Acrylic Polymer Market Report Scope & Overview:

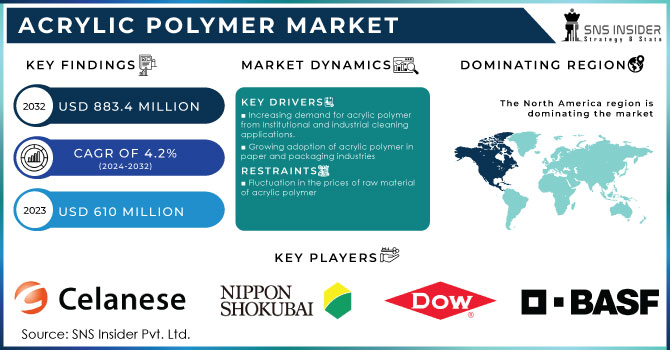

The Acrylic Polymer Market Size was valued at USD 610 million in 2023, and is expected to reach USD 883.4 million by 2032, and grow at a CAGR of 4.2% over the forecast period 2024-2032.

Get More Information on Acrylic Polymer Market - Request Sample Report

The acrylic polymer market is booming, primarily owing to a wide array of applications across industries such as automotive, construction, packaging, and electronics. Increasing demand for high-performance materials from these industries has been acting as the major growth driver. In the case of the automotive industry, the growing requirement for lightweight structures yet more hardened or strengthened one has resulted in increasing demand for acrylic polymers, as it helps in increasing fuel efficiency and lowering emissions. Similarly, in the building and construction sectors, the demand for acrylic-based paints and coatings has accelerated with present infrastructure projects and the need for durable but handsome materials. Acrylic polymers make a significant contribution to the packaging sector as they possess clarity, strength, and chemical resistance, which enables them to be applied in many sectors.

Development in the acrylic polymer market is highly influenced by technological innovation, which has led to new formulations with improved properties. Specifically, innovations lately developed acrylic polymers that show better UV resistance, thermal stability, and water repellency. For instance, in March 2024, BASF announced its new line of acrylic polymers that ensured better UV resistance. In June 2024, Dow announced water-repellent acrylic coatings for use in construction. These developments help improve the needs of various industries, making new demands on product performance and quality. The more companies research and develop, the more innovative products created in the market are tailor-made to suit specific industrial requirements.

Another major factor that may influence the acrylic polymer market is environmental concerns and associated regulatory measures. With increasing awareness about the impact on the environment and pressure to use greener solutions, there is a rising preference for eco-friendly materials such as low-VOC acrylic polymers. Companies are thus developing products that would support stringent environmental regulations while consumer demand for green alternatives continues. For instance, AkzoNobel introduced its line of low-VOC acrylic paints in April 2024 for both the building and automotive industries. Moreover, the expansion of construction activities in emerging markets like Asia-Pacific and Latin America, driven by urbanization and rising disposable incomes, is further fueling market growth. Companies like PPG Industries, which expanded its production capacity in Brazil in February 2024, are capitalizing on this trend, underscoring the market's potential in these regions. Overall, the acrylic polymer market is on a robust growth trajectory, supported by technological innovations, environmental considerations, and expanding global construction activities.

Market Dynamics:

Drivers:

-

Increasing demand for acrylic polymer from Institutional and industrial cleaning applications.

The increased demand from institutional and industrial cleaning applications is another major driver in the market due to high demand for the polymers. Acrylic polymers have good adhesion properties and film-forming, hence help improve performance and durability for cleaning products of all kinds. Of particular use, they come in formulations for floor finishes, polishes, and surface coatings where they give protective action and enhance gloss in an effort to increase the appeal and durability of treated surfaces. For example, in May 2024, Henkel announced a new line of industrial floor finishes containing advanced acrylic polymer formulations designed to withstand heavy foot traffic and chemical exposure in manufacturing facilities. In July 2023, Diversey announced a line of surface cleaners and polishes using acrylic polymers for a high sheen and protection in very busy facilities such as hospitals and schools. Such products use the polymer's capacity to form a hard, resilient film that is impervious to water and resists stains and dirt. Because of this fact, they fit perfectly into applications in heavy-traffic areas where cleanliness and frequent maintenance are of great concern. These polymers provide a balance of performance, durability, and ease of application, generating constant demand for sophisticated cleaning solutions in the institutional and industrial surroundings. Moreover, given the new standards of hygiene and cleaning brought in by the pandemic, more attention by businesses and institutions to the creation of clean and safe environments increased the adoption of acrylic polymer-based cleaning products.

-

Growing adoption of acrylic polymer in paper and packaging industries

The growing application of acrylic polymers in the paper and packaging industries as a result of versatile properties. Besides, increasing demand for more sustainable solutions in packaging also fuels demand for acrylic polymers in the paper and packaging industries. Good adhesion, barrier properties, and film-forming ability make acrylic polymers very useful in paper and packaging industries. Such excellent adhesion, barrier properties, and film-forming ability make acrylic polymers very useful in paper and packaging industries. They provide good adhesion and clarity in coating applications in films, labels, and laminates used in packaging materials. For example, in August 2023, Avery Dennison launched a new line of acrylic adhesive labels, which are very eco-friendly, have a strong adhesion property, and are transparent; these are of growing demand due to the increased trend toward more attractive label faces in packaging. On the other hand, Mondi Group launched innovative acrylic coatings onto a portfolio of recyclable paper packaging solutions during October 2023 for protection with moisture-resistance and strength during transportation. These coatings also aid in the reduction of plastic usages, thus falling in line with the global goals of sustainability. Acrylic polymers are further used in the process of paper production for enhancing the quality of paper through rendering it smooth and improving its printability and water and oil resistance. The shift towards eco-friendlier and recyclable forms of packaging materials has also contributed to the increase in the consumption of acrylic polymers, as companies strive to live up to consumer tastes and legislations enforcing sustainable forms of packaging. This is accelerated further by innovations in acrylic polymer formulations, including the development of water-based adhesives and coatings, which also spur further their adoption into the paper and packaging industries as a friendly eco-alternative to traditional material usage.

Restraints:

-

Fluctuation in the prices of raw material of acrylic polymers

The major restraint of the market is due to the price fluctuation of the raw materials used to make acrylic polymers. Acrylonitrile, methyl methacrylate, and other petrochemical by-products represent major raw materials for acrylic polymers; therefore, their prices remain very volatile under the influence of changes in crude oil prices, disruptions in the supply chain, and geopolitical factors. For instance, in February 2024, Dow Chemical increased the price of MMA, the main monomer of acrylic, due to a sudden shortage in supply, which was exacerbated by a major plant shutdown in Asia. This surge in prices compelled many companies to reassess production costs and increase prices, thereby affecting market demand and profitability. In a financial report, BASF broke its silence in November 2023 to point out the volatility of managing costs due to raw material scarcity and increasing demand from other industries. This has driven acrylonitrile prices higher. These changes not only result in changes to the price of acrylic polymer products but bring in uncertainty regarding supply contracts and long-term planning for manufacturers. The cost structure in this industry is, therefore, intimately linked to the vagaries of the oil market, making it very vulnerable to sudden changes because it is based on petrochemical feedstocks.

Opportunities:

-

Growing demand for green and sustainable materials.

-

Construction activity has been quite strong, mainly in developing countries, and this will greatly boost the demand for acrylic-based construction materials.

Challenges

-

Competition from alternative materials like epoxy, polyurethane, etc.

-

Rising concerns regarding the environmental impact of acrylic polymers, particularly in terms of disposal and recycling.

KEY MARKET SEGMENTS

By Type

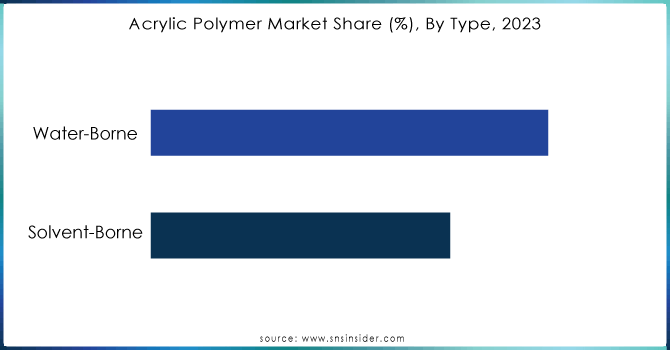

By type, the Water-Borne segment dominated the acrylic polymer market with the largest share in terms of generated revenue, approximately 55%, during 2023. The drive is attributed to the eco-friendliness of the product and compliance with more stringent environmental regulations. Water-borne acrylic polymers have fewer VOC emissions, thus being safer not only for the users but also to the environment. Moreover, their ease of application and cleanup, and performance properties equal to their solvent-based brethren, have fueled their preference across a wide array of industries. Growing consumer demand for green solutions also adds to the fast-paced adoption. The water-borne acrylic polymer is well-established as the leading choice in the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

In 2023, the laundry and detergent segment dominated the acrylic polymer market with more than 35% of the highest revenue share in 2023. The fast urbanization of populations all around the globe increases demand for laundry and detergent products. Because COVID-19 broke out, people became more aware of hygiene and cleanliness and hence demand better laundry solutions. Moreover, growth in cleaning performance and stain removal by technological progress in detergent formulation, such as acrylic polymer introduction, increased demand. Moreover, with the growing e-commerce sector, easier access to laundry and detergent products has been seen, and this segment is thus showing robust revenue growth.

Regional Analysis

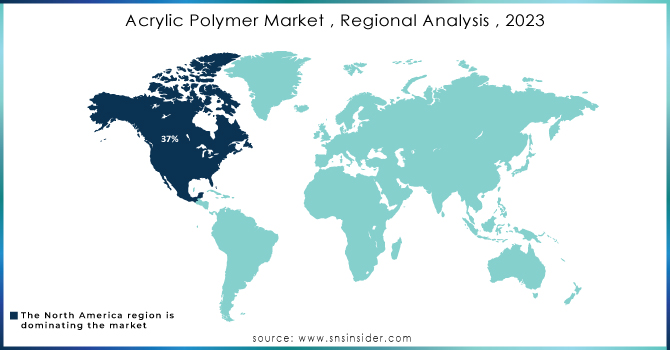

In 2023, North America dominated and accounted for a revenue share of about 37% in the acrylic polymer market in 2023. Several factors contribute to this. First and foremost, this can be attributed to the advanced industrial landscape of this region, especially in the sectors of automobiles, paint and coatings, construction, and consumer goods. For instance, the North American automotive industry has, over the recent past, used acrylic polymers in production for light parts with added strength that improved fuel efficiency, reduced emissions, and so on. General Motors and Ford have used acrylic-based materials in a number of components, thus showing the depth of demand for these polymers in the region. In the paint and coatings industry, companies from North America, such as Sherwin-Williams and PPG Industries, remain among the largest consumers of acrylic polymers due to their higher performance in aspects like durability, gloss, and resistance to weather conditions, further fueling market growth. The construction industry also uses acrylic polymers in paints and sealants; with major initiatives in urban development and infrastructure, new applications have further been extended. Besides, the strict nature of environmental legislation in North America paves the way for green materials. For example, the Clean Air Act by the United States Environmental Protection Agency favors low-VOC and sustainable products, thus increasing the demand for acrylic polymers as they have lower emissions than conventional materials. This is further supported by the fact that the region has strong research and development, as shown by innovations from companies like BASF and Dow Chemical, who keep coming up with advanced formulations in acrylic polymer. These collectively placed North America at the center of the global acrylic polymer market, capturing about 35-40% of the market share due to its robust industrial base, regulatory environment, and technological advancement.

Moreover, in 2023, the Asia-pacific region is the fastest-growing region and holds a 25% market share. This could be due to its fast pace of industrialization and urbanization. Countries like China, India, and various South East Asian countries are witnessing high economic growth, hence demand for acrylic polymers in these countries across industries is growing at a higher pace. In China, the notable growth in building and infrastructure has offered impetus to demand for acrylic-based paints and coatings, evidenced by big-ticket infrastructure projects such as the expansion of urban transit systems and city high-rise building projects like those in Shanghai and Beijing. In the case of India, growing industries like the automobile industry, where companies like Tata Motors and Mahindra & Mahindra use acrylic polymers to enhance the efficiency and strength-to-weight ratio of the parts of the vehicles, are a cause for the growth in the sector. In Southeast Asia, the rise is also recorded in the electronic industry and packaging where the acrylic polymer is used because of its clarity and durability. For example, in July 2023, Samsung introduced acrylic polymer components in electronic devices that bring out the life and beauty in their products. The government of the region is also motivating the market through initiatives such as "Make in India" in India and the Belt and Road Initiative in China, which increases infrastructure development and industrial investments. These favourable policies and rising industrial activities have been attending the rapid expansion in the region's acrylic polymer market.

Key Players:

The major key players are Kamsons Chemicals Pvt. Ltd, Celanese Corporation, Nippon Shokubai Co. Ltd., BASF SE, Pexi Chem Private Limited, The Dow Chemical Company, The Lubrizol Corporation, Xyntra Chemicals B.V., Asian Paints Ltd., StanChem, Inc., and other players mentioned in the final report.

Recent Development:

-

November 2023: BASF introduced BVERDE® GP 790 L as the newest addition to its extensive range of ingredients for laundry detergent applications. This innovative, readily biodegradable*, anti-redeposition polymer is specifically designed to meet the increasing demand from customers for sustainable products without compromising on performance.

-

February 2023: Univar Solutions B.V., a subsidiary of Univar Solutions Inc., was appointed as a distributor for the acrylic emulsion polymer products from Dow in the United Kingdom and Ireland.

-

May 2023: PT. NIPPON SHOKUBAI INDONESIA, a subsidiary of NIPPON SHOKUBAI CO., LTD., inaugurated a new acrylic acid (hereinafter referred to as "AA") facility with a capacity of 100,000 MT/Y in Cilegon, Banten, Indonesia. The total investment in the project amounts to approximately 200 million US dollars.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 610 Million |

| Market Size by 2032 | US$ 883.4 Million |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solvent-borne, Water-borne) • By Application (Laundry & Detergent, Industrial & Institutional, Hard Surface Cleaning, Dish Washing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kamsons Chemicals Pvt. Ltd, Celanese Corporation, Nippon Shokubai Co. Ltd., BASF SE, Pexi Chem Private Limited, The Dow Chemical Company, The Lubrizol Corporation, Xyntra Chemicals B.V., Asian Paints Ltd., StanChem, Inc., and Other Players |

| DRIVERS |

• Increasing demand for acrylic polymer from Institutional and industrial cleaning applications. • Growing adoption of acrylic polymer in paper and packaging industries |

| Restraints | • Fluctuation in the prices of raw material of acrylic polymer |