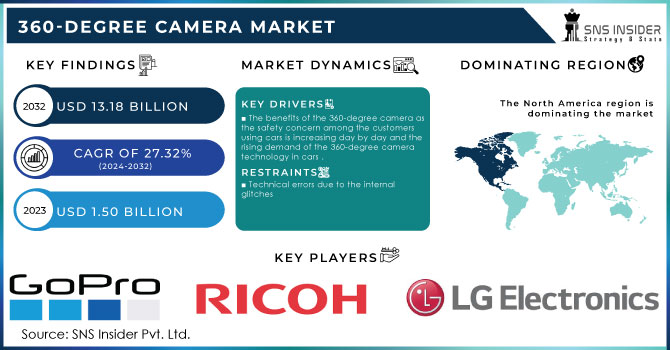

The 360-degree Camera Market size was valued at USD 1.50 billion in 2023 and is expected to reach USD 13.18 billion by 2032 and grow at a CAGR of 27.32% over the forecast period 2024-2032.

Get more information on 360-Degree Camera Market - Request Sample Report

The 360-degree camera market is growing rapidly, driven by the increasing demand for immersive content across industries such as real estate, education, tourism, and entertainment. Businesses are adopting 360-degree videos and virtual tours to enhance marketing strategies, boost engagement, and improve conversion rates. For instance, virtual tours are known to increase property sales by 30%, while infographics can enhance website traffic by 12%, fostering stronger customer relationships. The market’s expansion is further propelled by advancements in technology, including LiDAR integration and AI capabilities, which enable higher-resolution videos and seamless user experiences. These innovations make 360-degree cameras essential tools for delivering engaging content. With 65% of people identified as visual learners and 90% of information processed visually, the use of such tools is becoming indispensable for effective communication and storytelling.360-degree content creates interactive environments that improve learning outcomes by providing practical, hands-on experiences. According to C-I Studios, this approach makes training more engaging and impactful. Similarly, the entertainment industry, particularly gaming and immersive storytelling, has embraced these cameras to captivate audiences and offer enhanced engagement.

The tourism sector also benefits significantly, as immersive 360-degree experiences allow potential travelers to explore destinations virtually, influencing their decisions. Businesses in these sectors are leveraging personalized marketing campaigns powered by 360-degree content, leading to higher conversion rates and better customer retention.The growing reliance on visual storytelling, coupled with technological advancements, positions the 360-degree camera market for sustained growth as businesses increasingly focus on creating immersive experiences to connect with audiences and enhance their market presence.

Market Dynamics

Drivers

The growing demand for 360-degree cameras in construction, marketing, and immersive technologies is driving market expansion

The 360-degree camera market is witnessing significant growth due to its transformative impact on project management, marketing, and immersive technology solutions. In the construction sector, 72% of professionals use these cameras for project oversight, with 54% leveraging them for building design and 51% for construction monitoring. Despite their utility, challenges like low image quality (30%), cumbersome sharing processes (28%), and limited capture range (26%) have spurred advancements in imaging technology. These improvements address industry needs for enhanced visualization and seamless integration into workflows.A clear distinction between CGI-based virtual reality and 360 videos has also fueled adoption, with the latter offering a comprehensive spatial perspective crucial for immersive technology projects. By enabling effective planning for VR/AR integrations, 360-degree cameras are becoming indispensable across industries. For architecture, engineering, and construction (AEC) professionals, nearly 50% rely on these cameras for documentation, boosting collaboration and minimizing errors. Platforms like CloudPano empower businesses to create self-guided virtual tours, enhancing customer engagement and operational transparency. These innovations extend the application scope of 360-degree cameras into areas like immersive storytelling and real estate, driving higher engagement and improving decision-making. The continuous refinement of features, such as extended capture ranges and seamless sharing capabilities, further solidifies their role in modern workflows.By addressing technological limitations and bridging gaps in visualization, 360-degree cameras are revolutionizing multiple sectors, from construction to marketing, ensuring a robust market trajectory and fostering innovation.

Restraints

Challenges in integrating 360-degree cameras include synchronization issues, camera calibration, platform compatibility, and the need for high data transfer.

Integrating 360-degree cameras into systems presents significant challenges, particularly in areas like hardware and software synchronization, which are critical for accurate data capture. While software synchronization works well in static settings, real-time applications, such as those in construction or robotics, require more complex hardware synchronization. Additionally, selecting the correct camera interface (e.g., MIPI vs. USB) and ensuring compatibility with platforms like NVIDIA Jetson is essential for achieving optimal performance. Another hurdle is camera calibration, which is necessary to minimize distortion and ensure seamless image stitching. Furthermore, camera placement and supporting infrastructure that can handle high data transfer rates are also significant challenges. These issues have particular relevance in industries like construction, where 360-degree cameras enhance project management, documentation, and remote monitoring, as well as facilitate real-time reporting and site inspections. Incorporating these cameras into a workflow offers notable benefits, including increased efficiency, time savings, and cost reduction. However, addressing the technical aspects of integration, such as selecting appropriate interfaces and calibrating cameras to prevent image distortion, is essential for smooth implementation. These advancements are helping professionals in the construction sector improve project management, streamline operations, and ensure accurate documentation of all stages of construction projects. As the use of 360-degree cameras becomes more prevalent in industries like construction, the need for seamless integration with existing systems becomes increasingly critical for maximizing their potential.

Segment Analysis

By Connectivity Type

The wireless segment dominates the 360-degree camera market, accounting for approximately 70% of the market share in 2023. This dominance is driven by the increasing preference for wireless connectivity, which provides greater flexibility and convenience in camera setup and operation. Wireless cameras offer the advantage of remote access, eliminating the need for physical connections and enabling easy integration with cloud-based systems. Additionally, the growing adoption of wireless technology in various industries, such as real estate, tourism, and event management, has further propelled the demand for wireless 360-degree cameras, as they facilitate real-time streaming, seamless communication, and enhanced user experience.

The wired segment in the 360-degree camera market is projected to be the fastest-growing segment from 2024 to 2032. This growth is attributed to the advantages of wired cameras in offering high quality, uninterrupted video streams, especially in professional settings that demand consistent performance. Wired cameras ensure stable connections with minimal risk of interference, making them ideal for real-time applications like live events, security, and surveillance. Additionally, the increasing demand for high-definition content and the need for reliable connectivity are key drivers of the wired segment's growth.

By Resolution

In 2023, the HD resolution segment dominates the 360-degree camera market, holding around 69% of the share. Regionally, North America leads the market due to technological advancements and a strong presence of key industry players. The demand for high-definition cameras is particularly strong in sectors such as real estate, media, and entertainment in the U.S. Meanwhile, the Asia Pacific region is witnessing rapid growth, driven by sectors like gaming and tourism. Europe is also seeing increased adoption as industries prioritize high-quality content creation. This regional growth is fueled by the rising demand for enhanced visual experiences.

The UHD (Ultra High Definition) segment is expected to be the fastest-growing segment in the 360-degree camera market from 2024 to 2032. This growth is driven by the increasing demand for superior image quality in industries such as entertainment, gaming, real estate, and virtual tours. UHD resolution offers more detailed and immersive experiences, which is especially appealing for applications requiring high-quality content. As technological advancements make UHD more accessible and affordable, its adoption is set to rise across various sectors, enhancing visual experiences and driving market expansion. This trend indicates a shift towards higher quality, professional-grade 360-degree cameras.

Regional Analysis

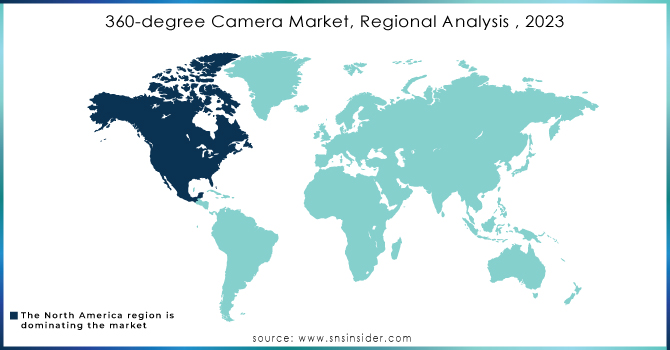

In 2023, North America held a dominant 40% share of the 360-degree camera market, primarily driven by technological advancements in sectors such as real estate, marketing, and entertainment. The United States, in particular, has emerged as a leader in adopting immersive technologies like virtual and augmented reality. With key industry players, infrastructure investments, and growing demand for virtual tours and immersive experiences, the region's market growth remains robust. North America's focus on innovation and its strong tech ecosystem significantly contribute to its market dominance, setting the stage for continued growth in the coming years.

Asia-Pacific is expected to be the fastest-growing region in the 360-degree camera market from 2024 to 2032, driven by rapid technological advancements in countries like China, Japan, and India. These nations are heavily investing in industries such as real estate, entertainment, and manufacturing, adopting immersive technologies like VR and AR. Additionally, the growing demand for high-quality content creation, virtual tours, and surveillance is propelling market growth. With improving infrastructure and a burgeoning consumer base, Asia-Pacific is positioning itself as a key player in the global 360-degree camera market.

Need any customization research on 360-Degree Camera Market - Enquiry Now

Key Players

Some of the major key players in 360-Degree Camera Market along with their product:

360fly (360fly 4K Camera)

Denso Corporation (360-degree cameras for automotive use)

Digital Domain Productions (Digital Domain 360 VR Cameras)

Freedom360 LLC (Freedom360 Camera)

GoPro (GoPro Max)

Insta360 (Insta360 One X2, Insta360 One R)

LG Electronics (LG 360 CAM)

Nikon (Nikon KeyMission 360)

PONONO (Professional 360 GmbH) (PONONO 360 Camera)

Ricoh (Ricoh Theta Z1)

Samsung Electronics (Samsung Gear 360)

Vuze Camera (Vuze XR)

Xiaomi (Xiaomi Mi Sphere 360 Camera)

YI Technology (YI 360 VR Camera)

Immervision (Immervision 360 Camera Solutions)

List of Suppliers who provide raw material and component for the 360-degree camera market:

Sony Corporation

LG Electronics

Panasonic Corporation

Samsung Electronics

Nikon Corporation

Canon

Sharp Corporation

Omnivision Technologies

STMicroelectronics

Qualcomm

Recent Development

October 15, 2024: The Nikon Nikkor Z 600mm F6.3 VR S is a lightweight, weather-sealed telephoto lens weighing 3.2 lbs. Its Phase Fresnel optics offer excellent image quality while minimizing weight. Although it lacks Arca-Swiss compatibility and 90-degree detent stops, it remains a top choice for wildlife photographers needing portability and performance.

July 19, 2024: The Xiaomi 360 Home Security Camera 2K features a 360° panoramic view and AI-powered human motion detection, It includes simple setup steps, a solid build, and a convenient design with a micro-USB port and microSD card slot for added functionality

| Report Attributes | Details |

| Market Size in 2023 | USD 1.50 Billion |

| Market Size by 2032 | USD 13.18 Billion |

| CAGR | CAGR of 27.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Connectivity Type (Wired, Wireless) • By Resolution (HD, UHD) • By Verticals (Automotive, Commercials, Military, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 360fly, Denso Corporation, Digital Domain Productions, Freedom360 LLC, GoPro, Insta360, LG Electronics, Nikon, PONONO, Ricoh, Samsung Electronics, Vuze Camera, Xiaomi, YI Technology, and Immervision are key players in the 360-degree camera market. |

| Key Drivers | • The growing demand for 360-degree cameras in construction, marketing, and immersive technologies is driving market expansion |

| Restraints | • Challenges in integrating 360-degree cameras include synchronization issues, camera calibration, platform compatibility, and the need for high data transfer. |

Ans: The 360-Degree Camera Market is growing at a CAGR of 27.32% over the forecast period 2024-2032.

Ans: The 360-Degree Camera market size was valued at USD 1.50 Billion in 2023.

Ans: The benefits of the 360-degree camera as the safety concern among the customers using cars is increasing day by day and the rising demand of the 360-degree camera technology in cars.

Ans: North America is dominating in 360-Degree Camera market

By Connectivity Type

By Resolution

By Verticals

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Connectivity Type

Wired

Wireless

By Resolution

HD

UHD

By Verticals

Automotive

Commercials

Military

Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Smart Home Security Market Size was valued at USD 72.42 billion in 2023 and is expected to grow at a CAGR of 9.96% to reach USD 169.63 billion by 2032.

The Carbon Dioxide (CO2) Monitors Market Size was valued at USD 622.14 million in 2023, and is expected to reach USD 1340.10 million by 2032, and grow at a CAGR of 8.9% over the forecast period 2024-2032

The Vibration Sensor Market Size was valued at USD 4.29 Billion in 2023 and is expected to reach USD 8.19 Billion by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

The Wireless Audio Device Market Size was USD 69.02 Billion in 2023 and will reach to USD 190.54 Billion by 2032 and grow at a CAGR of 11.99% by 2024-2032.

The Semi-Insulating Silicon Carbide Wafer Market Size was valued at USD 521.85 million in 2023 and is expected to grow at 20.20% CAGR During 2024-2032.

The Image Sensor Market size was valued at USD 25.12 billion in 2023 and is expected to grow to USD 50.77 billion by 2032 and grow at a CAGR of 8.13% over the forecast period of 2024-2032

Hi! Click one of our member below to chat on Phone