Adhesives & Sealants Market Report Scope & Overview:

Get More Information on Adhesives & Sealants Market - Request Sample Report

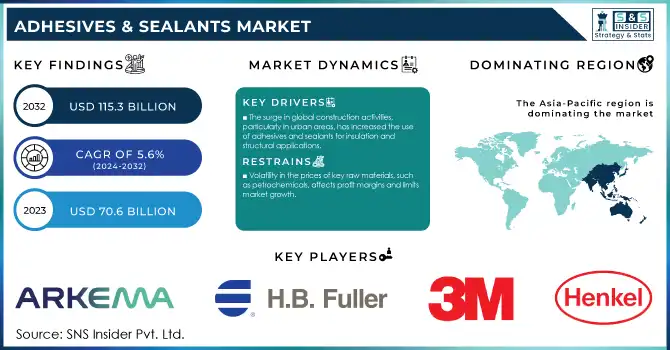

The Adhesives & Sealants Market Size was valued at USD 70.6 Billion in 2023 and is expected to reach USD 115.3 Billion by 2032, growing at a CAGR of 5.6% over the forecast period 2024-2032.

The growth of the adhesives and sealants industry is significant, mainly due to increasing demand from various industries, including construction, automotive, and packaging. This demand has in turn given rise to a burgeoning construction industry. U.S. Department of Commerce data shows construction spending reached $1.93 trillion in November 2023, 6.1% greater than the previous year. This upward trend emphasizes the importance of adhesives and sealants in improving the bonding, structural integrity, and durability of construction materials, which is an integral part of any modern construction methodology.

The growth in this market is largely attributed to various key driving factors such as increasing technology advancements in water-based adhesives. With a market share of 30% in 2023, these adhesives have become an increasingly attractive choice, primarily due to their environmental advantages, as well as their compliance with high regulatory standards like the REACH regulation of the European Union. Water-based adhesives are low in emissions when compared to their solvent-based counterparts, making them convenient and environmentally friendly by sustainable practices. It coincides with the global action of the reduction of carbon footprints which sets up the sustainability goals.

Global construction practices are undergoing and will continue to undergo sustainable transformations due to which the demand for green construction is increasing, hence driving the market of bio-based Builders Adhesive. The increasing focus on sustainable development is illustrated by the commitment of the Indian Government to invest USD 12 billion in green infrastructure in its 2023 budget. Such investments will not only help make infrastructure more resilient but also contribute to the demand for advanced adhesive technologies supporting sustainability objectives. Collectively, these elements highlight the solid growth trend for the adhesives and sealants market as multiple industries continue to seek eco-conscious materials and practices.

Adhesives & Sealants Market Dynamics

Drivers

-

The surge in global construction activities, particularly in urban areas, has increased the use of adhesives and sealants for insulation and structural applications.

-

The development of water-based adhesives and low-VOC formulations is gaining traction due to stringent environmental regulations. Leading manufacturers are focusing on bio-based adhesives to meet sustainability goals and consumer demand.

Adhesives and sealants are increasingly being used in construction, automotive, and other applications, which is the key driver for the growth of the market. With the advanced growth in construction, adhesives are now creating their market in construction where they are highly considered for insulation assembling, panel bonding, and waterproofing. On the other hand, sealants are essential for structural integrity and energy efficiency. Urbanization is an ongoing phenomenon that is taking the world by storm and, with that, the need for infrastructure development has increased. For instance, by 2050 more than 2.5 billion people will migrate towards urban areas, which will drive the demand for adhesive technologies in green building materials.

Adhesives and sealants are an integral part of lightweight strategies in the automotive sector that help in reducing vehicular weight for greater fuel efficiency and low emissions. Innovative automotive adhesives have now replaced traditional fasteners in the automotive design and manufacturing space, which has resulted in the average vehicle losing between 15-20% of its weight. These products, for example, are heavily utilized by electric vehicle (EV) manufacturers for battery safety and aerodynamic enhancement. For instance, Tesla and BMW adopt state-of-the-art adhesive formulations within their EV models for premium performance. Underpinned by developments like temperature and impact-proof adhesive solutions that pass strict industry requirements. Additionally, the focus on eco-friendly formulations, including water-based adhesives, aligns with regulatory standards and consumer preferences, further bolstering demand in these sectors.

Restraints

-

Volatility in the prices of key raw materials, such as petrochemicals, affects profit margins and limits market growth.

-

Regulatory restrictions on solvent-based adhesives due to their environmental and health impact pose compliance challenges.

The fluctuating prices of raw materials, especially for petrochemicals-based inputs such as resins, solvents, and polymers, is one of the major restraints for the adhesives and sealants market. Global crude oil prices have a major effect on such materials, subjected to fluctuations driven by geopolitical pressures, demand-supply mismatch, and economies in reset mode. Manufacturers are financially affected by the unpredictable nature of these costs, which can cause production schedule disruptions and lowered profit margins. Furthermore, supply chain challenges, such as transportation bottlenecks and trade restrictions, exacerbate the issue by causing delays and increasing logistics costs.

In order to address these issues, manufacturers are focused on alternative sourcing methods and possible bio-based or recycled solutions. In turn, however, moving to these sustainable alternatives takes a considerable amount of R&D and funding, which is especially challenging for small companies that struggle to compete. This ongoing challenge underscores the market's dependency on stable raw material availability and pricing.

Adhesives & Sealants Market Segments Analysis

By Adhesives Technology

In 2023, the adhesives technology market has been dominated by the water-based segment with a share of 30% owing to their superior performance and environmental attributes compliant in nature. Applications requiring strong adhesion without harmful emissions are best suited to water-based adhesives. In 2023, the Environmental Protection Agency (EPA) reported that VOC emissions from industrial processes have declined 18% over the last five years primarily because of the standardization of water-based technologies. Moreover, governments across the globe are promoting sustainable resources with tax benefits and the provision of incentives. For example, in 2023, the German government released €500 million to assist industries in shifting to environmentally friendly materials. In industries like Packaging, Construction, and Automotive, regulatory compliance and sustainability are of high focus, thus water-based adhesives are widely used. These adhesives’ quick curing times and adaptability to various substrates further enhance their appeal, solidifying their dominance in the market.

By Adhesives Product

The acrylic segment dominated the adhesives & sealants market in 2023, with a significant revenue share of 37% in 2023 owing to better versatility, durable performance, & better performance in extreme environments. Due to their ability to resist UV fluctuations, temperature changes, as well as moisture, these acrylic adhesives are extremely valuable to industries such as automotive and construction. Data from the U.K. Office for National Statistics (ONS) reports a 4.8% rise in automotive production in 2023, which is attributable to high performance and competitive adhesive solutions such as acrylics by volume and revenue. Developments in renewable energy applications that demand specialty grade adhesive will also increase the adoption of acrylic adhesives such as solar panel assembly and the U.S. Inflation Reduction Act of 2022 providing cities and towns with billions for tax credits for energy-efficient product use as part of government initiative which in turn will amplify the sales of Acrylic Adhesives over the forecast period. Their advantages, like high strength and flexibility, which are necessary for effective bonds between dissimilar materials, make acrylics the material of choice in several industrial sectors, thus maintaining their market dominance.

By Adhesives Application

In 2023, the paper and packaging industry has led the adhesives and sealants market due to growth in demand for water-resistant/sustainable and recyclable packaging solutions. Due to consumer preference and environmental concerns, eco-friendly packaging is being promoted by governments and organizations. According to the World Economic Forum’s 2023 report, global e-commerce sales grew by 11%, significantly increasing the demand for paper-based packaging materials. In addition, government regulations such as the EU's Single-Use Plastics Directive, which came into effect in July 2023, also have forced the companies for paper and cardboard packaging solutions. Therefore, adhesives are key to maintaining the integrity and performance of such packaging." The Chinese government also stimulates the demand for paper and packaging adhesives by releasing a reduced "plastic waste" policy of 30% by 2030. In this segment, water-based and hot-melt adhesives are particularly popular due to their superior bonding properties, in addition to being safe for food application. Since consumers are demanding more sustainable products and regulatory frameworks are becoming more stringent, the paper and packaging industry relying more on advanced adhesive solutions is expected to be one of the prominent factors driving growth.

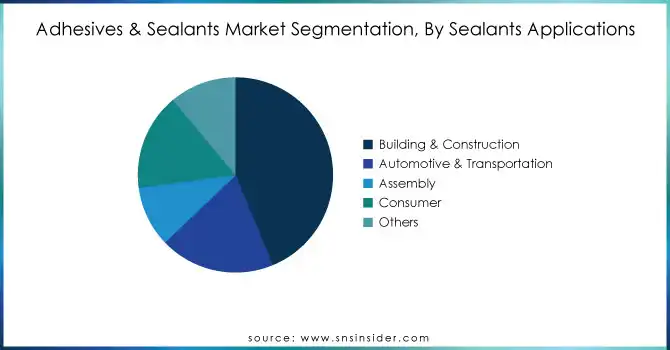

By Sealants Applications

Building & Construction dominated the sealants application segment with a revenue share of 43.58% in 2023. This is due to the increasing use of sealants in various construction activities. Sealants are vital for sealing joints, gaps, and cracks in buildings, ensuring structural integrity and preventing water infiltration. With increasing construction projects globally, including residential, commercial, and infrastructure developments, the demand for sealants for applications such as windows, doors, roofs, and façade systems has significantly surged. Additionally, advancements in sealant formulations, offering enhanced durability, weather resistance, and ease of application, have further propelled their widespread adoption in the building and construction industry.

Adhesives & Sealants Market Regional Overview

In 2023, the Asia-Pacific region dominated the global adhesives and sealants market with a 43% revenue share. This dominance is driven by swift industrialization, urbanization, and vibrant growth in various industries such as construction and automobiles. With China and India leading the charge, already substantial growth was supported by government policies such as India's "Make in India" initiative and the Chinese "Made in China 2025" plan. Such policies spur local manufacturing and innovations, thus enabling demand for adhesives and sealants for different applications.

North America region is projected to grow with the fastest CAGR over the forecast period 2024-2032. This growth is mainly driven by the increasing investments in infrastructural developments and innovations in adhesive technologies. The U.S. government Infrastructure Investment and Jobs Act, which includes $1.2 trillion for infrastructure improvements, is one of the key drivers for the region. It also acts as a major driver for construction adhesives & sealants, as the demand for more sophisticated and long-lasting materials used in modernization projects will continue to increase with this funding.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players in Adhesives & Sealants Market

Service Providers / Manufacturers

-

Henkel AG & Co. KGaA (Loctite, Technomelt)

-

The 3M Company (Scotch-Weld, VHB Tape)

-

H.B. Fuller Company (Clarity, Flextra)

-

Sika AG (Sikaflex, Sikadur)

-

Arkema S.A. (Bostik, Kynar)

-

Dow Inc. (Dowsil, Betaseal)

-

Illinois Tool Works Inc. (Permatex, Devcon)

-

RPM International Inc. (DAP, Tremco)

-

Avery Dennison Corporation (Fastener Adhesive, Supreme Tape)

-

Wacker Chemie AG (Elastosil, SilGel)

Key Users

-

Tesla Inc.

-

Boeing Company

-

Ford Motor Company

-

Samsung Electronics

-

General Electric

-

Pfizer Inc.

-

LG Electronics

-

Procter & Gamble

-

Unilever

-

Nike, Inc.

Recent Developments

-

In January 2024, The U.S. Environmental Protection Agency (EPA) launched a new initiative to promotion of lower-VOC adhesive use in construction and manufacturing. The plan offers grants worth $200 million for companies that adopt sustainable adhesive technology.

-

In March 2023 Arkema purchased Polytec PT an adhesives-focused company specialized in the growing markets of batteries and electronics, intensifying Bostik’s responses to better serve these markets. This acquisition complements Arkema's strategy to become a full system provider enabling customers to accelerate their sustainable solutions in the battery and electronics markets.

-

In May 2024, Dow increased capacity at SAS Chemicals for high-performance adhesives and sealants for glass manufacturing to meet growing demand.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 70.6 Billion |

| Market Size by 2032 | USD 115.3 Billion |

| CAGR | CAGR of 5.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Adhesives Product (Acrylic, PVA, Polyurethanes, Styrenic block, Epoxy, EVA, Others) • By Adhesives Technology (Water Based, Solvent Based, Hot Melt, Reactive & Others) • By Adhesives Application (Paper & packaging, Consumer & DIY, Building & construction, Furniture & woodworking, Footwear & leather, Automotive & transportation, Medical, Others) • By Sealants Product (Silicones, Polyurethanes, Acrylic, Polyvinyl acetate, Others) • By Sealants Applications (Building & Construction, Assembly, Automotive & Transportation, Consumer, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Sika AG, Arkema Group, Dow Inc., Illinois Tool Works Inc., RPM International Inc., Avery Dennison Corporation, Wacker Chemie AG |

| Key Drivers | • The surge in global construction activities, particularly in urban areas, has increased the use of adhesives and sealants for insulation and structural applications. • The development of water-based adhesives and low-VOC formulations is gaining traction due to stringent environmental regulations. Leading manufacturers are focusing on bio-based adhesives to meet sustainability goals and consumer demand. |

| Restraints | • Volatility in the prices of key raw materials, such as petrochemicals, affects profit margins and limits market growth. • Regulatory restrictions on solvent-based adhesives due to their environmental and health impact pose compliance challenges. |