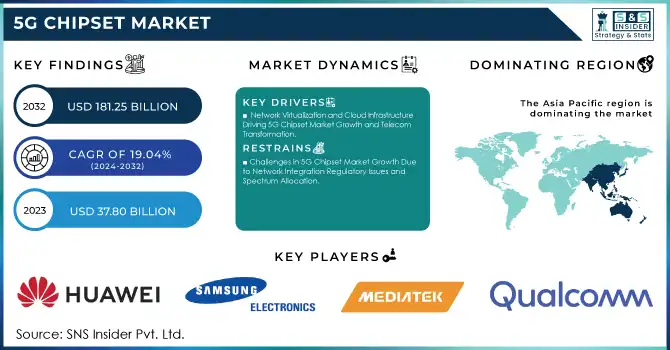

The 5G Chipset Market Size was valued at USD 37.80 Billion in 2023 and is expected to reach USD 181.25 Billion by 2032 and grow at a CAGR of 19.04% over the forecast period 2024-2032.

Get more information on 5G Chipset Market - Request Sample Report

Demand for faster, more reliable, and efficient communication networks is skyrocketing 5G chipset market is expanding well with profitability. 5G technology is witnessing a wave of innovation among the services and applications it is being integrated into as it offers higher speeds, low latency, and wider bandwidth than earlier generations of mobile networks. Consequently, there has been a consistent increase in the adoption of 5G-capable devices such as smartphones, tablets, wearables, and connected cars, driving the need for high-performance chips that can handle these high-performance applications. Moreover, industries such as IT & Telecoms, manufacturing, and health care are adopting 5G to improve operational efficiencies, real-time data transmission, and raising the Internet of Things (IoT). Global 5G connections neared 2 billion by Q1 2024, having added 185 million connections in the quarter. Global shipments of 5G-enabled smartphones are estimated to reach 50% by the end of 2024. By the year 2025, the globally connected car count is expected to be more than 400 million, while V2X communication has become possible with the technology of 5G. With increased health monitoring and data processing capabilities, the market for 5G-enabled wearables is predicted to pass the 200 million units mark in 2025.

Additionally, an increasing number of new applications such as augmented reality (AR), virtual reality (VR), smart cities, and autonomous vehicles are also aiding the growth of this market. The technologies require high-speed data processing and low latency, which can only be achieved with 5g chipsets. As telecommunications providers and industries continue to invest in infrastructure for deploying 5G networks, the market for advanced chipsets will surely expand as well. Rapidly evolving consumer use cases and ongoing worldwide rollout of 5G infrastructure will likely keep the 5G chipset market on its growth spurt for years to come. Global investment in smart city technologies could be as high as USD 2.7 trillion by 2025, requiring 5G networks to process 5G data in real-time. In 2030, there will be 30 million autonomous vehicles on the road, and it is 5G that will take care of V2V and V2I communication. At a global level, as of 2023, there are 25.6 million 5G IoT connections on the planet and this number is expected to continue rising, especially as 5G solely device-enabled devices increase.

KEY DRIVERS:

Network Virtualization and Cloud Infrastructure Driving 5G Chipset Market Growth and Telecom Transformation

Demand for network virtualization and cloud-based infrastructure will be one of the important markets driving the growth of the 5G chipset market. As 5G comes into play, telecom companies are more and more transitioning toward virtualized and would reasonably be able to cloud local arrange engineering. This shift allows networks to be built in a more scalable, flexible, and cost-effective manner, with 5G chipsets playing a significant role in enabling this transition. Cloud tech enables operators to support larger volumes of data traffic and deliver a better-performing network without the investment in new hardware. Moreover, network slicing where a physical network is partitioned into multiple virtual networks for different needs depends on 5G chipsets to control the dynamic allocation of data channels, optimizing resource use for specific services. This change in the network infrastructure is fueling the need for these types of advanced chipsets, for them to be able to support these technologies. A 5G-enabled edge cloud infrastructure and network slicing will be required to handle the onset of 5G global data traffic which is expected to surpass 60 exabytes per month by 2025. It is expected that 60% of the infrastructure will be moved to cloud environments, which will provide scalability and also reduce hardware expenses, by 2025 for the telecom companies. Telecom operators will spend more than USD 2 billion on network function virtualization (NFV) technologies by 2024, helping to fast-track the migration to cloud-native architecture.

Rapid 5G Expansion in Developing Economies Driving Demand for Low-Cost Chipsets and Devices

With more 5G networks being deployed across the world, especially in developing economies, the technology is rolling out faster than anticipated to help close the digital divide. Coupled with that, these regions are laying large amounts of investments in constructing 5G infrastructure to grow economic growth and enhance connectivity and emerging industries. The ramp-up of 5G in these markets will create strong demand for low-cost 5G chipsets capable of serving a wide array of devices from smartphones to industrial IoT systems. Moreover, as mobile operators and service providers from such areas roll out affordable 5G plans, there will be significant growth in the shipment of 5G-enabled devices, thus escalating the demand for chipsets. There are numerous reasons to believe that the 5G expansion effort towards emerging economies will expedite the rollout of 5G infrastructure to reach new heights in the chipset market. Connections Global 5G connections grew to 2 billion in Q1 2024, with 185 million new connections added in that quarter. In SA, MTN launched the MTN Icon 5G smartphone (opens in new tab) available at just 2,499 rand (~USD 138), making it easy for more users to experience 5G. In addition, Ericson won a contract to supply 5G equipment to Vodafone Idea in India for USD 3.6 billion Africa will hit the milestone of more than 150 million 5G subscriptions by 2027, compared to fewer than 4 million in 2023. In 2024, more than 50 mobile operators in high-growth markets initiated 5G trials and services.

RESTRAIN:

Challenges in 5G Chipset Market Growth Due to Network Integration Regulatory Issues and Spectrum Allocation

The complexity of network integration and interoperability is one of the major challenges that are hindering the growth of the 5G chipset market. Even as 5G networks are rolled out around the world, it is not trivial to match new 5G chipsets to existing infrastructure. Telecom operators need to ensure that 5G devices and networks work with existing systems and can transfer between different frequency bands and across regional transportation. That is a huge leap in technology with a great deal of testing needed to ensure that devices can perform consistently and reliably across diverse network landscapes. The other 5G chipsets supporting issues are regulatory and spectrum allocation. The distribution of the 5G spectrum in each country is regulated and each government has different policies over time, causing a delay in the development of 5G networks. Governments around the world need to find ways to deal with these regulatory barriers and provide spectrum availability, which will influence the opportunity of 5G networks and hence the availability and uptake of 5G chipsets internationally.

BY TYPE

Radio Frequency Integrated Circuits (RFICs) led in 2023, with a total market share of 41.5%, due to their role as the backbone of 5G communication systems by providing continuous signal processing across multiple frequency bands. RFICs have led to an increase in RFIC demand due to the need to deploy 5G infrastructure including macro base stations, small cells, etc, and densify existing networks, with the use of RFICs necessary for both uplink and downlink. This trend combined with the transition to high-frequency bands such as millimeter wave (mmWave) means that RFICs must address moving forward increasingly complex RF challenges, including signal loss and interference. The RFICs also facilitate MIMO (Multiple-Input Multiple-Output), which provides faster transmission speed and efficient spectral usage. This versatility in supporting various devices from smartphones to industrial IoT applications cements their place as the dominant players in the market.

Modems are projected to register the highest CAGR from 2024 to 2032 attributed to their key function in supporting 5G connectivity among consumers and enterprise devices. As the global race towards adoption heats up, there will be a significant rise in demand for devices that support embedded 5G modems smartphones, tablets, laptops, and wearables. In addition, the modem technology development like mmWave supporting and Sub-6 GHz frequency and dynamic spectrum sharing is extending their boundary and usage. The 5G modems enable high-speed, low-latency connectivity that is critical for emerging applications such as augmented reality (AR), virtual reality (VR), autonomous vehicles, and industrial IoT. The modem sector buried the record and is the fastest-growing category in the market increasingly driven by the lower cost of 5G devices, paired with the deployment of 5G networks in developing economies.

BY DEPLOYMENT TYPE

Smartphones and tablets dominated the 2023 market share with 43.2%. Consumer demands for higher internet speeds, better streaming, and an upgrade to mobile gaming have played a large role in the transition from 4G to 5G. For example, many of the most popular smartphone makers released 5G-compatible devices, including low-cost offerings aimed at emerging markets. We adopt these devices, thanks to their ubiquitousness and the speed of 5G network rollout. The telecom operators have also aggressively marketed 5G-capable handsets by bundling them with competitive 5G data tariffs, forcing their dominance on the market. There were other tablet beneficiaries from this type of development, especially in the educational, enterprise, and entertainment sectors, where mobility and new levels of connectivity made a lot of sense.

Connected devices which include IoT devices, wearables, smart home devices, and industrial IoT applications, will continue to experience the fastest CAGR growth based on increasing IoT ecosystem and reliance on 5G. With ultra-low latency, massive device connectivity, and reliable communication delivering new use cases for connected devices in areas such as healthcare, manufacturing, and transportation, 5G networks is enabling these capabilities at scale. The growth of things such as 5G-enabled wearables improve real-time health monitoring, and smart home devices are also aided by 5G with better integration for advanced automation. The use of the 5G technology in Industrial IoT, especially for manufacturing and logistics, is advancing smart factories, predictive maintenance, and real-time supply chain tracking. Rapid growth in the number of 5G-enabled IoT devices deployed in both consumer and enterprise sectors is helping propel their fast-growing adoption rate, making connected devices a major market growth driver in the following years.

BY PROCESSING NODE

In 2023, 7 nm processing node accounted for 57.5% of the market share as it is the standard for advanced semiconductor manufacturing. The sub-6GHz band is the perfect mix of speed, power consumption, and price, and is the most common frequency in 5G chipsets, and for phones, tablets, and IoT devices. This makes it a popular choice among OEMs for handling high frequencies, enabling complex tasks, including those driven by AI, and supporting high-speed connectivity with 5G. 7nm li technology also reached mass production maturity which also guarantees cost efficiency and high yields and 7nm li 2WD also further strengthens market dominance. The 7 nm process has become the most advanced technology used to manufacture 5G chipsets, as major leading semiconductor houses such as TSMC and Samsung have optimized their 7 nm processes.

The 10 nm processing node is projected to witness the strongest CAGR over the forecast period from 2024-2032, as its use in particular 5G applications will continue to increase, as end-users are looking for cost-effective solutions, requiring the utmost performance. With 5G rolling out into emerging markets and consumer demand for low-power, lower-cost devices on the rise, 10 nm chipsets offer a sweet spot in delivering enough performance for the company's true mainstream devices at a more economical production cost. Moreover, the original 10 nm is starting to support more energy-efficient designs too, which could be of real interest to IoT and connected devices with strict power efficiency requirements. Also, with the semiconductor industry tightening its manufacturing processes, the 10 nm node is becoming popular for mid-range 5G devices which will make sure that we will see fast adoption and growth of this node in the following years.

BY OPERATING FREQUENCY

In 2023, the Sub-6 GHz frequency band occupied a substantial share of 53.6%, as it is generally used in the first stage of 5G network construction. The frequency range strikes a balance in coverage and performance, making it suitable for wide deployment in urban, suburban, and rural areas. The frequency is widely used by telecom operators who are seeking to provide wider 5G coverage, thanks to its provision of more reliable connectivity over longer ranges and through obstacles such as buildings. Furthermore, the Sub-6 GHz frequency band is largely compatible with 5G devices like smartphones, tablets, and IoT devices, which supports its prevalence. In addition to this, Governments and regulatory bodies have also dedicated Sub-6 GHz spectrum on higher priorities, and hence expect fast deployment around the world.

The 24–39 GHz frequency band, under the millimeter wave (mmWave) spectrum, is expected to have the fastest growth rate (CAGR) from 2024 to 2032 because it provides ultra-high data rates with lower latency. This spectrum band is getting widely adopted for high-capacity use cases including its usage in enhanced mobile broadband, fixed wireless access, and industrial automation. As telecom infrastructure matures, operators are turning to 24 – 39 GHz to serve high-bandwidth applications in dense urban areas, large stadiums, and smart-city deployments. Additionally, the emergence of advanced antenna technologies (e.g., Massive MIMO, beamforming) is addressing issues of limited range and dependence on line-of-sight conditions, further unlocking mmWave deployments. With the increase in penetration of mmWave-enabled devices and the increasing investments in 5G infrastructure worldwide.

BY VERTICAL

In 2023, IT & Telecom led the market share with 38.6% as 5G acts as a catalyst to adopt new technology. The big stakeholders in deploying and utilizing 5G networks to improve communication services, data transfer speed, and network reliability are telecom operators and IT companies. 5G-enabled devices are being deployed in droves and the sector has poured heavily on the associated infrastructure, including base stations and small cells, along with cloud-native and containerized architectures. In addition, the IT & Telecom sector gains from the immediate requirement for improved network capabilities needed to enable applications like cloud computing, video conferencing, and remote work, which experienced a sharp rise after COVID-19. IT & Telecom firmly held a strong place in the market, as they require 5G connectivity for smooth functioning.

The Manufacturing industry is projected to dominate the CAGR for 2024 to 2032 owing to the rise in the deployment of 5G-driven smart manufacturing tools. With 5G connectivity that enables time-sensitive applications such as real-time monitoring, predictive maintenance, and automation, factories can streamline operations, improve efficiency, and lower costs. As Industry 4.0 ramped up, manufacturers are using 5G for industrial IoT (IIoT) solutions, robotics & augmented reality (AR) for assembly & quality control. In addition, the high speed and high reliability of 5G networks are an ideal environment for enabling innovative technologies like digital twins and autonomous systems in manufacturing. Due to the quest for global competitiveness, investors are channeling funds into 5G for industrial automation through better-functioning manufacturing, which is projected as a high-growth vertical in the future.

Asia Pacific contributed to 43.3% of the total share of the 5G chipset market in 2023, which can be attributed to its high 5G adoption along with superior manufacturing skills in the region. Nations like China, South Korea, and Japan are at the forefront of the development of 5G networks. China Mobile, China Telecom, and China Unicom combined deployed hundreds of thousands of 5G base stations, establishing China as the largest 5G market in the world. With major telecom companies such as SK Telecom and KT Corporation pioneering 5G-based applications, including gaming and VR, South Korea became the first nation to offer nationwide 5G services in October 2023. Japan, too, has pumped money into 5G in readiness for mass-scale events such as the Olympics, where NTT Docomo and KDDI are boosting 5G usage across consumer and industrial markets. On top of that, Asia Pacific is already leading in global semiconductor manufacturing as TSMC and Samsung secure their dominance in the 5G chipset market.

North America is anticipated to grow at the highest CAGR through 2024 – 2032. Particularly the US is using the 5G to push new developments in autonomous vehicles, smart cities, and industrial automation. Verizon, AT&T, and T-Mobile are pouring money into 5G rollouts, with T-Mobile's low-band spectrum blanketing enormous swathes of the country. It is also unlocking advances in mmWave deployment for urban high-speed mobility. Additionally, we've seen rapid growth of 5G in industries like healthcare, with companies such as Qualcomm and Intel enabling remote surgeries and telemedicine. Investments in 5G for rural digitization and smart agriculture in Canada are also adding to the expansion. This development makes North America a hot spot for the 5G chipset market.

Need any customization research on 5G Chipset Market - Enquiry Now

Some of the major players in the 5G Chipset Market are:

Qualcomm Technologies, Inc. (Snapdragon X70 5G Modem-RF System, Snapdragon 8 Elite)

MediaTek Inc. (Dimensity 9000, Dimensity 1200)

Samsung Electronics Co., Ltd. (Exynos 2200, Exynos 2100)

Huawei Technologies Co., Ltd. (Kirin 9000, Balong 5000)

Intel Corporation (XMM 8160 5G modem, Atom P5900)

Broadcom Inc. (BCM43752, BCM4389)

NXP Semiconductors N.V. (Layerscape Access LA1200, QorIQ LS1046A)

Qorvo, Inc. (QM19000, QPF4006)

Skyworks Solutions, Inc. (Sky5® RF Front-End Solutions, SKY66423-11)

Analog Devices, Inc. (ADRV9026, AD9375)

Marvell Technology Group Ltd. (OCTEON Fusion, Prestera DX)

Unisoc Communications, Inc. (T7520, T7510)

ZTE Corporation (ZX297520, ZX297510)

Apple Inc. (Custom 5G modem in development)

NVIDIA Corporation (Mellanox ConnectX-6 Dx, BlueField-2 DPU)

Infineon Technologies AG (BGT60TR13C, BGT24MTR11)

Texas Instruments Incorporated (AWR6843AOP, DRA829V)

Xilinx, Inc. (Zynq UltraScale+ RFSoC, Versal AI Core)

Renesas Electronics Corporation (R-Car M3, RZ/G2M)

Anokiwave, Inc. (AWMF-0156, AWMF-0123)

Some of the Raw Material Suppliers for 5G Chipset Companies:

BASF SE

LG Chem Ltd.

Indium Corporation

KYOCERA Corporation

DuPont de Nemours, Inc.

Rogers Corporation

Soitec

GlobalFoundries Inc.

Samsung Electronics Co., Ltd.

In July 2024, Qualcomm launched the Snapdragon 4s Gen 2 chip, aiming to bring gigabit 5G to smartphones under USD 99, targeting 2.8 billion users globally. Xiaomi will debut the chip in a smartphone expected by the end of 2025.

In December 2024, MediaTek launched the Dimensity 8400, the first all-big core chip designed for premium smartphones, offering enhanced performance for high-end devices. The new chip is set to elevate the mobile experience with improved processing power and efficiency.

In September 2024, Qualcomm announced a new agreement with Apple to supply chips for its devices, marking a significant collaboration between the two companies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 37.80 Billion |

| Market Size by 2032 | USD 181.25 Billion |

| CAGR | CAGR of 19.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Modems, RFICs, Millimeter Wave Integrated Circuit (mmWave IC), Cellular Integrated Circuit (Cellular IC), Others) • By Deployment Type (Smartphone/Tablets, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, Others) • By Processing Node (7 nm, 10 nm, Others) • By Operating Frequency (Sub-6 GHz, 24-39 GHz, above 39 GHz) • By Vertical (Manufacturing, Energy & Utilities, Media & Entertainment, IT & Telecom, Transportation & Logistics, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm Technologies, Inc., MediaTek Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Intel Corporation, Broadcom Inc., NXP Semiconductors N.V., Qorvo, Inc., Skyworks Solutions, Inc., Analog Devices, Inc., Marvell Technology Group Ltd., Unisoc Communications, Inc., ZTE Corporation, Apple Inc., NVIDIA Corporation, Infineon Technologies AG, Texas Instruments Incorporated, Xilinx, Inc., Renesas Electronics Corporation, Anokiwave, Inc. |

| Key Drivers | • Network Virtualization and Cloud Infrastructure Driving 5G Chipset Market Growth and Telecom Transformation • Rapid 5G Expansion in Developing Economies Driving Demand for Low-Cost Chipsets and Devices |

| Restraints | • Challenges in 5G Chipset Market Growth Due to Network Integration Regulatory Issues and Spectrum Allocation |

Ans: The 5G Chipset Market is expected to grow at a CAGR of 19.04% during 2024-2032.

Ans: The 5G Chipset Market size was USD 37.80 billion in 2023 and is expected to Reach USD 181.25 billion by 2032.

Ans: The major growth factor of the 5G chipset market is the increasing global demand for 5G-enabled devices and infrastructure.

Ans: The Sub-6 GHz segment dominated the 5G Chipset Market in 2023.

Ans: Asia Pacific dominated the 5G Chipset Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 5G Chipset Adoption Rate (2023)

5.2 5G Chipset OEM Adoption Rate (2023)

5.3 5G Chipset R&D Investment

5.4 5G Chipset Deployment in IoT

5.5 5G Chipset Consumer Demand Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. 5G Chipset Market Segmentation, By Type

7.1 Chapter Overview

7.2 Modems

7.2.1 Modems Market Trends Analysis (2020-2032)

7.2.2 Modems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 RFICs

7.3.1 RFICs Market Trends Analysis (2020-2032)

7.3.2 RFICs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Millimeter Wave Integrated Circuit (mmWave IC)

7.4.1 Millimeter Wave Integrated Circuit (mmWave IC) Market Trends Analysis (2020-2032)

7.4.2 Millimeter Wave Integrated Circuit (mmWave IC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Cellular Integrated Circuit (Cellular IC)

7.5.1 Cellular Integrated Circuit (Cellular IC) Market Trends Analysis (2020-2032)

7.5.2 Cellular Integrated Circuit (Cellular IC) Market Size Estimates and Forecasts to 2032 (USD Billion) 7.4 Services

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. 5G Chipset Market Segmentation, By Deployment Type

8.1 Chapter Overview

8.2 Smartphone/Tablets

8.2.1 Smartphone/Tablets Market Trends Analysis (2020-2032)

8.2.2 Smartphone/Tablets Market Size Estimates and Forecasts To 2032 (USD Billion)

8.3 Connected Vehicles

8.3.1 Connected Vehicles Market Trends Analysis (2020-2032)

8.3.2 Connected Vehicles Market Size Estimates and Forecasts To 2032 (USD Billion)

8.4 Connected Devices

8.4.1 Connected Devices Market Trends Analysis (2020-2032)

8.4.2 Connected Devices Market Size Estimates and Forecasts To 2032 (USD Billion)

8.5 Broadband Access Gateway Devices

8.5.1 Broadband Access Gateway Devices Market Trends Analysis (2020-2032)

8.5.2 Broadband Access Gateway Devices Market Size Estimates and Forecasts To 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

9. 5G Chipset Market Segmentation, By Processing Node

9.1 Chapter Overview

9.2 7 nm

9.2.1 7 nm Market Trends Analysis (2020-2032)

9.2.2 7 nm Market Size Estimates and Forecasts To 2032 (USD Billion)

9.3 10 nm

9.3.1 10 nm Market Trends Analysis (2020-2032)

9.3.2 10 nm Market Size Estimates and Forecasts To 2032 (USD Billion)

9.4 Others

9.4.1 Others Market Trends Analysis (2020-2032)

9.4.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

10. 5G Chipset Market Segmentation, By Operating Frequency

10.1 Chapter Overview

10.2 Sub-6 GHz

10.2.1 Sub-6 GHz Market Trends Analysis (2020-2032)

10.2.2 Sub-6 GHz Market Size Estimates and Forecasts To 2032 (USD Billion)

10.3 24-39 GHz

10.3.1 24-39 GHz Market Trends Analysis (2020-2032)

10.3.2 24-39 GHz Market Size Estimates and Forecasts To 2032 (USD Billion)

10.4 Above 39 GHz

10.3.1 Above 39 GHz Market Trends Analysis (2020-2032)

10.3.2 Above 39 GHz Market Size Estimates and Forecasts To 2032 (USD Billion)

11. 5G Chipset Market Segmentation, By Vertical

11.1 Chapter Overview

11.2 Manufacturing

11.2.1 Manufacturing Market Trends Analysis (2020-2032)

11.2.2 Manufacturing Market Size Estimates and Forecasts To 2032 (USD Billion)

11.3 Energy & Utilities

11.3.1 Energy & Utilities Market Trends Analysis (2020-2032)

11.3.2 Energy & Utilities Market Size Estimates and Forecasts To 2032 (USD Billion)

11.4 Media & Entertainment

11.4.1 Media & Entertainment Market Trends Analysis (2020-2032)

11.4.2 Media & Entertainment Market Size Estimates and Forecasts To 2032 (USD Billion)

11.5 IT & Telecom

11.5.1 IT & Telecom Market Trends Analysis (2020-2032)

11.5.2 IT & Telecom Market Size Estimates and Forecasts To 2032 (USD Billion)

11.6 Transportation & Logistics

11.6.1 Transportation & Logistics Market Trends Analysis (2020-2032)

11.6.2 Transportation & Logistics Market Size Estimates and Forecasts To 2032 (USD Billion)

11.7 Healthcare

11.7.1 Healthcare Market Trends Analysis (2020-2032)

11.7.2 Healthcare Market Size Estimates and Forecasts To 2032 (USD Billion)

11.8 Others

11.8.1 Others Market Trends Analysis (2020-2032)

11.8.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America 5G Chipset Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America 5G Chipset Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12.2.4 North America 5G Chipset Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.2.5 North America 5G Chipset Market Estimates and Forecasts, By Processing Node (2020-2032) (USD Billion)

12.2.6 North America 5G Chipset Market Estimates and Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.2.7 North America 5G Chipset Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA 5G Chipset Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12.2.8.2 USA 5G Chipset Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.2.8.3 USA 5G Chipset Market Estimates and Forecasts, By Processing Node (2020-2032) (USD Billion)

12.2.8.4 USA 5G Chipset Market Estimates and Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.2.8.5 USA 5G Chipset Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada 5G Chipset Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12.2.9.2 Canada 5G Chipset Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.2.9.3 Canada 5G Chipset Market Estimates and Forecasts, By Processing Node (2020-2032) (USD Billion)

12.2.9.4 Canada 5G Chipset Market Estimates and Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.2.9.5 Canada 5G Chipset Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico 5G Chipset Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12.2.10.2 Mexico 5G Chipset Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.2.10.3 Mexico 5G Chipset Market Estimates and Forecasts, By Processing Node (2020-2032) (USD Billion)

12.2.10.4 Mexico 5G Chipset Market Estimates and Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.2.10.5 Mexico 5G Chipset Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe 5G Chipset Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe 5G Chipset Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe 5G Chipset Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe 5G Chipset Market Estimates and Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe 5G Chipset Market Estimates and Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe 5G Chipset Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland 5G Chipset Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.8.2 Poland 5G Chipset Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland 5G Chipset Market Estimates and Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.1.8.4 Poland 5G Chipset Market Estimates and Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.1.8.5 Poland 5G Chipset Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania 5G Chipset Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.9.2 Romania 5G Chipset Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania 5G Chipset Market Estimates and Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.1.9.4 Romania 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.1.9.5 Romania 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.10.2 Hungary 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.1.10.4 Hungary 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.1.10.5 Hungary 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.11.2 Turkey 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.1.11.4 Turkey 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.1.11.5 Turkey 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe 5G Chipset Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.4 Western Europe 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.6 Western Europe 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.7 Western Europe 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.8.2 Germany 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany 5G Chipset Market Estimates And Forecasts, By Material Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.4 Germany 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.8.5 Germany 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.9.2 France 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.9.3 France 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.9.4 France 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.9.5 France 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.10.2 UK 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.10.3 UK 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.10.4 UK 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.10.5 UK 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.11.2 Italy 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.11.4 Italy 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.11.5 Italy 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.12.2 Spain 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.12.4 Spain 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.12.5 Spain 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.15.2 Austria 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.15.4 Austria 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.15.5 Austria 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific 5G Chipset Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.4 Asia Pacific 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.6 Asia Pacific 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.7 Asia Pacific 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.8.2 China 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.8.3 China 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.8.4 China 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.8.5 China 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.9.2 India 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.9.3 India 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.9.4 India 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.9.5 India 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.10.2 Japan 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.10.3 Japan 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.10.4 Japan 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.10.5 Japan 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.11.2 South Korea 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.11.3 South Korea 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.11.4 South Korea 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.11.5 South Korea 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.12.2 Vietnam 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.12.4 Vietnam 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.12.5 Vietnam 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.13.2 Singapore 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.13.3 Singapore 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.13.4 Singapore 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.13.5 Singapore 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.14.2 Australia 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.14.3 Australia 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.14.4 Australia 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.14.5 Australia 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East 5G Chipset Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.4 Middle East 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.1.5 Middle East 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.1.6 Middle East 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.1.7 Middle East 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.8.2 UAE 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.1.8.3 UAE 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.1.8.4 UAE 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.1.8.5 UAE 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.9.2 Egypt 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.1.9.4 Egypt 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.1.9.5 Egypt 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.11.2 Qatar 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.1.11.4 Qatar 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.1.11.5 Qatar 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa 5G Chipset Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.4 Africa 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.2.5 Africa 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.2.6 Africa 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.2.7 Africa 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.8.2 South Africa 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.2.8.4 South Africa 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.2.8.5 South Africa 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America 5G Chipset Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.4 Latin America 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.6.5 Latin America 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.6.6 Latin America 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.6.7 Latin America 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.8.2 Brazil 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.6.8.3 Brazil 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.6.8.4 Brazil 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.6.8.5 Brazil 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.9.2 Argentina 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.6.9.3 Argentina 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.6.9.4 Argentina 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.6.9.5 Argentina 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.10.2 Colombia 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.6.10.3 Colombia 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.6.10.4 Colombia 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.6.10.5 Colombia 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America 5G Chipset Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America 5G Chipset Market Estimates And Forecasts, By Deployment Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America 5G Chipset Market Estimates And Forecasts, By Processing Node (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America 5G Chipset Market Estimates And Forecasts, By Operating Frequency (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America 5G Chipset Market Estimates And Forecasts, By Vertical (2020-2032) (USD Billion)

13. Company Profiles

13.1 Qualcomm Technologies, Inc.

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 MediaTek Inc

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Samsung Electronics Co., Ltd.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Huawei Technologies Co., Ltd

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Intel Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Broadcom Inc.

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 NXP Semiconductors N.V

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Qorvo, Inc.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Skyworks Solutions, Inc

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Analog Devices, Inc

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Modems

RFICs

Millimeter Wave Integrated Circuit (mmWave IC)

Cellular Integrated Circuit (Cellular IC)

Others

By Deployment Type

Smartphone/Tablets

Connected Vehicles

Connected Devices

Broadband Access Gateway Devices

Others

By Processing Node

7 nm

10 nm

Others

By Operating Frequency

Sub-6 GHz

24-39 GHz

Above 39 GHz

By Vertical

Manufacturing

Energy & Utilities

Media & Entertainment

IT & Telecom

Transportation & Logistics

Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Application Performance Monitoring Market was valued at USD 7.26 Billion in 2023 and is expected to reach USD 22.81 Billion by 2032, growing at a CAGR of 34.61% over the forecast period 2024-2032.

The Physical Security Information Management Market was valued at USD 3.61 billion in 2023 and is expected to reach USD 12.0 Billion by 2032, growing at a CAGR of 21.30% from 2024-2032.

The Predictive Analytics Market size was valued at USD 13.5 billion in 2023 and will grow to USD 82.9 billion by 2032 and grow at a CAGR of 22.4 % by 2032.

The Enterprise Networking Market Size was valued at USD 153.51 Billion in 2023 and will reach USD 284.44 Billion by 2032 and grow at a CAGR of 7.1% by 2032.

Explore Big Data and Analytics in the GCC Market, covering trends in digital transformation, AI, and data-driven decision-making. Learn how GCC countries are leveraging big data in industries like finance, healthcare, and government for growth and efficie

The IoT Security Market was valued at USD 25 billion in 2023 and is expected to reach USD 153.44 billion by 2032, growing at a CAGR of 22.40% by 2032.

Hi! Click one of our member below to chat on Phone