Parts)

DSB Technologies (Powder Metal Components, Sintered Bearings, Metal Injection Molding Parts)

EOS (Metal 3D Printers, Polymer 3D Printers, Additive Manufacturing Materials)

FCT Systeme (Spark Plasma Sintering Machines, High-Temperature Sintering Systems, Hot Pressing Systems)

GKN Powder Metallurgy (Metal Powders, Sintered Gear Components, Precision Metal Additive Manufacturing Parts)

Hoganas AB (Metal Powders, Soft Magnetic Composites, Sintered Metal Components)

Linn High Therm (Laboratory Furnaces, Industrial Sintering Furnaces, Thermal Processing Equipment)

Materialise NV (3D Printing Software, Additive Manufacturing Services, Customized Medical Implants)

Miba AG (Sintered Components, Friction Materials, Engine Bearings)

Oerlikon AM (Metal Powders for Additive Manufacturing, Sintered Coatings, 3D Printed Metal Components)

Plansee Group (Molybdenum and Tungsten Products, High-Temperature Sintering Tools, Thermal Management Components)

Shanghai Gehang Vacuum Technology Co., Ltd (Vacuum Sintering Furnaces, Graphite Sintering Equipment, Hot Pressing Machines)

Sinterit (Desktop SLS 3D Printers, Nylon Powders for Additive Manufacturing, Sintering Accessories)

Sumitomo Heavy Industries Ltd. (Powder Metallurgy Equipment, Industrial Sintering Machines, High-Pressure Compacting Machines)

The ExOne Company (Binder Jetting 3D Printers, Sintered Metal Parts, Additive Manufacturing Systems)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.2 Billion |

| Market Size by 2032 | US$ 2.2 Billion |

| CAGR | CAGR of 7.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Conventional Pressureless Sintering, Spark Plasma Sintering, Microwave Sintering, Hot Pressing, Others) •By Material Type (Metals, Ceramics, Composites, Others) •By Application (Aerospace, Electronics, Automotive, Medical, Energy, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ALD Vacuum Technologies, Linn High Therm, Sumitomo Heavy Industries Ltd., EOS, ChinaSavvy, FCT Systeme, BTU International, Shanghai Gehang Vacuum Technology Co., Ltd, Linn High Therm, DSB Technologies, Hoganas AB and other key players |

| Key Drivers | •Rising Demand for High-Performance Materials in Aerospace and Automotive Sectors Fuels Market Growth •Growing Trend of Additive Manufacturing Applications Promotes the Adoption of Advanced Sintering Techniques |

| RESTRAINTS | •High Initial Investment and Operating Costs Associated with Advanced Sintering Technologies Limit Market Expansion |

Ans: The Advanced Sintering Technologies Market is expected to grow at a CAGR of 7.3%

Ans: The Advanced Sintering Technologies Market Size was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.2 billion by 2032

Ans: Emerging industrial hubs, advancements in automated systems, and demand for specialized manufacturing solutions are propelling the evolution of sintering technologies.

Ans: The advanced sintering technologies market faces challenges due to intense competition from both established players and new entrants, requiring constant innovation and investment in research and development to maintain market share and adapt to evolving customer demands.

Ans: North America, with a 40% share, dominates the advanced sintering technologies market due to key players, strong aerospace and automotive sectors, and significant investments in R&D and government support, particularly in the U.S. and Canada.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Advanced Sintering Technologies Market Segmentation, by Type

7.1 Chapter Overview

7.2 Conventional Pressureless Sintering

7.2.1 Conventional Pressureless Sintering Market Trends Analysis (2020-2032)

7.2.2 Conventional Pressureless Sintering Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Spark Plasma Sintering

7.3.1 Spark Plasma Sintering Market Trends Analysis (2020-2032)

7.3.2 Spark Plasma Sintering Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Microwave Sintering

7.4.1 Microwave Sintering Market Trends Analysis (2020-2032)

7.4.2 Microwave Sintering Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Hot Pressing

7.5.1 Hot Pressing Market Trends Analysis (2020-2032)

7.5.2 Hot Pressing Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Advanced Sintering Technologies Market Segmentation, by Material Type

8.1 Chapter Overview

8.2 Metals

8.2.1 Metals Market Trends Analysis (2020-2032)

8.2.2 Metals Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Ceramics

8.3.1 Ceramics Market Trends Analysis (2020-2032)

8.3.2 Ceramics Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Composites

8.4.1 Composites Market Trends Analysis (2020-2032)

8.4.2 Composites Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Advanced Sintering Technologies Market Segmentation, by Application

9.1 Chapter Overview

9.2 Aerospace

9.2.1 Aerospace Market Trends Analysis (2020-2032)

9.2.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Electronics

9.3.1 Electronics Market Trends Analysis (2020-2032)

9.3.2 Electronics Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Automotive

9.4.1 Automotive Market Trends Analysis (2020-2032)

9.4.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Medical

9.5.1 Medical Market Trends Analysis (2020-2032)

9.5.2 Medical Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Energy

9.6.1 Energy Market Trends Analysis (2020-2032)

9.6.2 Energy Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Industrial

9.7.1 Industrial Market Trends Analysis (2020-2032)

9.7.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Million)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Advanced Sintering Technologies Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.4 North America Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.2.5 North America Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.2 USA Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.2.6.3 USA Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.2 Canada Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.2.7.3 Canada Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.2 Mexico Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.2.8.3 Mexico Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.2 France Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.7.3 France Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.2 UK Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.8.3 UK Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Advanced Sintering Technologies Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.2 China Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.6.3 China Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.2 India Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.7.3 India Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.2 Japan Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.8.3 Japan Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.2 South Korea Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.9.3 South Korea Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.2 Singapore Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.11.3 Singapore Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.2 Australia Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.12.3 Australia Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Advanced Sintering Technologies Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.4 Middle East Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.1.5 Middle East Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.4 Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.2.5 Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Advanced Sintering Technologies Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.4 Latin America Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.6.5 Latin America Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.2 Brazil Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.6.6.3 Brazil Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.2 Argentina Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.6.7.3 Argentina Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.2 Colombia Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.6.8.3 Colombia Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Advanced Sintering Technologies Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Advanced Sintering Technologies Market Estimates and Forecasts, by Material Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Advanced Sintering Technologies Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11. Company Profiles

11.1 ALD Vacuum Technologies

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Linn High Therm

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Sumitomo Heavy Industries Ltd.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 EOS

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 ChinaSavvy

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 FCT Systeme

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 BTU International

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Shanghai Gehang Vacuum Technology Co., Ltd

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 DSB Technologies

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Hoganas AB

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Conventional Pressureless Sintering

Spark Plasma Sintering

Microwave Sintering

Hot Pressing

Others

By Material Type

Metals

Ceramics

Composites

Others

By Application

Aerospace

Electronics

Automotive

Medical

Energy

Industrial

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Green Building Materials Market was USD 371.25 billion in 2023 and is expected to Reach USD 1020.53 billion by 2032, growing at a CAGR of 11.89% by 2024-2032.

The Diesel Exhaust Fluid Market Size was valued at USD 37.0 billion in 2023, and is expected to reach USD 74.0 Billion by 2032, and grow at a CAGR of 8.0% over the forecast period 2024-2032.

Energy Efficient Building Market was valued at USD 129.63 billion in 2023 and is expected to reach USD 226.61 billion by 2032 at a CAGR of 6.41% from 2024-2032.

Battery Metals Market size was USD 10.6 Billion in 2023 and is expected to reach USD 21.3 Billion by 2032 and grow at a CAGR of 8.1% from 2024-2032.

The Laminated Glass Market size was valued at USD 22.71 Billion in 2023 and is expected to reach USD 39.18 Billion by 2032, growing at a CAGR of 6.25% over the forecast period 2024-2032.

The Cellulosic Fire Protection Intumescent Coatings Market size was USD 599 Bn in 2023 & will reach $823.5 Bn by 2032 with a CAGR of 3.6% by 2024 to 2032.

Hi! Click one of our member below to chat on Phone