Advanced Composites Market Key Insights:

To Get More Information on Advanced Composites Market - Request Sample Report

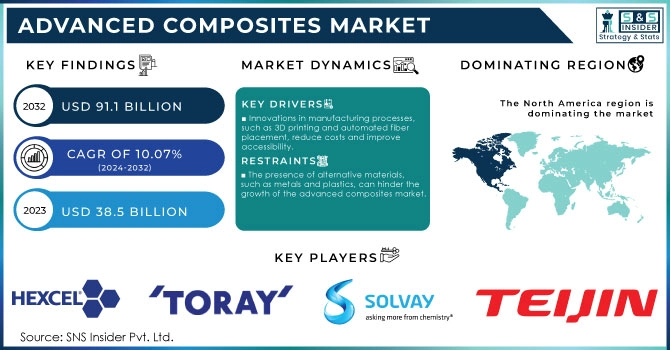

The Advanced Composites Market size was valued at USD 38.5 billion in 2023 and is expected to reach USD 91.1 Billion by 2032, growing at a CAGR of 10.07% Over the Forecast Peroid of 2024-2032.

The advanced composites market is witnessing significant growth, driven by rising demand across various sectors, especially aerospace, automotive, and construction. Advanced composites, including carbon fiber reinforced polymers (CFRPs), glass fiber reinforced polymers (GFRPs), and aramid fibers, provide superior strength-to-weight ratios, corrosion resistance, and durability compared to conventional materials. For example, the aerospace industry is increasingly adopting CFRPs for aircraft structures to improve fuel efficiency and reduce weight. A notable instance is Boeing's 787 Dreamliner, which utilizes approximately 50% composite materials, leading to significant enhancements in fuel efficiency. In the automotive sector, manufacturers are turning to advanced composites to comply with stringent emissions regulations and enhance vehicle performance. The surge in electric vehicle (EV) production has further driven the demand for lightweight materials, highlighted by Tesla's incorporation of advanced composites in its vehicle designs to improve battery range and overall performance. Recent industry reports indicate a substantial rise in the use of composites in automotive applications, fueled by the shift toward lightweight and sustainable materials.

Advancements in manufacturing technologies, such as 3D printing and automated fiber placement, are also lowering production costs and making advanced composites more accessible. Companies like Hexcel and Toray Industries exemplify this trend, investing in innovative production methods to boost efficiency and minimize waste. Sustainability is another key growth driver, with manufacturers increasingly focusing on developing eco-friendly composite materials. The emergence of bio-based composites is noteworthy, as companies like BASF and Trex create sustainable alternatives that attract environmentally conscious consumers.

In summary, the advanced composites market is set for substantial expansion, driven by technological advancements, sustainability efforts, and rising demand from critical sectors, solidifying its essential role in the future of material science.

Advanced Composites Market Dynamics

Drivers

-

These materials offer improved durability and resistance to corrosion, making them ideal for demanding environments.

-

Innovations in manufacturing processes, such as 3D printing and automated fiber placement, reduce costs and improve accessibility.

-

Increased production of electric vehicles necessitates lightweight materials to enhance battery efficiency and vehicle performance.

The rising production of electric vehicles (EVs) is significantly increasing the demand for advanced composites in the automotive industry. As manufacturers strive to enhance battery efficiency and overall vehicle performance, the need for lightweight materials has become critical. Advanced composites, including carbon fiber reinforced polymers (CFRPs) and glass fiber reinforced polymers (GFRPs), offer an excellent solution due to their remarkable strength-to-weight ratios. By substituting heavier traditional materials like steel and aluminum with these composites, EV manufacturers can significantly reduce the overall weight of their vehicles. This weight reduction directly improves battery efficiency, as lighter vehicles require less energy to operate, thereby extending the driving range of electric cars on a single charge. Additionally, advanced composites contribute to better vehicle performance by facilitating more innovative designs and enhancing aerodynamics. Their strength and flexibility allow for the creation of intricate shapes that improve airflow and decrease drag, further boosting energy efficiency. Companies like Tesla are at the forefront, integrating advanced composites into their vehicle designs to optimize performance while ensuring structural integrity and safety.

Furthermore, the automotive sector faces increasing pressure to comply with stringent emissions regulations. Lightweight vehicles generate less CO2, aligning with global sustainability objectives and aiding manufacturers in meeting regulatory standards. Advanced composites also offer enhanced resistance to corrosion and environmental damage, which adds to the durability and reliability of EVs.

In conclusion, the incorporation of advanced composites in electric vehicle production is essential for enhancing performance, improving battery efficiency, and adhering to regulatory standards. As the EV market continues to expand, the importance of advanced composites will only grow, propelling innovation and sustainability in the automotive sector.

|

Benefit |

Description |

|---|---|

|

Weight Reduction |

Decreases vehicle mass, improving battery efficiency and range. |

|

Enhanced Performance |

Enables innovative designs that improve aerodynamics and energy usage. |

|

Corrosion Resistance |

Increases durability, leading to lower maintenance costs over time. |

|

Safety and Strength |

Maintains high safety standards while using lightweight materials. |

|

Regulatory Compliance |

Assists in meeting emissions standards by reducing overall vehicle weight. |

|

Sustainability |

Supports the development of eco-friendly vehicles through recyclable materials. |

|

Design Flexibility |

Allows for complex shapes and structures that improve vehicle aesthetics and functionality. |

Restraints

-

The manufacturing processes for advanced composites are often more expensive compared to traditional materials, limiting widespread adoption.

-

The presence of alternative materials, such as metals and plastics, can hinder the growth of the advanced composites market.

-

Disruptions in the supply chain for raw materials can impact the availability and pricing of advanced composites.

Disruptions in the supply chain for raw materials can greatly affect the availability and pricing of advanced composites, which are essential in sectors such as automotive, aerospace, and construction. Advanced composites, like carbon fiber reinforced polymers (CFRPs) and glass fiber reinforced polymers (GFRPs), rely on specific materials, including carbon fibers, epoxy resins, and specialized additives. Challenges in sourcing these materials—such as production delays, transportation issues, or geopolitical tensions—can result in shortages. When supply chains are disrupted, manufacturers may find it difficult to obtain the materials necessary for producing advanced composites, leading to delays in production schedules. This can hinder their capacity to meet market demand, resulting in longer lead times for customers. Furthermore, diminished availability may push prices higher, as suppliers are likely to raise costs in response to scarcity. As a result, higher prices might deter manufacturers from using advanced composites, causing a shift back to traditional materials like metals and plastics.

Additionally, fluctuations in the prices of raw materials can introduce uncertainty for manufacturers, complicating their budgeting and financial planning. This instability can impede investment in advanced composites technology and innovation. In summary, maintaining a stable supply chain for raw materials is vital for the growth and sustainability of the advanced composites market, as it ensures consistent availability, competitive pricing, and continuous advancements in material technology.

The availability of alternative materials, such as metals and plastics, poses a notable challenge to the growth of the advanced composites market. Although advanced composites, including carbon fiber reinforced polymers (CFRPs) and glass fiber reinforced polymers (GFRPs), offer significant advantages—such as outstanding strength-to-weight ratios, corrosion resistance, and design flexibility—traditional materials continue to dominate various applications due to their established use and lower costs. Metals, such as aluminum and steel, are recognized for their strength and durability, making them the preferred choice in industries like automotive and aerospace. Conversely, plastics are valued for their lightweight nature and cost-effectiveness, particularly in applications where high strength is not critical. This widespread acceptance of alternative materials can limit the market penetration of advanced composites, as manufacturers may be reluctant to switch to these more expensive and less familiar options.

Additionally, the familiarity and established supply chains associated with metals and plastics further solidify their dominance in numerous sectors. Manufacturers often prioritize cost, ease of processing, and material availability, making it difficult for advanced composites to compete, especially in price-sensitive markets.

In summary, while advanced composites offer substantial benefits, the strong presence of alternative materials such as metals and plastics can hinder their adoption and growth. To gain traction, advanced composites must effectively demonstrate their value in performance, efficiency, and long-term cost savings to motivate a shift away from traditional materials.

Advanced Composites Market Segmentation Analysis

By Product

The carbon fiber segment dominated the market and accounted for 67.25% revenue share in 2023, and is expected to grow at the fastest CAGR rate during the forecast period. The glass and carbon composites are dominant in using the aerospace industry because of their lightweight and exceptional impact resistance properties, which drives market opportunity. Besides, there is increasing demand for these materials in automotive, sporting goods and pipes & tanks applications. Reduced heat and impact resistance make them quite beneficial for pipe and tank manufacturing while the rising popularity of lightweight solutions will probably drive their demand in sporting goods.

Advanced glass composites will grow significantly during the forecast period, as they outperform other composites with their unique properties dimensional stability, moisture resistance, high strength, fire and chemical resistance electrical resistivity and thermal conductivity. This means that glass composites can be used for a lot of different purposes such as the electrical insulation space, various manufacturing processes, and even marine applications. Besides, the process of manufacturing glass fibers into a polymer matrix is quite economical and facilitates high strength fibers with molten material in amore attractive way. In addition, glass fibers' chemical inertness, combined with the inert properties associated with plastics, make them well-suited for many corrosive environments.

By Application

In 2023, the automotive segment dominated the market, achieving a notable revenue share of 15.75% and is projected to experience the highest compound annual growth rate (CAGR) over the forecast period. This growth is largely driven by a rising demand for durable, lightweight, and conductive materials within the automotive sector. The global automotive market is witnessing steady expansion, spurred by continuous technological advancements, an urgent need for emission reductions, and shifting economic conditions in emerging markets like India and Brazil. These factors are likely to boost the demand for advanced composites in automotive applications.

Furthermore, the increasing appetite for air travel and heightened consumer spending are anticipated to serve as significant growth drivers for the aerospace sector throughout the forecast period, thereby benefiting the advanced composites market. Additionally, rising investments in the defense industry are expected to further escalate the demand for aramid composites. With global political tensions on the rise, funding for the defense sector is projected to increase, which is likely to positively impact the demand for these products in the years to come.

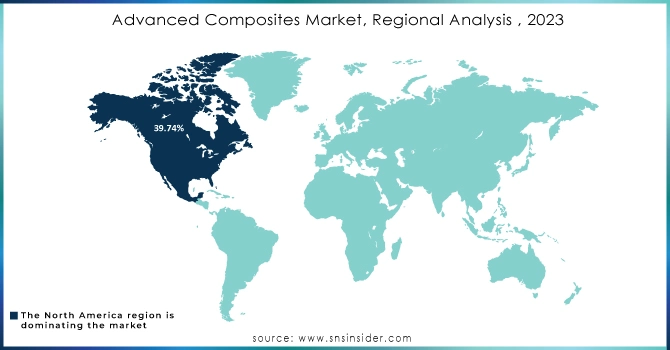

Advanced Composites Market Regional Outlook

In 2023, North America emerged as the leader in the advanced composites market, holding a substantial revenue share of 39.74%. The automotive sector in North America ranks among the largest in the world, with the U.S. recognized as a key automobile manufacturer. This dominant position, along with high consumer disposable income, efficient mass production capabilities, and a diverse range of product offerings, has greatly fueled industry growth in the region. As a result, the consumption of advanced composites in automotive applications is expected to increase significantly.

Conversely, the advanced composites market in Europe is anticipated to experience a considerable compound annual growth rate (CAGR) during the forecast period. The swift growth of the wind energy sector, particularly in Germany and Spain, is expected to drive the demand for composites. Furthermore, the strong expansion of the aerospace and defense industries in the region is projected to positively influence the advanced composites market.

Do You Need any Customization Research on Advanced Composites Market - Inquire Now

Key Players

The Major key Players are

-

Hexcel Corporation - Hexcel Composites

-

Toray Industries, Inc. - Toray Advanced Composites

-

Solvay S.A. - Solvay Composite Materials

-

Teijin Limited - Teijin Composites

-

SGL Carbon SE - SGL Composites

-

Mitsubishi Chemical Corporation - Mitsubishi Chemical Advanced Materials

-

3M Company - 3M Advanced Materials

-

BASF SE - BASF Advanced Materials

-

Huntsman Corporation - Huntsman Advanced Materials

-

DSM Company - DSM Composite Resins

-

Covestro AG - Covestro Composite Solutions

-

Axiom Materials, Inc. - Axiom Advanced Composites

-

Royal Ten Cate N.V. - TenCate Advanced Composites

-

Zoltek Companies, Inc. - Zoltek Carbon Fiber

-

General Electric Company - GE Aviation Composites

-

Northrop Grumman Corporation - Northrop Grumman Aerospace Composites

-

Gurit Holding AG - Gurit Composites

-

Lanxess AG - Lanxess High Performance Materials

-

Boeing Company - Boeing Commercial Airplanes (Composites Division)

-

Airbus S.A.S. - Airbus Composites Division

Raw Material Suppliers Name

-

Hercules

-

Huntsman Advanced Materials

-

DuPont

-

Trevira GmbH

-

Kieselguhr

-

Asahi Kasei

-

BASF

-

Covestro AG

-

SABIC

-

Toray Industries

-

3M

-

SGL Carbon

Recent Developments

-

In July 2024, Hexcel announced a collaboration with the University of Bristol to develop innovative carbon fiber applications for aerospace and automotive industries

-

In August 2024, Toray launched a new high-performance carbon fiber aimed at enhancing the efficiency of wind turbine blades

-

In September 2024, BASF launched a new range of thermoplastic composites specifically for the automotive industry, emphasizing sustainability

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 38.5 Billion |

| Market Size by 2032 | USD 91.1 Billion |

| CAGR | CAGR of 10.07 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Aramid Fiber, Carbon Fiber, Glass Fiber) • By Resin (Advanced Thermosetting Composites, Advanced Thermoplastic Composites) • By Application (Aerospace & Defense, Automotive, Wind Energy, Sporting Goods and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HashiCorp, Amazon Web Services (AWS), Microsoft, Google Cloud, Red Hat, IBM, VMware, Puppet, Chef, Atlassian,GitLab |

| Key Drivers | • These materials offer improved durability and resistance to corrosion, making them ideal for demanding environments. • Innovations in manufacturing processes, such as 3D printing and automated fiber placement, reduce costs and improve accessibility. |

| Restraints | • The manufacturing processes for advanced composites are often more expensive compared to traditional materials, limiting widespread adoption. • The presence of alternative materials, such as metals and plastics, can hinder the growth of the advanced composites market. |