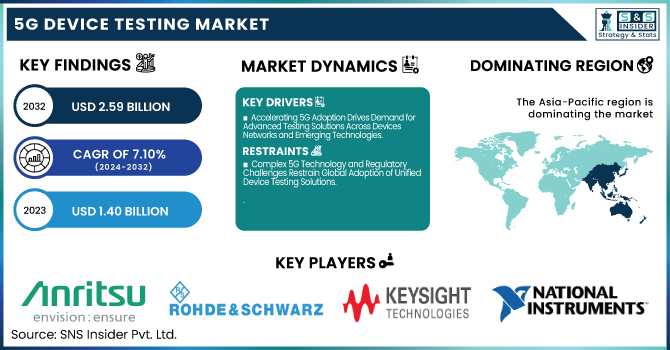

The 5G Device Testing Market was valued at USD 1.40 billion in 2023 and is expected to reach USD 2.59 billion by 2032, growing at a CAGR of 7.10% over the forecast period 2024-2032.

To Get More Information About 5G Device Testing Market - Request Free Sample Report

5G Device With the rising complexity of 5G-enabled devices and changing network standards, the market for equipment used in 5G device testing is forecasted to have higher usage. Increased prototype and production testing demands are prompting test labs to operate at ever higher capacity utilization. The technology adoption continues to be fast, particularly in mmWave and standalone 5G areas whereas the validation tools have to be more sophisticated. Also, the growing need for compliance and conformance testing as manufacturers must comply with global certification and interoperability standards is expected to boost the Market Industry. Growing adoption of 5G technologies in telecommunications, automotive, healthcare, and other sectors, has led to substantial development in the U.S. 5G device testing market. The ramp-up in availability of 5G services by the major network operators, Verizon, AT&T, and T-Mobile drew more usage out of the testing gear. Manufacturers needed to comply with stringent regulatory standards, consequently, demand for compliance and conformance testing peaked.

The U.S. 5G Device Testing Market is estimated to be USD 0.29 Billion in 2023 and is projected to grow at a CAGR of 7.45%. Growing demand for ultra-low latency and high-speed 5G connectivity in autonomous vehicles, smart cities, and industrial automation is driving the demand for the U.S. 5G device testing market. This has amplified the need for testing nationwide as private 5G networks grow, mmWave technology advances, and demand interoperability over different devices.

Key Drivers:

Accelerating 5G Adoption Drives Demand for Advanced Testing Solutions Across Devices Networks and Emerging Technologies

The global 5G device testing market is gaining traction due to the rapid rollout of 5G networks across the globe which is driving the demand for advanced testing solutions to ensure uninterrupted connectivity, ultra-low latency, and high-speed data transfer. Also, the increasing use of IoT, autonomous vehicles, and smart devices is another contributing factor to the growth of SSD Test Equipment markets, as it is mandatory to test the performance for all types of applications. At the same time, the growing number of 5G applications combined with strict regulatory standards and increasing investments in R&D by telecom equipment manufacturers and semiconductor companies continue to drive a greater need for advanced spectrum analyzers for 5G millimeter-wave, network analyzers, and oscilloscopes. In addition to that, the combination of Open RAN (O-RAN) and virtualization in the telecom infrastructure is also helping in the market growth as they need novel testing solutions to ensure network reliability and interoperability.

Restrain:

Complex 5G Technology and Regulatory Challenges Restrain Global Adoption of Unified Device Testing Solutions

The complexity of 5G technology is one of the major restraints for the 5G device testing market as the 5G device testing market needs highly specialized testing equipment and expertise. While 5G spans across several frequency bands, including mmWave, which are all more susceptible to signal interference, penetration problems, and beamforming complexity than their predecessors. To test accurately across these varied frequency ranges, we need ongoing innovations in testing methodologies and capabilities. Even currently, unequal standardization worldwide creates a bottleneck for manufacturers due to a necessity to meet various regulatory requirements and testing protocols, making global testing solutions tricky to adopt.

Opportunity:

Rising 6G Research and Private Networks Unlock New Opportunities for Advanced 5G Testing Solutions

6G being in the research and development phase also opens a massive opportunity for 5G test equipment manufacturers, as next-gen wireless will require more sophisticated tests. Additionally, the escalation from software-defined and AI-integrated testing solutions paves the way for automation-centric 5G test solutions to accelerate the time to market of 5G devices. The growing adoption of private 5G networks by many industries including manufacturing, healthcare, and smart cities opens new opportunities for dedicated testing solutions. Moreover, there is also a need for low-cost and compact portable 5G testing solutions, especially among IDMs and ODMs, which will promote innovation in payload programming with compact yet high-performance test devices.

Challenges:

Evolving Mobile Networks Demand Scalable AI Driven Testing Solutions Beyond Legacy Approaches and Traditional Tools

As 5G matures and 6G looms on the horizon, the ever-evolving nature of mobile technology presents a particular problem for test equipment vendors, which continually have to give constant updating to their solutions to align with new network designs, AI-powered optimization, and virtualized network functions (VNFs). Also, moving to more SDN and cloud-native infrastructures in telecom networks needs new testing strategies that cost companies in terms of new testing tools on a flexible, AI-driven, and automated basis. Yet, massive IoT and edge computing use cases run the risk of being strangled by legacy testing approaches, as traditional validation techniques depending on modeling prescriptive semi-analytical solutions are not scalable for very wide geographical networks needed to reach cost-optimal deployments in 5G nor validate the performance of highly distributed & ultra-low-latency 5G networks.

By Equipment Type

Spectrum analyzers accounted for 36.3% of the share in the 5G device testing market in 2023. The high percentage was due to the essentiality of spectrum analyzers in providing signal integrity, frequency accuracy, and interference level information in 5G networks. As mmWave frequencies and massive MIMO deployments continue to grow in complexity, spectrum analyzers play a critical role in delivering the confidence of proper network performance and compliance with global standards.

The network analyzers segment is projected to expand at the highest CAGR during the forecasting years from 2024 to 2032, due to the increasing demand for high-accuracy testing of 5G network parts, such as antennas, RF modules, and transmission systems. The idea of manipulating and performance validates fully open telecom infrastructure layers based on paradigms like Open RAN, software-defined network (SDN), and end-to-end AI-driven optimizations will need a lot of more comprehensive network analysis & real-time skillsets. As the 5G market expands into new areas and more functionalities, this trend will also force manufacturers to develop advanced, automated, and portable network analyzers to facilitate next-generation 5G and 6G network deployment and testing.

By Equipment Type

The 5G devices testing market in 2023 was dominated by telecom equipment manufacturers, with a 58.4% market share. This strong position was underpinned by their large investments into 5G infrastructure buildout, in terms of both base stations as well as antennas and network elements. While 5G networks continue to flourish across the globe, telecom equipment manufacturers are still utilizing ubiquitous testing solutions like spectrum analyzers, network analyzers, and signal generators to test performance, compliance, and connectivity.

From 2024-2032, IDMs (Integrated Device Manufacturers) & ODMs (Original Design Manufacturers) will have the highest CAGR. This growth is driven by the increasing demand for bespoke 5G devices, chipsets, and RF components, and also due to the wider adoption of private 5G networks in various industries. The focus has turned to AI-powered small, economic testing solutions, through which IDMs & ODMs are earmarking funds for cutting-edge testing tools to fast-track product innovation and time-to-market.

In 2023, the 5G device testing market in Asia Pacific accounted for the largest revenue share of 36.8%, owing to extensive 5G rollouts in multiple active markets, continuous government and financial backing, and unlimited innovations in 5G in China, Japan, South Korea, India, and other Asia Pacific nations. With top telecom companies including Huawei and ZTE operating across the country, China has attempted a more massive deployment of 5G base stations and networks, generating a high demand for test solutions. With a mmWave 5G technology leadership role assumed by Samsung, South Korea has quickly increased demand for interpreters and system analyzers. Meanwhile, the rollout of 5G in India aided by Reliance Jio and Bharti Airtel is driving testing solutions in this sector as well.

From 2024-2032, North America is anticipated to experience the highest CAGR, thanks to rising investments in 5G and 6G research, private 5G networks, and Open RAN technology. Of course, the USA having its market leaders for telecom like Qualcomm, Verizon, and AT&T is spending aggressively on testing and validation of 5G devices to make sure that they can provide the best network experience. Likewise, Keysight Technologies and Rohde & Schwarz are further innovating 5G testing solutions in response to increasing demand in the industry. The growth of 5G test devices in North America will be propelled by the need for the expansion of smart cities, autonomous vehicles, industrial IoT, and automation.

Get Customized Report As Per Your Business Requirement - Enquiry Now

Anritsu (MT8000A Radio Communication Test Station),

Rohde & Schwarz (R&S®CMX500 5G One-Box Signaling Tester),

Keysight Technologies (Keysight UXM 5G Wireless Test Platform),

National Instruments Corp. (NI TestStand),

Teradyne, Inc. (UltraFLEX Test System),

Advantest Corporation (V93000 SoC Test System),

SPEA (Flying Probe Testers),

FormFactor (Autonomous RF Measurement Assistant),

Viavi Solutions Inc. (TM500 Network Tester),

LitePoint (IQgig-5G Non-Signaling Test Solution),

Spirent Communications (Spirent 8100 Mobile Device Test System),

Teledyne LeCroy (Frontline X500 Wireless Protocol Analyzer),

EXFO Inc. (EXFO 5GPro Test Solution),

Rohm Semiconductor (LAPIS Development Board for 5G Testing),

Tektronix (Tektronix RSA5000 Real-Time Spectrum Analyzer).

In August 2024, Anritsu enhanced its ME7873NR Lite Model, transforming it into a one-box tester for 5G RF and protocol conformance testing, reducing test time by 20%.

In March 2025, Rohde & Schwarz and Pegatron 5G showcased a new O-RU test solution using the PVT360A at MWC 2025, enhancing Open RAN production testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.40 Billion |

| Market Size by 2032 | USD 2.59 Million |

| CAGR | CAGR of 7.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment Type (Oscilloscopes, Signal Generators, Spectrum Analyzers, Network Analyzers, Others) • By End Use (IDMs & ODMs, Telecom Equipment Manufacturer) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Anritsu, Rohde & Schwarz, Keysight Technologies, National Instruments Corp., Teradyne, Inc., Advantest Corporation, SPEA, FormFactor, Viavi Solutions Inc., LitePoint, Spirent Communications, Teledyne LeCroy, EXFO Inc., Rohm Semiconductor, Tektronix. |

Ans: The 5G Device Testing Market is expected to grow at a CAGR of 7.10% during 2024-2032.

Ans: 5G Device Testing Market size was USD 1.40 Billion in 2023 and is expected to Reach USD 2.59 Billion by 2032.

Ans: The major growth factor of the 5G device testing market is the global rollout of complex 5G networks, driving demand for advanced, high-frequency, and automated testing solutions.

Ans: The Spectrum Analyzers segment dominated the 5G Device Testing market in 2023.

Ans: Asia Pacific dominated the 5G Device Testing Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Equipment Usage Trends

5.2 Test Lab Capacity Utilization

5.3 Technology Adoption Rates

5.4 Compliance & Conformance Testing Demand

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. 5G Device Testing Market Segmentation, By Equipment Type

7.1 Chapter Overview

7.2 Oscilloscopes

7.2.1 Oscilloscopes Market Trends Analysis (2020-2032)

7.2.2 Oscilloscopes Market Size Estimates and Forecasts to 2032 (USD BILLION)

7.3 Signal Generators

7.3.1 Signal Generators Market Trends Analysis (2020-2032)

7.3.2 Signal Generators Market Size Estimates and Forecasts to 2032 (USD BILLION)

7.4 Spectrum Analyzers

7.4.1 Spectrum Analyzers Market Trends Analysis (2020-2032)

7.4.2 Spectrum Analyzers Market Size Estimates and Forecasts to 2032 (USD BILLION)

7.5 Network Analyzers

7.5.1 Network Analyzers Market Trends Analysis (2020-2032)

7.5.2 Network Analyzers Market Size Estimates and Forecasts to 2032 (USD BILLION)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD BILLION)

8. 5G Device Testing Market Segmentation, By End Use

8.1 Chapter Overview

8.2 IDMs & ODMs

8.2.1 IDMs & ODMs Market Trends Analysis (2020-2032)

8.2.2 IDMs & ODMs Market Size Estimates and Forecasts to 2032 (USD BILLION)

8.3 Telecom Equipment Manufacturer

8.3.1 Telecom Equipment Manufacturer Market Trends Analysis (2020-2032)

8.3.2 Telecom Equipment Manufacturer Market Size Estimates and Forecasts to 2032 (USD BILLION)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America 5G Device Testing Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.2.3 North America 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.2.4 North America 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.2.5 USA

9.2.5.1 USA 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.2.5.2 USA 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.2.6 Canada

9.2.6.1 Canada 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.2.6.2 Canada 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.2.7 Mexico

9.2.7.1 Mexico 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.2.7.2 Mexico 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe 5G Device Testing Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.3.1.3 Eastern Europe 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.1.4 Eastern Europe 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.1.5 Poland

9.3.1.5.1 Poland 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.1.5.2 Poland 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.1.6 Romania

9.3.1.6.1 Romania 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.1.6.2 Romania 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.1.7 Hungary

9.3.1.7.1 Hungary 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.1.7.2 Hungary 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.1.8 turkey

9.3.1.8.1 Turkey 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.1.8.2 Turkey 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.1.9.2 Rest of Eastern Europe 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe 5G Device Testing Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.3.2.3 Western Europe 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.4 Western Europe 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.5 Germany

9.3.2.5.1 Germany 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.5.2 Germany 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.6 France

9.3.2.6.1 France 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.6.2 France 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.7 UK

9.3.2.7.1 UK 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.7.2 UK 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.8 Italy

9.3.2.8.1 Italy 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.8.2 Italy 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.9 Spain

9.3.2.9.1 Spain 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.9.2 Spain 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.10.2 Netherlands 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.11.2 Switzerland 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.12 Austria

9.3.2.12.1 Austria 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.12.2 Austria 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.3.2.13.2 Rest of Western Europe 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific 5G Device Testing Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.4.3 Asia Pacific 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.4 Asia Pacific 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.5 China

9.4.5.1 China 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.5.2 China 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.6 India

9.4.5.1 India 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.5.2 India 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.5 Japan

9.4.5.1 Japan 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.5.2 Japan 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.6 South Korea

9.4.6.1 South Korea 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.6.2 South Korea 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.7 Vietnam

9.4.7.1 Vietnam 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.2.7.2 Vietnam 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.8 Singapore

9.4.8.1 Singapore 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.8.2 Singapore 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.9 Australia

9.4.9.1 Australia 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.9.2 Australia 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.4.10.2 Rest of Asia Pacific 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East 5G Device Testing Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.5.1.3 Middle East 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.1.4 Middle East 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.1.5 UAE

9.5.1.5.1 UAE 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.1.5.2 UAE 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.1.6 Egypt

9.5.1.6.1 Egypt 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.1.6.2 Egypt 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.1.7.2 Saudi Arabia 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.1.8 Qatar

9.5.1.8.1 Qatar 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.1.8.2 Qatar 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.1.9.2 Rest of Middle East 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa 5G Device Testing Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.5.2.3 Africa 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.2.4 Africa 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.2.5 South Africa

9.5.2.5.1 South Africa 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.2.5.2 South Africa 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.2.6.2 Nigeria 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.5.2.7.2 Rest of Africa 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America 5G Device Testing Market Estimates and Forecasts, by Country (2020-2032) (USD BILLION)

9.6.3 Latin America 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.6.4 Latin America 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.6.5 Brazil

9.6.5.1 Brazil 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.6.5.2 Brazil 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.6.6 Argentina

9.6.6.1 Argentina 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.6.6.2 Argentina 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.6.7 Colombia

9.6.7.1 Colombia 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.6.7.2 Colombia 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America 5G Device Testing Market Estimates and Forecasts, By Equipment Type (2020-2032) (USD BILLION)

9.6.8.2 Rest of Latin America 5G Device Testing Market Estimates and Forecasts, By End Use (2020-2032) (USD BILLION)

10. Company Profiles

10.1 Anritsu

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Rohde & Schwarz

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Keysight Technologies

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 National Instruments

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Teradyne, Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Advantest Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 SPEA

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 FormFactor

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Viavi Solutions Inc

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 LitePoint

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Equipment Type

Oscilloscopes

Signal Generators

Spectrum Analyzers

Network Analyzers

Others

By End Use

IDMs & ODMs

Telecom Equipment Manufacturer

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Semi-Insulating Silicon Carbide Wafer Market Size was valued at USD 521.85 million in 2023 and is expected to grow at 20.20% CAGR During 2024-2032.

The Torque Sensor Market size is expected to be valued at USD 7.28 Billion in 2023. It is estimated to reach USD 11.88 Billion by 2032, growing at a CAGR of 5.64% during 2024-2032.

The Wafer Process Control Equipment Market Size was valued at USD 7.93 billion in 2023 and is estimated to reach USD 14.06 billion by 2032 and grow at a CAGR of 6.52% over the forecast period 2024-2032.

The Foot Ulcer Sensors Market size was valued at USD 163.03 Million in 2023 and expected to reach USD 224.46 Million by 2032 with a growing CAGR of 3.62% over the forecast period of 2024-2032.

The Next Generation Display Market was valued at USD 208.08 billion in 2023 and is expected to reach USD 417.61 billion by 2032, growing at a CAGR of 8.09% over the forecast period 2024-2032.

The Multi-touch Screen Market was USD 14.46 Billion in 2023 and is expected to reach USD 41.73 Billion by 2032 and grow at a CAGR of 12.54% by 2024-2032.

Hi! Click one of our member below to chat on Phone