Get More Information on Erectile Dysfunction Treatment Drugs Market - Request Sample Report

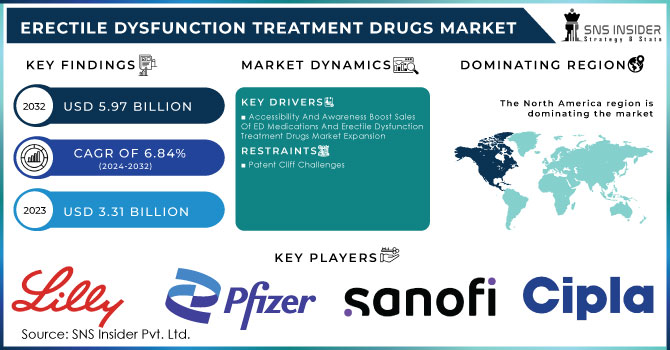

The Erectile Dysfunction Treatment Drugs Market was valued at USD 3.31 billion in 2023 and is expected to reach USD 5.97 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.84% from 2024 to 2032.

Erectile dysfunction (ED) is a growing concern due to modern lifestyles and a rise in chronic conditions. Over 150 million men worldwide have erectile dysfunction, and that number is expected to climb. Erectile dysfunction is linked to diabetes, heart disease, and age. Men with diabetes and those over 65 are more likely to experience erectile dysfunction. Smoking, drinking, and drug use can also contribute for the market expansion.

The Erectile dysfunction treatment drugs market is increasing due to demand, with some positive impact from the COVID-19 pandemic. However, limited healthcare access and drug recalls can hinder market growth. There are currently various ED medications available, including Viagra (Sildenafil), Levitra, Cialis, and Stendra. The COVID-19 pandemic itself increased the risk of ED by nearly six times, with an estimated prevalence of 31.8% in men with a history of COVID-19 according to National Library of Medicine, April 2021. Additionally, aging populations and rising rates of chronic diseases like diabetes 72.2% prevalence globally in 2021 with ED as a common symptom as per BMC Endocrine Disorders, July 2021 and hypertension 1.28 billion adults affected globally according to WHO study, 2021 which indicates all contribute to erectile dysfunction treatment drugs market growth.

Accessibility And Awareness Boost Sales Of ED Medications And Erectile Dysfunction Treatment Drugs Market Expansion

An aging population and rising chronic disease rates are key drivers of the erectile dysfunction treatment drugs market. In the US alone, 30 million men experience ED annually as per National Institutes of Health, 2022, and conditions like diabetes 72.2% prevalence globally with ED as a common symptom according to BMC Endocrine Disorders, July 2021 and hypertension 1.28 billion adults affected globally according to WHO, 2021 are becoming increasingly common, further contributing to ED cases. Mental health issues like depression and anxiety, affecting 21 million US adults according to American Hospital Association, 2020, can also be culprits.

Emerging markets present a lucrative opportunity due to their large patient pool, improving healthcare infrastructure, and growing awareness of ED treatment options. The availability of prescription medications like Viagra (Sildenafil) (brand name for Sildenafil Citrate) and generic alternatives from companies like Teva pharmaceuticals makes ED treatment more accessible to a wider range of men. Additionally, new drug formulations and regulatory approvals, such as Teva's launch of ALYQ (generic tadalafil) in 2020, are fueling market growth.

Public awareness about ED medications is on the rise, with sales of phosphodiesterase-5 inhibitors increasing by an average of 285,653 units monthly before March 2020 as per National Center for Biotechnology Information. This increased awareness is likely due to a combination of factors, including educational campaigns and the wider availability of ED medications through online providers and hospital pharmacies.

However, it's important to note that potential side effects like headaches and back pain, as well as interactions with other medications, can deter some men from using ED drugs. Consulting a healthcare professional is crucial before starting any ED medication to ensure it's safe and appropriate for individual needs.

Patent Cliff Challenges

The erectile dysfunction treatment drugs market is facing headwinds due to the expiration of patents on major medications like Viagra (Sildenafil). This expiration allows generic versions to enter the market, which can significantly drive down prices and erode market share for the original brand-name drugs.

Viagra (Sildenafil)

Cialis

Zydena

Levitra

Stendra

Others

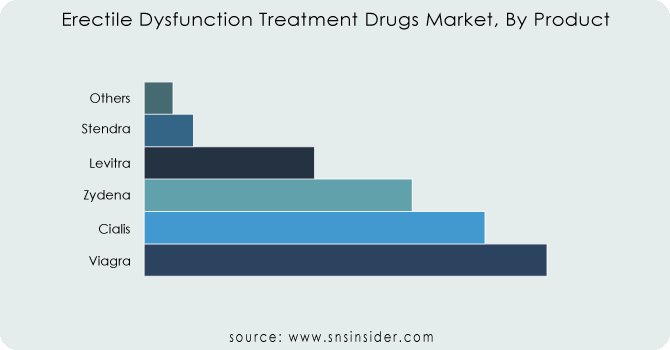

Viagra (Sildenafil) is the current leader of erectile dysfunction treatment drugs market, holding the market share 31.97% in 2023. Companies are working together and developing new products to expand their offerings. This includes deals like Pfizer partnering with a telehealth clinic to offer generic Viagra (Sildenafil) and the recent FDA approval of a topical erectile dysfunction gel for over-the-counter sales. In instance, June 2023, Futura Medical's Eroxon marked a significant step forward - it was the first topical gel for ED to receive FDA clearance for OTC marketing in the US.

Furthermore, for other erectile dysfunction treatment drugs market is expected to grow even faster, at over 13% per year. This is because there are many different erectile dysfunction medications available, and some are becoming easier to access. For example, a generic version of Cialis was recently approved for over-the-counter sale in Poland. These developments make it more convenient for men to get the treatment they need.

Need any customization research on Erectile Dysfunction Treatment Drugs Market - Enquiry Now

Oral Medication

Injectable Medication

The erectile dysfunction treatment drugs market in 2023, oral medications (56.19%) like Cialis, Stendra, and Viagra (Sildenafil) dominating, and this dominance is forecast to hold strong. There are two key reasons behind this trend like convenience and affordability. Unlike injectable medications, oral drugs offer a discreet and user-friendly option for patients as they can be self-administered at home. Additionally, oral medications are generally less expensive than injectables, making them a more accessible treatment for a wider range of men. These factors combined are propelling the oral medication segment to be the driving force of the erectile dysfunction treatment drugs market.

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

Hospital pharmacies dominating in the erectile dysfunction treatment drug market, capturing the largest share 56.30% in 2023. This dominance stems from a three-pronged advantage such as a growing number of ED cases requiring treatment, a wider range of ED medications stocked (including those with stricter controls), and a focus on prescription drugs, which form a major chunk of the erectile dysfunction treatment drugs market.

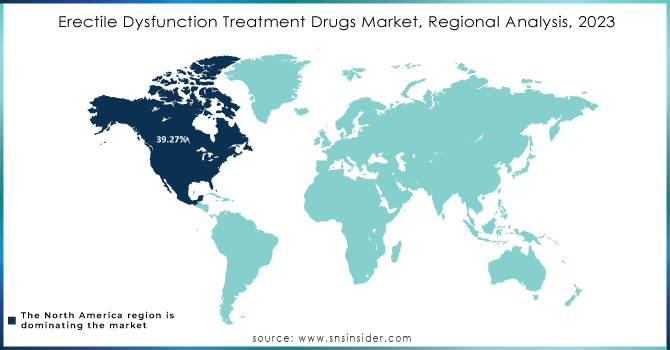

North America is the world's biggest for erectile dysfunction treatment drugs market, holding the largest share 39.27% in 2023. This is due to a few reasons that is, there are many men in North America with ED. The healthcare system is well-developed, making it easier for men to get diagnosed and treated. Finally, new ED treatments get approved for sale quickly in North America. For example, a generic version of a medication used to treat ED was recently approved by the FDA. This makes these medications more affordable and accessible, which increases the number of men who can get treatment and boosts the overall market size.

Asia Pacific is expected to be the fastest growing region in the coming years, with a projected growth rate of over 10% annually. This surge is driven by two main factors such as, new ED medications are being introduced in Asia Pacific at a steady pace. For instance, telemedicine platforms are being used to deliver treatments like Silcap and Wafesil in Australia. This increased access to new options is fueling market growth. Research shows a significant portion of the male population in Asia Pacific experiences ED, with rates ranging from 9% to 73% depending on the location. This high prevalence suggests a large potential erectile dysfunction treatment drugs market in the region.

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some of the major key players of the erectile dysfunction treatment drugs market are: Eli Lilly and Company, Pfizer Inc., Sanofi, Cipla Inc, Teva Pharmaceutical Industries Ltd., Bayer AG, Sun Pharmaceutical Industries Ltd., VIVUS, Inc., Petros Pharmaceuticals, Inc., Adamed, Auxilium Pharmaceuticals, Inc. and other players.

In a May 2022 deal, Aspargo Laboratories, Inc., a company focused on innovative formulations of existing medications, acquired the Bandol prescription brand for erectile dysfunction from Laboratorios Rubio S.A., a Spanish specialty pharmaceutical company.

Generic Options Emerge: In 2021, Glenmark Pharmaceuticals received US approval for their generic tadalafil tablets, offering more affordable treatment options for patients.

Digital Health Integration: Greenstone, a subsidiary of Pfizer, partnered with Roman, a digital men's health clinic, in 2021. This collaboration allows Roman to offer generic Viagra (Sildenafil) online, potentially increasing access and convenience for consumers.

New Topical Treatments: Futura Medical launched Eroxon gel in the UK in 2021, providing a topical alternative for treating erectile dysfunction.

China Approves Sublingual Sildenafil: iX Biopharma signed a licensing deal to bring Wafesil, a fast-acting sublingual sildenafil wafer, to the Chinese market for treating erectile dysfunction.

New ED Tablet Debuts in UK: Almus launched its Almus Erectile Dysfunction Relief 50mg film-coated tablets in the UK pharmaceutical market, providing another treatment option for men.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.31 billion |

| Market Size by 2031 | US$ 5.97 Billion |

| CAGR | CAGR of 6.84 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Viagra (Sildenafil), Cialis, Zydena, Levitra, Stendra, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) • By Mode Of Administration (Oral Medication, Injectable Medication) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eli Lilly and Company, Pfizer Inc., Sanofi, Cipla Inc, Teva Pharmaceutical Industries Ltd., Bayer AG, Sun Pharmaceutical Industries Ltd., VIVUS, Inc., Petros Pharmaceuticals, Inc., Adamed, Auxilium Pharmaceuticals, Inc. |

| Key Drivers | • Accessibility And Awareness Boost Sales Of ED Medications And Erectile Dysfunction Treatment Drugs Market Expansion |

| RESTRAINTS | • Patent Cliff Challenges |

Ans: The estimated compound annual growth rate is 6.84% during the forecast period for the Erectile Dysfunction Treatment Drugs market.

Ans: The projected market value of the Erectile Dysfunction Treatment Drugs market is estimated USD 3.31 billion in 2023 and expected to reach USD 5.97 billion by 2032.

Ans: Accessibility and awareness boost sales of ED medications is one of the drivers of the Erectile Dysfunction Treatment Drugs market.

Ans: Expiration of patents on major medications like Viagra (Sildenafil) is the restraints of the Erectile Dysfunction Treatment Drugs market.

Ans: North America is the dominating region with 39.27% share in the Erectile Dysfunction Treatment Drugs market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Erectile Dysfunction Treatment Drugs Market Segmentation, By Product

7.1 Introduction

7.2 Viagra (Sildenafil)

7.3 Cialis

7.4 Zydena

7.5 Levitra

7.6 Stendra

7.7 Others

8. Erectile Dysfunction Treatment Drugs Market Segmentation, By Mode Of Administration

8.1 Introduction

8.2 Oral Medication

8.3 Injectable Medication

9. Erectile Dysfunction Treatment Drugs Market Segmentation, By Distribution Channel

9.1 Introduction

9.2 Hospital Pharmacies

9.3 Retail Pharmacies

9.4 Online Pharmacies

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Erectile Dysfunction Treatment Drugs Market by Country

10.2.3 North America Erectile Dysfunction Treatment Drugs Market By Product

10.2.4 North America Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.2.5 North America Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.2.6 USA

10.2.6.1 USA Erectile Dysfunction Treatment Drugs Market By Product

10.2.6.2 USA Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.2.6.3 USA Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.2.7 Canada

10.2.7.1 Canada Erectile Dysfunction Treatment Drugs Market By Product

10.2.7.2 Canada Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.2.7.3 Canada Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.2.8 Mexico

10.2.8.1 Mexico Erectile Dysfunction Treatment Drugs Market By Product

10.2.8.2 Mexico Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.2.8.3 Mexico Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Erectile Dysfunction Treatment Drugs Market by Country

10.3.2.2 Eastern Europe Erectile Dysfunction Treatment Drugs Market By Product

10.3.2.3 Eastern Europe Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.2.4 Eastern Europe Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.2.5 Poland

10.3.2.5.1 Poland Erectile Dysfunction Treatment Drugs Market By Product

10.3.2.5.2 Poland Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.2.5.3 Poland Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.2.6 Romania

10.3.2.6.1 Romania Erectile Dysfunction Treatment Drugs Market By Product

10.3.2.6.2 Romania Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.2.6.4 Romania Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.2.7 Hungary

10.3.2.7.1 Hungary Erectile Dysfunction Treatment Drugs Market By Product

10.3.2.7.2 Hungary Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.2.7.3 Hungary Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.2.8 Turkey

10.3.2.8.1 Turkey Erectile Dysfunction Treatment Drugs Market By Product

10.3.2.8.2 Turkey Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.2.8.3 Turkey Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Erectile Dysfunction Treatment Drugs Market By Product

10.3.2.9.2 Rest of Eastern Europe Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.2.9.3 Rest of Eastern Europe Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3 Western Europe

10.3.3.1 Western Europe Erectile Dysfunction Treatment Drugs Market by Country

10.3.3.2 Western Europe Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.3 Western Europe Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.4 Western Europe Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.5 Germany

10.3.3.5.1 Germany Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.5.2 Germany Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.5.3 Germany Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.6 France

10.3.3.6.1 France Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.6.2 France Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.6.3 France Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.7 UK

10.3.3.7.1 UK Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.7.2 UK Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.7.3 UK Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.8 Italy

10.3.3.8.1 Italy Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.8.2 Italy Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.8.3 Italy Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.9 Spain

10.3.3.9.1 Spain Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.9.2 Spain Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.9.3 Spain Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.10.2 Netherlands Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.10.3 Netherlands Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.11.2 Switzerland Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.11.3 Switzerland Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.12 Austria

10.3.3.12.1 Austria Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.12.2 Austria Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.12.3 Austria Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Erectile Dysfunction Treatment Drugs Market By Product

10.3.3.13.2 Rest of Western Europe Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.3.3.13.3 Rest of Western Europe Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Erectile Dysfunction Treatment Drugs Market by Country

10.4.3 Asia-Pacific Erectile Dysfunction Treatment Drugs Market By Product

10.4.4 Asia-Pacific Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.5 Asia-Pacific Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.6 China

10.4.6.1 China Erectile Dysfunction Treatment Drugs Market By Product

10.4.6.2 China Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.6.3 China Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.7 India

10.4.7.1 India Erectile Dysfunction Treatment Drugs Market By Product

10.4.7.2 India Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.7.3 India Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.8 Japan

10.4.8.1 Japan Erectile Dysfunction Treatment Drugs Market By Product

10.4.8.2 Japan Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.8.3 Japan Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.9 South Korea

10.4.9.1 South Korea Erectile Dysfunction Treatment Drugs Market By Product

10.4.9.2 South Korea Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.9.3 South Korea Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.10 Vietnam

10.4.10.1 Vietnam Erectile Dysfunction Treatment Drugs Market By Product

10.4.10.2 Vietnam Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.10.3 Vietnam Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.11 Singapore

10.4.11.1 Singapore Erectile Dysfunction Treatment Drugs Market By Product

10.4.11.2 Singapore Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.11.3 Singapore Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.12 Australia

10.4.12.1 Australia Erectile Dysfunction Treatment Drugs Market By Product

10.4.12.2 Australia Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.12.3 Australia Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Erectile Dysfunction Treatment Drugs Market By Product

10.4.13.2 Rest of Asia-Pacific Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.4.13.3 Rest of Asia-Pacific Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Erectile Dysfunction Treatment Drugs Market by Country

10.5.2.2 Middle East Erectile Dysfunction Treatment Drugs Market By Product

10.5.2.3 Middle East Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.2.4 Middle East Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.2.5 UAE

10.5.2.5.1 UAE Erectile Dysfunction Treatment Drugs Market By Product

10.5.2.5.2 UAE Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.2.5.3 UAE Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.2.6 Egypt

10.5.2.6.1 Egypt Erectile Dysfunction Treatment Drugs Market By Product

10.5.2.6.2 Egypt Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.2.6.3 Egypt Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Erectile Dysfunction Treatment Drugs Market By Product

10.5.2.7.2 Saudi Arabia Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.2.7.3 Saudi Arabia Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.2.8 Qatar

10.5.2.8.1 Qatar Erectile Dysfunction Treatment Drugs Market By Product

10.5.2.8.2 Qatar Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.2.8.3 Qatar Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Erectile Dysfunction Treatment Drugs Market By Product

10.5.2.9.2 Rest of Middle East Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.2.9.3 Rest of Middle East Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.3 Africa

10.5.3.1 Africa Erectile Dysfunction Treatment Drugs Market by Country

10.5.3.2 Africa Erectile Dysfunction Treatment Drugs Market By Product

10.5.3.3 Africa Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.3.4 Africa Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Erectile Dysfunction Treatment Drugs Market By Product

10.5.3.5.2 Nigeria Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.3.5.3 Nigeria Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.3.6 South Africa

10.5.3.6.1 South Africa Erectile Dysfunction Treatment Drugs Market By Product

10.5.3.6.2 South Africa Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.3.6.3 South Africa Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Erectile Dysfunction Treatment Drugs Market By Product

10.5.3.7.2 Rest of Africa Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.5.3.7.3 Rest of Africa Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Erectile Dysfunction Treatment Drugs Market by country

10.6.3 Latin America Erectile Dysfunction Treatment Drugs Market By Product

10.6.4 Latin America Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.6.5 Latin America Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.6.6 Brazil

10.6.6.1 Brazil Erectile Dysfunction Treatment Drugs Market By Product

10.6.6.2 Brazil Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.6.6.3 Brazil Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.6.7 Argentina

10.6.7.1 Argentina Erectile Dysfunction Treatment Drugs Market By Product

10.6.7.2 Argentina Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.6.7.3 Argentina Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.6.8 Colombia

10.6.8.1 Colombia Erectile Dysfunction Treatment Drugs Market By Product

10.6.8.2 Colombia Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.6.8.3 Colombia Erectile Dysfunction Treatment Drugs Market By Distribution Channel

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Erectile Dysfunction Treatment Drugs Market By Product

10.6.9.2 Rest of Latin America Erectile Dysfunction Treatment Drugs Market By Mode Of Administration

10.6.9.3 Rest of Latin America Erectile Dysfunction Treatment Drugs Market By Distribution Channel

11. Company Profiles

11.1 Eli Lilly and Company

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Pfizer Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Sanofi

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Cipla Inc

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Teva Pharmaceutical Industries Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Bayer AG

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Sun Pharmaceutical Industries Ltd.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 VIVUS, Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Petros Pharmaceuticals, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Adamed

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The HIV Diagnostics Market Size was valued at USD 1.15 billion in 2023, expected to reach USD 1.80 billion by 2032 and grow at a CAGR of 5.10% from 2024-2032.

Lyme Disease Testing Market was valued at USD 10.32 billion in 2023 and is expected to reach USD 21.52 billion by 2032, growing at a CAGR of 8.56% from 2024-2032.

Pet Boarding Services Market Size was valued at USD 7.6 billion in 2023 and is expected to reach USD 15.46 billion by 2032, growing at a CAGR of 8.2% over the forecast period 2024-2032.

The Vitamins Market size was valued at USD 5.93 billion in 2023 and is expected to reach USD 10.54 billion by 2032 and grow at a CAGR of 6.64%.

Coagulants Market was valued at USD 9.94 billion in 2023 and is expected to reach USD 17.63 billion by 2032, growing at a CAGR of 6.62% from 2024 to 2032.

The Low-Pressure Liquid Chromatography Market Size was valued at USD 5.6 billion in 2023 and is expected to reach USD 10.3 billion by 2032 and grow at a CAGR of 7.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone