Get More Information on Advanced Driver Assistance Market - Request Sample Report

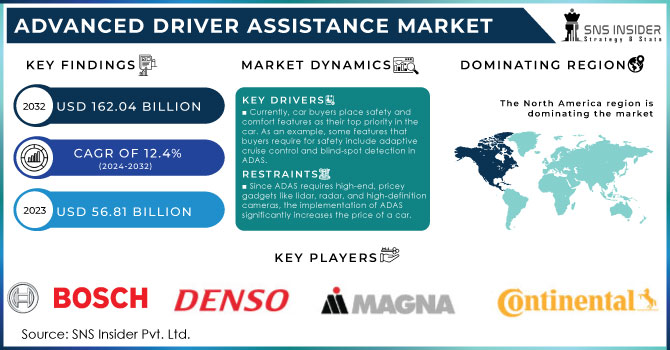

The Advanced Driver Assistance Market size is projected to reach USD 162.04 billion by 2032, was values at USD 56.81 billion in 2023 and will grow at a CAGR of 12.4% over 2024-2032.

The demand for such systems on the consumer front has been consistently rising, and from what the current adoption rate portrays, the ADAS market is prepared to achieve high growth. A 2023 survey by the American Automobile Association showed that 72% of United States drivers would pay extra for advanced safety features such as Automatic Emergency Braking. Also, it coincides with the government's policies aimed at increasing ADAS usage. The NHTSA proposes mandating all new light-duty vehicles with AEB systems by 2026 after which the use of ADAS will be increased by leaps and bounds. Besides, the segment of luxury cars in the US will sell up to 2.8 million units by the year 2025, indicating that it is also among the main drivers for the development of ADAS. Also, these types of cars are usually equipped with lots of advanced driver-assistance features, which makes market growth even much better. Such development would mean that for the next few years, the US ADAS sector is bound to grow hugely on account of greater emphasis on safety by better regulation and a strong luxury car segment.

According to a recent Insurance Institute for Highway Safety study, LDW systems can cut the odds of lane departure collisions by 86%, showing how effective this technology is. The second reason is that more stringent government regulations have required the installation of some features of ADAS in cars. All new passenger cars and light trucks sold in the US from May 2022 shall come fitted with AEB as standard, thus making the way for wider adoption. Thirdly, the development of sensor technology in particular-LiDAR-developing more sophisticated ADAS functions is now conceivable. With 20% LiDAR penetration expected in US luxury cars by 2025, high-resolution 3D perception will allow enhanced object recognition and auto lane changing, among others.

An important factor is the fact that accidents are very prevalent throughout the world, coming about because of human error. This can be addressed directly by functions such as collision warning and lane departure warning, which allow immediate feedback and corrective measures in ADAS functionalities.

More states are requiring the installation of ADAS systems in new cars. Moreover, these efforts also advocate progress in general; for instance, the "Vision Zero" campaign from the European Union set a target for zero road deaths until 2050.

Currently, car buyers place safety and comfort features as their top priority in the car. As an example, some features that buyers require for safety include adaptive cruise control and blind-spot detection in ADAS.

This imperative shift starts with technological guardian angels, namely Advanced Driver-Assistance Systems, on our roads. Take Adaptive Cruise Control, for example; it takes away the monotony of highway commuting because it responsively manages a secure offering from the vehicle ahead. Blind-Spot Detection acts as extra eyes for the consumer that identify blind corners where there might be vehicles crossing over lanes or changing lanes without even knowing it. It goes deeper than any one particular feature; it becomes general awareness. Studies are indicating that well over eighty percent of drivers report having ADAS on their cars and has increased confidence and made them feel more in control on the road. This is a harbinger of smooth drives for one and all on the road. This demand for features is not just hearsay.

Restrains:

Since ADAS requires high-end, pricey gadgets like lidar, radar, and high-definition cameras, the implementation of ADAS significantly increases the price of a car.

Being complex, software-based systems, ADAS systems are also prone to hacking. A cyber-attack on an ADAS is most likely to hijack the vehicle, resulting in losses of life and property.

Successful cyberattacks on ADAS systems will have consequences that may not be confined to single incidents of compromise; it could mean a halt in their development and deployment due to the erosion of consumer confidence in this technology. Additionally, such incidents may result in choking regulations because widescale traffic accidents and fatalities would probably impede innovation-no longer allowing the complete realization of the ADAS potentiality. That calls for strong cybersecurity measures towards safe integration of ADAS into any vehicle models." This involves unceasing watchfulness against changing hacking threats, following secure coding practices, and carrying out thorough penetration testing to find out and fix vulnerabilities before they are exploited.

By Vehicle Type

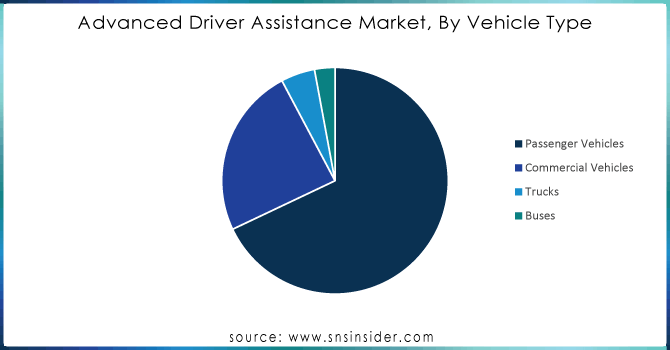

The Passenger Vehicles category held the highest share of 75% in 2023. This is explained by several things. Initially, there has been rising awareness as well as government regulations that make the consumers in developing markets increasingly give priority to safety features in their personal cars. Furthermore, technological advances have made it affordable for use outside luxury car segments. In 2023, vans and pickups, classified as Light Commercial Vehicles (LCVs), accounted for 15% of share. Urbanization growth and increasing delivery requirements has resulted to this rise due to commercial value of ADAS. Trucks and Buses are grouped together in accounting for the remaining 10%. There are obvious benefits of applying this technology on these bigger vehicles however, factors like higher initial costs involved and complex integration into existing infrastructure have hampered its adoption rate.

Need any customization research on Advanced Driver Assistance Market - Enquiry Now

By Electric Vehicle Type

BEVs accounted for 40% of share in 2023 and is considered as the most popular among ADAS market. On the contrary, Fuel Cell Electric Vehicles received the lowest share due to their limited production volumes and emphasis on immediate safety improvements rather than overall car range. Their part is projected to be just below 5%. Hybrid Electric Vehicles (HEVs) fall somewhere in between and make up about 30%. The desire to have environmentally friendly cars that still use internal combustion engines makes them more attractive to wider consumer base where ADAS features may be perceived as additional benefits rather than necessities. Plug-in Hybrid Electric Vehicles (PHEVs) are an interesting case they can operate both on electricity and petrol making this segment lie between BEVs and HEVs. SNS Insider analysts see their proportion in ADAS being at around 25%, which reflects a trade-off between BEVs’ safety orientation vs HEVs broader appeal.

By Level of Autonomy

The largest proportion of the market, constituting about 70% in 2023, is for L1 which has basic features like Automatic Emergency Braking (AEB) and Lane Departure Warning (LDW). This dominance is due to their affordability, extensive availability as well as their function as a bridge towards autonomous driving. About 20% of the market falls into L2 which includes Adaptive Cruise Control (ACC) and Lane Keeping Assist (LKA). In this segment, there is a sense of automation but it still requires the presence of a driver all through driving. Conditional Automation or L3 accounts for approximately 5% of the market. In such cases, certain tasks can be performed by the vehicle in specific conditions although readiness on part of driver to take over remains crucial.

High Automation or L4 represents a significant leap but only makes up about 3% of the total market share. These types of cars can run without drivers, subject to certain limitations, such as unusual situations that may necessitate their intervention.

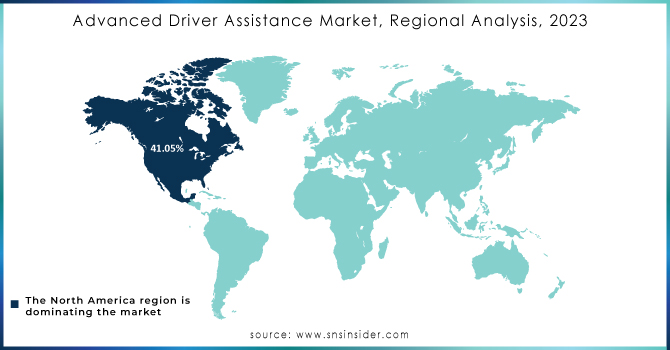

North America is the leader in the ADAS market accounted for 41.05% global share in 2023, due to several factors. Tt is evident that there is a high demand for safety features in vehicles since more than 60% of US car buyers prioritize ADAS functionalities such as Automatic emergency braking and Lane departure warning. Second, government regulations in the region are also forcing the incorporation of core ADAS functions thereby pushing up market numbers even further. An example here is NHTSA’s call for automatic emergency braking systems in light-duty vehicles by 2023. Thirdly, North America benefits from the presence of major automotive OEMs (Original Equipment Manufacturers) and a strong tier-one supplier base which creates a vibrant environment for ADAS research and implementation. That is why over 40% of cars manufactured in Detroit are equipped with level 2 intelligent driving capabilities; this marks an important milestone toward partial automation. However, challenges will be issue of privacy concerns and possible cyber-attacks on these systems persists, requiring manufacturers to come up with robust solutions.

Europe will be growing at a highest CAGR of 13.4% over 2024-2032, due to several key reasons. Strict safety regulations from the European Union (EU) require the progressive introduction of ADAS features like Lane Departure Warning (LDW) and Autonomous Emergency Braking (AEB) in new cars thereby fostering their integration by manufacturers. In that regard IHS Markit expects Europe’s LDW penetration ratio to reach 82% by 2025, contrasted with the global average of 67%. Secondly, a growing emphasis on easing traffic jams and safeguarding pedestrians within crowded regions in Europe has hastened adoption of ADAS techniques. According to ACEA researches, pedestrian and cyclist accident rates can drop by up to 30% with vehicles having AEB technology.

The major key players are Robert Bosch, ZF Friedrishshafen, Continental AG, Denso, Magna International, Mobiliye, Valeo, Hyundia Mobis, Aptiv and others.

In February 2024, Bosch released a statement concerning its partnership with Microsoft to explore generative AI for vehicle features that could possibly revolutionize automation.

Continental’s focus on advanced technology is consistent with this. In February, they launched an 8MP high-resolution camera boasting a 30% improvement on earlier versions. This translates into better details for features like autonomous driving and 3D surround view, enhancing safety and parking assistance.

ZF Friedrichshafen, a Tier-One supplier, is not sitting idle either. They designed their Smart Camera 6 specifically for advanced driver-assistance systems in January 2023. This barrage of hi-tech cameras may mark a tipping point towards better visual perception in ADAS.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 56.81 Billion |

| Market Size by 2032 | US$ 162.04 Billion |

| CAGR | CAGR of 12.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch, ZF Friedrishshafen, Continental AG, Denso, Magna International, Mobiliye and others. |

| Key Drivers |

|

| RESTRAINTS |

|

Ans: The Advanced Driver Assistance Market size is projected to reach USD 162.04 billion by 2032, was values at USD 56.81 billion in 2023

Ans: ADAS relies on sophisticated equipment such as lidar, radar, and high-definition cameras that can lead to a substantial hike in the car's price

Ans: ADAS market will grow at a CAGR of 12.4% over 2024-2032.

Ans: North America is the leader in the ADAS market accounted for 41.05% global share in 2023, due

Ans: Many states are requiring new cars to have ADAS systems installed. Progress is being propelled by efforts such as the European Union's "Vision Zero" campaign, which targets achieving zero road deaths by 2050.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Advanced Driver Assistance Market Segmentation, By Vehicle Type

7.1 Chapter Overview

7.2 Passenger Vehicles

7.2.1 Passenger Vehicles Market Trends Analysis (2020-2032)

7.2.2 Passenger Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Commercial Vehicles

7.3.1 Commercial Vehicles Market Trends Analysis (2020-2032)

7.3.2 Commercial Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Trucks

7.4.1 Trucks Market Trends Analysis (2020-2032)

7.4.2 Trucks Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Buses

7.4.1 Buses Market Trends Analysis (2020-2032)

7.4.2 Buses Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Advanced Driver Assistance Market Segmentation, By System Type

8.1 Chapter Overview

8.2 Adaptive Cruise Control

8.2.1 Adaptive Cruise Control Market Trends Analysis (2020-2032)

8.2.2 Adaptive Cruise Control Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Adaptive Front Light

8.3.1 Adaptive Front Light Market Trends Analysis (2020-2032)

8.3.2 Adaptive Front Light Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Adaptive Emergency Braking

8.3.1 Adaptive Emergency Braking Market Trends Analysis (2020-2032)

8.3.2 Adaptive Emergency Braking Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Blind Spot Detection

8.4.1 Blind Spot Detection Market Trends Analysis (2020-2032)

8.4.2 Blind Spot Detection Market Size Estimates And Forecasts To 2032 (USD Billion)

8.5 Cross-traffic alert

8.5.1 Cross-traffic alert Market Trends Analysis (2020-2032)

8.5.2 Cross-traffic alert Market Size Estimates And Forecasts To 2032 (USD Billion)

8.6 Traffic Jam Assist

8.6.1 Traffic Jam Assist Market Trends Analysis (2020-2032)

8.6.2 Traffic Jam Assist Market Size Estimates And Forecasts To 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Advanced Driver Assistance Market Segmentation, By Electric Vehicle Type

9.1 Chapter Overview

9.2 BEV

9.2.1 BEV Market Trends Analysis (2020-2032)

9.2.2 BEV Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 FCEV

9.3.1 FCEV Market Trends Analysis (2020-2032)

9.3.2 FCEV Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 HEV

9.3.1 HEV Market Trends Analysis (2020-2032)

9.3.2 HEV Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 PHEV

9.3.1 PHEV Market Trends Analysis (2020-2032)

9.3.2 PHEV Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Advanced Driver Assistance Market Segmentation, By Level of Autonomy

10.1 Chapter Overview

10.2 L1

10.2.1 L1 Market Trends Analysis (2020-2032)

10.2.2 L1 Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 L2

10.3.1 L2 Market Trends Analysis (2020-2032)

10.3.2 L2 Market Size Estimates And Forecasts To 2032 (USD Billion)

10.4 L3

10.4.1 L3 Market Trends Analysis (2020-2032)

10.4.2 L3 Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 L4

10.5.1 L4 Market Trends Analysis (2020-2032)

10.5.2 L4 Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 L5

10.5.1 L5 Market Trends Analysis (2020-2032)

10.5.2 L5 Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Advanced Driver Assistance Market Segmentation, By Offerings

11.1 Chapter Overview

11.2 Hardware

11.2.1 Hardware Market Trends Analysis (2020-2032)

11.2.2 Hardware Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.1 Camera Unit

11.2.1.1 Camera Unit Market Trends Analysis (2020-2032)

11.2.1.2 Camera Unit Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.2 Radar Sensor

11.2.2.1 Radar Sensor Market Trends Analysis (2020-2032)

11.2.2.2 Radar Sensor Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.3 Ultrasonic Sensor

11.2.3.1 Ultrasonic Sensor Market Trends Analysis (2020-2032)

11.2.3.2 Ultrasonic Sensor Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.4 LiDAR

11.2.4.1 LiDAR Market Trends Analysis (2020-2032)

11.2.4.2 LiDAR Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.5 ECU

11.2.5.1 ECU Market Trends Analysis (2020-2032)

11.2.5.2 ECU Market Size Estimates And Forecasts To 2032 (USD Billion)

11.2.6 Others

11.2.6.1 Others Market Trends Analysis (2020-2032)

11.2.6.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Software

11.3.1 Software Market Trends Analysis (2020-2032)

11.3.2 Software Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.1 Middleware

11.3.1.1 Middleware Market Trends Analysis (2020-2032)

11.3.1.2 Middleware Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.2 Application Software

11.3.2.1 Application Software Market Trends Analysis (2020-2032)

11.3.2.2 Application Software Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3.3 Operating System

11.3.3.1 Operating System Market Trends Analysis (2020-2032)

11.3.3.2 Operating System Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Advanced Driver Assistance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.4 North America Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.2.5 North America Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.2.6 North America Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.7 North America Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.8.2 USA Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.2.8.3 USA Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.2.8.4 USA Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.8.5 USA Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.9.2 Canada Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.2.9.3 Canada Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.2.9.4 Canada Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.9.5 Canada Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.10.2 Mexico Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.2.10.4 Mexico Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.10.5 Mexico Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.2 Poland Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.4 Poland Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.8.5 Poland Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.2 Romania Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.4 Romania Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.9.5 Romania Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.4 Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.6 Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.7 Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.2 Germany Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.4 Germany Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.8.5 Germany Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.2 France Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.9.3 France Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.4 France Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.9.5 France Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.2 UK Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.4 UK Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.10.5 UK Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.2 Italy Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.4 Italy Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.11.5 Italy Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.2 Spain Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.4 Spain Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.12.5 Spain Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.2 Austria Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.4 Austria Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.15.5 Austria Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.4 Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.6 Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.7 Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.8.2 China Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.8.3 China Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.8.4 China Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.8.5 China Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.9.2 India Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.9.3 India Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.9.4 India Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.9.5 India Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.10.2 Japan Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.10.3 Japan Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.10.4 Japan Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.10.5 Japan Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.11.2 South Korea Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.11.4 South Korea Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.11.5 South Korea Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.12.2 Vietnam Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.12.4 Vietnam Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.12.5 Vietnam Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.13.2 Singapore Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.13.4 Singapore Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.13.5 Singapore Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.14.2 Australia Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.14.3 Australia Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.14.4 Australia Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.14.5 Australia Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.4 Middle East Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.1.6 Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.7 Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.2 UAE Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.4 UAE Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.8.5 UAE Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Advanced Driver Assistance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.4 Africa Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.2.5 Africa Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.2.6 Africa Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.7 Africa Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.4 Latin America Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.6.5 Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.6.6 Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.7 Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.8.2 Brazil Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.6.8.4 Brazil Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.8.5 Brazil Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.9.2 Argentina Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.6.9.4 Argentina Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.9.5 Argentina Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.10.2 Colombia Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.6.10.4 Colombia Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.10.5 Colombia Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Advanced Driver Assistance Market Estimates And Forecasts, By System Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Electric Vehicle Type (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Advanced Driver Assistance Market Estimates And Forecasts, By Offerings (2020-2032) (USD Billion)

13. Company Profiles

13.1 Robert Bosch

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 ZF Friedrishshafen

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Continental AG

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Denso

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Magna International

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Mobiliye

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Valeo

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 APTIV

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Hyundai MOBIS

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Others

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

Trucks

Buses

By System Type

Adaptive Cruise Control

Adaptive Front Light

Adaptive Emergency Braking

Blind Spot Detection

Cross-traffic alert

Traffic Jam Assist

Others

By Electric Vehicle Type

BEV

FCEV

HEV

PHEV

By Level of Autonomy

L1

L2

L3

L4

L5

By Offerings:

Hardware

Camera Unit

Radar Sensor

Ultrasonic Sensor

LiDAR

ECU

Others

Software

Middleware

Application Software

Operating System

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The AC Charger for EVs Market Size was valued at USD 6.48 billion in 2023, and will reach $93.34 billion by 2032, and grow at a CAGR of 34.5% by 2024-2032

The Car Rental Market Size was valued at USD 130.45 billion in 2023 and will reach USD 311.63 billion by 2031 and grow at a CAGR of 11.5% by 2024-2031

The Vehicle Analytics Market Size was valued at USD 4.20 billion in 2023, and expected to reach USD 25.87 billion by 2031, and grow at a CAGR of 25.5% over the forecast period 2024-2031.

Automatic Number Plate Recognition (ANPR) System Market Size was valued at USD 3.17 Billion in 2023 and is expected to reach USD 6.96 Billion by 2032 and grow at a CAGR of 9.15% over the forecast period 2024-2032.

The Automotive Horn Systems Market Size was valued at USD 923.17 million in 2023 and is expected to reach USD 1812.64 million by 2031 and grow at a CAGR of 8.8% over the forecast period 2024-2031.

The Dashboard Camera Market Size was USD 4.0 Billion in 2023 and is expected to reach $10.8 Billion by 2032, growing at a CAGR of 11.50% from 2024-2032.

Hi! Click one of our member below to chat on Phone