Get More Information on 3D-printed Meat Market - Request Sample Report

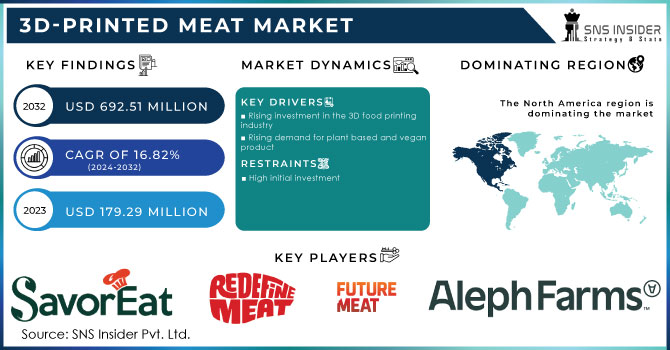

The 3D-printed Meat Market was valued at USD 179.29 million in 2023 and is expected to reach USD 692.51 million by 2032 and grow at a CAGR of 16.82% over the forecast period 2024-2032.

3D-printed meat is created by incubating animal stem cells in a bioreactor for a few weeks, where they grow and develop into muscle and fat cells. This cell filament is subsequently extruded into the shape and texture of meat before it is re-incubated and cooked.

According to the ingredients used to 'print' the meat, 3D-printed meat may or may not be vegetarian. Plant-based components such as soy, beets, pea protein, coconut fat, and chickpeas are used in the production of certain 3D-printed meat. Other types of 3D meat, also known as cultured meat, are created utilizing animal cells.

Based on type, the steak segment is estimated to grow rapidly in the forecast period as it could be used to create unique and innovative steak dishes for restaurants and other foodservice such as steak tartare made from 3D printed beef or steak fajitas made from 3D printed chicken. Steak segments are easily available at grocery stores and other retail outlets for consumers and sold directly to consumers.

KEY DRIVERS

Rising investment in the 3D food printing industry

3D printed meat does not require the slaughter of animals. This makes it a more morally responsible option to conventional meat production for customers who care about the treatment of animals. Meat products that are individualized and catered to specific dietary requirements can be produced using 3D printed meat. The development of 3D printed meat products is receiving significant funding from a number of venture capital firms and food companies. The development of 3D-printed meat is being accelerated by this financing. Millions of dollars have been raised by businesses like Aleph Farms and MeaTech 3D to produce and market their 3D printed meat products.

Rising demand for plant based and vegan product

RESTRAIN

High initial investment

Companies must invest in expensive equipment, such as 3D printers, bioreactors, and cell culture media, to manufacture 3D printed meat. They must also create their own recipes and techniques for growing and molding the meat. Because of the expensive initial expenditure, 3D printed meat companies have found it difficult to scale up their operations and bring their products to market on a wide scale. As a result, 3D printed beef remains a fairly specialized commodity, available only in a few restaurants and food service organizations.

OPPORTUNITY

Concern about animal welfare

Traditional meat production necessitates the slaughter of billions of animals each year. Many customers are becoming more aware of the moral ramifications of eating meat because this process can be brutal and immoral. A solution to enjoy the flavor and texture of meat without killing animals is provided by 3D printed meat. Cells from animal muscle tissue are cultured in a lab to create 3D printed meat. This indicates that no animals are killed to produce meat via 3D printing. Additionally, traditional meat production plays a significant role in environmental issues like climate change. The market for 3D printed meat is expanding since it is a more environmentally friendly method of producing meat.

CHALLENGES

consumers hesitate to try 3D printed meat

Some individuals may be unaware of the benefits of 3D printed meat. Because it is a new and unknown product. Some customers may be apprehensive to try new things, particularly when it comes to food. The safety and quality of 3D printed meat are currently being debated. Some customers may be apprehensive about the potential health dangers of 3D printed meat, or they may be confused about how it is manufactured. The cost of 3D printed beef remains higher than that of traditional meat. Some customers may be unwilling to pay a higher price for a new and untested product.

High cost of 3D printed meat

The Russia-Ukraine conflict has had an enormous effect on the food supply and the market for 3D printed meat. Global food prices have increased by 20% since the start of the war. The price of soybeans, another key ingredient in meat substitutes, has increased by 30%. Companies are finding it more difficult and expensive to make and market 3D printed meat products as prices rise. According to a recent Barclays analysis, the war might impede the growth of the 3D printed meat market by up to 25% by 2023.

The market for 3D printed meat has been hampered by the recession. The global market for meat replacements is likely to increase further as the vegan and vegetarian population grows. The rising awareness of the health benefits of 3D printed meat has fueled the 3D printed meat market. The technology for making 3D printed meat is quickly developing. In the following years, the cost of making 3D printed beef is likely to fall. According to a recent Barclays analysis, a recession might restrict the growth of the 3D printed meat market by up to 50% in 2023. Plant-based meat and cultured meat, which are normally less expensive than 3D printed meat, may become more competitive during a recession.

By Product Type

Beef

Pork

Poultry

Seafood

Exotic Meats

Blended Products

By Source

Plant-Based

Animal Cell-Based

By End User

Restaurants & Hotels

Fast-Food Chains

Specialty Stores

Institutions

Bakeries & Confectionaries

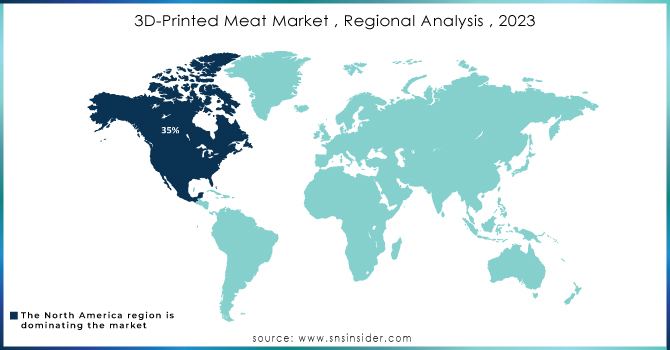

North America dominates the global 3D printed meat market in terms of a market share of 35% during the forecast period. Many companies in the area are engaged in the research & development and marketing of 3D-printed meat products. The market in North America is expanding as a result of rising consumer awareness of the advantages of 3D-printed meat, including its high nutritional content and capacity to meet the needs of vegetarians and vegans.

Europe's 3D-printed meat market accounts for 27% market share. The consumers in these regions have high disposable income and an increased demand for nutritious and environmentally friendly food products has driven the market growth. Furthermore, the presence of strong laws and regulations for the food business is encouraging market expansion in Europe.

Asia Pacific is predicted to be the fastest-growing market for 3D-printed meat. The region with a large growing population in countries like India and China and the rising disposable income and the increasing awareness about the benefits of 3D-printed meat are elevating the growth of the market. Consumers in this region prefer fresh meat and consumers hesitate to try 3D printed meat.

Need any customization research on 3D-printed Meat Market - Enquiry Now

REGIONAL COVERAGE

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the 3D-printed Meat Market are Redefine Meat, SavorEat, Future Meat, Aleph Farms, Shiok Meats, CellX., Meat-Tech 3D, Novameat, BlueNalu, Fork & Goode, Novameat, Believer Meats, and other key players.

In September 2023, Steakholder Foods Ltd., an international deep-tech food firm, is excited to introduce SH Beef Steak Ink, a breakthrough that will change the future of sustainable 3D printed meat manufacturing. The food technology industry is well-established in the region, and the market for alternative protein products is already very well-established. This ground-breaking ink, designed for use with the firm's fusion printer technology, aims to bring cultured meat to new heights of realism and gastronomic diversity.

In April 2023, Aleph Farms, an Israeli produced meat company, is set to introduce its first commercial product, a cultivated steak. The company has already secured a regulatory license for selling its product in Singapore and Israel, and both markets are slated to open later this year.

In January 2022, SavorEat announced a collaboration with the Israeli food company Osem to offer a new line of 3D-printed meat products made from plant-based materials. The items created with SavorEat's patented technology are intended to replicate the flavor and texture of genuine meat.

| Report Attributes | Details |

| Market Size in 2023 | US$ 179.29 Million |

| Market Size by 2032 | US$ 629.51 Million |

| CAGR | CAGR of 16.82 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Beef, Pork, Poultry, Seafood, Exotic Meats, Blended Products) • By Source (Plant-Based, Animal Cell-Based) •By End User (Restaurants & Hotels, Fast-Food Chains, Specialty Stores, Institutions, Bakeries & Confectionaries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Redefine Meat, SavorEat, Future Meat, Aleph Farms, Shiok Meats, CellX., Meat-Tech 3D, Novameat, BlueNalu, Fork & Goode, Novameat, Believer Meats |

| Key Drivers | • Rising investment in the 3D food printing industry • Rising demand for plant based and vegan product |

| Market Restrain | • High initial investment |

Ans: 3D-Printed Meat Market size was valued at USD 179.29 million in 2023.

Ans: 3D-Printed Meat Market is anticipated to expand by 16.82% from 2024 to 2032.

Ans: The rising investment in the 3D food printing industry and the rising demand for plant-based and vegan products are the drivers of the 3D-Printed Meat Market.

Ans: Consumers hesitate to try 3D printed meat and the high cost of 3D printed meat are the challenge of the 3D-printed Meat Market.

Ans: The North American region dominate the 3D-Printed Meat Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on Major Economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. 3D-Printed Meat Market Segmentation, By Type

8.1 Beef

8.2 Pork

8.3 Poultry

8.4 Seafood

8.5 Exotic Meats

8.6 Blended Products

9. 3D-Printed Meat Market Segmentation, By Source

9.1 Plant-Based

9.2 Animal Cell-Based

10. 3D-Printed Meat Market Segmentation, By End-user

10.1 Restaurants & Hotels

10.2 Fast-Food Chains

10.3 Specialty Stores

10.4 Institutions

10.5 Bakeries & Confectionaries

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America 3D-Printed Meat Market by Country

11.2.2 North America 3D-Printed Meat Market by Type

11.2.3 North America 3D-Printed Meat Market by Source

11.2.4 North America 3D-Printed Meat Market by End-user

11.2.5 USA

11.2.5.1 USA 3D-Printed Meat Market by Type

11.2.5.2 USA 3D-Printed Meat Market by Source

11.2.5.3 USA 3D-Printed Meat Market by End-user

11.2.6 Canada

11.2.6.1 Canada 3D-Printed Meat Market by Type

11.2.6.2 Canada 3D-Printed Meat Market by Source

11.2.6.3 Canada 3D-Printed Meat Market by End-user

11.2.7 Mexico

11.2.7.1 Mexico 3D-Printed Meat Market by Type

11.2.7.2 Mexico 3D-Printed Meat Market by Source

11.2.7.3 Mexico 3D-Printed Meat Market by End-user

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe 3D-Printed Meat Market by Country

11.3.1.2 Eastern Europe 3D-Printed Meat Market by Type

11.3.1.3 Eastern Europe 3D-Printed Meat Market by Source

11.3.1.4 Eastern Europe 3D-Printed Meat Market by End-user

11.3.1.5 Poland

11.3.1.5.1 Poland 3D-Printed Meat Market by Type

11.3.1.5.2 Poland 3D-Printed Meat Market by Source

11.3.1.5.3 Poland 3D-Printed Meat Market by End-user

11.3.1.6 Romania

11.3.1.6.1 Romania 3D-Printed Meat Market by Type

11.3.1.6.2 Romania 3D-Printed Meat Market by Source

11.3.1.6.4 Romania 3D-Printed Meat Market by End-user

11.3.1.7 Turkey

11.3.1.7.1 Turkey 3D-Printed Meat Market by Type

11.3.1.7.2 Turkey 3D-Printed Meat Market by Source

11.3.1.7.3 Turkey 3D-Printed Meat Market by End-user

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe 3D-Printed Meat Market by Type

11.3.1.8.2 Rest of Eastern Europe 3D-Printed Meat Market by Source

11.3.1.8.3 Rest of Eastern Europe 3D-Printed Meat Market by End-user

11.3.2 Western Europe

11.3.2.1 Western Europe 3D-Printed Meat Market by Type

11.3.2.2 Western Europe 3D-Printed Meat Market by Source

11.3.2.3 Western Europe 3D-Printed Meat Market by End-user

11.3.2.4 Germany

11.3.2.4.1 Germany 3D-Printed Meat Market by Type

11.3.2.4.2 Germany 3D-Printed Meat Market by Source

11.3.2.4.3 Germany 3D-Printed Meat Market by End-user

11.3.2.5 France

11.3.2.5.1 France 3D-Printed Meat Market by Type

11.3.2.5.2 France 3D-Printed Meat Market by Source

11.3.2.5.3 France 3D-Printed Meat Market by End-user

11.3.2.6 UK

11.3.2.6.1 UK 3D-Printed Meat Market by Type

11.3.2.6.2 UK 3D-Printed Meat Market by Source

11.3.2.6.3 UK 3D-Printed Meat Market by End-user

11.3.2.7 Italy

11.3.2.7.1 Italy 3D-Printed Meat Market by Type

11.3.2.7.2 Italy 3D-Printed Meat Market by Source

11.3.2.7.3 Italy 3D-Printed Meat Market by End-user

11.3.2.8 Spain

11.3.2.8.1 Spain 3D-Printed Meat Market by Type

11.3.2.8.2 Spain 3D-Printed Meat Market by Source

11.3.2.8.3 Spain 3D-Printed Meat Market by End-user

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands 3D-Printed Meat Market by Type

11.3.2.9.2 Netherlands 3D-Printed Meat Market by Source

11.3.2.9.3 Netherlands 3D-Printed Meat Market by End-user

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland 3D-Printed Meat Market by Type

11.3.2.10.2 Switzerland 3D-Printed Meat Market by Source

11.3.2.10.3 Switzerland 3D-Printed Meat Market by End-user

11.3.2.11.1 Austria

11.3.2.11.2 Austria 3D-Printed Meat Market by Type

11.3.2.11.3 Austria 3D-Printed Meat Market by Source

11.3.2.11.4 Austria 3D-Printed Meat Market by End-user

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe 3D-Printed Meat Market by Type

11.3.2.12.2 Rest of Western Europe 3D-Printed Meat Market by Source

11.3.2.12.3 Rest of Western Europe 3D-Printed Meat Market by End-user

11.4 Asia-Pacific

11.4.1 Asia-Pacific 3D-Printed Meat Market by Country

11.4.2 Asia-Pacific 3D-Printed Meat Market by Type

11.4.3 Asia-Pacific 3D-Printed Meat Market by Source

11.4.4 Asia-Pacific 3D-Printed Meat Market by End-user

11.4.5 China

11.4.5.1 China 3D-Printed Meat Market by Type

11.4.5.2 China 3D-Printed Meat Market by End-user

11.4.5.3 China 3D-Printed Meat Market by Source

11.4.6 India

11.4.6.1 India 3D-Printed Meat Market by Type

11.4.6.2 India 3D-Printed Meat Market by Source

11.4.6.3 India 3D-Printed Meat Market by End-user

11.4.7 Japan

11.4.7.1 Japan 3D-Printed Meat Market by Type

11.4.7.2 Japan 3D-Printed Meat Market by Source

11.4.7.3 Japan 3D-Printed Meat Market by End-user

11.4.8 South Korea

11.4.8.1 South Korea 3D-Printed Meat Market by Type

11.4.8.2 South Korea 3D-Printed Meat Market by Source

11.4.8.3 South Korea 3D-Printed Meat Market by End-user

11.4.9 Vietnam

11.4.9.1 Vietnam 3D-Printed Meat Market by Type

11.4.9.2 Vietnam 3D-Printed Meat Market by Source

11.4.9.3 Vietnam 3D-Printed Meat Market by End-user

11.4.10 Singapore

11.4.10.1 Singapore 3D-Printed Meat Market by Type

11.4.10.2 Singapore 3D-Printed Meat Market by Source

11.4.10.3 Singapore 3D-Printed Meat Market by End-user

11.4.11 Australia

11.4.11.1 Australia 3D-Printed Meat Market by Type

11.4.11.2 Australia 3D-Printed Meat Market by Source

11.4.11.3 Australia 3D-Printed Meat Market by End-user

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific 3D-Printed Meat Market by Type

11.4.12.2 Rest of Asia-Pacific 3D-Printed Meat Market by Source

11.4.12.3 Rest of Asia-Pacific 3D-Printed Meat Market by End-user

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East 3D-Printed Meat Market by Country

11.5.1.2 Middle East 3D-Printed Meat Market by Type

11.5.1.3 Middle East 3D-Printed Meat Market by Source

11.5.1.4 Middle East 3D-Printed Meat Market by End-user

11.5.1.5 UAE

11.5.1.5.1 UAE 3D-Printed Meat Market by Type

11.5.1.5.2 UAE 3D-Printed Meat Market by Source

11.5.1.5.3 UAE 3D-Printed Meat Market by End-user

11.5.1.6 Egypt

11.5.1.6.1 Egypt 3D-Printed Meat Market by Type

11.5.1.6.2 Egypt 3D-Printed Meat Market by Source

11.5.1.6.3 Egypt 3D-Printed Meat Market by End-user

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia 3D-Printed Meat Market by Type

11.5.1.7.2 Saudi Arabia 3D-Printed Meat Market by Source

11.5.1.7.3 Saudi Arabia 3D-Printed Meat Market by End-user

11.5.1.8 Qatar

11.5.1.8.1 Qatar 3D-Printed Meat Market by Type

11.5.1.8.2 Qatar 3D-Printed Meat Market by Source

11.5.1.8.3 Qatar 3D-Printed Meat Market by End-user

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East 3D-Printed Meat Market by Type

11.5.1.9.2 Rest of Middle East 3D-Printed Meat Market by Source

11.5.1.9.3 Rest of Middle East 3D-Printed Meat Market by End-user

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by Country

11.5.2.2 Africa 3D-Printed Meat Market by Type

11.5.2.3 Africa 3D-Printed Meat Market by Source

11.5.2.4 Africa 3D-Printed Meat Market by End-user

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria 3D-Printed Meat Market by Type

11.5.2.5.2 Nigeria 3D-Printed Meat Market by Source

11.5.2.5.3 Nigeria 3D-Printed Meat Market by End-user

11.5.2.6 South Africa

11.5.2.6.1 South Africa 3D-Printed Meat Market by Type

11.5.2.6.2 South Africa 3D-Printed Meat Market by Source

11.5.2.6.3 South Africa 3D-Printed Meat Market by End-user

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa 3D-Printed Meat Market by Type

11.5.2.7.2 Rest of Africa 3D-Printed Meat Market by Source

11.5.2.7.3 Rest of Africa 3D-Printed Meat Market by End-user

11.6 Latin America

11.6.1 Latin America 3D-Printed Meat Market by Country

11.6.2 Latin America 3D-Printed Meat Market by Type

11.6.3 Latin America 3D-Printed Meat Market by Source

11.6.4 Latin America 3D-Printed Meat Market by End-user

11.6.5 Brazil

11.6.5.1 Brazil 3D-Printed Meat Market by Type

11.6.5.2 Brazil 3D-Printed Meat Market by Source

11.6.5.3 Brazil 3D-Printed Meat Market by End-user

11.6.6 Argentina

11.6.6.1 Argentina 3D-Printed Meat Market by Type

11.6.6.2 Argentina 3D-Printed Meat Market by Source

11.6.6.3 Argentina 3D-Printed Meat Market by End-user

11.6.7 Colombia

11.6.7.1 Colombia 3D-Printed Meat Market by Type

11.6.7.2 Colombia 3D-Printed Meat Market by Source

11.6.7.3 Colombia 3D-Printed Meat Market by End-user

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America 3D-Printed Meat Market by Type

11.6.8.2 Rest of Latin America 3D-Printed Meat Market by Source

11.6.8.3 Rest of Latin America 3D-Printed Meat Market by End-user

12.Company profile

12.1 Redefine Meat

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 SavorEat

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Future Meat

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Shiok Meats

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Aleph Farms

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 CellX.

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Meat-Tech 3D

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Novameat

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 BlueNalu

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Fork & Goode

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Novameat

12.11.1 Company Overview

12.11.2 Financials

12.11.3 Product/Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 Believer Meats

12.12.1 Company Overview

12.12.2 Financials

12.12.3 Product/Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Nuts Market Report Scope & Overview: Nuts Market Size was value

The Phytosterols Market Size was esteemed at USD 0.87 billion out of 2022 and is supposed to arrive at USD 1.64 billion by 2030, and develop at a CAGR of 8.2% over the forecast period 2023-2030.

The UHT Processing Market size was USD 4.6 billion in 2023 and is expected to reach USD 8.2 billion by 2032 and grow at a CAGR of 6.6% over the forecast period of 2024-2032.

The Fruit and Vegetable Processing Market size was USD 8.59 billion in 2022 and is expected to Reach USD 14.0 billion by 2030 and grow at a CAGR of 6.3% over the forecast period of 2023-2030.

The Culinary Sauces Market size was USD 45.43 billion in 2022 and is expected to Reach USD 59.82 billion by 2030 and grow at a CAGR of 3.5 % over the forecast period of 2023-2030.

The Hominy Feed Market size was USD 1.27 billion in 2023, is expected to Reach USD 2.29 billion by 2032, and grow at a CAGR of 6.8% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone