To Get More Information on Bluetooth 5.0 Market - Request Sample Report

Bluetooth 5.0 Market was valued at USD 4.62 billion in 2023 and is expected to reach USD 11.84 Billion by 2032, growing at a CAGR of 11.04% from 2024-2032.

The Bluetooth 5.0 market is experiencing rapid growth with widespread acceptance of wireless connectivity combined with increasing demand in the consumer electronics, healthcare, automotive, and smart home industry verticals. Specifically, it enables a number of audio streaming, data transfer and location tracking applications, making it the backbone of the Internet of things (IoT) ecosystem. In audio streaming devices, Bluetooth 5.0 shipments are projected to rise from 448 million Bluetooth headphones and earbuds by 2024, to 712 million units by 2028. The segment is seeing advantages from consumer preferences for wireless audio solutions, as well as developments such as LE Audio that enhance audio quality and power. On the other hand, the new interest in portable, high-quality audio devices is expected to push Bluetooth speaker shipments to 262 million in 2024.

Bluetooth 5.0 is fueling applications in wearables in healthcare such as activity, heart rate and patient health management. The market is further boosted by smart home devices such as those with Bluetooth capabilities including home appliances such as refrigerators and washing machines which allow users to remotely control and monitor them. Bluetooth is also used for wireless monitoring of equipment across industrial applications such as logistics and manufacturing, contributing to operational efficiency.

North America is currently at the forefront of adoption owing to technological leadership whereas Asia-Pacific is the fastest-growing market driven by rising disposable income and demand for smart devices, particularly in the rapidly developing countries like China and India. Examples include an Auracast broadcast audio feature for sharing sound in specific locations, as well as energy-harvesting Bluetooth 5.3 SoCs, highlighting the innovation taking place in this market to address a wide variety of consumer and industrial applications. Bluetooth 5.0 is versatile and updated with state of art functionalities and capabilities making it important in various applications of wireless connectivity which is going to stay in every aspect of life. These reasons outline its crucial place in the changing digital and connected ecosystems.

Market Dynamics

Drivers

Growing use in smart home devices, including appliances and security systems, drives demand

Increasing use in wearables for health monitoring and medical device connectivity

Deployment in manufacturing for equipment monitoring and automotive applications like keyless entry and infotainment systems

Bluetooth 5.0 is revolutionizing the manufacturing and automotive industries by enabling advanced equipment monitoring and keyless entry systems. Its extended range (up to 800 feet) and improved data transmission speeds make it ideal for real-time monitoring of manufacturing equipment, ensuring efficiency and minimizing downtime. Sensors equipped with Bluetooth 5.0 transmit critical performance data to central systems, allowing for predictive maintenance and reducing the risk of equipment failures. This wireless technology eliminates the need for complex cabling, providing cost-effective and scalable solutions for industrial automation.

In the automotive sector, Bluetooth 5.0 facilitates seamless connectivity for keyless entry systems, enhancing user convenience and security. By linking a smartphone or key fob to a vehicle, Bluetooth enables automatic door locking and unlocking, as well as engine ignition, without physical keys. Additionally, the technology is used in infotainment systems to connect multiple devices, stream audio, and provide hands-free communication, delivering a superior in-car experience.

Innovations like Bluetooth Low Energy (LE) ensure minimal power consumption, critical for battery-operated sensors and devices in these industries. For instance, companies such as Broadcom and Alps Alpine have collaborated to create high-accuracy Bluetooth positioning systems, enhancing the functionality of automotive applications like precise vehicle location tracking and improved navigation systems Furthermore, the ability of Bluetooth 5.0 to handle multiple device connections simultaneously supports the growing use of IoT in manufacturing. Equipment data, environmental conditions, and worker safety metrics can all be monitored in real-time through a single Bluetooth network. This reduces manual intervention, increases operational efficiency, and supports the adoption of Industry 4.0 practices. Overall, Bluetooth 5.0's versatility and technological advancements are transforming these sectors by enabling smarter, more connected systems. Its ability to integrate with diverse applications while ensuring low power consumption and reliable performance positions it as a critical technology for the future of manufacturing and automotive industries

Restraints

Limited backward compatibility with legacy systems hinders widespread adoption

Potential vulnerabilities in Bluetooth connections pose risks of unauthorized access and data breaches

While energy-efficient, the range of Bluetooth 5.0 for certain industrial or automotive applications may require additional amplifiers or infrastructure.

Bluetooth 5.0 is known for its power efficiency and additional range, providing up to 800 feet under optimal conditions. However, its range does limit its use in more demanding industrial or automotive applications, where connectivity is needed over larger or more complex environments. Complex environments – take for example, large manufacturing facilities or multi-story buildings which typically experience physical impediments to Bluetooth signals through walls, machinery, or other structures. Likewise, in vehicular applications that involve communication between a vehicle and a device (e.g. vehicle-to-device communication), the effective range decreases due to external factors such as metal obstacles or interference from other wireless signals. This often requires extra infrastructure like amplifiers or repeaters to overcome these challenges. Although these improve range and maintain signal quality over longer distances, they eventually add to system complexity and costs. Deploying Bluetooth-enabled predictive maintenance systems across a factory, for instance, could require amplifiers to ensure that there is high-fidelity communication between sensors and control systems. In the same vein, automotive use cases, such as keyless entry systems based on Bluetooth or infotainment capabilities in larger vehicles, e.g., buses or trucks, will also need additional infrastructure to cope with signal attenuation from vehicle design. In addition, while Bluetooth 5.0's power-saving capabilities result in reduced energy use for individual devices, the overall energy consumption of the system might raise by providing infrastructure components (e.g., amplifiers). That may prove more difficult for sectors with an energy-efficient or sustainability focus.

Although Bluetooth 5.0 provides a significant improvement over Bluetooth 4.x, the maximum practical range of Bluetooth in industrial and automotive applications may require further investments in amplifiers or other infrastructure. This can increase the cost and complexity of deployment, and may prevent adoption in cost-sensitive environments or applications.

Segment Analysis

By Offering

The hardware segment dominated the Bluetooth 5.0 market and represented revenue share of more than 42.0% in 2023. This expansion of the adoption of Bluetooth devices like headphones, speakers, wearables, and automotive systems is the primary driver for the hardware segment. As the demand for Bluetooth in consumer and industrial applications increases, the need for premium and reliable hardware like Bluetooth chips, transmitters and receivers is also increasing. Hardware leads driven by booming IoT device & smart home product demand alongside expansion of wireless audio systems. Growth to be powered by innovations such as Bluetooth 5.2 and 5.3 that enable enhanced energy savings, increased range, and greater data transfer rates, increasing the requirement for newer hardware. The hardware segment will remain at the forefront of wireless market growth, with strong Bluetooth adoption, new product launches, and continued innovation powering demand of the Bluetooth-enabled solutions.

The software category is expected to experience the largest compound annual growth rate (CAGR) during the forecast period for the Bluetooth 5.0 market with the rising inclination towards software solutions that support integration & improved functionality for Bluetooth devices. It is, therefore, essential that dedicated software helps refine hardware compatibility, security, and connectivity functionalities like geolocation services and active transfer protocols. As IoT, smart homes and industrial automation revolutionize the world, the demand for high-end Bluetooth software solutions including device management software, application software and security software is only set to increase. The growing shift to cloud-based solutions and networking of devices in general will also require more advanced Bluetooth software as the years go by. Innovative software solutions delighting customers will experience rapid growth, confirming this segment to have the largest growth in the upcoming billion dollar market over the next few years.

By Organization Size

In 2023, The Large enterprise segment dominated the market and accounting for 70.28% of revenue share, since it has a strong technological infrastructure, and have a higher budget, as well as more structured wireless solutions at low power, longer range, and higher-performance wireless solutions irrespective of its scalability or its reliability. The adoption of Bluetooth 5.0 is expected to increase across large enterprises across major industries verticals such as automotive, manufacturing automotive, healthcare and retail as they seek support for IoT initiatives, smart devices and more enhanced customer experiences. These organizations use Bluetooth for asset tracking, real-time transfer and other solutions for automating numerous applications. The continued digitalisation process and the growing requirement for wireless communication give the demand an extra push. Future adoption of Bluetooth 5.0 is expected to see more uptick especially within sectors that required strong security and real-time data analytics, even as large enterprises are ready to strengthen their connected devices and smart systems

The highest growth rate in Bluetooth 5.0 market is expected in the Small and Medium Enterprises (SMEs) segment due to rising cost-effectiveness and scalability of Bluetooth technology. Bluetooth 5.0 is being adopted by SMEs across different sectors including Retail, Logistics AND Healthcare to improve their enterprise functions with economical wireless solutions. As IoT ecosystem develops, these businesses are using Bluetooth 5.0 in particular for applications including inventory management, asset tracking and customer interaction via smart devices. With the availability of cheaper Bluetooth modules and sensors today, and with the inevitable SME demand for automation and data analytics, the stage has been set for quick adoption. With Bluetooth technology available to almost anyone, this segment's growth will only accelerate, allowing every SME to stand up and compete with large enterprises with better, more efficient systems.

Regional Analysis

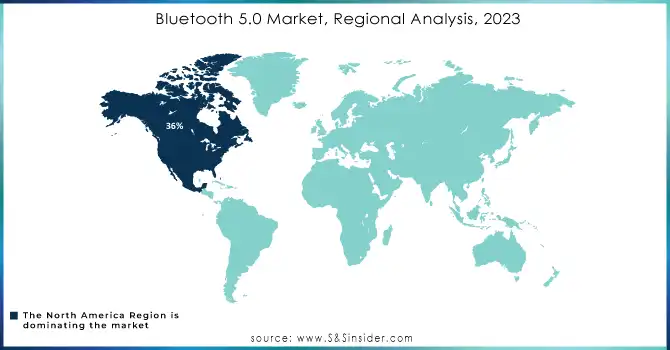

North America dominated the Bluetooth 5.0 market and represented revenue share of 36% in 2023, due to the technological improvements in countries such as the U.S. and Canada. A well-established infrastructure, high IoT devices penetration rate and rapid wireless connectivity development in auto, healthcare, and consumer electronic sectors are propelling the region. Combine that with strong R&D at companies such as Qualcomm, Broadcom and Intel and it’s easy to see why the region continues to propel Bluetooth 5.0 technologies. Also, regulatory support of energy efficiency and wireless communication standards enhances the adoption of the Bluetooth-based solutions. With sustained investment in smart cities, IoT and industrial automation, the North American market is likely to flourish further yielding increasing demand for Bluetooth 5.0.

Asia Pacific (APAC) is expected to hold the highest CAGR in the Bluetooth 5.0 market. China, India, Japan, and South Korea are some of the major profiteers of this upsurge because of the quickly increasing urbanization, higher disposable incomes, and an abundance of Bluetooth-supporting devices. Giant demand from consumer electronics, automotive, and industrial sector growth is driving the rapid development of the APAC market because they all need Bluetooth as a mandatory support to have high-performance automatic systems. Apart from the expansion of demand for wireless solutions in healthcare, retail, and logistics, rise of IoT and smart cities in country like China and India are also major factors contributing towards the growth of the market. The Bluetooth 5.0 market in the APAC region will continue to grow rapidly as the increasing number of businesses and consumers move toward connected, smart devices, fuelling demand for next-generation wireless solutions.

Do You Need any Customization Research on Bluetooth 5.0 Market - Enquire Now

Key Players

The major key players are

Qualcomm – Qualcomm QCC514X Bluetooth Audio SoC

Broadcom – BCM4356 Bluetooth 5.0 SoC

Intel – Intel Wireless-AC 9560 (Bluetooth 5.0)

Texas Instruments – SimpleLink Bluetooth 5.0 SoC

NXP Semiconductors – NXP KW41Z Bluetooth 5.0 Solution

Nordic Semiconductor – nRF52840 Bluetooth 5.0 SoC

Microchip Technology – ATBTLC1000 Bluetooth 5.0 Module

STMicroelectronics – BlueNRG-2 Bluetooth 5.0 SoC

Qualcomm Atheros – Qualcomm QCA9377 Bluetooth 5.0 Chipset

MediaTek – MT2523 Bluetooth 5.0 System-on-Chip

CSR (a subsidiary of Qualcomm) – CSR1010 Bluetooth 5.0 Module

Roku – Roku Wireless Speakers (Bluetooth connectivity)

Samsung Electronics – Galaxy Buds (Bluetooth 5.0)

Apple – AirPods Pro (Bluetooth 5.0)

Harman International – JBL Flip 5 Bluetooth Speaker

Sony Corporation – Sony WH-1000XM4 Headphones (Bluetooth 5.0)

Broadcom – BCM43455 Bluetooth 5.0 SoC

Anker Innovations – Soundcore Liberty Air 2 Pro (Bluetooth 5.0)

Garmin Ltd. – Garmin Forerunner 245 Music (Bluetooth 5.0)

Fitbit (Google) – Fitbit Charge 5 Fitness Tracker (Bluetooth 5.0)

Recent Developments

Broadcom and Alps Alpine Partnership (October 2023): These companies collaborated to develop a high-accuracy positioning system using Bluetooth Low Energy (BLE) technology. This innovation is particularly geared towards automotive applications, such as keyless entry and precision navigation, enhancing Bluetooth's role in the industry

LE Audio Deployment (2024): LE Audio, which builds on Bluetooth technology, is set to significantly enhance audio performance with lower power consumption and improved sound quality. It includes the introduction of Auracast™ broadcast audio, allowing one audio source device to broadcast to multiple audio devices, which is expected to revolutionize public venues and hearing aids. Major companies like Samsung and Xiaomi have already integrated support for this feature

| Report Attributes | Details |

| Market Size in 2023 | USD 4.62 billion |

| Market Size by 2031 | USD 11.84 Billion |

| CAGR | CAGR of 11.04% from 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Application (Audio Streaming, Data Transfer, Location Services, Device Networks) • By Organization Size (SMEs, Large Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Qualcomm, Broadcom, Intel, Texas Instruments, NXP Semiconductors, Nordic Semiconductor, Microchip Technology, STMicroelectronics, Qualcomm Atheros, MediaTek |

| Key Drivers | •Growing use in smart home devices, including appliances and security systems, drives demand •Increasing use in wearables for health monitoring and medical device connectivity •Deployment in manufacturing for equipment monitoring and automotive applications like keyless entry and infotainment systems |

| Market Restraints | •Limited backward compatibility with legacy systems hinders widespread adoption •Potential vulnerabilities in Bluetooth connections pose risks of unauthorized access and data breaches •While energy-efficient, the range of Bluetooth 5.0 for certain industrial or automotive applications may require additional amplifiers or infrastructure. |

Ans- Challenges in the Bluetooth 5.0 Market are

Ans- one main growth factor for the Bluetooth 5.0 Market is

Ans- The North America dominated the market and represented significant revenue share in 2023

Ans- the CAGR of Bluetooth 5.0 Market during the forecast period is of 11.04% from 2024-2032.

Ans- Bluetooth 5.0 Market was valued at USD 4.62 billion in 2023 and is expected to reach USD 11.84 Billion by 2032, growing at a CAGR of 11.04% from 2024-2032.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Bluetooth 5.0 Market Segmentation, By Offering

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3Software

7.3.1Software Market Trends Analysis (2020-2032)

7.3.2Software Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Bluetooth 5.0 Market Segmentation, by Organization Size

8.1 Chapter Overview

8.2 Small & Medium Enterprises

8.2.1 Small & Medium Enterprises Market Trends Analysis (2020-2032)

8.2.2 Small & Medium Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Large Enterprises

8.3.1 Large Enterprises Market Trends Analysis (2020-2032)

8.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Bluetooth 5.0 Market Segmentation, by Application

9.1 Chapter Overview

9.2 Audio Streaming

9.2.1 Audio Streaming Market Trends Analysis (2020-2032)

9.2.2 Audio Streaming Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Data Transfer

9.3.1 Data Transfer Market Trends Analysis (2020-2032)

9.3.2 Data Transfer Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Location Services

9.4.1 Location Services Market Trends Analysis (2020-2032)

9.4.2 Location Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5Device Networks

9.5.1Device Networks Market Trends Analysis (2020-2032)

9.5.2Device Networks Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Bluetooth 5.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.4 North America Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.5 North America Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.6.2 USA Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.6.3 USA Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.7.2 Canada Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.7.3 Canada Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.2.8.2 Mexico Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.8.3 Mexico Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Bluetooth 5.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.6.2 Poland Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.6.3 Poland Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.7.2 Romania Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.7.3 Romania Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Bluetooth 5.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.4 Western Europe Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.5 Western Europe Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.6.2 Germany Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.6.3 Germany Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.7.2 France Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.7.3 France Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.8.2 UK Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.8.3 UK Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.9.2 Italy Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.9.3 Italy Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.10.2 Spain Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.10.3 Spain Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.13.2 Austria Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.13.3 Austria Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Bluetooth 5.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.4 Asia Pacific Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.5 Asia Pacific Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.6.2 China Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.6.3 China Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.7.2 India Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.7.3 India Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.8.2 Japan Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.8.3 Japan Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.9.2 South Korea Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.9.3 South Korea Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.10.2 Vietnam Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.10.3 Vietnam Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.11.2 Singapore Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.11.3 Singapore Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.12.2 Australia Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.12.3 Australia Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Bluetooth 5.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.4 Middle East Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.5 Middle East Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.6.2 UAE Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.6.3 UAE Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Bluetooth 5.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.4 Africa Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.5 Africa Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Bluetooth 5.0 Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.4 Latin America Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.5 Latin America Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.6.2 Brazil Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.6.3 Brazil Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.7.2 Argentina Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.7.3 Argentina Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.8.2 Colombia Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.8.3 Colombia Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Bluetooth 5.0 Market Estimates and Forecasts, By Offering (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Bluetooth 5.0 Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Bluetooth 5.0 Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Qualcomm

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Broadcom

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Intel

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Texas Instruments

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 NXP Semiconductors

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Nordic Semiconductor

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Microchip Technology

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Gemalto (Thales Group)

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 STMicroelectronics

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Qualcomm Atheros

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation:

By Offering

Hardware

Software

Services

By Application

Audio Streaming

Data Transfer

Location Services

Device Networks

By Organization Size

Large Enterprises

Small & Medium Enterprises

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Real Estate Software Market was valued at USD 12.22 billion in 2023 and is expected to reach USD 37.16 billion by 2032, growing at a CAGR of 13.22% from 2024-2032.

The Recruitment Process Outsourcing Market was valued at USD 7.8 billion in 2023 and will reach USD 32.3 Billion by 2032, growing at a CAGR of 17.19% by 2032.

Conversational AI Market Size was valued at USD 10.1 Billion in 2023 and is expected to reach USD 64.5 Billion by 2032 and grow at a CAGR of 22.89 % over the forecast period 2024-2032.

The Time and Attendance Software Market was valued at USD 3.1 Billion in 2023 and is expected to reach USD 8.9 Billion by 2032, growing at a CAGR of 12.29% from 2024-2032.

System Infrastructure Software Market was valued at USD 161 billion in 2023 and is expected to reach USD 297.18 billion by 2032, growing at a CAGR of 7.12% from 2024-2032.

The LTE IoT Market was valued at USD 2.7 billion in 2023 and is expected to reach USD 23.6 billion by 2032, growing at a CAGR of 27.3% over 2024-2032.

Hi! Click one of our member below to chat on Phone