Active & Intelligent Packaging Market Key Insights:

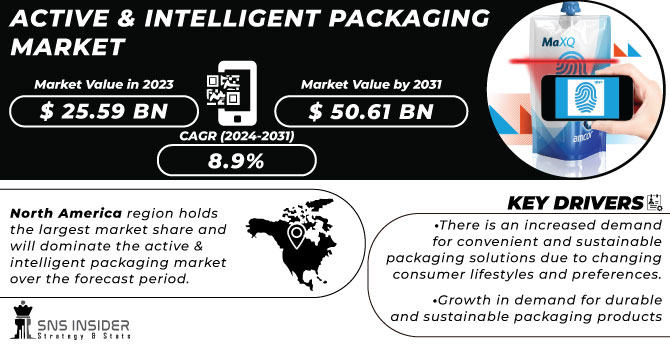

The Active & Intelligent Packaging Market size was USD 25.59 billion in 2023 and is expected to reach USD 50.61 billion by 2031 and grow at a compound annual growth rate (CAGR) of 8.9 % over the forecast period from 2024 to 2031.

The global active and smart packaging market is expected to grow owing to the increasing need for specialty packaging to preserve product freshness and nutritional value at competitive prices. Advanced transportation facilities are expected to facilitate global trade and, in turn, have a positive impact on the market. Rising urban populations and changing lifestyles are increasing the demand for ready-to-eat frozen and packaged foods. Increased global trade practices are driving demand for exotic fruits and vegetables, meats and frozen products in many countries, as well as demand for specialty packaging.

Get More Information on Active & Intelligent Packaging Market - Request Sample Report

The trend shift from traditional packaging systems to advanced packaging systems addressing internal and external aspects of product protection is expected to increase the demand for the products. Active packaging aims to protect the product from the material, while intelligent systems add additional information in electronic or non-electronic form to the sleeve.

Especially in North America and Europe, the demand for advanced systems is increasing due to the growing demand for convenient ready-to-eat food and strict regulations on fresh food packaging. Rising demand for intelligent packaging technology to organize value chains, increase efficiency and reduce customer wait times at the point of sale is also expected to drive growth over the next seven years.

The increasing number of convenience stores and his technologically advanced POS have increased the need for intelligent systems. Shorter tracking times and efficient product monitoring are expected to drive the global active and intelligent packaging system during the forecast period. High implementation costs due to heavy investment in research and development are expected to restrain product demand during the forecast period. Rising raw material costs also increase filing costs, which are passed directly on to the purchaser. This is also expected to hamper the growth of the active and intelligent packaging market.

MARKET DYNAMICS

KEY DRIVERS:

-

Growth in demand for durable and sustainable packaging products.

Active packaging technologies such as oxygen absorbers and moisture absorbers can help extend the shelf life of fresh produce. Active packaging solutions help meet consumer demand for longer-lasting products and reduce food waste by preserving product freshness and quality.

-

There is an increased demand for convenient and sustainable packaging solutions due to changing consumer lifestyles and preferences.

RESTRAIN:

-

A range of complex technologies and expertise are required to implement and operate these innovative and intelligent packaging solutions.

It may be complicated and require specialized knowledge and resources in the integration of sensors, connectivity and data management systems. In the case of organizations that are not sufficiently trained or infrastructured, this complexity can be a barrier to adoption.

OPPORTUNITY:

-

Opportunities exist in the market for active and intelligent packaging by the developments in printed electronics.

Printed electronics allow the construction of tamper-resistant packaging, ensuring product integrity and enhancing consumer protection. These innovations will strengthen the capabilities of packaging, provide improved transparency and consumer experiences in the supply chain as well as stimulate growth on the market for Active and Intelligent Packaging.

-

The rapid growth in e-commerce as well as growing popularity of D2C models provide opportunities for Active and intelligent packaging solutions.

CHALLENGES:

-

It can be challenging to ensure compliance with the rules on safety, labelling and environmental impact which may require additional testing and certification procedures.

IMPACT OF RUSSIA-UKRAINE WAR

Russia Ukraine war had affected businesses. Many businesses suspended their operations in the region and postponed or cancelled the investment activities. Due to the availability of raw materials and other resources, large companies operate in both Russia and Ukraine.

The dispute affected the company's operations, and sales fell by 13%. Supply chain complexity was also a major challenge during the conflict. World GDP was 3.9% before the war, but it fell to 1.3% due to the conflict and its impact on major economies. World trade fell to 1.4%. However, Russia is an important supplier of machinery and equipment to other countries.

The conflict has reduced the supply of machinery and equipment, hurting industry production and growth.

IMPACT OF ONGOING RECESSION

During economic downturns, consumers can cut back on voluntary spending, including on non-essential items. Declining consumption may lead to lower output for manufacturers, resulting in lower demand for active & intelligent packaging solutions need.

Declining consumption and declining per capita income of consumers are impacting the market. In times of recession, people tend to save money. Consumer behavior influences this market. As the industry spends less on research and development, new breakthrough innovations and machines will not enter the market during a recession. This is because the industry does not spend money during recessions due to losses or economic fluctuations.

KEY MARKET SEGMENTATION

By Material

-

Plastic

-

Glass

-

Metal

-

Paper

-

Wood

By Technology

-

Shelf-Life Sensing

-

Time Temperature Indicator

-

Moisture Absorber

-

Others

By Application

-

Food & Beverage

-

Pharmaceutical

-

Healthcare

-

Personal Care

-

Others

North American region holds the largest market share and will dominate the active & intelligent packaging market over the forecast period. Historically, North America is at the forefront of technological advances. The adoption of these packaging technologies is driven by the region's highly developed food and beverage industry, coupled with a large increase in consumer awareness. The market growth is also influenced by stringent rules governing food safety and quality.

Europe is the second-largest growing market for active and intelligent packaging. There are strong regulations on food safety and environmental sustainability in this region, which lead to demand for innovative packaging solutions. In addition to this, the adoption of such technologies has been facilitated by growing consumer preferences for convenience and information transparency.

The Middle East and Africa region is gradually adopting active and intelligent packaging technologies. Factors such as increased urbanization, the development of modern retail formats and an increase in consumer awareness on product quality and safety are driving demand in this region. But due to factors such as economic constraints and infrastructure problems, market penetration in these regions may be limited compared with others.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are Amcor PLC, Crown Holdings Inc, Mitsubishi Gas Chemical Co, Constar International Inc, Ball Corporation, 3M Company, Coveris Holdings SA, Sealed Air Corporation, LCR Hall Crest LLC, Varcode Ltd and other players.

Crown Holdings Inc-Company Financial Analysis

RECENT DEVELOPMENTS

-

A new sensor has been developed by Senoptica Technologies, a deep-tech packaging sensor technology company based in Ireland, using food-safe ink that can be printed directly on the inside of the packaging, to monitor the state of packaged, perishable food products.

-

To prolong the freshness of foods and cut food waste, Hellmanns has teamed up with Ogilvy & Mather to build an innovative jar for mayonnaise that will tell customers when their fridge is at its optimum temperature.

-

In order to increase its production capacity for RFID tags within the Americas, Avery Dennison Smartrac is investing $100 million at a new manufacturing site in Queretaro, Mexico.

| Report Attributes | Details |

| Market Size in 2023 | US$ 25.59 Bn |

| Market Size by 2031 | US$ 50.61 Bn |

| CAGR | CAGR of 8.9 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Glass, Metal, Paper, Wood) • By Technology (Oxygen Scavenger, Shelf-Life Sensing, Time Temperature Indicator, Moisture Absorber, Others) • By Application (Food & Beverage, Pharmaceutical, Healthcare, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor PLC, Crown Holdings Inc, Mitsubishi Gas Chemical Co, Constar International Inc, Ball Corporation, 3M Company, Coveris Holdings SA, Sealed Air Corporation, LCR Hall Crest LLC, Varcode Ltd |

| Key Drivers | • Growth in demand for durable and sustainable packaging products • There is an increased demand for convenient and sustainable packaging solutions due to changing consumer lifestyles and preferences. |

| Market Restraints | • A range of complex technologies and expertise are required to implement and operate these innovative and intelligent packaging solutions |