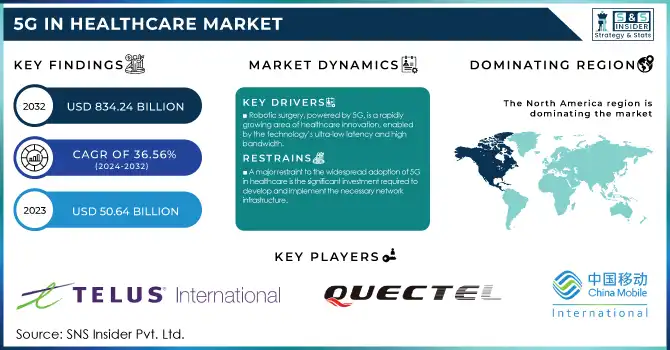

The 5G In Healthcare Market Size was valued at USD 50.64 billion in 2023 and will reach to USD 834.24 billion by 2032, and grow at a CAGR of 36.56% by 2024 to 2032.

Get More Information on 5G In Healthcare Market - Request Sample Report

The 5G in healthcare market is experiencing rapid growth, with 5G technology offering significant advancements in patient care and operational efficiency. According to a report from the FDA, 5G connectivity will enable the expansion of telehealth services, improving patient access to healthcare services, especially in rural areas. This is particularly important as around 20% of the U.S. population lives in rural areas with limited access to healthcare providers. With 5G, telemedicine can offer high-quality video consultations, enabling healthcare providers to reach these underserved populations more effectively.

One notable example is T-Mobile's partnership with LIVONGO, a health management platform, which utilizes 5G-enabled remote patient monitoring tools. This collaboration allows patients with chronic conditions, such as diabetes, to track their health data in real-time and share it with healthcare providers, facilitating faster interventions and improving outcomes. These devices, such as continuous glucose monitors, leverage 5G’s low latency for immediate data transmission, providing doctors with near-instant feedback for timely medical decisions.

Moreover, 5G is powering advancements in robotic surgery, where high-definition imaging and real-time data transfer are crucial. A key example is Intuitive Surgical, which has been testing remote robotic surgery using 5G networks. In 2021, surgeons in New York used a 5G connection to remotely control robotic arms in California, demonstrating the ability of 5G to support intricate surgical procedures without geographic constraints. This breakthrough highlights 5G's role in overcoming the limitations of traditional surgery, providing greater access to expert care, and improving surgical precision.

The application of AI and machine learning in healthcare is also accelerating due to 5G’s high bandwidth and low latency. In a 2020 study conducted by NVIDIA and GE Healthcare, AI algorithms were able to process and analyze medical imaging data in real-time, significantly reducing diagnostic times for conditions like cancer. With 5G’s ability to handle large volumes of data without delay, AI can now make faster, more accurate diagnostic predictions, improving patient outcomes.

Drivers

The growing need for remote patient care, particularly for individuals with chronic conditions, is one of the major drivers of the 5G in healthcare market.

With the proliferation of wearable devices and healthcare IoT, 5G enables real-time transmission of vital health data, such as heart rate, blood sugar, and oxygen levels, directly from patients to healthcare providers. This constant monitoring allows doctors to detect early signs of health deterioration and intervene before conditions worsen, reducing the risk of hospital admissions. 5G’s low latency and high-speed capabilities ensure that this data is transmitted with minimal delay, which is crucial for managing urgent health conditions. The ability to track patients remotely also reduces the need for in-person visits, easing the strain on healthcare systems and improving patient convenience, especially for those in rural or underserved areas.

Robotic surgery, powered by 5G, is a rapidly growing area of healthcare innovation, enabled by the technology’s ultra-low latency and high bandwidth.

5G allows for real-time transmission of high-resolution imaging and surgical commands, enabling surgeons to perform precise procedures remotely. This capability is especially beneficial in regions where access to specialized surgical care is limited, as patients can receive complex surgeries without the need for travel. Remote surgery also increases the availability of expert surgeons, who can now extend their reach globally. The integration of 5G in robotic systems allows for greater accuracy and fewer complications, as real-time feedback and control enable precise manipulation of surgical instruments. As this technology matures, it will likely become a cornerstone of future medical procedures, improving outcomes while reducing costs and recovery times for patients.

Artificial intelligence (AI) and data analytics are key drivers in the 5G healthcare market, with 5G enhancing their capabilities by providing the high-speed data transfer necessary to process large datasets quickly.

AI-powered tools are being used for a variety of applications, including medical imaging, diagnostics, and predictive analytics, all of which benefit from the real-time data transmission that 5G enables. In radiology, for example, AI algorithms analyze imaging data almost instantaneously, allowing doctors to make faster, more accurate diagnoses and improve treatment planning. Moreover, 5G enhances machine learning models that predict patient outcomes, helping healthcare providers optimize treatment plans and resource allocation. This real-time data flow also supports the development of personalized medicine, where treatments can be tailored to individual genetic profiles, increasing the efficacy of healthcare services and improving patient outcomes.

Restraints

A major restraint to the widespread adoption of 5G in healthcare is the significant investment required to develop and implement the necessary network infrastructure.

Establishing 5G networks involves building base stations, antennas, and small cells, which requires substantial capital and technical resources. This is especially challenging in rural or underserved regions where the cost of infrastructure may not provide sufficient returns. Furthermore, healthcare providers must invest in upgrading their existing systems and equipment to ensure compatibility with 5G, adding to the financial burden. Additionally, navigating through regulatory processes and obtaining approvals for new infrastructure can delay the deployment of 5G networks. These financial and logistical hurdles also pose a challenge for smaller healthcare organizations, which may not have the resources to adopt 5G technology at the same pace as larger institutions, limiting the technology’s accessibility and adoption across the sector.

By Component

In 2023, the hardware segment was the dominant component in the 5G healthcare market, holding the largest share, accounting for 70.4%. The primary reason for this dominance is the essential role of hardware, such as connected medical devices (wearables, sensors, diagnostic tools), in enabling the core functionalities of 5G in healthcare. These devices allow real-time data collection and transmission, which is crucial for patient monitoring, diagnostics, and treatment planning. Hardware is the backbone of 5G-enabled healthcare services, facilitating advancements in telemedicine, remote patient care, and healthcare automation.

The services segment is experiencing rapid growth, driven by the increasing need for network management, consulting, and support services to deploy and maintain 5G systems. As healthcare providers scale up their use of 5G-enabled devices and systems, demand for services such as 5G network optimization, integration, and maintenance is expanding rapidly.

By Application

The remote patient monitoring (RPM) application segment was the leading segment in 2023, representing around 66.2% of the market. This dominance can be attributed to the increasing reliance on IoT-enabled devices that continuously track patients’ vital signs, reducing the need for frequent hospital visits. RPM enables healthcare providers to manage chronic conditions and offer more personalized care to patients in remote locations, improving accessibility and reducing the burden on healthcare systems.

The connected medical devices segment is the fastest-growing application of 5G in healthcare, fueled by the increasing integration of advanced devices into the healthcare ecosystem. Devices such as wearable sensors, implants, smart diagnostic tools, and home-based health monitoring devices leverage 5G’s fast data transmission capabilities to deliver real-time health information to healthcare providers. These devices help in continuous patient monitoring, improving early diagnosis, and facilitating remote care.

5G In Healthcare Market Regional Outlook

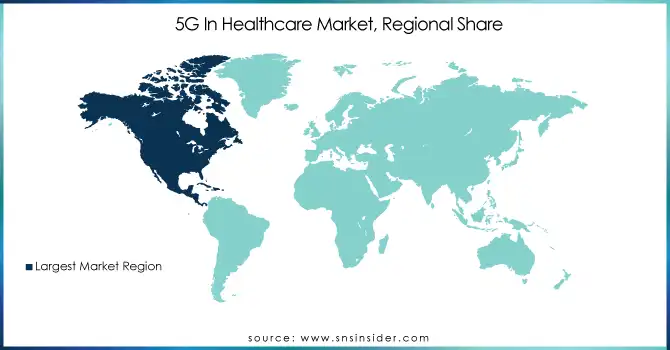

North America continued to dominate the 5G in Healthcare market in 2023, with the United States leading the charge. The country’s robust technological infrastructure, advanced healthcare networks, and substantial investments in 5G rollout are fueling widespread adoption. By 2023, over 70% of U.S. hospitals had integrated 5G technology for applications like remote patient monitoring, telemedicine, and connected devices. Government initiatives, such as funding and regulatory support, have played a critical role in accelerating 5G adoption across healthcare institutions. Investment in 5G healthcare infrastructure exceeded USD 6 billion in 2023, and this trend is expected to continue, bolstering the sector’s growth.

In contrast, the Asia-Pacific region is poised to experience the fastest growth in 5G healthcare adoption. Countries like China, Japan, and South Korea are leading efforts to implement 5G-powered healthcare solutions. South Korea, in particular, has become a pioneer, leveraging 5G for telemedicine and robotic surgery. Government-backed infrastructure expansion and investments in healthcare technology are set to boost patient care delivery and accessibility. Moreover, China has already deployed 5G in over 700 hospitals, while Japan is incorporating the technology into smart hospitals, enabling AI-driven diagnostics and real-time consultations. With the rapid development of 5G infrastructure, the region is poised to transform global healthcare, offering innovative solutions to both urban and rural populations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

China Mobile International Limited – 5G Healthcare Solutions, Remote Healthcare Monitoring, and Telemedicine Services.

Quectel – 5G IoT Modules, Healthcare Connectivity Solutions, and Smart Medical Devices.

TELUS International – TELUS 5G Health Services for Telemedicine, Remote Care, and Mobile Health Applications.

Huawei Technologies Co., Ltd. – Huawei 5G-Enabled Healthcare Solutions, Telemedicine Infrastructure, and Connected Medical Devices.

Cisco Systems, Inc. – Cisco 5G Healthcare Solutions for Telehealth Platforms and Secure Healthcare Communications.

Orange – Orange 5G-Powered Remote Monitoring Solutions, Connected Medical Devices, and Healthcare IoT.

NEC Corporation – NEC 5G Network Solutions for Healthcare, Telemedicine, and Remote Patient Management Systems.

Fibocom Wireless Inc. – 5G IoT Modules for Healthcare Devices and Connected Medical Equipment.

Qualcomm – Qualcomm 5G Chips for Healthcare Devices, Wearables, and Remote Monitoring.

Ericsson – Ericsson 5G-enabled Healthcare Network Infrastructure and IoT Solutions for Remote Patient Monitoring.

Nokia Corporation – Nokia 5G Healthcare Connectivity, Smart Medical Devices, and Remote Health Monitoring Solutions.

China Mobile Limited – 5G-Based Telehealth Solutions and Smart Healthcare Services.

Samsung Electronics Co., Ltd. – Samsung 5G-Enabled Smart Healthcare Devices, Wearables, and Mobile Health Applications.

Recent Developments

In Dec 2024, CelcomDigi, a Malaysian telecommunications provider, partnered with KPJ Healthcare to enhance healthcare tourism through 5G-powered AI and telemedicine solutions. This collaboration aims to improve remote healthcare services and support the growth of medical tourism in Malaysia by leveraging advanced technologies.

In Sept 2024, ZTE Corporation partnered with China Telecom's Suzhou Branch to implement a cutting-edge 5G IoT integration network solution at The First Affiliated Hospital of Soochow University, significantly advancing 5G-powered healthcare infrastructure. This collaboration aims to enhance hospital operations and patient care through 5G technology.

In Sept 2024, Tata Elxsi launched its 'xG-Force' 5G applications lab in Bengaluru to drive digital transformation across sectors, including healthcare. The lab aims to enhance innovation by leveraging 5G technology for advanced applications in various industries.

| Report Attributes | Details |

| Market Size in 2023 | USD 50.64 Billion |

| Market Size by 2032 | USD 834.24 Billion |

| CAGR | CAGR of 36.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component [Hardware, Services] • By Application [Remote Patient Monitoring, Connected Medical Devices, AR/VR, Connected Ambulance, Asset Tracking] • By End Use [Healthcare Providers, Healthcare Payers, Other End Users] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | China Mobile International Limited, Quectel, TELUS International, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Orange, NEC Corporation, Fibocom Wireless Inc., Qualcomm, Ericsson, Nokia Corporation, Samsung Electronics Co., Ltd. |

| Key Drivers | • The growing need for remote patient care, particularly for individuals with chronic conditions, is one of the major drivers of the 5G in healthcare market. • Robotic surgery, powered by 5G, is a rapidly growing area of healthcare innovation, enabled by the technology’s ultra-low latency and high bandwidth. • Artificial intelligence (AI) and data analytics are key drivers in the 5G healthcare market, with 5G enhancing their capabilities by providing the high-speed data transfer necessary to process large datasets quickly. |

| Restraints | • A major restraint to the widespread adoption of 5G in healthcare is the significant investment required to develop and implement the necessary network infrastructure. |

Ans: The 5G in Healthcare Market Size was valued at USD 50.64 Billion in 2023.

Ans: The 5G In Healthcare Market is to grow at a CAGR of 36.56% over the forecast period 2024-2032

Asia Pacific will hold the highest share of the global market.

Telecommunications have progressed, Low-cost sensors are available. are strict, are the drivers of Laboratory Informatics market.

AI's Importance in 5G Health, High resiliency and low latency are two of the most important factors to consider. A new wave of healthcare apps will benefit from 5G networks. are the opportunities of 5G in healthcare market.

Table of content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rate and Market Penetration (2023)

5.2 5G Network Deployment in Healthcare (2023), by Region

5.3 Usage Trends: 5G-Enabled Healthcare Applications (2020-2032)

5.4 Healthcare IT Spending on 5G, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and Promotional Activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. 5G in Healthcare Market Segmentation, by Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. 5G in Healthcare Market Segmentation, by Application

8.1 Chapter Overview

8.2 Remote Patient Monitoring

8.2.1 Remote Patient Monitoring Market Trends Analysis (2020-2032)

8.2.2 Remote Patient Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Connected Medical Devices

8.3.1 Connected Medical Devices Market Trends Analysis (2020-2032)

8.3.2 Connected Medical Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 AR/VR

8.4.1 AR/VR Market Trends Analysis (2020-2032)

8.4.2 AR/VR Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Connected Ambulance

8.5.1 Connected Ambulance Market Trends Analysis (2020-2032)

8.5.2 Connected Ambulance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Asset Tracking

8.6.1 Asset Tracking Market Trends Analysis (2020-2032)

8.6.2 Asset Tracking Market Size Estimates and Forecasts to 2032 (USD Billion)

9. 5G in Healthcare Market Segmentation, by End Use

9.1 Chapter Overview

9.2 Healthcare Providers

9.2.1 Healthcare Providers Market Trends Analysis (2020-2032)

9.2.2 Healthcare Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Healthcare Payers

9.3.1 Healthcare Payers Market Trends Analysis (2020-2032)

9.3.2 Healthcare Payers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Other End Users

9.4.1 Other End Users Market Trends Analysis (2020-2032)

9.4.2 Other End Users Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America 5G in Healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.4 North America 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.6.2 USA 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.7.2 Canada 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.8.2 Mexico 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe 5G in Healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 turkey

10.3.1.9.1 Turkey 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe 5G in Healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.7.2 France 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.8.2 UK 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific 5G in Healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.4 Asia Pacific 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.6.2 China 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.7.2 India 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.8.2 Japan 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.9.2 South Korea 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.11.2 Singapore 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.12.2 Australia 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East 5G in Healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.4 Middle East 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa 5G in Healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.4 Africa 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America 5G in Healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.4 Latin America 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.6.2 Brazil 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.7.2 Argentina 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.8.2 Colombia 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America 5G in Healthcare Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America 5G in Healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America 5G in Healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 China Mobile International Limited

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product / Services Offered

11.1.4 SWOT Analysis

11.2 Quectel

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product / Services Offered

11.2.4 SWOT Analysis

11.3 TELUS International

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product / Services Offered

11.3.4 SWOT Analysis

11.4 Huawei Technologies Co., Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product / Services Offered

11.4.4 SWOT Analysis

11.5 Cisco Systems, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product / Services Offered

11.5.4 SWOT Analysis

11.6 Orange

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product / Services Offered

11.6.4 SWOT Analysis

11.7 NEC Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product / Services Offered

11.7.4 SWOT Analysis

11.8 Fibocom Wireless Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product / Services Offered

11.8.4 SWOT Analysis

11.9 Qualcomm

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product / Services Offered

11.9.4 SWOT Analysis

11.10 Nokia Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product / Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Hardware

Services

By Application

Remote Patient Monitoring

Connected Medical Devices

AR/VR

Connected Ambulance

Asset Tracking

By End Use

Healthcare Providers

Healthcare Payers

Other End Users

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Medication Management Market Size was valued at USD 7.08 Billion in 2023 and is expected to reach USD 13.37 Billion by 2032 and grow at a CAGR of 7.66% over the forecast period 2024-2032.

The Nano Biotechnology Market Size was valued at USD 5.65 billion in 2023 and is expected to reach USD 12.99 billion by 2032 and grow at a CAGR of 9.71% over the forecast period 2024-2032.

The Healthcare Technology Management Market Size was valued at USD 7.44 billion in 2023 and is expected to reach USD 26.04 billion by 2032 and grow at a CAGR of 15.70% over the forecast period 2024-2032.

The Protein Engineering Market Size was USD 2.15 billion in 2023 and is expected to reach USD 7.39 billion by 2032 at a CAGR of 14.72% by 2024-2032.

Burial Insurance Market was valued at USD 280 billion in 2023 and is expected to reach USD 463.7 billion by 2032, growing at a CAGR of 5.8% over the forecast period 2024-2032.

The Cardiac Safety Services Market Size was valued at USD 740 Million in 2023 and is expected to reach USD 1,888.34 Million by 2032 and grow at a CAGR of 11.48% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone