3D Printing Plastics Market Report Scope & Overview:

The 3D Printing Plastics Market Size was valued at USD 1.6 billion in 2023 and is expected to reach USD 10.0 billion by 2032 and grow at a CAGR of 22.6% over the forecast period 2024-2032.

Get more information on the 3D Printing Plastics Market - Request a Sample Report

The 3D printing plastics market is experiencing rapid advancements, driven by increasing demand across healthcare, automotive, aerospace, and consumer goods. Key market dynamics include material innovation, recyclability, and enhanced performance characteristics. The development of solvent-free 3D printing materials in October 2024 by a collaborative effort highlights the push for sustainable manufacturing. This material innovation enables better performance while aligning with environmental goals. Similarly, the introduction of new materials like SAF Polypropylene in September 2024 by Tri-Tech 3D underscores the emphasis on expanding material options to meet diverse industry needs. These advancements enhance application versatility, allowing for greater adoption in high-demand areas like prototyping and end-use production.

Recent company initiatives further demonstrate the momentum in this market. Jamplast launched a dedicated unit for 3D printing materials in August 2024, reinforcing the importance of distribution channels tailored to advanced polymers. In March 2024, researchers at the University of Maine worked on recycling wind turbine blades into 3D printing materials, showcasing how sustainability is being integrated into the supply chain. Nexa3D's acquisition of Essentium in January 2024 strengthened its portfolio in additive manufacturing, allowing for the development of cutting-edge 3D printing plastics. In September 2021, BigRep introduced a dry cabinet for 3D printing materials, addressing the need for maintaining material integrity during storage. These developments collectively underscore how technological advancements and strategic collaborations are driving innovation in the 3D printing plastics market, ensuring its growth and application expansion.

Market Dynamics:

Drivers:

-

Increasing Adoption of 3D Printing in Healthcare Enhances Material Demand for Medical Devices and Prosthetics

The adoption of 3D printing technologies in the healthcare sector has led to significant demand for specialized 3D printing plastics, especially for medical devices, prosthetics, and implants. These materials are chosen for their ability to be customized to meet the specific needs of individual patients, allowing for improved comfort, functionality, and recovery times. Plastics such as polylactic acid (PLA), polyamide, and polyethylene terephthalate glycol (PETG) are highly sought after for their biocompatibility, strength, and flexibility. For example, 3D printing allows the creation of patient-specific surgical guides, implants, and anatomical models, which are essential in planning complex surgeries. The medical sector also benefits from reduced lead times, as 3D printing allows for rapid prototyping and on-demand production of devices. Moreover, the growing trend of personalized medicine, where treatments are tailored to individual patients, further drives the demand for 3D printed medical solutions. The aging global population and the increasing need for customized treatments also contribute to the steady expansion of this market.

-

Advancements in Material Innovations, Including Solvent-Free and High-Performance Polymers, Drive Market Expansion

-

Growing Emphasis on Sustainable and Recyclable Materials in Additive Manufacturing

Sustainability is a major driver of growth in the 3D printing plastics market as companies across industries strive to meet increasing environmental regulations and consumer demand for eco-friendly products. The production of 3D printing materials from recyclable or renewable resources, such as bioplastics, plays a crucial role in reducing the environmental footprint of additive manufacturing. As companies explore ways to minimize waste and improve the recyclability of 3D printing plastics, many have turned to recycled polymers, which are increasingly being integrated into 3D printing filament production. This trend not only addresses sustainability concerns but also supports the growing demand for green manufacturing solutions. For example, some companies are recycling industrial waste, such as wind turbine blades, into 3D printing materials, further advancing the push for circular economy practices. The introduction of sustainable materials, including bio-based plastics like PLA and composites made from natural fibers, is allowing industries to reduce their reliance on petroleum-based plastics. This aligns with the growing trend of environmentally conscious consumerism and regulations promoting waste reduction. As sustainable and recyclable materials become more available and efficient, the 3D printing plastics market is expected to benefit from an expanding range of environmentally friendly options, offering substantial growth opportunities.

Restraint:

-

High Initial Costs of 3D Printing Technologies and Materials Limit Adoption in Price-Sensitive Industries

While 3D printing offers numerous advantages, such as design flexibility, faster prototyping, and reduced material waste, the high initial costs associated with 3D printing technologies and materials remain a significant barrier to wider adoption. The price of 3D printers, especially those capable of producing high-quality parts, can be prohibitively expensive for small and medium-sized enterprises (SMEs), which limits their ability to fully leverage these technologies. Additionally, many advanced 3D printing plastics, such as carbon fiber-reinforced polymers and high-temperature thermoplastics, come with a higher price tag compared to traditional materials. The cost of raw materials, including specialized filaments and resins, further increases production expenses. For industries with tight budgets, such as small-scale manufacturing and prototyping firms, the high upfront investment can be a deterrent. This cost barrier is compounded by the need for skilled operators to run the equipment and maintain quality control. While the long-term savings in reduced material waste and faster production times may offset these costs, the initial capital investment remains a significant restraint, especially in price-sensitive industries like consumer goods and electronics, where margins can be thin.

Opportunity:

-

Expanding Use of 3D Printing Plastics in Electric Vehicles and Renewable Energy Applications

-

Rising Investments in Research and Development Drive New Material Innovations and Market Growth

The 3D printing plastics market is benefiting from a growing investment in research and development (R&D), which is driving innovation and the creation of new materials. Many companies are focused on developing polymers with improved properties, such as enhanced mechanical strength, heat resistance, and flexibility. Additionally, there is a significant push for materials that are biodegradable or recyclable, addressing the increasing demand for sustainability. R&D in the 3D printing space also extends to developing specialized materials for specific applications, such as medical devices, aerospace, and automotive parts. The continuous improvement of these materials allows for a broader range of applications, helping companies expand their product offerings and penetrate new industries. As the market grows, further innovations in material science will likely lead to more affordable, high-performance 3D printing plastics, making this technology more accessible to industries and accelerating its adoption. Investments in R&D, particularly in high-performance and sustainable materials, will continue to drive market expansion.

Challenge:

-

Lack of Standardization in Material Properties and Manufacturing Processes Hinders Market Adoption

A key challenge in the 3D printing plastics market is the lack of standardization in material properties and manufacturing processes. With various materials and technologies available, ensuring consistent quality and performance is difficult, particularly when printing large volumes of parts. Variability in properties like strength, flexibility, and heat resistance can lead to inconsistent results. The absence of industry-wide standards for material compatibility, printer settings, and post-processing techniques further complicates industrial adoption. This lack of standardization poses barriers for industries requiring reliable, repeatable results, limiting the widespread use of 3D printing for mass production. Developing universal standards will be essential to drive broader market acceptance.

Consumer Sentiment and Market Perception in the 3D Printing Plastics Market

|

Aspect |

Description |

|

Adoption Barriers |

Consumers perceive high costs of 3D printers and materials as barriers to widespread adoption. |

|

Sustainability Concerns |

Growing concerns about the environmental impact of traditional plastics drive interest in eco-friendly alternatives. |

|

Quality and Reliability |

Consumers prioritize the consistency and quality of 3D printed products, affecting the choice of materials and printers. |

|

Speed of Production |

Speed remains a key factor, with slow production rates in some 3D printing technologies affecting market perception. |

|

Material Variety and Performance |

The need for a broader range of performance-specific materials influences consumer decisions and applications. |

Consumer sentiment and market perception towards 3D printing plastics are influenced by several key factors. High upfront costs for printers and materials are seen as major adoption barriers. Sustainability is a significant concern, with more consumers seeking eco-friendly alternatives to traditional plastics. In terms of product quality, consumers demand consistent results and reliable performance, which impacts material selection. The speed of production is another important consideration, as slower processes in some 3D printing technologies may deter large-scale industrial applications. Additionally, the desire for a broader variety of high-performance materials tailored to specific use cases remains an essential aspect for consumers in choosing 3D printing solutions.

Key Market Segments

By Type

In 2023, Polylactic Acid (PLA) dominated the 3D printing plastics market, with a market share of 35%. PLA is derived from renewable resources, such as corn starch or sugarcane, which makes it a popular choice for environmentally conscious consumers. Its biodegradable nature appeals to industries aiming to reduce their environmental footprint. The material is known for its ease of printing and versatility, making it suitable for a variety of applications, from rapid prototyping to end-use parts in consumer products. PLA offers good mechanical properties, including decent tensile strength and flexibility, while being relatively low-cost compared to other materials. Additionally, the low printing temperature required for PLA makes it compatible with most desktop 3D printers, further enhancing its adoption among hobbyists and professionals alike. Leading companies in the 3D printing sector continue to develop new PLA formulations, including blends with other polymers to enhance specific characteristics such as heat resistance and durability. This ongoing innovation ensures PLA remains at the forefront of the 3D printing plastics market.

By Form

In 2023, the Filament segment dominated the 3D printing plastics market, holding a substantial market share of 50%. Filament is the most widely used form in consumer and industrial 3D printing due to its accessibility and ease of use. This form is compatible with a majority of desktop 3D printers, making it a go-to choice for hobbyists and professionals alike. The filament-based printing process allows for a broad range of materials, including PLA, ABS, PETG, and Nylon, which cater to various applications and performance requirements. The flexibility of using different filament materials enables users to select the most suitable option for their specific needs, whether it’s for prototyping, tooling, or end-use parts. Furthermore, advancements in filament technology, such as the introduction of composite filaments infused with carbon fiber or metal powders, have expanded the possibilities for creating high-performance parts. This growth in filament options continues to drive market demand, as users seek materials that offer improved strength, durability, and aesthetic appeal for their 3D-printed products.

By Application

In 2023, Prototyping application dominated the 3D printing plastics market, capturing a significant market share of 45%. Prototyping is a crucial phase in product development, allowing designers and engineers to create rapid physical models of their concepts. The advantages of 3D printing for prototyping include the ability to quickly iterate designs, test fit and functionality, and gather user feedback before moving to mass production. This process significantly reduces lead times and costs compared to traditional manufacturing methods. Various industries, such as automotive, aerospace, and consumer goods, leverage 3D printing for prototyping to innovate and refine their products. For instance, automotive manufacturers use 3D-printed prototypes for design validation and testing, allowing them to enhance vehicle components before full-scale production. Additionally, the flexibility of 3D printing enables the production of complex geometries and customized parts, further enhancing the prototyping process. As companies continue to prioritize rapid innovation and responsiveness to market demands, the prototyping application of 3D printing plastics is expected to maintain its strong position in the market.

By End-use Industry

In 2023, the Automotive industry dominated the 3D printing plastics market, with a market share of 30%. The automotive sector has increasingly adopted 3D printing technologies to enhance various aspects of production, including prototyping, tooling, and manufacturing. The ability to quickly create prototypes allows automotive companies to streamline the design process and reduce time-to-market for new models. Additionally, 3D printing facilitates the production of complex and lightweight components, contributing to overall vehicle efficiency and performance. Major automotive manufacturers, such as Ford and BMW, have integrated 3D printing into their production workflows, using it for both functional prototypes and end-use parts. This integration not only accelerates innovation but also reduces material waste and lowers production costs. The customization capabilities of 3D printing enable manufacturers to produce tailored components that meet specific requirements, enhancing vehicle personalization. As the automotive industry continues to embrace advanced manufacturing technologies, the demand for 3D printing plastics is expected to grow, further solidifying its dominance in this sector.

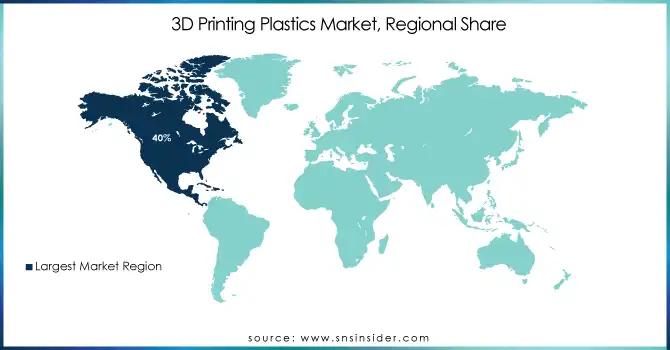

Regional Analysis

In 2023, North America dominated the 3D printing plastics market with a market share of 40%. The region's leadership can be attributed to its highly advanced manufacturing infrastructure, strong adoption of 3D printing technologies, and significant investments in research and development. The United States, in particular, has emerged as the key driver, with a robust presence of leading companies such as Stratasys, 3D Systems, and Materialise. The country’s manufacturing and automotive industries leverage 3D printing for rapid prototyping, tooling, and end-use parts, making it a major market for 3D printing plastics. In addition, sectors like healthcare, aerospace, and electronics in the U.S. have increasingly adopted 3D printing for medical device production, aircraft parts, and custom electronic components. The demand for 3D printing plastics is further bolstered by the government’s support for advanced manufacturing initiatives, including funding for R&D programs and tax incentives for innovation. Canada and Mexico also contribute to the North American market's dominance, with the growing adoption of 3D printing across industries such as automotive and aerospace. Major automotive companies like Ford and General Motors have incorporated 3D printing for rapid prototyping and custom tooling, driving further growth in the region.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the 3D printing plastics market, with a CAGR of 25%. The rapid expansion of the 3D printing market in this region can be attributed to the increasing adoption of advanced manufacturing technologies across various industries, including automotive, electronics, healthcare, and consumer goods. China stands as the dominant player in the Asia-Pacific market, supported by its large-scale manufacturing base and government initiatives to promote 3D printing adoption. The country’s ambitious goals to become a global leader in additive manufacturing, combined with significant investments in 3D printing research and development, have fostered substantial growth. China’s automotive and electronics industries, in particular, are increasingly utilizing 3D printing for prototyping, tooling, and the production of customized components. Japan and South Korea are also contributing to the region's growth, with industries such as aerospace, automotive, and healthcare investing heavily in 3D printing technologies. For example, Japan’s major automotive manufacturer Toyota has been using 3D printing to create lightweight car parts and prototype components, contributing to the market's expansion. The availability of cost-effective 3D printing materials and the rise of small and medium enterprises (SMEs) investing in 3D printing technologies in India and Southeast Asia also play a crucial role in the region’s rapid growth, further cementing Asia-Pacific as a key player in the 3D printing plastics market.

Get a Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

3D Systems Corporation (VisiJet, DuraForm)

-

Arkema S.A. (Rilsan, Kepstan)

-

BASF SE (Ultrafuse, Ultramid)

-

Covestro AG (Addigy, Makrolon)

-

DuPont (Zytel, Hytrel)

-

EOS GmbH Electro Optical Systems (PA 2200, Alumide)

-

Evonik Industries (VESTOSINT, INFINAM)

-

Formlabs (Standard Resins, Tough Resins)

-

GE Additive (AP&C Powders, Arcam EBM Powders)

-

Henkel (Loctite 3D Printing Resins, Technomelt)

-

HP Inc. (HP High Reusability PA 12, HP 3D High Reusability PP)

-

Materialise NV (Magics Software, OnSite Materials)

-

Protolabs (Nylon, ABS-Like Resin)

-

SABIC (ULTEM, LEXAN)

-

Sinterit (PA12 Smooth, Flexa Grey)

-

Solvay S.A. (KetaSpire, Radel)

-

Stratasys, Inc. (FDM Nylon 12CF, PolyJet Resins)

-

Ultimaker (Tough PLA, PETG)

-

Voxeljet AG (PMMA, Phenolic Resins)

-

Zortrax (Z-ABS, Z-ULTRAT)

Recent Developments

-

September 2024: Tri-Tech 3D launched SAF polypropylene for 3D printing, enhancing strength and durability for functional prototypes and production parts in industries like automotive and healthcare.

-

August 2024: Jamplast opened a new unit to develop specialized 3D printing materials, catering to industries such as automotive, aerospace, and medical.

-

December 2023: Shenzhen Esun acquired Hi-Tech Changjiang PLA Co., enhancing its sustainable 3D printing plastics portfolio with expertise in PLA yarn and non-woven fabric production.

-

October 2023: Arkema teamed up with EOS, HP, and Stratasys to develop sustainable 3D printing materials, including HP 3D High Reusability PA12S, to minimize waste and improve application performance.

-

March 2023: Solvay and Airborne received funding to develop lightweight composite battery enclosures for electric vehicles and aircraft, focusing on weight reduction and composite waste reuse.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.6 Billion |

| Market Size by 2032 | US$ 10.0 Billion |

| CAGR | CAGR of 22.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Photopolymers, Polylactic Acid (PLA), Acrylonitrile Butadiene Styrene (ABS), Polyamide (Nylon), Polycarbonate (PC), Others) •By Form (Powder, Filament, Liquid) •By Application (Prototyping, Tooling, Manufacturing) •By End-Use Industry (Aerospace & Defense, Healthcare, Automotive, Electronics & Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3D Systems Corporation, Stratasys, Inc., Covestro AG, Arkema S.A., Evonik Industries, BASF SE, Solvay S.A., Henkel, EOS GmbH Electro Optical Systems, SABIC and other key players |

| Key Drivers | •Advancements in Material Innovations, Including Solvent-Free and High-Performance Polymers, Drive Market Expansion •Growing Emphasis on Sustainable and Recyclable Materials in Additive Manufacturing |

| RESTRAINTS | •High Initial Costs of 3D Printing Technologies and Materials Limit Adoption in Price-Sensitive Industries |