Acrylonitrile Market Report Scope & Overview:

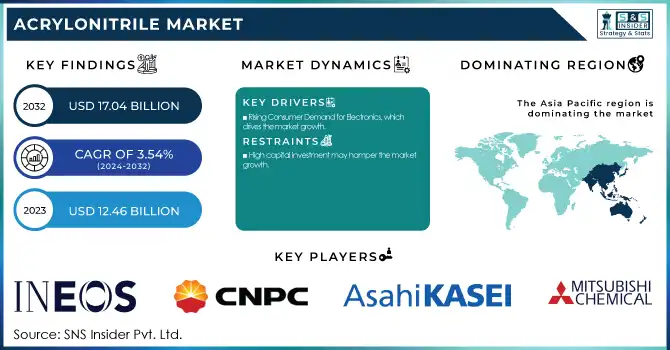

The Acrylonitrile Market size was USD 12.46 Billion in 2023 and is expected to reach USD 17.04 Billion by 2032 and grow at a CAGR of 3.54% over the forecast period of 2024-2032. This reporting on the acrylonitrile market provides key insights into the production capacity and utilization trends across regions in 2023, highlighting feedstock price fluctuations and their impact on production costs. It examines the regulatory landscape, detailing the influence of environmental and industry-specific regulations on the market. Environmental metrics are explored, including emissions data and sustainability initiatives in major producing regions. The report also focuses on recent innovations and R&D efforts, particularly in green production technologies. Furthermore, it covers market demand trends by end-use applications such as acrylic fibers and nitrile rubber. Key regional shifts in production and consumption patterns are analyzed, offering a comprehensive view of market dynamics. These insights are crucial for understanding the evolving acrylonitrile market landscape.

To Get more information on Acrylonitrile Market - Request Free Sample Report

Acrylonitrile Market Dynamics:

Drivers

-

Rising Consumer Demand for Electronics, which drives the market growth.

A major proportion of acrylonitrile is used in the production of ABS (Acrylonitrile Butadiene Styrene) plastics widely used in the electronics sector owing to the increasing consumer demand for electronics which is propelling acrylonitrile market. As smartphones, laptops, home appliances, and other electronic devices proliferate in terms of both usage and volume of manufacturing, the demand for durable, lightweight, and low-cost materials to produce outer casings and parts continues to rise. Moreover, of its excellent strength, impact resistance, and ease of molding, ABS is great for these applications. The worldwide demand for consumer electronics is growing at a rapid pace owing to technological development, increasing disposable income, and an emerging middle class, resulting in high demand for acrylonitrile-based ABS plastics. The request for acrylonitrile is enhanced by this increasing trend in electronics, driving the creation in the production of this material to find means to fit the electronic industry's changing requirements.

Restraint

-

High capital investment may hamper the market growth.

A major challenge that can restrain the growth of the acrylonitrile market is the high capital investment required to set up acrylonitrile production plants. Acrylonitrile is produced through a multi-stage, and high-energy intensive processes, which is associated with use of any large-scale production facilities, and special equipment, and necessary technologies. Setting up these facilities often comes with high cost, making it difficult for smaller players or new entrants to the market to make such an investment. The long payback times of these investments will also be long-term a disincentive in investment decisions on the part of potential investors in a volatile and demand-variable price environment. Such high capex also reduces the flexibility of companies to quickly scale operations due to market shifts, which might delay innovation and lower competitiveness. This leads to huge initial investments that can be a barrier to the overall growth of the acrylonitrile market.

Opportunity

-

Rising demand for bio-based acrylonitrile create an opportunity in the market.

Rise of bio-based numbers among industries and consumers is gaining priority over sustainability and eco-friendly solutions. However, the traditional processes to produce acryl nitrile have high-energy and fossil fuel dependency, which raises environmental and climate concerns. This has led to an increased commitment to alternative approaches that use renewable and sustainable resources of biomass or waste materials instead of petrochemical feedstocks. The transition to greener energy vehicles is fueled in part by tighter environmental policies from the governments, and by consumers looking for greener products. By producing bio-based acrylonitrile, the carbon footprint of its production is reduced and companies are prepared for the growing demand for sustainable materials in important business areas such as textiles, automotive and electronics applications.

Challenges

-

Technological barriers in bio-based production may create a challenge for the market.

Technological hurdles concerned with bio-based production is one of the most notable challenges for acrylonitrile market owing to the fact that, industries are shifting towards sustainable practices. Although fantastic potential exists for bio-based acrylonitrile to mitigate the environmental impact of its current production, manufacturing technologies remain in the developmental stages needed for commercial production. There are multiple technical challenges to address when scaling up bio-based production processes, such as optimizing yields, securing feedstock availability, and establishing cost-competitiveness compared to traditional petrochemical-based methods. Moreover, existing bio-based processes are relatively more expensive due to the high costs involved in R&D, not to mention the infrastructure needed for commercial-scale production. The ability to overcome these technological barriers will play a crucial role in whether or not bio-based acrylonitrile achieves widespread adoption, thus preventing its market disruption and the opportunity to meet increasing demand for sustainable materials.

Acrylonitrile Market Segmentation Analysis:

By Application

Acrylonitrile Butadiene Styrene (ABS) held the largest market share, around 27% in 2023. Due to its good impact resistance properties, high strength, and good processability, ABS is used as raw materials in many fields including automotive parts, consumer electronics, household appliances, and construction materials. ABS is being used extensively in the automotive sector to produce lightweight and strong parts to enhance fuel recurrence and safety. Moreover, the moldability of ABS to complex geometries and its metal and rubber substrate compatibility increases its market share. ABS acceptance has been primarily driven by the increasing need for durable yet inexpensive materials and the growth of manufacturing technologies. ABS has found its way to become largest market share holder in the acrylonitrile market out of excellent traits it provides to industries for manufacturing goods as high demand in consumer products, electronics and automotive sector continue.

Acrylonitrile Market Regional Outlook:

Asia Pacific held the largest market share, around 52% in 2023. It is owing to rapid industrialization, development of manufacturing capabilities, increasing demand from various end-use industries such as automotive, textiles, electronics, and construction for acrylonitrile-based products in the region. Well, because of large-scale manufacturing industries and growing populations the nations noted are some of the largest consumers and producers of acrylonitrile: China, India and Japan. For example, acrylonitrile derivatives, such as acrylonitrile-butadiene-styrenes (ABS) plastics, are used extensively in automotive and electronics industries, which are the main drivers for the segment in the region. In addition, cost-effective production, low labor cost, and proximity to key resources have turned Asia-Pacific into a global chemical cluster. Continued government initiatives in nations like China and India to raise the level of industrialization and the development of infrastructure and urbanization drive the region towards being the leader. This factor, propelled by the rising need for sustainable and innovative solutions, bolsters Asia-Pacific’s competitive edge in the global acrylonitrile market through its investments in research and development.

North America held a significant market share of the acrylonitrile market. The region, specifically the USA, is also where some of the largest acrylonitrile production plants in the world are found, using a well-established chemical industry base. The automotive industry in North America contributes significantly for containing large volume of acrylonitrile-based products such as ABS plastics used for the production of lightweight, highly durable and fuel-efficient car components. The increasing emphasis on innovation and sustainability in the region has also contributed to a rising demand for acrylonitrile derivatives in the high-performance applications market. North America strengthens its market due to a strong chemical industry presence, along with supportive government policies and ongoing R&D investment. Moreover, North America being a market leader with demand for acrylonitrile in textiles, construction, and other industries, is lucrative.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

-

INEOS (Novacryl, Acrylon Ultra)

-

China Petroleum Development Corp. (CPDC AN, Acrylon Prime)

-

Asahi Kasei Advance Corp. (Leona AN, Thermyln AN)

-

Ascend Performance Materials (Trinohex Ultra, Vydyne AN)

-

Chemelot (ChemoNitril, NitroPlast AN)

-

Formosa Plastics Corp. (Formonitrile, ForPlas AN)

-

Mitsubishi Chemical Corp. (Acryrex, Lucite AN)

-

Secco (SeccoPure, Acrylon Elite)

-

Taekwang Industrial Co., Ltd. (Taekryl, Taeflex AN)

-

Sumitomo Chemical Co., Ltd. (Sumikril, AcrylSum)

-

LG Chem (Lupoy, Lusep AN)

-

Sinopec (SinoAcrylo, SinoNitril)

-

SABIC (Vestolen, KSAcryl)

-

Toray Industries, Inc. (Toraylon, Torelina AN)

-

Lotte Chemical (LotteNitril, AcryLotte)

-

Versalis (Vyrtix, Versacryl)

-

BASF (Ultraform, Bascryl)

-

AnQore (Econitril, QoreAcryl)

-

PetroChina Company Limited (PetroNitril, ChinaCryl)

-

Kumho Petrochemical (KumhoNitril, KumhoFlex)

Recent Development:

-

In 2023, INEOS launched Novacryl, a new range of high-performance acrylonitrile products designed for use in automotive and construction sectors. The company has also expanded its production capacity to meet the growing demand for advanced plastics.

-

In 2023, Ascend introduced its Vydyne AN product line for applications in advanced automotive composites, capitalizing on the growing trend for lightweight, durable, and energy-efficient materials. This development supports the company’s strategic goal of expanding its market presence in sustainable automotive materials.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 12.46 Billion |

|

Market Size by 2032 |

USD 17.04 Billion |

|

CAGR |

CAGR of 3.54% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

|

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

|