Get More Information on 3D Printing Materials Market - Request Sample Report

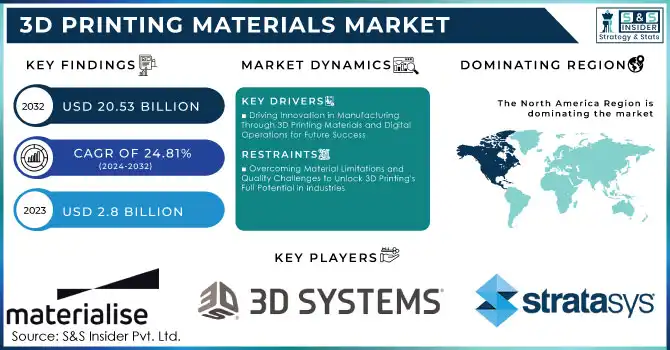

The 3D Printing Materials Market size was valued at USD 2.8 Billion in 2023 and is expected to reach USD 20.53 Billion by 2032 and grow at a CAGR of 24.81% during the forecast period of 2024-2032.

The 3D printing material market is growing due to the advancement of 3D printing technology which has been one of the main drivers for 3D printing materials. As a result of technological advancements, led to the specific requirements of industries and the diversification of materials based on their origin, chemical composition, performance, and other features. For example, 3D-printed metals can withstand high temperatures, and they have been used more frequently in the automotive and aerospace industries. As for polymers, they are mainly applied in 3D printing household appliances and larger objects due to the cheap price of the production and relatively low functionality. Simultaneously, such a widespread application of various materials was still preferable to traditional manufacturing methods, where different polymers are still used. Corporate aircraft average 75,000 miles per month. A single 3D-printed component can reduce air drag by 2.1%, cutting fuel costs by 5.41%. Additionally, producing jigs and fixtures through 3D printing can lower costs and lead times by 60 to 90% for each aircraft, as companies often have hundreds of these parts. Weight reduction is another significant benefit a 3D-printed metal bracket can weigh 50-80% less, saving around USD 2.5 million annually in fuel. Furthermore, 3D printing allows for precise material usage, leading to up to a 40% reduction in waste in metal applications

With more industries applying 3D printing for their operations, there was a growing need for appropriate materials that could have a high mechanical performance suitable for specific mechanical and functional requirements. This will also be particularly pronounced in the biomedical and healthcare industries, where 3D printing materials will become medical-grade and applicable to prosthetics, implants, and other biomedical devices.

KEY DRIVERS:

Driving Innovation in Manufacturing Through 3D Printing Materials and Digital Operations for Future Success

The increased application of digital manufacturing and Industry 4.0 is one of the key drivers of 3D printing materials’ growth. With more manufacturers opting for all-digital operations, there is a growing demand for materials that can work seamlessly with advanced 3D printing systems. A survey by Smartsheet found that about 40% of manufacturing companies are actively investing in 3D printing technologies and materials to enhance product design and reduce time-to-market. Indeed, the opportunity to reduce lead times of production cycles, as well as to create products that are extremely complex and customizable at once, is hard to ignore. Thus, material suppliers have to adjust to the changing operational patterns of many companies and develop formulations that are optimized for printing systems. For these industries that now have access to increased design freedom, it is critical to continue developing materials to suit the need for physical objects. Furthermore, companies are collecting data to analyze how the materials can be optimized, which implies that 3D printing materials will likely continue evolving as manufacturers learn how to improve different products’ properties. A study by MIT found that companies implementing 3D printing can reduce supply chain costs by 25-30% due to decreased transportation and inventory costs

Revolutionizing Manufacturing with Localized 3D Printing for Faster Production and Sustainable Practices

Mass production and shipment by some manufacturers and suppliers result in long supply chains that may be costly and can create delays. For example, after the introduction of the 3D printing technology to General Electric's process of producing the parts for jet engines, the number of details required to complete a fuel nozzle for a GE jet engine was reduced from 20 parts to one. In addition, the components were ready for delivery six times faster, with the entire lead time decreasing from 30 weeks to only 3. 3D printing is opening up opportunities to localize production so that parts and products can be produced on location at the given plant or factory. It is a development that fits with the aerospace industries or automotive sectors. As these industries increasingly wish to complete prototyping as rapidly as possible, and even on-site, there is a call for advanced materials that can be used in innovative 3D printing systems. Aerospace and automotive manufacturers will need to keep various components to match the chart covering all possible malfunctions and accidents. Airbus uses 3D printing in the production of some of its aircraft parts. The company has reportedly determined that lead times for specific components manufactured with this technology are decreased by 90% from the normal methods. According to forecasts, by 2030, Airbus will have integrated additive manufacturing when producing 20% of its parts.

RESTRAIN:

Overcoming Material Limitations and Quality Challenges to Unlock 3D Printing's Full Potential in Industries

The list of materials suitable for printing seems only to be expanding, many high-performance materials are still underdeveloped, and thus, their use is limited. As a result, certain industries, such as aerospace or medicine, struggle to utilize 3D printing for all components. Approximately 40% of manufacturers identified material constraints as a major impediment to the adoption of 3D printing technologies. Although the 3D printing materials market will be growing, only 15-20% are high-performing materials. Such a low amount of 3D printing materials can be used for different kinds of applications such as aerospace, and medical. Furthermore, the quality of the items remains questionable at best. The items created via 3D printing can vary in quality significantly, making them a potential concern in cases when the safety requirements must be met. Finally, although considerable advancements have been made in the realm of 3D printing, the high demand for skilled workers persists. With the complexity of the operation of 3D printing devices and the knowledge of materials required for the purpose, the staff should first obtain comprehensive training. Furthermore, the compatibility with the existing regulations in the realm of quality Management standards is a concern. In the context of aviation, for instance, every detail of an aircraft must be tested and certified by the appropriate authorities. Minding the above-mentioned facts is imperative to promote the further adoption and integration of the technology in other sectors.

BY OUTLOOK

Photopolymers segment dominated the total market share of 39.4% in 2023, and this industry is presently growing because of several factors. The material is in great demand since it can create the most intricate models, prototypes, and end-use objects. Furthermore, their superb resolution allows for obtaining highly detailed structures of relatively small sizes, which is useful in many industries, such as dentistry, jewelry, electronics, and others. Finally, they are both easy to use and convenient due to their quick curing time and ability to create smooth finishes. Thus, high-precision applications where such materials are in demand allow it to be the leading resin at the moment.

The thermoplastic segment is expected to grow at a high CAGR for 2024-2032. Organic chemicals encompassing synthetic polymers make this group of resins familiar to many and multifunctional. Its excellent mechanical properties and high tensile strength provide greater flexibility and durability, which is why such material is used for creating a wide range of objects, such as functional prototypes and end-use objects. The growing automotive, aerospace, and consumer goods industries require materials resistant to high temperatures or mechanical stress, which thermoplastics can provide. Additionally, the increasing demand for environmentally friendly materials is likely to enhance the demand for thermoplastics, creating some of the most significant market growth.

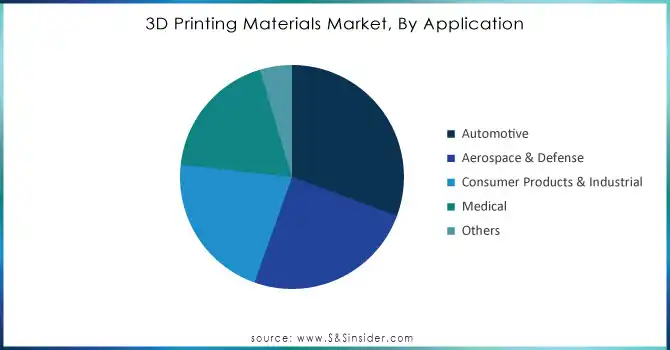

BY APPLICATION

The automotive segment dominated the 3D printing materials market with a market share of 30.6% in 2023, the automotive industry is adopting 3D printing due to the increased usage of this technology in prototyping, tooling, and manufacturing of end-use parts. Moreover, 3D printing facilitates the design process and reduces the design to a product lead time, physical waste, and cost. In emerging markets such as BRIC, automotive manufacturers are developing composite thermosetting parts, bumpers, and other automotive parts made from composites. Additionally, the trend of lightweight parts for achieving efficiency in performance is gaining the utmost importance in the manufacturing of components.

The aerospace and defense segment is expected to experience the highest growth from 2024 to 2032. First, the aerospace industry increasingly embraces 3D printing to produce complex components with reduced weight, which is crucial for improving fuel efficiency and performance. The ability to manufacture parts on demand significantly enhances supply chain efficiency and reduces the need for large inventories. Moreover, stringent regulations in the aerospace sector necessitate continuous innovation in materials that meet safety and performance standards. As manufacturers look to push the boundaries of design and functionality, they are increasingly turning to advanced 3D printing materials, including high-performance metals and polymers.

Need Any Customization Research On 3D Printing Materials Market - Inquiry Now

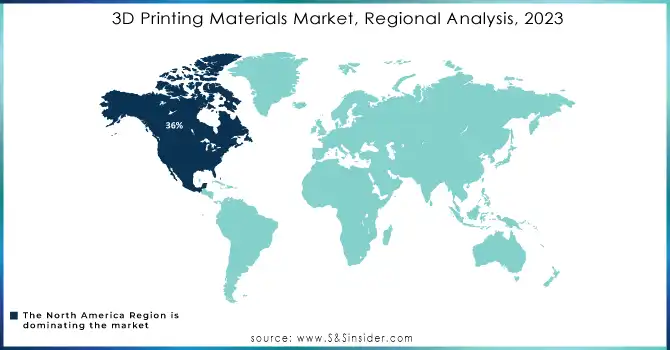

North America held a dominant market share of 36% in 2023 in the 3D printing materials market, which can be attributed to its highly developed manufacturing infrastructure and considerable investments in research and development. It is also the home to many key players and innovative companies that lead and contribute to the development of 3D printing technologies. For instance, the United States is a hub for the global market leader in 3D printing solutions, Stratasys, which has been at the forefront of new material development and new applications in the automotive and aerospace industries. Moreover, the presence of car giants such as Ford and General Motors in North America has given strength to the adoption curve of 3D printing for prototype as well as production purposes, making North America a market leader in the region.

The Asia Pacific region will be the fastest-growing in the 3D printing materials market based on the provided forecast for the period from 2024 to 2032. In particular, such an increase can be explained by the growing demand for additive manufacturing in various industries, primarily in China and Japan. In China, for instance, SANY Heavy Industry, a company that produces construction machinery, has adopted 3D printing technology to develop large machinery parts. It has helped the firm to accelerate prices and reduce costs hours away from producing Iwabuchi, 2021). As for Japan, the country is one of the leaders in manufacturing and invests greatly in developing advanced technologies of production. For instance, Mitsubishi is now leveraging 3D printing in the production of pieces for its airplanes, which also enhances their efficiency and prospects for customization.

Some of the major players in the 3D Printing Materials Market are:

Stratasys (ABS, PLA)

3D Systems (SLA Resin, Nylon)

EOS (PA12, AlSi10Mg)

Materialise (Magenta, MJP Resin)

HP (Nylon 12, TPU)

Formlabs (Tough Resin, Grey Resin)

Ultimaker (PLA, Nylon)

Sabic (ULTEM 9085, PETG)

Arkema (Rilsan, Kepstan)

BASF (Ultrafuse PLA, Ultrafuse TPU)

SABIC (Lexan, ULTEM)

Mitsubishi Chemical (Filament, Resin)

LG Chem (Polycarbonate, ABS)

Eastman Chemical Company (Tritan, Amphora)

RTP Company (RTP 3000, RTP 6000)

Nexa3D (Xtreme 8K Resin, XCE White Resin)

Xerox (Xerox 3D Printing, Filament)

Polymaker (PolyMax PLA, PolySupport)

ColorFabb (ColorFabb PLA, ColorFabb PETG)

Reprapper (ABS, PLA)

Axtra 3D

BASF

Dow Chemical

Evonik Industries

DuPont

Solvay

Eastman Chemical

PolyOne

Mitsubishi Chemical

LG Chem

Sabic

In 2024, Axtra3D revolutionizes vat polymerization by merging digital light processing with laser stereolithography, achieving precise edges, superior finishes, and high throughput. These capabilities make it a standout choice for applications like molds and casting.

At Formnext 2024, HP introduced significant advancements in additive manufacturing (AM), including new materials, workflow optimization tools, and enhanced metal printing capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.8 Billion |

| Market Size by 2032 | USD 20.53 Billion |

| CAGR | CAGR of 24.81% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Outlook (Photopolymers, Thermoplastic, Metals, Others), • By Application (Automotive, Aerospace & Defense, Consumer Products & Industrial, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stratasys, 3D Systems, EOS, Materialise, HP, Formlabs, Ultimaker, Sabic, Arkema, BASF, SABIC, Mitsubishi Chemical, LG Chem, Eastman Chemical Company, RTP Company, Nexa3D, Xerox, Polymaker, ColorFabb, Reprapper |

| Key Drivers | • Driving Innovation in Manufacturing Through 3D Printing Materials and Digital Operations for Future Success • Revolutionizing Manufacturing with Localized 3D Printing for Faster Production and Sustainable Practices |

| Restraints | • Overcoming Material Limitations and Quality Challenges to Unlock 3D Printing's Full Potential in Industries |

Ans: The 3D Printing Materials Market is expected to grow at a CAGR of 24.81% during 2024-2032.

Ans: 3D Printing Materials Market size was USD 2.8 billion in 2023 and is expected to Reach USD 20.53 billion by 2032.

Ans: The major growth factor of the 3D Printing Materials Market is the increasing demand for customized and complex designs across various industries, including aerospace, automotive, and healthcare.

Ans: The Photopolymers segment dominated the 3D Printing Materials Market in 2023.

Ans: North America dominated the 3D Printing Materials Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 3D Printing Materials Sustainability Metrics, by Region, (2020-2023)

5.2 3D Printing Materials Pricing Trends, by Region, (2020-2023)

5.3 3D Printing Materials Technological Adoption Rates, by Region

5.4 3D Printing Materials Supply Chain Metrics, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. 3D Printing Materials Market Segmentation, By Outlook

7.1 Chapter Overview

7.2 Photopolymers

7.2.1 Photopolymers Market Trends Analysis (2020-2032)

7.2.2 Photopolymers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Thermoplastic

7.3.1 Thermoplastic Market Trends Analysis (2020-2032)

7.3.2 Thermoplastic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Metals

7.4.1 Metals Market Trends Analysis (2020-2032)

7.4.2 Metals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. 3D Printing Materials Market Segmentation, by Application

8.1 Chapter Overview

8.2 Automotive

8.2.1 Automotive Market Trends Analysis (2020-2032)

8.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Aerospace & Defense

8.3.1 Aerospace & Defense Market Trends Analysis (2020-2032)

8.3.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Consumer Products & Industrial

8.4.1 Consumer Products & Industrial Market Trends Analysis (2020-2032)

8.4.2 Consumer Products & Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Medical

8.5.1 Medical Market Trends Analysis (2020-2032)

8.5.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Other Market Trends Analysis (2020-2032)

8.6.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America 3D Printing Materials Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.2.4 North America 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.2.5.2 USA 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.2.6.2 Canada 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.2.7.2 Mexico 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe 3D Printing Materials Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.1.5.2 Poland 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.1.6.2 Romania 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.1.7.2 Hungary 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.1.8.2 Turkey 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe 3D Printing Materials Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.4 Western Europe 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.5.2 Germany 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.6.2 France 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.7.2 UK 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.8.2 Italy 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.9.2 Spain 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.12.2 Austria 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific 3D Printing Materials Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.4 Asia Pacific 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.5.2 China 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.5.2 India 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.5.2 Japan 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.6.2 South Korea 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.2.7.2 Vietnam 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.8.2 Singapore 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.9.2 Australia 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East 3D Printing Materials Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.1.4 Middle East 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.1.5.2 UAE 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.1.6.2 Egypt 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.1.8.2 Qatar 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa 3D Printing Materials Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.2.4 Africa 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.2.5.2 South Africa 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America 3D Printing Materials Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.6.4 Latin America 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.6.5.2 Brazil 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.6.6.2 Argentina 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.6.7.2 Colombia 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America 3D Printing Materials Market Estimates and Forecasts, By Outlook (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America 3D Printing Materials Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Stratasys

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 3D Systems

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 EOS

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Materialise

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 HP

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Formlabs

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Ultimaker

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Sabic

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Arkema

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 BASF

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Outlook

Photopolymers

Thermoplastic

Metals

Others

By Application

Automotive

Aerospace & Defense

Consumer Products & Industrial

Medical

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Temperature Sensor Market Size was valued at USD 7.30 Billion in 2023 and is expected to reach USD 12.03 Billion by 2032 and grow at a CAGR of 5.71% over the forecast period 2024-2032.

The OLED Market Size was valued at USD 46.25 Billion in 2023 and is expected to grow at a CAGR of 19.64% to reach USD 232.22 Billion by 2032.

The Intruder Alarm System Market size was valued at USD 2.52 Billion in 2023 and is expected to grow to USD 5.91 Billion at a CAGR of 9.9% By 2024-2032

The Rotary and RF Rotary Joints Market Size was valued at USD 1.61 Billion in 2023 and is expected to grow at 5.09% CAGR to reach USD 2.52 Billion by 2032.

The Vision Processing Unit Market Size was valued at USD 2.70 billion in 2023 and is expected to grow at a CAGR of 20.04% to reach USD 13.90 billion by 2032.

The Embedded Security Market Size was valued at USD 7.07 Billion in 2023 and is expected to grow at 6.60% CAGR to reach USD 12.52 Billion by 2032.

Hi! Click one of our member below to chat on Phone