Get More Information on Active Pharmaceutical Ingredient Market - Request Sample Report

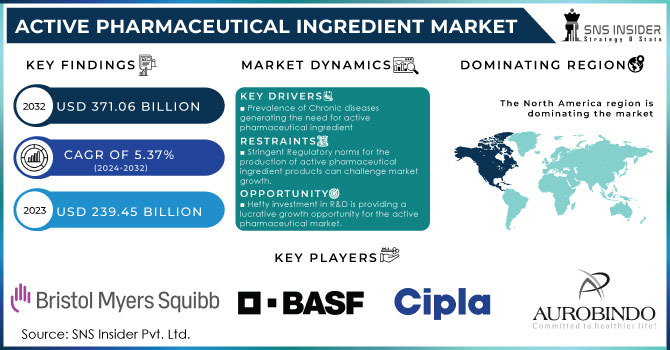

The Active Pharmaceutical Ingredient Market Size was valued at USD 239.45 billion in 2023 and is expected to reach USD 371.06 billion by 2032 and grow at a CAGR of 5.37% over the forecast period 2024-2032.

Progress in active pharmaceutical ingredient manufacturing, the expansion of biopharmaceuticals, and the aging of the global population are the API market’s key motorists. The market will be boosted by the rise in chronic diseases such as cancer and cardiovascular disease. The global geriatric population is growing rapidly. According to the UN, in 2022, the 65-and-older age group accounted for 771 million people, and by 2030 and 2050, it is expected to number 994 million and 1.6 billion, respectively. The most rapid growth in the number of persons over age 60 will be in Africa, with a threefold increase in the number of persons over 60 years to 18.8 billion, and in Latin America, where, by 2050, there will be one-fifth of a billion such persons. Due to aging, there is a high risk of the onset of many diseases, including cardiovascular and neurologic ones, which also suggests that the rapidly growing global geriatric population will become a high-impact rendering driver of the API market.

The rise in the incidence of infectious and hospital-acquired infections will be a high-impact rendering driver of this market. Moreover, further development of genetic, cardiovascular, and neurologic disorders will become a high-impact rendering driver of this market. According to WHO, CVDs are the cause of death of 17.9 million people per day and are expected to cause nearly 25 million deaths by 2030. The growing number of cigarette smokers worldwide, along with rising obesity levels and eating habits, are likely to drive market growth. A report released by the United Nations in May 2023 revealed that the number of girls with obesity increased by 75 percent and boys by 61 percent in Europe.

KEY DRIVERS:

RESTRAINTS:

OPPORTUNITY:

By Synthesis

The synthetic APIs segment held 70.65% largest revenue share in 2023. The most important driving factor for the synthetic API market is the high volume of generic drugs. Synthetic and Chemical API Manufacturers' Expansion on the Back of APIs to Promote Generic Drugs, Points Toward High Revenue The overall market is expected to increase due to the rise in IoT demand. This is going to create a huge scope for the CDMOs that operate in this segment. This makes the opportunity even more attractive for CDMOs as many such companies seek to outsource, to achieve greater profitability by lowering production costs. In October 2023, Cambrex completed its USD 38 Million small molecule API manufacturing facility. It doubled the size of its manufacturing facility, adding more capacity to accommodate additional customers as their needs grew.

By Ingredients

The APIs segment related to the innovative API holds more than 60 percent revenue share of almost all segments, yet this number is expected to rise even higher through 2023. This market growth is anticipated due to an increase in funding and favorable regulations provided for R&D facilities Several novel innovative products will be coming down the pipeline soon, thanks to copious research in this field. In addition, increased support from regulatory bodies for the approval of new drugs is expected to create favorable market growth; this can be attributed to an increase in government focus on healthcare and pharmaceuticals as a result of COVID-19.

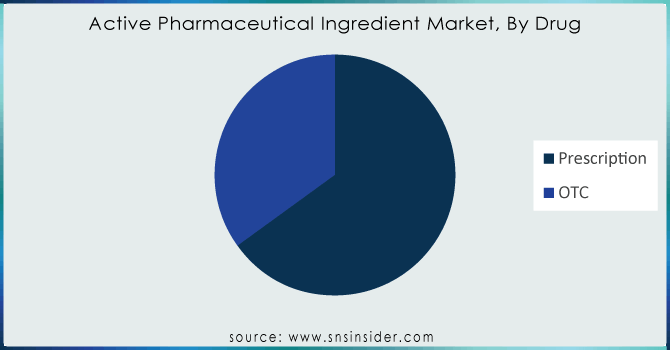

By Drug

The prescription segment accounted for the largest share of revenue in the overall API market by 2023 Unimaginably, the prescription drugs taken are to a great extent identified by physicians’ prescriptions. The use of prescription drugs, including Proton Pump Inhibitors (PPI) for common indications like heartburn has reached a plateau due to an array of side effects. There has been a change in the prescription rate of Histamine-2 Receptor Antagonist (H2RA), however. Oncology dominated the market for prescription drugs as cancer treatment is largely aided by chemotherapy, targeted therapy, immunotherapy, and hormonal therapy. There is also a growth in the usage of Biology. The number of prescriptions for targeted therapies is booming as more effective novel treatments get approved. Other major players are also launching new targeted drugs.

Need any customization research on Active Pharmaceutical Ingredient Market - Enquiry Now

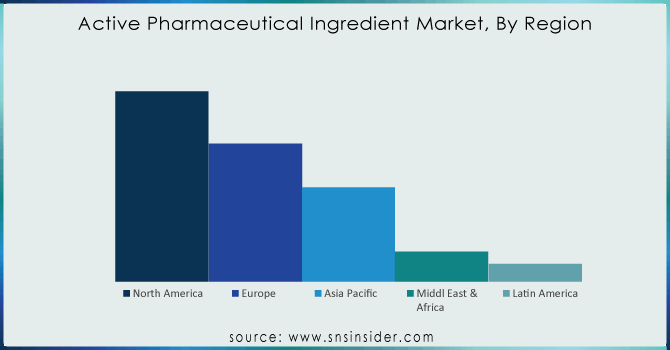

The highest revenue share is held by North America which is 40.01% in 2023. Key drivers include the inclining prevalence of chronic diseases such as cardiovascular, genetic, etc supported by increasing drug research which is anticipated to drive profits following a strong patent pipeline that has aided the active pharmaceutical ingredients market. The global market is powered by the availability of top industry players such as AbbVie Inc.; Curia; Pfizer Inc., Viatris Inc. as well as Fresenius Kabi AG; Viatris, for example, when it was created in a merger of Mylan NV and Pfizer Inc.'s Upjohn unit last year was not born from that kind of mega-deal but now has standing as one with over 100 ANDAs filed annually after the combination. Still big enough to generate billions every quarter even if hardly what we used to think of as Big Pharma., Viatris Ltd. gained approval from the FDA in February 2023; the generic drugs giant became active when won an immediate green light on Generic Restasis; a cyclosporine ophthalmic emulsion indicated ″for all patients suffering from severe dry eye disease. The region shows high-value manufacturing areas including complex & highly potent APIs, gene therapies & biologicals hence offering relative growth.

In addition, in February 2023 the Government of Canada released Good Manufacturing Practices guidance for active pharmaceutical ingredients (GUI-0104) to help anyone working with Active Pharmaceutical Ingredients (APIs) and their intermediates understand how to comply with Part C, Division 2 of the Food and Drug Regulations - GMP. This guideline applies to fabricators, packagers/labelers (including re-packagers/re-labelers), testers, importers and distributors, and wholesalers. This is anticipated to expand the need for API through a government initiative such as this which would further drive the growth of the API in the future.

Additionally, the rising number of API companies investing to enhance manufacturing facilities is expected to fuel market growth. Eurofins moves and grows its API development labs in January 2023 with a new home in Ontario, Canada. Also in May, Piramal Pharma reported that a new active pharmaceutical ingredient (API) plant at the company's facility in Aurora, Ontario is operational and has performed its first production runs. Hence the API Industry is anticipated to grow in the forecast period.

The Key players are Aurobindo Pharma, Bristol Myers Squibb, Eli Lilly and Company, BASF SE, Cipla, Abbvie Inc., Boehringer Ingelheim GmbH, Dr. Reddy’s Laboratories Ltd, Albemarle Corporation, Viatris Inc and Other Players. The key players are emphasizing the preservation of high-quality standards and catering to market demand with an existing customer base in the region at a large scale. This marketing strategy is only helpful if the brand has already established its name and trust in the market. They rely on significant investment in sophisticated new technology & infrastructure capable of high throughput processing & analysis.

In August 2023, the acquisition of BianoGMP will enable the expansion of EUROAPI CDMO capabilities through a high-growth industry: oligonucleotide manufacturing

In July 2023, Teva Pharmaceutical Industries Ltd. laid out a new growth plan and did not rule out selling off its API unit in the future API manufacturing facility about USD 2 billion.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 239.45 Billion |

|

Market Size by 2032 |

US$ 371.06 Billion |

|

CAGR |

CAGR of 5.37% From 2024 to 2032 |

|

Base Year |

2022 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type Of Synthesis (Biotech, Synthetic) •By Ingredients (Generic APIs, Innovative APIs) •By Application (Cardiovascular Diseases, Oncology, CNS and Neurology, Orthopedic, Endocrinology, Pulmonology Gastroenterology, Nephrology, Ophthalmology) •By Drug (Prescription, OTC) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Aurobindo Pharma, Bristol Myers Squibb, Eli Lilly and Company, BASF SE, Cipla, Abbvie Inc., Boehringer Ingelheim GmbH, Dr. Reddy’s Laboratories Ltd, Albemarle Corporation, Viatris Inc and Other Players |

|

Key Drivers |

•Prevalence of Chronic diseases generating the need for active pharmaceutical ingredient •An increase in demand for generic medicines is driving the active pharmaceutical ingredient market. |

|

Opportunities |

•Stringent Regulatory norms for the production of active pharmaceutical ingredient products can challenge market growth. •The higher manufacturing costs of active pharmaceutical ingredient products can limit the adoption of active pharmaceutical ingredients. |

Ans: The size of the Active Pharmaceutical Ingredient market was 239.45 billion by 2023.

Ans: Five steps are followed while doing the research process. First is secondary research, the second is primary research, third is data bank validation, the fourth QA/QC process, and the fifth final QC/QA process.

Ans: Drugs are assessed to bring down the market's turn of events, and Holistic drug price control is the restraint of the market.

Ans: North America held the greatest proportion of the active pharmaceutical ingredients market, followed by Europe and the Asia Pacific.

Ans: Yes, the data validation process is followed in this report.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Active Pharmaceutical Ingredient Market Segmentation, By Synthesis

7.1 Introduction

7.2 Biotech APIs

7.2.1 By type

7.2.1.1 Generic APIs

7.2.1.2 Innovative APIs

7.2.2 By Product

7.2.2.1 Monoclonal Antibodies

7.2.2.2 Hormones

7.2.2.3 Cytokines

7.2.2.4 Recombinant Proteins

7.2.2.5 Therapeutic Enzymes

7.2.2.6 Vaccines

7.2.2.7 Blood Factors

7.3 Synthetic APIs

7.3.1 By Type

7.3.1.1 Generic APIs

7.3.1.2 Innovative APIs

8. Active Pharmaceutical Ingredient Market Segmentation, By Ingredients

8.1 Introduction

8.2 Generic APIs

8.3 Innovative APIs

9. Active Pharmaceutical Ingredient Market Segmentation, By Application

9.1 Introduction

9.2 Cardiovascular Diseases

9.3 Oncology

9.4 CNS and Neurology

9.5 Orthopedic

9.6 Endocrinology

9.7 Pulmonology

9.8 Gastroenterology

9.9 Nephrology

9.10 Ophthalmology

9.11 Others

10. Active Pharmaceutical Ingredient Market Segmentation, By Drug

10.1 Introduction

10.2 Prescription

10.3 OTC

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Active Pharmaceutical Ingredient Market by Country

11.2.3 North America Active Pharmaceutical Ingredient Market By Synthesis

11.2.4 North America Active Pharmaceutical Ingredient Market By Ingredients

11.2.5 North America Active Pharmaceutical Ingredient Market By Application

11.2.6 North America Active Pharmaceutical Ingredient Market By Drug

11.2.7 USA

11.2.7.1 USA Active Pharmaceutical Ingredient Market By Synthesis

11.2.7.2 USA Active Pharmaceutical Ingredient Market By Ingredients

11.2.7.3 USA Active Pharmaceutical Ingredient Market By Application

11.2.7.4 USA Active Pharmaceutical Ingredient Market By Drug

11.2.8 Canada

11.2.8.1 Canada Active Pharmaceutical Ingredient Market By Synthesis

11.2.8.2 Canada Active Pharmaceutical Ingredient Market By Ingredients

11.2.8.3 Canada Active Pharmaceutical Ingredient Market By Application

11.2.8.4 Canada Active Pharmaceutical Ingredient Market By Drug

11.2.9 Mexico

11.2.9.1 Mexico Active Pharmaceutical Ingredient Market By Synthesis

11.2.9.2 Mexico Active Pharmaceutical Ingredient Market By Ingredients

11.2.9.3 Mexico Active Pharmaceutical Ingredient Market By Application

11.2.9.4 Mexico Active Pharmaceutical Ingredient Market By Drug

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Active Pharmaceutical Ingredient Market by Country

11.3.2.2 Eastern Europe Active Pharmaceutical Ingredient Market By Synthesis

11.3.2.3 Eastern Europe Active Pharmaceutical Ingredient Market By Ingredients

11.3.2.4 Eastern Europe Active Pharmaceutical Ingredient Market By Application

11.3.2.5 Eastern Europe Active Pharmaceutical Ingredient Market By Drug

11.3.2.6 Poland

11.3.2.6.1 Poland Active Pharmaceutical Ingredient Market By Synthesis

11.3.2.6.2 Poland Active Pharmaceutical Ingredient Market By Ingredients

11.3.2.6.3 Poland Active Pharmaceutical Ingredient Market By Application

11.3.2.6.4 Poland Active Pharmaceutical Ingredient Market By Drug

11.3.2.7 Romania

11.3.2.7.1 Romania Active Pharmaceutical Ingredient Market By Synthesis

11.3.2.7.2 Romania Active Pharmaceutical Ingredient Market By Ingredients

11.3.2.7.3 Romania Active Pharmaceutical Ingredient Market By Application

11.3.2.7.4 Romania Active Pharmaceutical Ingredient Market By Drug

11.3.2.8 Hungary

11.3.2.8.1 Hungary Active Pharmaceutical Ingredient Market By Synthesis

11.3.2.8.2 Hungary Active Pharmaceutical Ingredient Market By Ingredients

11.3.2.8.3 Hungary Active Pharmaceutical Ingredient Market By Application

11.3.2.8.4 Hungary Active Pharmaceutical Ingredient Market By Drug

11.3.2.9 Turkey

11.3.2.9.1 Turkey Active Pharmaceutical Ingredient Market By Synthesis

11.3.2.9.2 Turkey Active Pharmaceutical Ingredient Market By Ingredients

11.3.2.9.3 Turkey Active Pharmaceutical Ingredient Market By Application

11.3.2.9.4 Turkey Active Pharmaceutical Ingredient Market By Drug

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe Active Pharmaceutical Ingredient Market By Synthesis

11.3.2.10.2 Rest of Eastern Europe Active Pharmaceutical Ingredient Market By Ingredients

11.3.2.10.3 Rest of Eastern Europe Active Pharmaceutical Ingredient Market By Application

11.3.2.10.4 Rest of Eastern Europe Active Pharmaceutical Ingredient Market By Drug

11.3.3 Western Europe

11.3.3.1 Western Europe Active Pharmaceutical Ingredient Market by Country

11.3.3.2 Western Europe Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.3 Western Europe Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.4 Western Europe Active Pharmaceutical Ingredient Market By Application

11.3.3.5 Western Europe Active Pharmaceutical Ingredient Market By Drug

11.3.3.6 Germany

11.3.3.6.1 Germany Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.6.2 Germany Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.6.3 Germany Active Pharmaceutical Ingredient Market By Application

11.3.3.6.4 Germany Active Pharmaceutical Ingredient Market By Drug

11.3.3.7 France

11.3.3.7.1 France Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.7.2 France Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.7.3 France Active Pharmaceutical Ingredient Market By Application

11.3.3.7.4 France Active Pharmaceutical Ingredient Market By Drug

11.3.3.8 UK

11.3.3.8.1 UK Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.8.2 UK Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.8.3 UK Active Pharmaceutical Ingredient Market By Application

11.3.3.8.4 UK Active Pharmaceutical Ingredient Market By Drug

11.3.3.9 Italy

11.3.3.9.1 Italy Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.9.2 Italy Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.9.3 Italy Active Pharmaceutical Ingredient Market By Application

11.3.3.9.4 Italy Active Pharmaceutical Ingredient Market By Drug

11.3.3.10 Spain

11.3.3.10.1 Spain Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.10.2 Spain Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.10.3 Spain Active Pharmaceutical Ingredient Market By Application

11.3.3.10.4 Spain Active Pharmaceutical Ingredient Market By Drug

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.11.2 Netherlands Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.11.3 Netherlands Active Pharmaceutical Ingredient Market By Application

11.3.3.11.4 Netherlands Active Pharmaceutical Ingredient Market By Drug

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.12.2 Switzerland Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.12.3 Switzerland Active Pharmaceutical Ingredient Market By Application

11.3.3.12.4 Switzerland Active Pharmaceutical Ingredient Market By Drug

11.3.3.13 Austria

11.3.3.13.1 Austria Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.13.2 Austria Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.13.3 Austria Active Pharmaceutical Ingredient Market By Application

11.3.3.13.4 Austria Active Pharmaceutical Ingredient Market By Drug

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe Active Pharmaceutical Ingredient Market By Synthesis

11.3.3.14.2 Rest of Western Europe Active Pharmaceutical Ingredient Market By Ingredients

11.3.3.14.3 Rest of Western Europe Active Pharmaceutical Ingredient Market By Application

11.3.3.14.4 Rest of Western Europe Active Pharmaceutical Ingredient Market By Drug

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific Active Pharmaceutical Ingredient Market by Country

11.4.3 Asia-Pacific Active Pharmaceutical Ingredient Market By Synthesis

11.4.4 Asia-Pacific Active Pharmaceutical Ingredient Market By Ingredients

11.4.5 Asia-Pacific Active Pharmaceutical Ingredient Market By Application

11.4.6 Asia-Pacific Active Pharmaceutical Ingredient Market By Drug

11.4.7 China

11.4.7.1 China Active Pharmaceutical Ingredient Market By Synthesis

11.4.7.2 China Active Pharmaceutical Ingredient Market By Ingredients

11.4.7.3 China Active Pharmaceutical Ingredient Market By Application

11.4.7.4 China Active Pharmaceutical Ingredient Market By Drug

11.4.8 India

11.4.8.1 India Active Pharmaceutical Ingredient Market By Synthesis

11.4.8.2 India Active Pharmaceutical Ingredient Market By Ingredients

11.4.8.3 India Active Pharmaceutical Ingredient Market By Application

11.4.8.4 India Active Pharmaceutical Ingredient Market By Drug

11.4.9 Japan

11.4.9.1 Japan Active Pharmaceutical Ingredient Market By Synthesis

11.4.9.2 Japan Active Pharmaceutical Ingredient Market By Ingredients

11.4.9.3 Japan Active Pharmaceutical Ingredient Market By Application

11.4.9.4 Japan Active Pharmaceutical Ingredient Market By Drug

11.4.10 South Korea

11.4.10.1 South Korea Active Pharmaceutical Ingredient Market By Synthesis

11.4.10.2 South Korea Active Pharmaceutical Ingredient Market By Ingredients

11.4.10.3 South Korea Active Pharmaceutical Ingredient Market By Application

11.4.10.4 South Korea Active Pharmaceutical Ingredient Market By Drug

11.4.11 Vietnam

11.4.11.1 Vietnam Active Pharmaceutical Ingredient Market By Synthesis

11.4.11.2 Vietnam Active Pharmaceutical Ingredient Market By Ingredients

11.4.11.3 Vietnam Active Pharmaceutical Ingredient Market By Application

11.4.11.4 Vietnam Active Pharmaceutical Ingredient Market By Drug

11.4.12 Singapore

11.4.12.1 Singapore Active Pharmaceutical Ingredient Market By Synthesis

11.4.12.2 Singapore Active Pharmaceutical Ingredient Market By Ingredients

11.4.12.3 Singapore Active Pharmaceutical Ingredient Market By Application

11.4.12.4 Singapore Active Pharmaceutical Ingredient Market By Drug

11.4.13 Australia

11.4.13.1 Australia Active Pharmaceutical Ingredient Market By Synthesis

11.4.13.2 Australia Active Pharmaceutical Ingredient Market By Ingredients

11.4.13.3 Australia Active Pharmaceutical Ingredient Market By Application

11.4.13.4 Australia Active Pharmaceutical Ingredient Market By Drug

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Active Pharmaceutical Ingredient Market By Synthesis

11.4.14.2 Rest of Asia-Pacific Active Pharmaceutical Ingredient Market By Ingredients

11.4.14.3 Rest of Asia-Pacific Active Pharmaceutical Ingredient Market By Application

11.4.14.4 Rest of Asia-Pacific Active Pharmaceutical Ingredient Market By Drug

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Active Pharmaceutical Ingredient Market by Country

11.5.2.2 Middle East Active Pharmaceutical Ingredient Market By Synthesis

11.5.2.3 Middle East Active Pharmaceutical Ingredient Market By Ingredients

11.5.2.4 Middle East Active Pharmaceutical Ingredient Market By Application

11.5.2.5 Middle East Active Pharmaceutical Ingredient Market By Drug

11.5.2.6 UAE

11.5.2.6.1 UAE Active Pharmaceutical Ingredient Market By Synthesis

11.5.2.6.2 UAE Active Pharmaceutical Ingredient Market By Ingredients

11.5.2.6.3 UAE Active Pharmaceutical Ingredient Market By Application

11.5.2.6.4 UAE Active Pharmaceutical Ingredient Market By Drug

11.5.2.7 Egypt

11.5.2.7.1 Egypt Active Pharmaceutical Ingredient Market By Synthesis

11.5.2.7.2 Egypt Active Pharmaceutical Ingredient Market By Ingredients

11.5.2.7.3 Egypt Active Pharmaceutical Ingredient Market By Application

11.5.2.7.4 Egypt Active Pharmaceutical Ingredient Market By Drug

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia Active Pharmaceutical Ingredient Market By Synthesis

11.5.2.8.2 Saudi Arabia Active Pharmaceutical Ingredient Market By Ingredients

11.5.2.8.3 Saudi Arabia Active Pharmaceutical Ingredient Market By Application

11.5.2.8.4 Saudi Arabia Active Pharmaceutical Ingredient Market By Drug

11.5.2.9 Qatar

11.5.2.9.1 Qatar Active Pharmaceutical Ingredient Market By Synthesis

11.5.2.9.2 Qatar Active Pharmaceutical Ingredient Market By Ingredients

11.5.2.9.3 Qatar Active Pharmaceutical Ingredient Market By Application

11.5.2.9.4 Qatar Active Pharmaceutical Ingredient Market By Drug

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East Active Pharmaceutical Ingredient Market By Synthesis

11.5.2.10.2 Rest of Middle East Active Pharmaceutical Ingredient Market By Ingredients

11.5.2.10.3 Rest of Middle East Active Pharmaceutical Ingredient Market By Application

11.5.2.10.4 Rest of Middle East Active Pharmaceutical Ingredient Market By Drug

11.5.3 Africa

11.5.3.1 Africa Active Pharmaceutical Ingredient Market by Country

11.5.3.2 Africa Active Pharmaceutical Ingredient Market By Synthesis

11.5.3.3 Africa Active Pharmaceutical Ingredient Market By Ingredients

11.5.3.4 Africa Active Pharmaceutical Ingredient Market By Application

11.5.3.5 Africa Active Pharmaceutical Ingredient Market By Drug

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria Active Pharmaceutical Ingredient Market By Synthesis

11.5.3.6.2 Nigeria Active Pharmaceutical Ingredient Market By Ingredients

11.5.3.6.3 Nigeria Active Pharmaceutical Ingredient Market By Application

11.5.3.6.4 Nigeria Active Pharmaceutical Ingredient Market By Drug

11.5.3.7 South Africa

11.5.3.7.1 South Africa Active Pharmaceutical Ingredient Market By Synthesis

11.5.3.7.2 South Africa Active Pharmaceutical Ingredient Market By Ingredients

11.5.3.7.3 South Africa Active Pharmaceutical Ingredient Market By Application

11.5.3.7.4 South Africa Active Pharmaceutical Ingredient Market By Drug

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa Active Pharmaceutical Ingredient Market By Synthesis

11.5.3.8.2 Rest of Africa Active Pharmaceutical Ingredient Market By Ingredients

11.5.3.8.3 Rest of Africa Active Pharmaceutical Ingredient Market By Application

11.5.3.8.4 Rest of Africa Active Pharmaceutical Ingredient Market By Drug

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Active Pharmaceutical Ingredient Market by Country

11.6.3 Latin America Active Pharmaceutical Ingredient Market By Synthesis

11.6.4 Latin America Active Pharmaceutical Ingredient Market By Ingredients

11.6.5 Latin America Active Pharmaceutical Ingredient Market By Application

11.6.6 Latin America Active Pharmaceutical Ingredient Market By Drug

11.6.7 Brazil

11.6.7.1 Brazil Active Pharmaceutical Ingredient Market By Synthesis

11.6.7.2 Brazil Active Pharmaceutical Ingredient Market By Ingredients

11.6.7.3 Brazil Active Pharmaceutical Ingredient Market By Application

11.6.7.4 Brazil Active Pharmaceutical Ingredient Market By Drug

11.6.8 Argentina

11.6.8.1 Argentina Active Pharmaceutical Ingredient Market By Synthesis

11.6.8.2 Argentina Active Pharmaceutical Ingredient Market By Ingredients

11.6.8.3 Argentina Active Pharmaceutical Ingredient Market By Application

11.6.8.4 Argentina Active Pharmaceutical Ingredient Market By Drug

11.6.9 Colombia

11.6.9.1 Colombia Active Pharmaceutical Ingredient Market By Synthesis

11.6.9.2 Colombia Active Pharmaceutical Ingredient Market By Ingredients

11.6.9.3 Colombia Active Pharmaceutical Ingredient Market By Application

11.6.9.4 Colombia Active Pharmaceutical Ingredient Market By Drug

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Active Pharmaceutical Ingredient Market By Synthesis

11.6.10.2 Rest of Latin America Active Pharmaceutical Ingredient Market By Ingredients

11.6.10.3 Rest of Latin America Active Pharmaceutical Ingredient Market By Application

11.6.10.4 Rest of Latin America Active Pharmaceutical Ingredient Market By Drug

12. Company Profiles

12.1 Aurobindo Pharma

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 Bristol Myers Squibb

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 Eli Lilly and Company

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 BASF SE

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 Cipla

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 Abbvie Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

12.7 Boehringer Ingelheim GmbH

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 The SNS View

12.8 Dr. Reddy’s Laboratories Ltd

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 The SNS View

12.9 Albemarle Corporation

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 The SNS View

12.10 Viatris Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Synthesis

Biotech APIs

By Type

Generic APIs

Innovative APIs

By Product

Monoclonal Antibodies

Hormones

Cytokines

Recombinant Proteins

Therapeutic Enzymes

Vaccines

Blood Factors

Synthetic APIs

By Type

Generic APIs

Innovative APIs

By Ingredients

Generic APIs

Innovative APIs

By Drug

Prescription

OTC

Cardiovascular Diseasest

Oncology

CNS and Neurology

Orthopedic

Endocrinology

Pulmonology

Gastroenterology

Nephrology

Ophthalmology

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Healthcare Predictive Analytics Market was valued at USD 14.02 billion in 2023 and is expected to reach USD 126.15 billion by 2032, growing at a CAGR of 27.67% from 2024-2032.

The Small Animal Imaging (In Vivo) Market Size was valued at USD 1.16 billion in 2023 and is expected to reach USD 2.27 billion by 2032 and grow at a CAGR of 7.76% over the forecast period 2024-2032.

The Nanomedicine Market was valued at USD 223.6 billion in 2023 and is expected to reach USD 634.2 billion by 2032 and grow at a CAGR of 12.2% from 2024 to 2032.

Sepsis Diagnostics Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.5 billion by 2032, growing at a CAGR of 8.6% from 2024 to 2032.

The Type 2 Diabetes Market size was estimated at USD 35.78 billion in 2023 and is projected to reach USD 69.55 billion by 2032 and grow at a CAGR of 7.69%.

The Digital Wound Care Management System Market was valued at USD 3.86 billion in 2023 and is expected to reach USD 7.24 billion by 2032, growing at a CAGR of 7.28% from 2024-2032.

Hi! Click one of our member below to chat on Phone