Veterinary Vaccines Market Size Analysis:

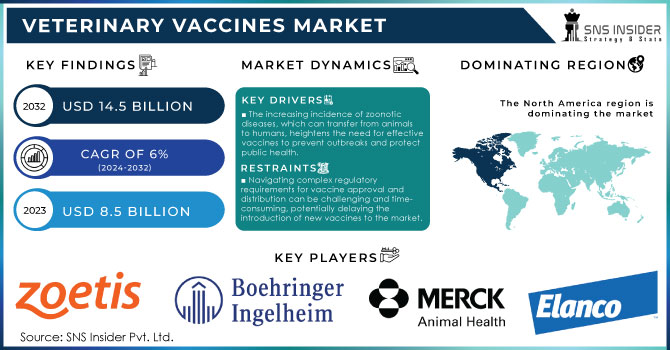

The veterinary vaccines market size was valued at USD 12.12 billion in 2024 and is expected to reach USD 19.06 billion by 2032, growing at a CAGR of 5.84% over 2025-2032.

Get More Information on Veterinary Vaccines Market - Request Sample Report

The veterinary vaccines market is growing at a significant CAGR due to an increase in the prevalence of zoonotic diseases, rising animal health expenditure, the growing incidence of livestock diseases, and the increased adoption of companion animals. Increased awareness of animal health, food safety, and the economic value of preventing diseases in animals is also working in the market's favour. Moreover, there is even more demand being stimulated in public ‘disease eradication’ programmes by governments, e.g., national vaccines. For instance, more than 70% of countries are currently reporting animal diseases to the World Organisation for Animal Health (WOAH), thereby indicating a global focus on veterinary disease surveillance.

In July 2025, Egypt’s new vaccine factory, the MEA region’s largest, seeks to reduce reliance on imports and support regional supply chains for veterinary vaccines, in a sign of movement towards local production and strategic independence.

Significant R&D investment and investments in infrastructure have led to the growth of the veterinary vaccines market, such as the launch of the largest veterinary vaccine production facility in Egypt to cater to the Middle East and Africa. Regulatory support is also strong EMA has recently proposed approval for the first Epizootic Haemorrhagic Disease vaccine, demonstrating favourable regulatory support. Higher investment in R&D, with a focus on recombinant & DNA vaccines, is adding to the veterinary vaccines market statistics, helping manufacturers develop novel products and helping to widen its veterinary vaccines market size by producing new products in different categories.

In July 2025, Qatar and Belarus declared a bilateral cooperation with respect to the development of vaccines and medicine for veterinarians, further strengthening the focus of the world on international vaccination collaboration and distribution in the veterinary vaccines market psychiatry sector.

Table: Emerging Trends in Veterinary Vaccines Market (2023–2025)

|

Trend Description |

Impact on Market |

Key Players/Regions Involved |

|

Surge in DNA and mRNA-based veterinary vaccine research |

Enhancing precision targeting and reducing side effects |

Zoetis, Merck, U.S., Germany |

|

Local manufacturing initiatives in the Middle East & Africa |

Reducing import dependence, boosting regional capacity |

Egypt, UAE, Qatar |

|

Integration of AI and biosensors in livestock vaccination programs |

Improving vaccine deployment and herd health monitoring |

Australia, China |

|

Expansion of companion animal vaccination campaigns |

Boosting demand in urban areas |

India, Brazil |

|

Supply chain disruptions and shortages in veterinary vaccines |

Raising concerns over availability and prompting localisation |

Russia, Eastern Europe |

Market Dynamics:

Drivers:

-

Rising Disease Burden, Technological Innovation, and Preventive Veterinary Care Fuel Market Expansion

The growth of the veterinary vaccines market is mainly driven by factors such as diseases among animals, increasing animal population and preventive concerns. With more than 60% of human infections of infectious diseases being zoonoses, the demand for animal vaccination has increased to avoid cross-species transmission.

Furthermore, livestock breeders are favouring vaccination to reduce losses and increase productivity, particularly in the poultry and dairy sectors. Emerging vaccine approaches, including viral and subunit vaccines, are receiving growing interest based on improved safety profiles and targeted efficacy. R&D has been attracting higher investment, as firms such as Zoetis and Elanco push the biologics pipeline further.

Global R&D investments in animal health currently surpass USD 1.5 billion per year and are driving innovation. On top of that, regulation has played a critical role in accelerating availability, with, for instance, the USDA’s green light for vaccines for both foot-and-mouth disease and African swine fever serving as evidence of supportive policies. Improved cold chain logistics and increasing veterinary infrastructure in developing nations are causing a demand-supply balance of pork. Moreover, the OIE (World Organisation for Animal Health) supports the use of such data-driven disease surveillance and vaccination strategies, which also augment the veterinary vaccines market growth and veterinary vaccines market size globally.

Restraints:

-

High Production Costs, Stringent Regulations, and Vaccine Hesitancy Hamper Market Growth

The veterinary vaccines market continues to face a number of challenges and barriers, including high production costs, stringent regulatory pathways, and vaccine reluctance among small-scale farmers. The development and production of vaccines for animals are expenses that must be capitalised and tend to be expenditure-intensive, owing to the complex biology of the pathogens as well as cold chain transportation and compliance with biosafety norms that hold true for human vaccines. Furthermore, stringent safety and efficiency testing is demanded by the authorities (e.g., EMA, USDA, etc.), which elongates the time-to-market by many years.

For instance, it can take 5–8 years to develop a new veterinary vaccine and cost millions before even getting to (or if you ever do) commercialisation. These barriers frequently keep smaller rivals away and stifle innovation. Farmers' wariness to vaccinate, whether due to misinformation, unawareness, or distrust of vaccines, also affects uptake in rural and low-income areas.

Supply-side barriers also limit its accessibility, including insufficient manufacturing capacity for patented vaccines and a challenging refrigeration chain. Trade embargos in times of an outbreak (e.g. avian influenza) frequently lead to interruptions in the supply chain and, as a result, delayed deliveries and immunisation campaigns. Post-market monitoring obligations also contribute to costs and the administrative burden for manufacturers. The combination of all of these factors serves to complicate analysis of the market for veterinary vaccines and impede the dissemination of new and advanced products to underserved markets.

Segmentation Analysis:

By Product

Based on product, the live attenuated vaccines segment had the biggest share of the veterinary vaccines market in 2024, covering 38.5% of the overall market. The vaccines do provide longer protection and require fewer booster doses, and are therefore more commonly used among veterinarians for cattle and pets. Their ability to manage highly pathogenic emerging diseases, including avian influenza and Newcastle disease, has driven demand. Nevertheless, recombination vaccines were the fastest growing segment owing to their high safety, precision targeting of pathogens, and ability to trace back infections from vaccinated animals (DIVA), particularly in terms of global trade maintenance and disease elimination efforts.

By Animal

By animal type, the livestock segment was the largest in 2024, with 60.3% of the veterinary vaccines market share. This is attributed to high demand for vaccination in cattle, poultry, and swine for food safety, with a decline in economic loss and a surge in meat and dairy product consumption. On the other hand, the companion animal segment is expanding at a rapid pace on account of escalating pet ownership, surging expenditure on pet health and an upsurge in the production of vaccines for dogs and cats.

By Route of Administration

Based on the route of administration, parenteral vaccines dominated the market in 2024 in terms of share. Due to their high bioavailability and accurate dose delivery, they are very well suited for mass vaccination, not least in organised herds and veterinarian environments. At the same time, the oral sector is expanding, based on the convenience of application (in particular in poultry) and increased convenience for pet animals. New encapsulation technology and thermostable oral formulations are also facilitating this pathway.

By Distribution Channel

By distribution channel, veterinary clinics took the lead with a market share of 34.7% in 2024, as they play an essential role in vaccine administration and aftercare. Pharmacies and drug stores are expected to register the fastest growth, due to growing retail presence in urban and semi-urban areas, coupled with rising consumer awareness and over-the-counter distribution of preventive veterinary solutions.

Regional Analysis:

North America was a major revenue contributor in 2024 due to the presence of established veterinary healthcare facilities, a high pet adoption rate, and a large number of livestock.

The U.S. veterinary vaccines market size was valued at USD 4.24 billion in 2024 and is expected to reach USD 6.22 billion by 2032, growing at a CAGR of 4.96% over 2025-2032. The U.S. led the market share in North America on account of a well-developed research infrastructure, regulatory support by the FDA, and rising uptake of advanced vaccines such as DNA and mRNA vaccines. The country presents one of the highest animal vaccination coverage rates in the world, which is a major factor determining the market growth. The U.S. accounted for more than 45% of the regional share in 2024. In addition, an increasing pet-care market and government-funded animal health programs are contributing to the growth in Canada. Mexico is experiencing moderate growth, with rising poultry and cattle farming and growing disease awareness.

Europe is the next largest followed region of the veterinary vaccine market, owing to government initiatives for eradication as well as prevention of animal diseases and a well-established veterinary healthcare infrastructure.

Germany led the European market with high-tech solutions for livestock monitoring, large R&D contribution and government support in the animal health technology space. Additionally, the European Medicines Agency (EMA)’s positive approval process for veterinary biologics takes place, with a significant impact on the availability of products. Following closely are France and the UK, with high levels of pet ownership combined with increased demand for companion animal vaccines. Rising interstate trade of livestock in the EU also supports the demand for vaccination to meet regional biosecurity standards. The EU’s Animal Health Law harmonised vaccine stipulations, reinforcing the efficiency of the production and distribution of vaccines between member states.

The Asia Pacific veterinary vaccines market is projected to be the fastest-growing, owing to the increasing livestock population, growing meat and milk consumption, and governmental support for the prevention of animal diseases.

China is a regional leader through its large livestock population, strong vaccination campaigns and growing investment in local vaccine production capacity. The country recently reported that it has stepped up its vaccine distribution networks in order to cover remote agrarian regions. India is fast growing owing to the presence of a large cattle and poultry sector and the increasing willingness of animal owners for preventive animal healthcare, supported by growing healthcare initiatives in the form of all-over animal vaccination programmes and growing R&D expenditure. Government initiatives such as NADCP (National Animal Disease Control Programme) to accelerate vaccine adoption are propelling the demand for vaccines. Japan and Australia are also contributors, and they share attention to pet health and sophisticated veterinary care systems.

Table: Veterinary Vaccine Shortage and Mitigation Efforts (Selected Countries, 2025)

|

Country |

Nature of Shortage |

Government/Industry Response |

|

Russia |

Acute shortage of veterinary biologics |

Calls for local production boost, expedited imports |

|

South Africa |

Delays in cold chain delivery |

Investment in cold storage infrastructure |

|

Indonesia |

Limited availability of recombinant vaccines |

Public-private partnerships to enhance access |

|

Brazil |

Seasonal surge in livestock immunisation demand |

Pre-positioning of inventory and mobile delivery units |

Key Players:

Leading veterinary vaccines companies in the market include Zoetis, Elanco, Merck Animal Health, Boehringer Ingelheim, Virbac, HIPRA, Ceva, NEOGEN, Hester Biosciences, and Phibro Animal Health.

Recent Developments/ Trends:

In July 2025, Qatar and Belarus initiated collaborative efforts to locally develop veterinary vaccines and enhance their joint response to animal epidemics, aiming to strengthen regional biosecurity and reduce reliance on imports.

In July 2025, over 500 dogs were vaccinated at NTR Veterinary Hospital in Andhra Pradesh on World Zoonosis Day, highlighting growing awareness and proactive public health measures to prevent zoonotic disease transmission.

In June 2025, Russia reported a severe shortage of animal vaccines, as noted by a leading veterinary association, raising concerns over livestock health and prompting calls for increased domestic production and imports.

| Report Attributes | Details |

| Market Size in 2024 | USD 12.12 billion |

| Market Size by 2032 | USD 19.06 billion |

| CAGR | CAGR of 5.84% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Inactivated, Live Attenuated, Recombinant, and Others) • By Animal (Companion (Feline, Canine, Avian, and Others), Livestock (Poultry, Porcine, Bovine, and Others) • By Route of Administration (Oral, Parenteral, and Others) • By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Zoetis, Elanco, Merck Animal Health, Boehringer Ingelheim, Virbac, HIPRA, Ceva, NEOGEN, Hester Biosciences, and Phibro Animal Health. |