Get More Information on Decentralized Identity Market - Request Sample Report

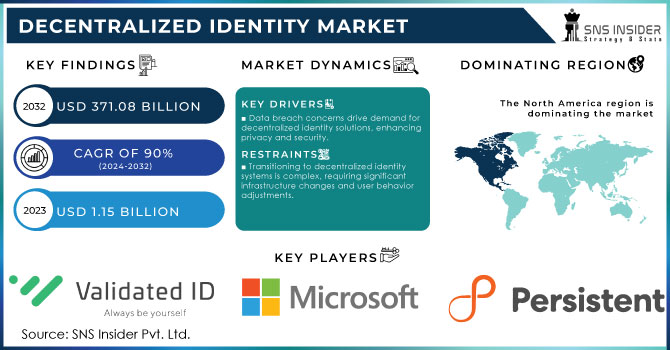

Decentralized Identity Market size was valued at USD 1.15 Billion in 2023. It is expected to Reach USD 371.08 Billion by 2032 and grow at a CAGR of 90% over the forecast period of 2024-2032.

The growing demand for seamless user experiences is driving the global acceptance of decentralized Identity. Decentralized Identity (ID) solutions fully compliant with the blockchain technology offering a transparent and unchangeable ledger, decentralized ID is enabled by storing user identification information on the blockchain while verifying it without a median regulator or third-party authentication under clear mandates. Approximately 45% of enterprises globally are expected to adopt some form of decentralized identity solution by 2024. Traditional verification processes will require various usernames, passwords, and authentication methods are cumbersome. Decentralized ID simplifies this by providing a single, portable identity verifiable across various platforms. In response to regulatory requirements (e.g. CCPA, GDPR), which have increased focus on responsible data handling and individual control over identity information - organizations are being pushed more directly into decentralized ID solutions. There are now over 1,000 active decentralized identity projects to early 2024 and most of them use blockchain technology on platforms such as Ethereum or Hyperledger. In 2023, around 25% of internet users are expected to be using some form of decentralized identity solution at an increasing growing trend toward digital identity management.

Decentralized IDs are becoming popular among industries like finance, healthcare, and e-commerce that require reliable Identity Management that is built for transaction validation which deters frauds or identity thefts as an added layer of cyber-security. Their widespread adoption is countered by infrastructure changes and transplantation between platforms. Collaboration among technology providers, industry associations, and regulatory bodies is crucial to establishing common frameworks and open standards for decentralized identity. Investment in decentralized identity startups reached $1.5 billion in 2023, highlighting significant venture capital interest in this technology. 85% of businesses will be affected by privacy regulation changes, adapting how they authenticate their identity with GDPR and CCPA regulations by 2025. Around the world, airlines and airports have taken up decentralized identity technologies introducing facial recognition check-in as well as contactless travel to numerous points in their travels.

Market Dynamics

Drivers

Growing concerns over data breaches and unauthorized access in centralized identity systems are driving the demand for decentralized identity solutions. These solutions provide individuals with more control over their data, enhancing privacy and security.

Sectors such as finance, healthcare, and e-commerce require robust identity verification processes to ensure secure transactions and protect sensitive data. The increasing digitalization of these industries drives the demand for reliable decentralized identity solutions.

Growing demand for data privacy and security is a major growth factor in the decentralized identity market. With data breaches and unauthorized access rising, individuals as well as organizations need to look for enhanced protection. Businesses using a decentralized identity solution have seen an overall 40% in fraud cases as regards identity theft compared to traditional identification management systems. More than 70% of consumers are willing to switch to services offering decentralized identity solutions due to increased concerns about data privacy and control.

Decentralized identity solutions provide a key advantage by allowing users to retain control over their data. This model reduces reliance on centralized databases, which are often targeted by hackers. For instance, in 2022, the average cost of a data breach was approximately $4.35 million, as reported by the Ponemon Institute. By implementing decentralized identity systems, organizations can mitigate such costs through improved security protocols and reduced risk of data compromise. Furthermore, our recent study indicates that 75% of consumers are increasingly concerned about how their data is managed and protected. This rising awareness drives the adoption of decentralized identity technologies, which offer a more secure way to manage and verify identity without exposing sensitive information to potential breaches. This shift towards enhanced data privacy solutions reflects the broader trend of prioritizing security in digital interactions. The Federal Trade Commission (FTC) has forecast a 45% increase in global fraud and identity theft losses. The rapid evolution of technology, including machine learning, results in a high rate of cyberattacks - attackers can generate new aggressive code versions daily. Cyber threat protection needed for business growth This has accelerated the building and adoption of decentralized identity solutions as businesses are now looking to leverage Decentralized Identity for secure & safeguard against security gaps, and DDoS attacks.

Restraints

Shifting from traditional centralized identity systems to decentralized models can be complex and requires significant changes in infrastructure and user behaviour.

Implementing decentralized identity solutions can involve substantial initial costs, including the need for new technology, training, and changes to existing systems.

Interoperability is a major challenge for the decentralized identity market and it remains as one of its most significant restraints. The decentralized identity systems function on various standards and protocols that can result in compatibility-related issues between different platforms. For example, there are many decentralized identity frameworks (e.g., Sovrin, uPort, and Veres One) with different technology licensing. This lack of uniformity can hinder the seamless exchange of identity information across different systems, which is crucial for broad adoption. A recent survey in 2023 revealed around 60% of organizations were experiencing interoperability problems with decentralized identity solutions. It also can be expensive to rectify these interoperability problems. The average organization might need to spend as much as 30% more on extra technology and integrations just so it will be able to support the different decentralized identity systems someone may join. This complexity and associated costs can delay the adoption of decentralized identity solutions and deter smaller organizations from making the switch. Overcoming this restrain, there needs to be industry-wide collaboration to establish common standards and protocols that enable decentralized identity systems that can interact seamlessly with each other.

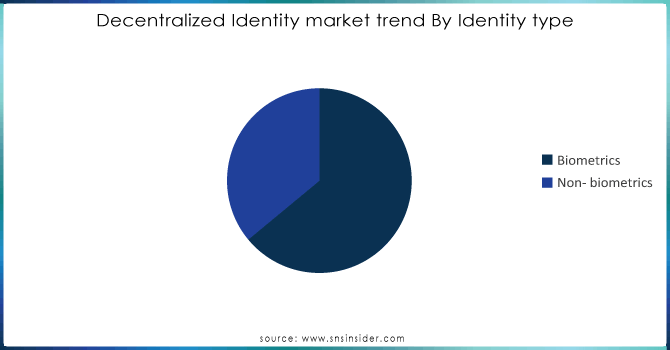

By Identity Type

The biometric segment led the market by identity type in 2023, accounting for over 64.0% of market revenue share Because the increase in precision in Biometric identifiers like fingerprints, face recognition and voice recognition, these methods provide a strong level of verification that is difficult to forge or replicate, ensuring reliable digital interactions. Biometric identity verification can enhance user convenience, who will surely appreciate the fact they can verify their own identities without any hassle. This eliminates the need for passwords or other traditional forms of authentication, which can be easily forgotten, stolen, or compromised. Non-biometrics is estimated to be the fastest growing in the coming years. The rise in the utilization rate of the consumer for non-biometric identity solutions on account of their portability and ease is anticipated to drive this sector's growth. Moreover, while biometric password-free security is on the rise it will likely drive a growing need for non-biometric authentication as backup.

Do You Need any Customization Research on Decentralized Identity Market - Enquire Now

By End-user

The enterprise segment accounted for the largest revenue share of over 64.0% in 2023 due to its need to mitigate business risks. A decentralized identity framework enables a platform to maintain an independent record of users' identities of the identity issuer, eliminating the need collect and store personal data.

The individual segment is expected to witness the highest compound annual growth rate (CAGR) of 91.6% during the period. This is being driven by individual adoption of decentralized identity solutions and self-management. These solutions allow people to do identification in many processes like loan application, bank account opening and another KYC-based processes where a human has to do the person. The potential use cases of decentralized identity, such as those for individual users will continue to create opportunities for the segment throughout the forecast years.

By organization Size

Large enterprises accounted for over 67.0% revenue share of the market in 2023, as the growing adoption of decentralized identity solutions to eliminate identity risks continues among these organizations. One such example that took place in August 2022 was Litentry, the multi-chain identity aggregation protocol partnered with blockchain infrastructure provider Node Real. At the same time, this partnership will bring the MegaNode of NodeReal to Litentry enterprise ecosystem for providing real-time and historical data indexing on Ethereum and Binance Chain networks. The SMEs segment is expected to grow with the fastest CAGR of 89.5% during the forecast period. Small and medium-scale businesses are slowly adopting digital services to provide better customer experience. Small and medium enterprises are increasingly turning to the use of blockchain for identity management over issues such as privacy, transparency between parties, and securing sensitive information. Furthermore, these offerings provide SMEs with improved product and service functionality, supply chain management capabilities, and opportunities for blockchain- driven business model innovation. This benefits are expected to drive the rapid adoption of decentralized identity solutions in the small and medium enterprise (SME) segment.

By Vertical

The BFSI segment dominated the market and accounted for a significant revenue share of over 18%. This sector, encompassing banking, financial services, and insurance, plays an important role in ensuring customer trust and security. Banks are mandated to conduct Know Your Customer (KYC) checks to verify the identity of their customers and safeguard against any involvement in illicit activities like bribery or money laundering. Moreover, it is noteworthy that the United States allocates a staggering USD 24 billion towards Anti-Money Laundering (AML) compliance measures. This substantial investment underscores the nation's commitment to combatting financial crimes and maintaining the integrity of its financial systems.

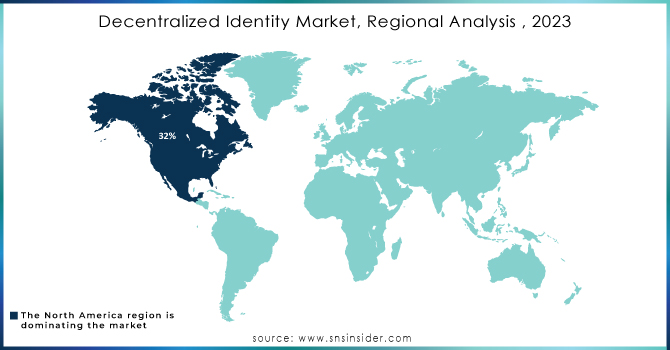

Regional analysis

North American region dominated the global market in 2023 with held revenue share of more than 32% in 2023, This region has diverse industries Including financial services, healthcare, and government to e-commerce all of which can take advantage of decentralized identity solutions. The increasing need for secure and reliable identity authentication, data exchange, and user identification in these respective sectors have accelerated the adoption of decentralized systems. Moreover, the tech-savvy population in North America is becoming more specific toward data privacy and digital security which propels the demand for market growth in the region

The Asia Pacific region is expected to grow at the fastest annual growth rate (CAGR) of 92% over the forecast period. This increase is attributed to growing awareness about cybersecurity in India, China, and Japan. In the Asia Pacific, several groups have been established to enforce consumer identity protection and are expected to strengthen market development in this region as well. In April 2021, The Commons Project Foundation and Affinidi (a Temasek identity startup) announced that they would empower individuals navigating the complexities of international travel during the pandemic era with a safe path to share their digital health records. They add to the region's reputation for robust cybersecurity and identity protection measures that help accelerated market expansion.

The major players are Validated ID, Persistent, Microsoft, Wipro, Dragonchain, SecureKey Technologies, Accenture, R3, Avast, Datarella, Serto, Ping Identity, NuID, SelfKey, Nuggets, Finema, Civic Technologies, Affinidy, Hu-manity, 1Kosmos, and others in final report.

Recent development

December 16, Quadrata Boosts DeFi Security in 2023 Web3 identity solution quadrata partnered with nine leading trusted defy protocols (Archblock, Truefi) to deliver secure and privacy-first user ID verification in San Francisco, This partnership seeks to introduce innovation designed with DeFi safety in mind and create trust within the industry.

Microsoft Enters to Decentralized ID, in 2022, MS relaunched its identity and access product and took the Entra Verified ID which appears to it will be their step into the decentralized identity space.

Tech-focused Information Security News, DailyAbout Menu In 2023 Avast Acquires for Digital ID Expansion Cybersecurity giant secures customer base and technology in the burgeoning field of decentralized digital IDs by Lucian Constantin June 28, Share As part.... The move also indicates Avast's dedication to the niche market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.15 Billion |

| Market Size by 2032 | USD 371.08 Billion |

| CAGR | CAGR of 90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Identity Type (Non- Biometrics, Biometrics) • By Organization Size (Large Enterprises, SMEs) • By End User (Enterprises, Individual) • By Verticals (BFSI, Government, Healthcare And Life Sciences, Telecom And IT, Retail & E-Commerce, Transport And Logistics, Real Estate, Media And Entertainment, Travel And Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Validated ID, Persistent, Microsoft, Wipro, Dragonchain, SecureKey Technologies, Accenture, R3, Avast, Datarella, Serto, Ping Identity, NuID, SelfKey, Nuggets, Finema, Civic Technologies, Affinidy, Hu-manity, 1Kosmos |

| Key Drivers | • Growing concerns over data breaches and unauthorized access in centralized identity systems are driving the demand for decentralized identity solutions. These solutions provide individuals with more control over their data, enhancing privacy and security. |

| RESTRAINTS | • Shifting from traditional centralized identity systems to decentralized models can be complex and requires significant changes in infrastructure and user behaviour. |

Ans. The projected market size for the Decentralized Identity Market is USD 371.08 billion by 2032.

Ans. The CAGR of the Decentralized Identity Market is 90% During the forecast period of 2024-2032.

Ans: The North American region dominated the market in 2023, with a 32% share.

Ans: Yes, you can customize the report as per your requirements.

Ans: Four segments are covered in the Decentralized Identity Market report, By Identity Type, By Organization size, By End-user, By Verticals.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Decentralized Identity Market Segmentation, by Identity Type

8.1 Non-biometrics

8.2 Biometrics

9. Decentralized Identity Market Segmentation, by Organization Size

9.1 Large Enterprises

9.2 SMEs

10. Decentralized Identity Market Segmentation, by End User

10.1 Enterprises

10.2 Individual

11. Decentralized Identity Market Segmentation, by Verticals

11.1 BFSI

11.2 Government

11.3 Healthcare and Life Sciences

11.4 Telecom and IT

11.5 Retail & E-Commerce

11.6 Transport and Logistics

11.7 Real Estate

11.8 Media and Entertainment

11.9 Travel and Hospitality

11.10 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Decentralized Identity Market by Country

12.2.2 North America Decentralized Identity Market by Identity Type

12.2.3 North America Decentralized Identity Market by Organization Size

12.2.4 North America Decentralized Identity Market by End-user

12.2.5 North America Decentralized Identity Market by Verticals

12.2.6 USA

12.2.6.1 USA Decentralized Identity Market by Identity Type

12.2.6.2 USA Decentralized Identity Market by Organization Size

12.2.6.3 USA Decentralized Identity Market by End User

12.2.6.4 USA Decentralized Identity Market by Verticals

12.2.7 Canada

12.2.7.1 Canada Decentralized Identity Market by Identity Type

12.2.7.2 Canada Decentralized Identity Market by Organization Size

12.2.7.3 Canada Decentralized Identity Market by End User

12.2.7.4 Canada Decentralized Identity Market by Verticals

12.2.8 Mexico

12.2.8.1 Mexico Decentralized Identity Market by Identity Type

12.2.8.2 Mexico Decentralized Identity Market by Organization Size

12.2.8.3 Mexico Decentralized Identity Market by End User

12.2.8.4 Mexico Decentralized Identity Market by Verticals

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Eastern Europe Decentralized Identity Market by Country

12.3.1.2 Eastern Europe Decentralized Identity Market by Identity Type

12.3.1.3 Eastern Europe Decentralized Identity Market by Organization Size

12.3.1.4 Eastern Europe Decentralized Identity Market by End-user

12.3.1.5 Eastern Europe Decentralized Identity Market by Verticals

12.3.1.6 Poland

12.3.1.6.1 Poland Decentralized Identity Market by Identity Type

12.3.1.6.2 Poland Decentralized Identity Market by Organization Size

12.3.1.6.3 Poland Decentralized Identity Market by End User

12.3.1.6.4 Poland Decentralized Identity Market by Verticals

12.3.1.7 Romania

12.3.1.7.1 Romania Decentralized Identity Market by Identity Type

12.3.1.7.2 Romania Decentralized Identity Market by Organization Size

12.3.1.7.3 Romania Decentralized Identity Market by End-user

12.3.1.7.4 Romania Decentralized Identity Market by Verticals

12.3.1.8 Hungary

12.3.1.8.1 Hungary Decentralized Identity Market by Identity Type

12.3.1.8.2 Hungary Decentralized Identity Market by Organization Size

12.3.1.8.3 Hungary Decentralized Identity Market by End User

12.3.1.8.4 Hungary Decentralized Identity Market by Verticals

12.3.1.9 Turkey

12.3.1.9.1 Turkey Decentralized Identity Market by Identity Type

12.3.1.9.2 Turkey Decentralized Identity Market by Organization Size

12.3.1.9.3 Turkey Decentralized Identity Market by End User

12.3.1.9.4 Turkey Decentralized Identity Market by Verticals

12.3.1.10 Rest of Eastern Europe

12.3.1.10.1 Rest of Eastern Europe Decentralized Identity Market by Identity Type

12.3.1.10.2 Rest of Eastern Europe Decentralized Identity Market by Organization Size

12.3.1.10.3 Rest of Eastern Europe Decentralized Identity Market by End-user

12.3.1.10.4 Rest of Eastern Europe Decentralized Identity Market by Verticals

12.3.2 Western Europe

12.3.2.1 Western Europe Decentralized Identity Market by Country

12.3.2.2 Western Europe Decentralized Identity Market by Identity Type

12.3.2.3 Western Europe Decentralized Identity Market by Organization Size

12.3.2.4 Western Europe Decentralized Identity Market by End-user

12.3.2.5 Western Europe Decentralized Identity Market by Verticals

12.3.2.6 Germany

12.3.2.6.1 Germany Decentralized Identity Market by Identity Type

12.3.2.6.2 Germany Decentralized Identity Market by Organization Size

12.3.2.6.3 Germany Decentralized Identity Market by End User

12.3.2.6.4 Germany Decentralized Identity Market by Verticals

12.3.2.7 France

12.3.2.7.1 France Decentralized Identity Market by Identity Type

12.3.2.7.2 France Decentralized Identity Market by Organization Size

12.3.2.7.3 France Decentralized Identity Market by End User

12.3.2.7.4 France Decentralized Identity Market by Verticals

12.3.2.8 UK

12.3.2.8.1 UK Decentralized Identity Market by Identity Type

12.3.2.8.2 UK Decentralized Identity Market by Organization Size

12.3.2.8.3 UK Decentralized Identity Market by End User

12.3.2.8.4 UK Decentralized Identity Market by Verticals

12.3.2.9 Italy

12.3.2.9.1 Italy Decentralized Identity Market by Identity Type

12.3.2.9.2 Italy Decentralized Identity Market by Organization Size

12.3.2.9.3 Italy Decentralized Identity Market by End User

12.3.2.9.4 Italy Decentralized Identity Market by Verticals

12.3.2.10 Spain

12.3.2.10.1 Spain Decentralized Identity Market by Identity Type

12.3.2.10.2 Spain Decentralized Identity Market by Organization Size

12.3.2.10.3 Spain Decentralized Identity Market by End User

12.3.2.10.4 Spain Decentralized Identity Market by Verticals

12.3.2.11 Netherlands

12.3.2.11.1 Netherlands Decentralized Identity Market by Identity Type

12.3.2.11.2 Netherlands Decentralized Identity Market by Organization Size

12.3.2.11.3 Netherlands Decentralized Identity Market by End User

12.3.2.11.4 Netherlands Decentralized Identity Market by Verticals

12.3.2.12 Switzerland

12.3.2.12.1 Switzerland Decentralized Identity Market by Identity Type

12.3.2.12.2 Switzerland Decentralized Identity Market by Organization Size

12.3.2.12.3 Switzerland Decentralized Identity Market by End User

12.3.2.12.4 Switzerland Decentralized Identity Market by Verticals

12.3.2.13 Austria

12.3.2.13.1 Austria Decentralized Identity Market by Identity Type

12.3.2.13.2 Austria Decentralized Identity Market by Organization Size

12.3.2.13.3 Austria Decentralized Identity Market by End User

12.3.2.13.4 Austria Decentralized Identity Market by Verticals

12.3.2.14 Rest of Western Europe

12.3.2.14.1 Rest of Western Europe Decentralized Identity Market by Identity Type

12.3.2.14.2 Rest of Western Europe Decentralized Identity Market by Organization Size

12.3.2.14.3 Rest of Western Europe Decentralized Identity Market by End User

12.3.2.14.4 Rest of Western Europe Decentralized Identity Market by Verticals

12.4 Asia-Pacific

12.4.1 Asia Pacific Decentralized Identity Market by Country

12.4.2 Asia Pacific Decentralized Identity Market by Identity Type

12.4.3 Asia Pacific Decentralized Identity Market by Organization Size

12.4.4 Asia Pacific Decentralized Identity Market by End User

12.4.5 Asia Pacific Decentralized Identity Market by Verticals

12.4.6 China

12.4.6.1 China Decentralized Identity Market by Identity Type

12.4.6.2 China Decentralized Identity Market by Organization Size

12.4.6.3 China Decentralized Identity Market by End User

12.4.6.4 China Decentralized Identity Market by Verticals

12.4.7 India

12.4.7.1 India Decentralized Identity Market by Identity Type

12.4.7.2 India Decentralized Identity Market by Organization Size

12.4.7.3 India Decentralized Identity Market by End User

12.4.7.4 India Decentralized Identity Market by Verticals

12.4.8 Japan

12.4.8.1 Japan Decentralized Identity Market by Identity Type

12.4.8.2 Japan Decentralized Identity Market by Organization Size

12.4.8.3 Japan Decentralized Identity Market by End User

12.4.8.4 Japan Decentralized Identity Market by Verticals

12.4.9 South Korea

12.4.9.1 South Korea Decentralized Identity Market by Identity Type

12.4.9.2 South Korea Decentralized Identity Market by Organization Size

12.4.9.3 South Korea Decentralized Identity Market by End User

12.4.9.4 South Korea Decentralized Identity Market by Verticals

12.4.10 Vietnam

12.4.10.1 Vietnam Decentralized Identity Market by Identity Type

12.4.10.2 Vietnam Decentralized Identity Market by Organization Size

12.4.10.3 Vietnam Decentralized Identity Market by End User

12.4.10.4 Vietnam Decentralized Identity Market by Verticals

12.4.11 Singapore

12.4.11.1 Singapore Decentralized Identity Market by Identity Type

12.4.11.2 Singapore Decentralized Identity Market by Organization Size

12.4.11.3 Singapore Decentralized Identity Market by End User

12.4.11.4 Singapore Decentralized Identity Market by Verticals

12.4.12 Australia

12.4.12.1 Australia Decentralized Identity Market by Identity Type

12.4.12.2 Australia Decentralized Identity Market by Organization Size

12.4.12.3 Australia Decentralized Identity Market by End User

12.4.12.4 Australia Decentralized Identity Market by Verticals

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Decentralized Identity Market by Identity Type

12.4.13.2 Rest of Asia-Pacific Decentralized Identity Market by Organization Size

12.4.13.3 Rest of Asia-Pacific Decentralized Identity Market by End User

12.4.13.4 Rest of Asia-Pacific Decentralized Identity Market by Verticals

12.5 Middle East & Africa

12.5.1 Middle East

12.5.1.1 Middle East Decentralized Identity Market by Country

12.5.1.2 Middle East Decentralized Identity Market by Identity Type

12.5.1.3 Middle East Decentralized Identity Market by Organization Size

12.5.1.4 Middle East Decentralized Identity Market by End User

12.5.1.5 Middle East Decentralized Identity Market by Verticals

12.5.1.6 UAE

12.5.1.6.1 UAE Decentralized Identity Market by Identity Type

12.5.1.6.2 UAE Decentralized Identity Market by Organization Size

12.5.1.6.3 UAE Decentralized Identity Market by End User

12.5.1.6.4 UAE Decentralized Identity Market by Verticals

12.5.1.7 Egypt

12.5.1.7.1 Egypt Decentralized Identity Market by Identity Type

12.5.1.7.2 Egypt Decentralized Identity Market by Organization Size

12.5.1.7.3 Egypt Decentralized Identity Market by End User

12.5.1.7.4 Egypt Decentralized Identity Market by Verticals

12.5.1.8 Saudi Arabia

12.5.1.8.1 Saudi Arabia Decentralized Identity Market by Identity Type

12.5.1.8.2 Saudi Arabia Decentralized Identity Market by Organization Size

12.5.1.8.3 Saudi Arabia Decentralized Identity Market by End User

12.5.1.8.4 Saudi Arabia Decentralized Identity Market by Verticals

12.5.1.9 Qatar

12.5.1.9.1 Qatar Decentralized Identity Market by Identity Type

12.5.1.9.2 Qatar Decentralized Identity Market by Organization Size

12.5.1.9.3 Qatar Decentralized Identity Market by End User

12.5.1.9.4 Qatar Decentralized Identity Market by Verticals

12.5.1.10 Rest of Middle East

12.5.1.10.1 Rest of Middle East Decentralized Identity Market by Identity Type

12.5.1.10.2 Rest of Middle East Decentralized Identity Market by Organization Size

12.5.1.10.3 Rest of Middle East Decentralized Identity Market by End User

12.5.1.10.4 Rest of Middle East Decentralized Identity Market by Verticals

12.5.2. Africa

12.5.2.1 Africa Decentralized Identity Market by Country

12.5.2.2 Africa Decentralized Identity Market by Identity Type

12.5.2.3 Africa Decentralized Identity Market by Organization Size

12.5.2.4 Africa Decentralized Identity Market by End User

12.5.2.5 Africa Decentralized Identity Market by Verticals

12.5.2.6 Nigeria

12.5.2.6.1 Nigeria Decentralized Identity Market by Identity Type

12.5.2.6.2 Nigeria Decentralized Identity Market by Organization Size

12.5.2.6.3 Nigeria Decentralized Identity Market by End User

12.5.2.6.4 Nigeria Decentralized Identity Market by Verticals

12.5.2.7 South Africa

12.5.2.7.1 South Africa Decentralized Identity Market by Identity Type

12.5.2.7.2 South Africa Decentralized Identity Market by Organization Size

12.5.2.7.3 South Africa Decentralized Identity Market by End User

12.5.2.7.4 South Africa Decentralized Identity Market by Verticals

12.5.2.8 Rest of Africa

12.5.2.8.1 Rest of Africa Decentralized Identity Market by Identity Type

12.5.2.8.2 Rest of Africa Decentralized Identity Market by Organization Size

12.5.2.8.3 Rest of Africa Decentralized Identity Market by End User

12.5.2.8.4 Rest of Africa Decentralized Identity Market by Verticals

12.6. Latin America

12.6.1 Latin America Decentralized Identity Market by Country

12.6.2 Latin America Decentralized Identity Market by Identity Type

12.6.3 Latin America Decentralized Identity Market by Organization Size

12.6.4 Latin America Decentralized Identity Market by End User

12.6.5 Latin America Decentralized Identity Market by Verticals

12.6.6 Brazil

12.6.6.1 Brazil Decentralized Identity Market by Identity Type

12.6.6.2 Brazil Decentralized Identity Market by Organization Size

12.6.6.3 Brazil Decentralized Identity Market by End User

12.6.6.4 Brazil Decentralized Identity Market by Verticals

12.6.7 Argentina

12.6.7.1 Argentina Decentralized Identity Market by Identity Type

12.6.7.2 Argentina Decentralized Identity Market by Organization Size

12.6.7.3 Argentina Decentralized Identity Market by End User

12.6.7.4 Argentina Decentralized Identity Market by Verticals

12.6.8 Colombia

12.6.8.1 Colombia Decentralized Identity Market by Identity Type

12.6.8.2 Colombia Decentralized Identity Market by Organization Size

12.6.8.3 Colombia Decentralized Identity Market by End User

12.6.8.4 Colombia Decentralized Identity Market by Verticals

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin Americas Decentralized Identity Market by Identity Type

12.6.9.2 Rest of Latin America Decentralized Identity Market by Organization Size

12.6.9.3 Rest of Latin America Decentralized Identity Market by End User

12.6.9.4 Rest of Latin America Decentralized Identity Market by Verticals

13. Company Profile

13.1 Validated ID

13.1.1 Company Overview

13.1.2 Financials

13.1.3 Product/Services/Offerings

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Persistent

13.2.1 Company Overview

13.2.2 Financials

13.2.3 Product/Services/Offerings

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Microsoft.

13.3.1 Company Overview

13.3.2 Financials

13.3.3 Product/Services/Offerings

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Wipro.

13.4.1 Company Overview

13.4.2 Financials

13.4.3 Product/Services/Offerings

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Dragonchain.

13.5.1 Company Overview

13.5.2 Financials

13.5.3 Product/Services/Offerings

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 SecureKey Technologies.

13.6.1 Company Overview

13.6.2 Financials

13.6.3 Product/Services/Offerings

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Accenture.

13.7.1 Company Overview

13.7.2 Financials

13.7.3 Product/Services/Offerings

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Avast.

13.8.1 Company Overview

13.8.2 Financials

13.8.3 Product/Services/Offerings

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Datarella

13.9.1 Company Overview

13.9.2 Financials

13.9.3 Product/Services/Offerings

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Ping Identity.

13.10.1 Company Overview

13.10.2 Financials

13.10.3 Product/Services/Offerings

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3 Mergers & Acquisitions

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Identity type

Non- biometrics

Biometrics

By Organization size

Large Enterprises

SMEs

By End user

Enterprises

Individual

By Verticals

BFSI

Government

Healthcare and life sciences

Telecom and IT

Retail & E-Commerce

Transport and Logistics

Real Estate

Media and Entertainment

Travel and Hospitality

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Digital Experience Platform Market was valued at USD 12.27 billion in 2023 and is expected to reach USD 34.50 billion by 2032, growing at a CAGR of 12.22% from 2024-2032.

The Applied AI Service Market Size was valued at USD 235.60 Million in 2023 and will reach to USD 1878.80 Million by 2032 and grow at a CAGR of 26.0% by 2032.

The Anime Merchandising Market Size was valued at USD 9.16 Billion in 2023 and will reach USD 19.92 Billion by 2032 and grow at a CAGR of 9.0% by 2032.

The Metaverse in Education Market was valued at USD 4.6 Billion in 2023 and will reach USD 85.6 Billion by 2032 and grow at a CAGR of 38.31% by 2032.

The Voice Picking Solutions Market Size was USD 2.6 Billion in 2023 & is expected to reach USD 8.78 Billion by 2032, growing at a CAGR of 14.5% by 2024-2032

The Artificial Neural Network Market size was valued at USD 248 million in 2023 and is expected to reach USD 1256 million by 2032, growing at a CAGR of 19.79% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone