3D Snapshot Sensor Market Size & Overview:

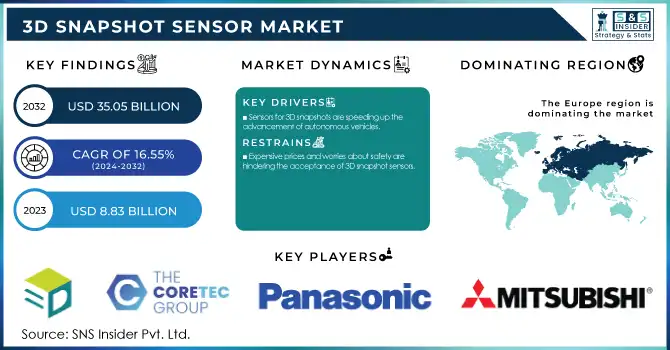

The 3D Snapshot Sensor Market size was valued at USD 8.83 Billion in 2023 and is Projected to reach USD 35.05 Billion by 2032 and growing at a CAGR of 16.55% over the forecast period of 2024-2032.

The growing automation scene, known for its increasing need for accuracy and productivity, has brought 3D snapshot sensors to the forefront. The IFR highlights this trend, predicting a worldwide industrial robot inventory of around 3.2 million units by 2023. The increase in robotic usage in various sectors has paved the way for the development of 3D snapshot sensor technology.

Get More Information on 3D Snapshot Sensor Market - Request Sample Report

These sensors play a crucial role in enhancing industrial processes by capturing high-resolution 3D data in real time. In quality control, their precise defect detection ability ensures only compliant products progress, reducing waste and improving product quality. Additionally, incorporating 3D snapshot sensors into automated systems speeds up production cycles and reduces errors by providing precise measurements and real-time data analysis. The IFR's detailed report on industrial robots, gathering information from close to 40 nations, offers important perspectives on the worldwide robotics industry. It explores topics like robot density, which is the number of robots per 10,000 employees and a crucial measure of automation adoption. Although the main emphasis of the report is on industrial robots, it also indirectly points out the increasing need for technologies such as 3D snapshot sensors that support advancements in automation. As industries globally aim for improved operations, the combination of 3D snapshot sensors and industrial robots is set to transform manufacturing and related industries. Their combined skills have the ability to increase productivity, cut costs, and raise product quality to a higher level.

Advancements in sensor technology are driving growth in the 3D snapshot sensor market. These progressions result in enhanced performance in key automation factors: resolution, speed, and miniaturization. High-resolution sensors are able to capture more precise details in 3D images, which are important for accurate tasks such as quality control and robotic vision. The use of 2K and 4K sensors has greatly enhanced precision in measurement and inspection within industrial automation. This results in less defects being missed and ultimately, better quality products. Advancements in sensor velocity make data capture and processing quicker. This is a revolutionary development in high-speed manufacturing environments, where quick inspection and immediate decision-making are crucial. Current sensors have the ability to record tens of thousands of frames in a single second, greatly enhancing the effectiveness of automated systems. Compact and portable devices can now incorporate 3D sensors due to miniaturization. This paves the way for use in medical devices, consumer electronics, and mobile robotics. More compact, stronger sensors allow for adaptable and multifaceted use, broadening their influence in various sectors. These progressions in 3D camera sensor technology perfectly align with the expanding Internet of Things (IoT) environment. Memoori forecasts a 13.7% compound annual growth rate for commercial smart building IoT devices market, with an estimated worth of 3.25 billion by 2028. Yet, this extensive volume of data frequently goes unused. This is where AI and Machine Learning (ML) are utilized. Through the analysis of sensor data, AI and ML have the potential to enable facilities managers to improve space utilization and enhance the experience of employees. Real-time location systems (RTLS) use sensor data to monitor the movements of individuals and equipment in a specific area. ML-enhanced real-time location systems can merge this information with cutting-edge analytics, establishing a potent tool for enhancing efficiency in various sectors.

| Report Attributes | Details |

|---|---|

| Key Segments | • By Type (Stereoscopic Camera And Time-Of-Flight (TOF) Camera) •By Application (Quality Inspection, Robotic Application, Automotive, Industrial, Automation, Consumer Electronics) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3DFusion, Coretec Group, Inc., Panasonic Corporation, Mitsubishi, LMI Technologies, Cognex Corporation, Keyence , Gocato, Lumen tum Operations LLC , Sony Corporation, Omni Vision Technologies |

3D Snapshot Sensor Market Dynamics

Drivers

Advancing Robotic Uptake through 3D Snapshot Sensors

The growing robotics sector, with a 5% increase in industrial robot installations reaching 553,052 units in 2022, is a promising market for 3D snapshot sensor technology. These sensors give robots the power to sense their surroundings in three dimensions, greatly improving their ability to navigate, detect obstacles, and manipulate objects. In industries such as manufacturing and logistics, 3D snapshot sensors play a crucial role in helping robots accurately find, grab, and handle items. This accuracy leads to improved efficiency, lower mistake levels, and boosted output. China, the dominant global manufacturing power, showcases a strong market potential for 3D snapshot sensors with 290,258 robot installations in 2022.With the growing presence of robotics in different industries like automotive and electronics, there is predicted to be a significant increase in the need for advanced sensor technology. The industry's push for automation and efficiency is well-matched by the accuracy and dependability provided by 3D snapshot sensors. Countries in Asia, Europe, and the Americas are leading the robotics market, paving the way for 3D snapshot sensors to have a significant impact on the future of automation.

Sensors for 3D snapshots are speeding up the advancement of autonomous vehicles.

The automotive sector is experiencing a significant change due to progress in advanced driver-assistance systems (ADAS) and autonomous driving technologies. At the core of this transformation are 3D imaging sensors, which are quickly becoming essential parts. These sensors capture detailed 3D images of the vehicle's environment to offer important information for immediate decision-making. In Advanced Driver Assistance Systems (ADAS), they improve road safety by enhancing features such as lane departure warning and adaptive cruise control. 3D snapshot sensors are essential for autonomous vehicles as they are responsible for providing accurate environmental mapping, object detection, and path planning capabilities. There is vast potential in autonomous driving. By 2035, this technology is expected to create revenue ranging from USD 300 billion to USD 400 billion according to estimates. Despite some remaining challenges, it is clear that the industry is dedicated, as evidenced by large companies making significant investments in research and development. As self-driving technology advances, the need for advanced sensors such as 3D snapshot systems will increase. The automotive industry is on track for a significant transformation with advancements in safety, convenience, and innovative business models. 3D snapshot sensors are leading the way in this change, spurring creativity and molding the future of transportation.

Restraints

Expensive prices and worries about safety are hindering the acceptance of 3D snapshot sensors.

The 3D snapshot sensor market is encountering major obstacles because of expensive prices and increasing security concerns. The manufacturing costs are high due to the use of advanced technology and specific materials in the production of these sensors. Small and medium-sized enterprises (SMEs) frequently face high costs for investment, which restrict their ability to enter new markets. Furthermore, the incorporation and upkeep of these sensors demand significant retypes, increasing the overall cost of ownership.

Although the advantages of 3D snapshot sensors are significant, overcoming cost-related barriers is necessary for their widespread use. As the IoT ecosystem grows, worries about data security and privacy become increasingly prominent. Sensor networks are at risk of cyber-attacks, requiring strong security measures to mitigate the threat. The urgent need for strong security protocols is emphasized by the potential USD 120 billion economic impact of a significant IoT breach. In order to maximize the benefits of 3D snapshot sensors, the sector needs to prioritize lowering costs through methods like increasing production volume and improving technology. At the same time, it is crucial to make a focused attempt to improve data security and privacy in order to establish trust and confidence in these technologies.

Challenges in technology are delaying the widespread use of 3D snapshot sensors.

The challenges of implementing 3D snapshot sensors across a wide range are due to their intricate nature. These sensors depend on advanced technology, such as high-quality imaging systems and complicated algorithms. The requirement of specific expertise to use and upkeep these systems results in a challenging learning process for potential users. Precise calibration is necessary to guarantee the precision of 3D snapshot sensors. This procedure requires a significant amount of time and necessitates specific tools and skills. The complexities of calibration can discourage businesses from incorporating these sensors into their operations. In order to address these obstacles, the sector needs to commit to developing easy-to-use interfaces, streamlining calibration procedures, and implementing thorough training initiatives. By overcoming these technical obstacles, the full potential of 3D snapshot sensors can be achieved.

3D Snapshot Sensor Market Segment Analysis

By Type

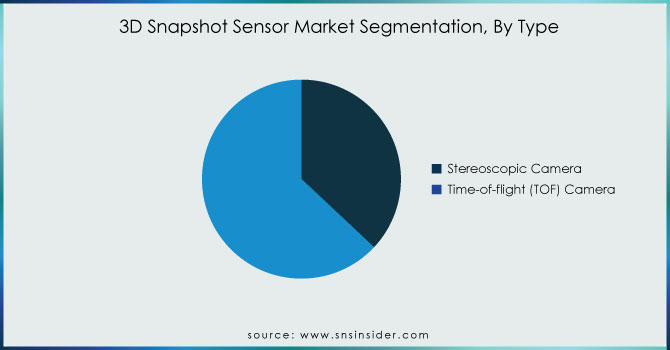

Based on Type, Time-of-flight (TOF) camera dominated the 3D Snapshot Sensor Market with 64% of share in 2023. TOF cameras use time-of-flight technology to gauge distances by sending out infrared light pulses and determining the time it takes for them to return. This allows for accurate 3D scanning, essential for many different sectors. Devices such as the iPhone 12, iPhone 13, and Samsung Galaxy S20+ utilize Sony TOF sensors powered by lasers to improve augmented reality capabilities and depth information. TOF sensors are utilized for more than just commercial purposes, as they are also being used in innovative ways such as identifying hidden spy cameras, highlighting their flexibility.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application

Based on Application, Robotic Application dominated the 3D Snapshot Sensor Market with 44% of share in 2023. The widespread use of 3D snapshot sensors in different robotic tasks like navigation, obstacle avoidance, and quality control is what makes this sector so influential. These sensors play a crucial role in modern robotics by providing essential real-time 3D perception for intelligent interaction with the surroundings. Robots utilize 3D snapshot sensors to capture precise images of their surroundings, enabling them to map the environment and recognize objects and obstacles accurately. These sensors are also used in quality control and inspection tasks for robots. In the manufacturing sector, robots utilize 3D imaging to examine products for flaws and guarantee they adhere to quality requirements.

3D Snapshot Sensor Market Regional Outlook

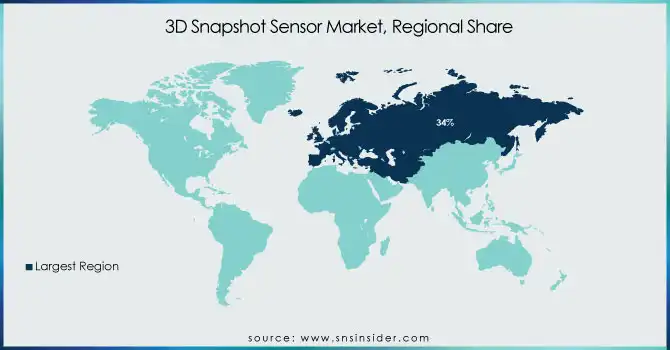

Europe dominates the worldwide 3D snapshot sensor market with a significant 34% share in 2023 fueled by the strong automotive and consumer electronics industries. Germany, especially, has a significant role in the growing smartphone industry. The area's strong automotive industry, shown by 298 assembly plants and 18.8 million vehicles produced, drives the need for sophisticated sensors. Europe's dominance in automotive patents, accounting for 33.3%, reinforces its status as a center for innovation. Europe is seen as a crucial growth driver for 3D snapshot sensor technology due to its dynamic automotive sector and expanding consumer electronics market.

In 2023, Asia Pacific is leading the way in the growth of the 3D snapshot sensor market with a 25% market share. The quick expansion is fueled by the area's growing use of 3D snapshot sensors in different applications, especially in vision-guided robotic systems and advanced manufacturing processes. These sensors allow robots to carry out intricate activities like accurate object detection, navigation, and manipulation with great precision. Utilization of automation, robotics, and Industry 4.0 technologies is rapidly becoming more prevalent across Southeast Asia. Enterprises are automating procedures, integrating IoT sensors, and utilizing data analytics to make more informed decisions. Additionally, the focus on environmental issues is leading to a trend towards sustainable methods of manufacturing.

Key players

Some of the major key players in the 3DFusion, Coretec Group, Inc., Panasonic Corporation, Mitsubishi, LMI Technologies, Cognex Corporation, Keyence , Gocato, Lumen tum Operations LLC , Sony Corporation, Omni Vision Technologies, and other Players .

RECENT DEVELOPMENT

-

In December 2023,Configuring machine vision inspections in 3D is now possible in a ‘snapshot’, due to the combination of SICK’s powerful and compact Visionary-T Mini AP camera with the new easy-to-use SICK Nova 3D Presence Inspection sensor App. The SICK Visionary-T Mini AP uses best-in-class time-of-flight snapshot technology to set new standards of data accuracy for detailed environmental perception at rapid production speeds.

-

In Dec 2021 Precision sensor manufacturer Micro-Epsilon has extended its surface Control range of high precision 3D snapshot measurement sensors for automated, inline measurement of geometry, shape and surface quality of objects.

| Report Attributes | Details |

| Market Size in 2023 | USD 8.83 Billion |

| Market Size by 2032 | USD 35.05 Billion |

| CAGR | CAGR of 16.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers |

|

| Restraints |

|