Get more information on the Accelerator Card Market - Request Sample Report

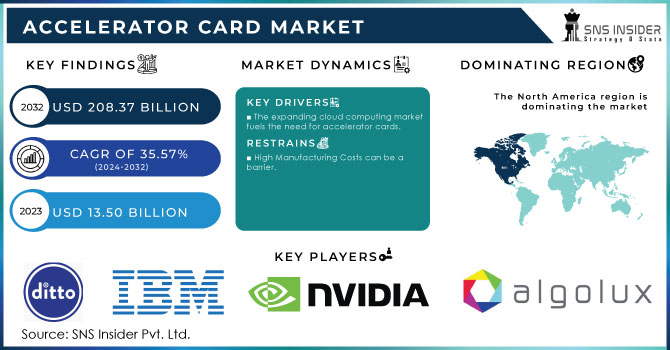

The Accelerator Card Market Size was valued at USD 13.50 Billion in 2023 and it is estimated to reach USD 208.37 Billion by 2032, growing at a CAGR of 35.57% during 2024-2032.

The accelerator cards market is experiencing substantial expansion due to the growing need for high-performance computing, artificial intelligence (AI), and data-heavy applications in different sectors. Accelerator cards are becoming crucial tools in helping organizations achieve faster data processing and more efficient computational capabilities as they strive for these objectives. The quick progress in AI and machine learning technologies is a key factor driving the accelerator card market. By 2032, the generative AI market is forecasted to achieve significant growth of USD 1.3 trillion, with a strong 42% CAGR, indicating a transformative period for AI and ML in 2024. 44% of executives are realizing the potential of generative AI, which organizations are increasingly recognizing as having the ability to revolutionize operational methodologies. Sectors like healthcare, finance, Machine learning, and telecommunications are utilizing these technologies to extract valuable information from large datasets. In healthcare, accelerator cards are utilized in fields such as medical imaging, genomics, and drug discovery, where processing intricate algorithms and large datasets efficiently is imperative. This feature doesn't just accelerate research and diagnostics but also allows for real-time data analysis, improving patient care and treatment results.

Accelerator cards are also widely used in the gaming industry as a significant application area. As high-definition gaming and virtual reality (VR) become more popular, gamers are looking for systems that can provide immersive experiences. In 2024, the gaming industry in the United States maintain its robust expansion, fueled by rising digital purchases and the prevalence of mobile gaming. Nearly 90% of total revenue comes from digital game sales, as gamers are showing a growing preference for downloadable content instead of physical copies. The popularity of mobile gaming has increased significantly, with in-game transactions expected to surpass USD 74 billion worldwide by 2025. Accelerator cards can enhance graphics performance by increasing frame rates and enhancing rendering quality. This has caused a higher need for specialized gaming accelerator cards designed for gamers, enhancing the user experience.

Market Dynamics

Drivers

Surging Demand for AI and HPC drives the market growth.

The rise in interest in Artificial Intelligence (AI) and High-Performance Computing (HPC) is a major factor fueling the expansion of the Accelerator Card Market. With the rising use of AI technologies like machine learning, deep learning, and data analytics in organizations, the demand for high-performance computational power has become crucial. Specialized cards like GPUs and TPUs are optimized for efficient processing of intricate computations and large amounts of data, making them well-suited for tasks involving artificial intelligence and high-performance computing. Sectors like finance, healthcare, and self-driving cars are at the forefront of this technological transition. In the financial industry, companies use accelerator cards to analyze large volumes of market information instantly, helping them make trades quicker and improve investment tactics. In healthcare, AI-powered diagnostic tools also use these algorithms to examine medical images and patient information, resulting in more precise diagnoses and customized treatment strategies.

The expanding cloud computing market fuels the need for accelerator cards.

The growing cloud computing industry greatly increases the demand for accelerator cards, specialized hardware that boosts processing efficiency and speed. As more companies transition to cloud-based services, the need for advanced processing capabilities grows with the increasing demand for high-performance computing (HPC). Accelerator cards, like GPUs and FPGAs, offer the required strength for managing intricate calculations, extensive data processing, and immediate analytics crucial in the current data-focused setting. Accelerator cards are crucial in industries such as artificial intelligence (AI) and machine learning. For example, in the field of AI, deep learning algorithms need extensive data to properly train models. Utilizing GPUs enables simultaneous processing, leading to quicker training periods and enhanced model precision. NVIDIA and other companies have experienced a rise in the need for their GPU products, especially in cloud services where scalability is important.

Restraints

High Manufacturing Costs as a Barrier in the Accelerator Card Market

Significant obstacles in the form of expensive manufacturing costs are impeding the Accelerator Card Market, limiting production capabilities and market entrance. Accelerator cards need complex manufacturing processes and advanced materials to boost computing performance in tasks such as data processing, artificial intelligence, and scientific simulations. The increased production costs are due to the requirement of specific parts like fast connectors, cooling systems, and strong circuit layouts. Higher expenses can hinder smaller manufacturers from entering the market, which in turn limits competition and innovation. Moreover, bigger companies might encounter difficulties in preserving profit margins while striving to provide products at competitive prices. In the financial services sector, companies heavily depend on accelerator cards for high-frequency trading, where speed and efficiency are crucial. Utilizing these cards allows companies to analyze large volumes of data instantly, giving them a competitive advantage.

Market Segmentation

BY ACCELERATOR TYPE

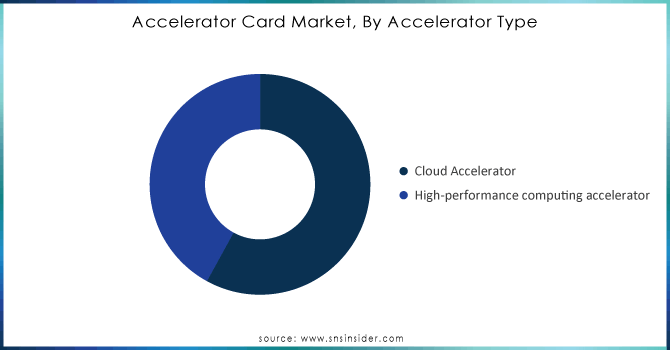

The cloud accelerator sector dominated the market in 2023 with 58% market share as cloud computing services are increasingly used in different industries. These accelerators are created to improve the efficiency of cloud-based applications by optimizing workload handling and data processing. They provide adaptable resources that can be customized according to demand, making them perfect for companies seeking to enhance efficiency without significant capital investment. The growth of cloud accelerators has been driven by the demand for real-time data analytics, machine learning, and AI applications to reduce latency and enhance computational speed.

The HPC accelerator sector is identified as the most rapidly expanding region in the Accelerator Card Market during 2024-2032. These accelerators are specifically designed for scientific research, simulations, and complex computational tasks that demand high processing power. HPC accelerators provide enhanced performance for tasks like computational fluid dynamics, weather modeling, and molecular dynamics simulations by incorporating numerous processing units. This sector is picking up speed thanks to the growing demand for enhanced computational abilities in academic, government research institutions, and large companies.

Need any customization research on Accelerator Card Market - Enquiry Now

BY PROCESSOR TYPE

The Graphic Processing Units (GPU) category led the accelerator card market in 2023 with a 42% market share, mainly because of its versatility and unmatched performance in parallel processing tasks. GPUs are designed to efficiently process demanding calculations, which are crucial for tasks in gaming, machine learning, artificial intelligence, and data presentation. Their design permits numerous concurrent threads, resulting in quicker data processing when compared to typical CPUs. Companies such as NVIDIA and AMD have had a significant influence on this industry, particularly with the widespread use of NVIDIA's GPUs in AI-related applications such as autonomous vehicles and deep learning.

Field Programmable Gate Arrays (FPGA) are to experience a rapid growth rate during 2024-2032 in the Accelerator Card Market because of their flexibility and effectiveness in specific roles. FPGAs, in contrast to fixed-function chips, can be reprogrammed to meet specific application needs, enabling companies to tailor their hardware for the best possible performance. This adaptability is especially advantageous in industries like telecommunications, healthcare, and aerospace, where swift technological progress requires immediate changes in processing capabilities. Xilinx and Intel are leading in this sector by providing FPGA solutions for tasks such as 5G networks and real-time data processing in medical imaging.

Regional Analysis

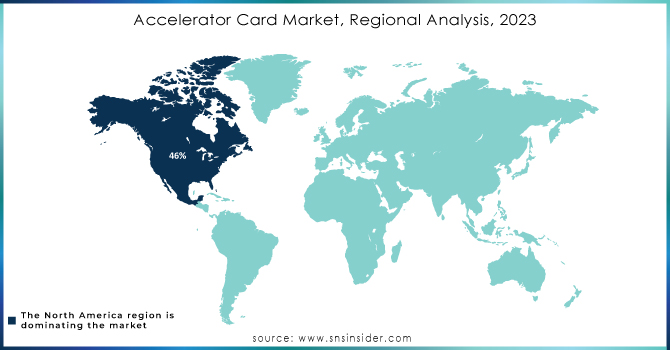

North America dominated the market in 2023 with a 46% market share due to its advanced technological infrastructure and significant investments in research and development. The area's focus on cloud computing and high-performance computing (HPC) is increasing the need for accelerator cards, as companies aim to improve their computational power and effectiveness. AMD and IBM, along with other corporations, are playing a significant role in this market by offering advanced solutions that meet the growing need for fast processing and parallel computing.

The APAC region is becoming the most rapidly expanding market for accelerator cards market during 2024-2032, driven mainly by quick digital transformation and the growing use of advanced technologies. Nations such as China, Japan, and India are seeing significant growth in areas like cloud computing, artificial intelligence, and big data analytics, leading to an increased need for effective processing solutions. The growing technology industry in APAC, including both startups and well-known companies such as Huawei and Alibaba, is driving the advancement and incorporation of accelerator cards in different uses, such as data centers and smart devices.

Key Players

The key players in the Accelerator Card market are:

NVIDIA (NVIDIA A100, NVIDIA RTX A6000)

AMD (Radeon Pro VII, Radeon RX 6000 Series)

Intel (Intel Xeon Phi, Intel FPGA PAC N3000)

Xilinx (now part of AMD) (Versal ACAP, Kintex UltraScale FPGA)

Micron Technology (Micron 9300 NVMe SSD, Micron 5210 ION SSD)

Broadcom (Broadcom NetXtreme II, Broadcom StrataXGS)

IBM (IBM Cloud Accelerator, IBM Power System AC922)

AWS (Amazon Web Services) (AWS Inferentia, AWS Graviton)

Qualcomm (Snapdragon 8cx, Qualcomm Cloud AI 100)

HPE (Hewlett Packard Enterprise) (HPE Apollo 6500 Gen10, HPE ProLiant DL380 Gen10)

Dell Technologies (Dell PowerEdge R740, Dell EMC VxRail)

Lenovo (ThinkSystem SR670, ThinkSystem SR850)

Mellanox Technologies (now part of NVIDIA) (Mellanox ConnectX-6, Mellanox Spectrum)

Supermicro (SuperServer 1029P-NDR, SuperServer 2029GP-TRT)

Oracle (Oracle Exadata Database Machine, Oracle Cloud Infrastructure)

Fusion-io (now part of Western Digital) (ioMemory, ioScale)

Samsung Electronics (Samsung PM1733, Samsung 970 EVO Plus)

Seagate Technology (Seagate Exos X16, Seagate IronWolf Pro)

Crucial (a brand of Micron Technology) (Crucial P5 SSD, Crucial MX500 SSD)

SK Hynix (SK Hynix Gold S31 SSD, SK Hynix P31 NVMe SSD)

Recent Development

February 2024: Intel introduced its Data Center GPU Max series, aimed at optimizing cloud workloads and AI applications. These GPUs are designed to handle extensive computational tasks while being energy efficient.

December 2023: AMD launched the Instinct MI300, its latest accelerator card targeting AI and high-performance computing (HPC). This product combines CPU and GPU capabilities on a single chip, significantly improving data processing speeds.

January 2023: Xilinx, now part of AMD, launched the Versal AI Core series, which integrates AI engines into a versatile architecture for various applications, including 5G and data center solutions.

April 2023: Achronix unveiled the Speedster7t FPGA, targeting AI inference and high-performance computing applications. This FPGA is designed to provide significant acceleration for data processing tasks.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.50 Billion |

| Market Size by 2032 | USD 208.37 Billion |

| CAGR | CAGR of 35.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Accelerator Type (Cloud Accelerator, High-Performance Computing Accelerator) • By Processor Type (Graphics Processing Units (GPU), Central Processing Units (CPU), Application Specific Integrated Circuits (ASIC), Field Programmable Gate Arrays (FPGA)) • By Application (Machine Learning, Mobile Phones, Video And Image Processing, Data Analytics, Financial Computing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA, AMD, Intel, Xilinx, Micron Technology, Broadcom, IBM, AWS, Qualcomm, HPE, Dell Technologies, Lenovo, Mellanox Technologies, Supermicro, Oracle, Fusion-io, Samsung Electronics, Seagate Technology, Crucial, SK Hynix |

| Key Drivers | • Surging Demand for AI and HPC drives the market growth. • The expanding cloud computing market fuels the need for accelerator cards. |

| RESTRAINTS | • High Manufacturing Costs as a Barrier in the Accelerator Card Market |

Ans: Accelerator Card Market size was USD 13.50 Billion in 2023 and is expected to Reach USD 208.37 Billion by 2032.

Ans: The Accelerator Card Market is expected to grow at a CAGR of 35.57% during 2024-2032.

Ans: The expanding cloud computing market fuels the need for the accelerator cards market.

Ans: The cloud accelerator segment dominated the Accelerator Card Market in 2023.

Ans: North America dominated the Accelerator Card Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Accelerator Card Production Sales Volume, by Region

5.2 Accelerator Card Regulatory Impact, by Region (2023)

5.3 Accelerator Card Pricing Trends, 2023

5.4 Accelerator Card Fab Capacity Utilization (2023)

5.5 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Accelerator Card Market Segmentation, by Accelerator Type

7.1 Chapter Overview

7.2 Cloud Accelerator

7.2.1 Cloud Accelerator Market Trends Analysis (2020-2032)

7.2.2 Cloud Accelerator Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 High-performance computing accelerator

7.3.1 High-performance computing accelerator Market Trends Analysis (2020-2032)

7.3.2 High-performance computing accelerator Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Accelerator Card Market Segmentation, by Application

8.1 Chapter Overview

8.2 Video and image processing

8.2.1 Video and image processing Market Trends Analysis (2020-2032)

8.2.2 Video and image processing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Machine learning

8.3.1 Machine learning Market Trends Analysis (2020-2032)

8.3.2 Machine learning Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Data Analytics

8.4.1 Data Analytics Market Trends Analysis (2020-2032)

8.4.2 Data Analytics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Financial Computing

8.5.1 Financial Computing Market Trends Analysis (2020-2032)

8.5.2 Financial Computing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Mobile phones

8.6.1 Mobile phones Market Trends Analysis (2020-2032)

8.6.2 Mobile phones Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Accelerator Card Market Segmentation, by Processor Type

9.1 Chapter Overview

9.2 Graphics Processing Units (GPU)

9.2.1 Graphics Processing Units (GPU) Market Trends Analysis (2020-2032)

9.2.2 Graphics Processing Units (GPU) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Central Processing Units (CPU)

9.3.1 Central Processing Units (CPU) Market Trends Analysis (2020-2032)

9.3.2 Central Processing Units (CPU) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Application Specific Integrated Circuits (ASIC)

9.4.1 Application Specific Integrated Circuits (ASIC) Market Trends Analysis (2020-2032)

9.4.2 Application Specific Integrated Circuits (ASIC) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Field Programmable Gate Arrays (FPGA)

9.5.1 Field Programmable Gate Arrays (FPGA) Market Trends Analysis (2020-2032)

9.5.2 Field Programmable Gate Arrays (FPGA) Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Accelerator Card Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.2.4 North America Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.2.6.2 USA Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.2.7.2 Canada Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Accelerator Card Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Accelerator Card Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.7.2 France Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Accelerator Card Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.6.2 China Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.7.2 India Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.8.2 Japan Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.12.2 Australia Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Accelerator Card Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Accelerator Card Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.2.4 Africa Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Accelerator Card Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.6.4 Latin America Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Accelerator Card Market Estimates and Forecasts, by Accelerator Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Accelerator Card Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Accelerator Card Market Estimates and Forecasts, by Processor Type (2020-2032) (USD Billion)

11. Company Profiles

11.1 NVIDIA

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 AMD

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Intel

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Xilinx

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Micron Technology

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Broadcom

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 IBM

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 AWS

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Qualcomm

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 HPE

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

BY ACCELERATOR TYPE

Cloud Accelerator

High-performance computing accelerator

BY PROCESSOR TYPE

Graphics Processing Units (GPU)

Central Processing Units (CPU)

Application Specific Integrated Circuits (ASIC)

Field Programmable Gate Arrays (FPGA)

BY APPLICATION

Video and image processing

Machine learning

Data Analytics

Financial computing

Mobile phones

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The ReRAM Market size was valued at USD 670.73 million in 2023 and is expected to grow to USD 3997.53 million by 2032 and grow at a CAGR of 21.94% over the forecast period of 2024-2032.

The Quantum Cascade Laser Market was valued at USD 416.85 million in 2023 and is expected to reach USD 617.93 million by 2032, growing at a CAGR of 4.50% over the forecast period 2024-2032.

The Consumer Electronics Market size was valued at USD 956.12 Billion in 2023 & will reach USD 1775.27 Billion by 2032, with a CAGR of 7.14% by 2024-2032.

The LED Drivers Market Size was valued at USD 46.55 Billion in 2023 and is expected to reach USD 105.35 Billion by 2032, and grow at a CAGR of 9.50% over the forecast period 2024-2032

The Crawler Camera System Market size was valued at USD 245.24 Million in 2023 and expected to grow at a CAGR of 6.79% to reach USD 443.04 Million by 2032

The Telepresence Equipment Market Size was valued at USD 5.54 billion in 2023 and is expected to grow at a CAGR of 7.34% to reach USD 10.45 billion by 2032.

Hi! Click one of our member below to chat on Phone