The healthcare gamification market size was valued at USD 3.99 billion in 2024 and is expected to reach USD 21.59 billion by 2032, growing at a CAGR of 23.57% over the forecast period of 2025-2032.

The global healthcare gamification market is growing due to increasing demand for patient engagement, preventive care, and digital health solutions. The use of gamified platforms for fitness tracking and chronic condition management, medication adherence, and mental wellness is growing. By leveraging advancements in mobile, AI, and wearables, healthcare providers, payers, and pharmaceutical companies are using gamification to drive health outcomes.

The U.S. healthcare gamification market size was valued at USD 1.19 billion in 2024 and is expected to reach USD 6.31 billion by 2032, growing at a CAGR of 23.19% over the forecast period of 2025-2032.

The healthcare gamification market is dominated by the U.S. in North America due to the digital healthcare infrastructure and the adoption of fitness and wellness apps are high in the U.S., and major technology companies, and healthcare IT companies that are present in the country, also contribute to the growth of the healthcare gamification market in the region. Its position is being strengthened by the ubiquity of smartphones, wearables, and enabling reimbursement models.

In December 2024, Ginkgo Health released Ginkgo Active, a software application that used AI technology to track personalized training exercises and encourage a general sense of fitness. The app, for users facing motivation or chronic conditions, leverages AI and a 3D game engine to deliver personalized exercise prescriptions, mental well-being support, and continuous health tracking. It includes a virtual assistant called Professor Ginkgo, and virtual workout landscapes you can customize.

Drivers

Rising Penetration of Smartphones, Wearables, and Digital Health Apps to Drive Market Growth

As the number of smartphone users exploded and activity trackers, fitness trackers, and smartwatches were widely spread and used, there has been a development of gamified health applications. These make it possible to track real-time physical activity, heart rate, sleep, and other health indices. Gamified features include points, badges, challenges, and social interaction, incentivizing users to meet daily goals and develop healthy habits. The ease and availability of these tools are enticing, particularly to tech-savvy and younger generations.

There will be more than 1.1 billion people using them by 2024. It is a sign of just how fast consumers are embracing the devices to track their health. At that point of the adoption curve, whole new products and services can be made.

Increased Adoption of Digital Therapeutics and Remote Patient Monitoring is Driving the Market for Providers

Healthcare gamification market trends are being incorporated more and more into digital therapeutics and remote patient monitoring approaches to help improve management of chronic disease and provide greater access to long-term care. For instance, people suffering from diabetes or hypertension can use gamified applications to record their vitals, get medication reminders, and even win rewards if they comply. These are sometimes linked up to remote monitoring devices that healthcare professionals can use to monitor progress and, if necessary, intervene. Through combining engagement with clinical oversight, gamification increases patient satisfaction as well as health metrics in virtual care environments.

Restraints:

Data Privacy and Security Concerns Hamper the Growth of the Market

One of the main drawbacks of the healthcare gamification market growth is the possible incidence of data leakage and personal health information misuse. Wellness gamified apps and platforms often have enormous data about the user available, from biometrics, activity, mental health, medication use, and others. Unencrypted or unprotected data such as this can be exposed to hacking or unauthorized access.

Many of the apps being gamified are developed by third-party tech companies, many of which may not be fully bound by healthcare rules such as the U.S.'s HIPAA (Health Insurance Portability and Accountability Act) or, in Europe, the GDPR (General Data Protection Regulation). And the users might not always know what’s happening to their data, where it is being stored, with whom it is shared, and how it is being monetised, leading to questions of trust. Considering the increasing relevance of data privacy globally, these privacy and security barriers have prevented the broader adoption of gamified solutions in the healthcare industry.

By Type

The exercise game segment dominated the healthcare gamification market share with a 45.22% in 2024 on account of the rising usage of fitness and wellness applications that motivate physical activity with the help of interactive and goal-oriented functionalities. These gamified application programs have proven to be effective in incentivizing people to remain active, monitor progress, and keep up their good habits, which has resulted in widespread adoption of the programs in preventive care and corporate wellness programs in developed and developing regions.

The casual game segment is projected to record the highest CAGR during the forecast period due to the overall accessibility, simple usage, and its ability to cater to a larger audience, which includes seniors and non-tech enthusiasts. These games are meant to embed health messages, behavior change techniques, and educational information into easy and fun packaging. As people become more aware and increasingly more anxious about mental health, stress relief, and healthy living, casual games and applications that promote relaxation, cognition, well-being, and actively seek to promote mental health are getting more traction. Given their potential to drive health literacy and daily use, they will be rapidly adopted by consumer-facing digital health platforms.

By Application

The education/training of the physician segment dominated the healthcare gamification market in 2024 with a 36.28% market share due to the cause of gamification in medical education can foster knowledge and decision-making in medical providers and occupational therapy practitioners by simulating clinical scenarios and procedural tasks. Adaptive systems are increasingly being developed in multiple medical specialties so that gamified platforms can now be well integrated within healthcare institutions and academic settings to support lifelong learning. They also have demonstrable learning outcomes and are effective in delivery and implementation within health systems globally.

The fastest-growing segment during the forecast period is expected to be gamification in clinical trials, due to the demand to enhance patient recruitment, engagement, and retention in clinical investigations. Features that make use of gamified concepts, such as progress monitoring, rewards, and interactive activities, can increase motivation and adherence to trial procedures. As trials become more complex, and the associated price of patient dropout becomes more expensive, sponsors and CROs are more frequently looking to gamification to run trials smoothly and accurately. Digitalization of clinical trials and increasing focus on patient centricity are driving increased penetration of gamified solutions in this space.

By End-Use

The enterprise-based segment led the healthcare gamification market in 2024 with a 61.25% market share, owing to the high acceptance of these solutions among healthcare providers, pharmaceutical companies, insurers, and wellness program providers. Health enterprises use gamified solutions to increase employee wellness, improve clinician training, increase medication adherence, and engage customers in chronic disease care. They gain from structured implementation, data analysis, and interfacing with existing healthcare IT systems.

The consumer-based segment is projected to grow at the fastest CAGR during the forecast period, owing to the rise in health awareness, smartphone adoption, and increasing fitness and wellness app usage. Consumers are looking for fun and personalized ways to manage their health, all aspects of health, ranging from mental well-being and fitness tracking to nutrition and medication reminders. The growing use of wearables and game-based apps that offer rewards, challenges, and easy monitoring of progress is making health management more approachable and motivating.

North America dominated the healthcare gamification market with a 40.43% market share in 2024, primarily driven by the well-established healthcare infrastructure, high digital literacy, and early uptake of the latest health technologies in the region. The area is home to power players in both healthcare and tech, which allows for the fast creation and adoption of the gamified solutions for fitness, chronic disease, and mental health. Further, favorable government welfare, reimbursement policies, and the adoption of mobile devices and wearable devices are also driving the market expansion in the North American region.

The healthcare gamification market analysis in Asia Pacific is growing significantly due to rising smartphone penetration, growing healthcare awareness, and a large pool of lifestyle disease-affected population. Countries such as China, India, Japan, and South Korea are making massive investments in the digital health infrastructure and are driving patient-centric care. With a younger tech-savvy base and increasing popularity of fitness and wellness homily apps, the region remains a hotspot for gamification adoption across consumer and enterprise healthcare.

Europe is projected to be a significantly growing region in the healthcare gamification market due to strong digital health implementation, increasing focus on preventive care, and a huge prevalence of chronic diseases. Health and wellness gamification is finding a place of interest in countries such as Germany, the U.K., and Spain, where innovative solutions using game mechanics are being accepted, especially in physical rehabilitation, mental wellness, and chronic disease. Growing government support, adoption of wearable devices, and penetration of gamification in public health programs are some of the other factors fueling the market growth in the region.

The Latin America and the Middle East & Africa (MEA) healthcare gamification market is registering a modest pace of expansion on account of the rising penetration of mobile and internet. Latin America is turning to gamified health apps for the management of chronic diseases and health programs as consumer interest in physical fitness and preventive care grows. Similarly, the adoption of gamification to promote employee wellness programs and patient participation is at a nascent stage in the MEA in countries such as Saudi Arabia and the UAE, but lags behind developed regions.

The healthcare gamification companies include Fitbit, Ayogo Health, Mango Health, EveryMove, Akili Interactive Labs, Bunchball, CogniFit, Microsoft, Nike, Google, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.99 Billion |

| Market Size by 2032 | USD 21.59 Billion |

| CAGR | CAGR of 23.57% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Exercise Game, Serious Game, Casual Game) • By Application (Education/Training of Physicians, Education/Training of Hospital Staff, Commercial Gains for Patients, Pharmaceutical Sales Training, Insurance Companies Using Gamification, Gamification in Clinical Trials) • By End Use (Enterprise Based, Consumer Based) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Fitbit, Ayogo Health, Mango Health, EveryMove, Akili Interactive Labs, Bunchball, CogniFit, Microsoft, Nike, Google, and other players. |

Ans: The Healthcare Gamification Market is expected to grow at a CAGR of 23.57% from 2025 to 2032.

Ans: The Healthcare Gamification Market was USD 3.99 billion in 2024 and is expected to reach USD 21.59 billion by 2032.

Ans: Increasing adoption of smartphones, wearables, and digital health applications to boost market growth.

Ans: Fitbit, Ayogo Health, Mango Health, EveryMove, Akili Interactive Labs, Bunchball, CogniFit, Microsoft, Nike, Google, and other players.

Ans: North America dominated the Healthcare Gamification Market in 2024.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 User Adoption & Engagement Rates (2024)

5.2 Gamified Application Usage Trends, by Region (2024)

5.3 Outcomes & Behavior Change Metrics (2020–2032)

5.4 Healthcare Payers & Provider Investment in Gamification (2024)

5.5 Gamification in Clinical Trials (2024–2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Healthcare Gamification Market Segmentation By Type

7.1 Chapter Overview

7.2 Exercise Game

7.2.1 Exercise Game Market Trends Analysis (2021-2032)

7.2.2 Exercise Game Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Serious Game

7.3.1 Serious Game Market Trends Analysis (2021-2032)

7.3.2 Serious Game Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Casual Game

7.4.1 Casual Game Market Trends Analysis (2021-2032)

7.4.2 Casual Game Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Healthcare Gamification Market Segmentation By Application

8.1 Chapter Overview

8.2 Education/Training of Physicians

8.2.1 Education/Training of Physicians Market Trend Analysis (2021-2032)

8.2.2 Education/Training of Physicians Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Education/Training of Hospital Staff

8.3.1 Education/Training of Hospital Staff Market Trends Analysis (2021-2032)

8.3.2 Education/Training of Hospital Staff Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Commercial Gains for Patients

8.4.1 Commercial Gains for Patients Market Trends Analysis (2021-2032)

8.4.2 Commercial Gains for Patients Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Pharmaceutical Sales Training

8.5.1 Pharmaceutical Sales Training Market Trends Analysis (2021-2032)

8.5.2 Pharmaceutical Sales Training Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Insurance Companies Using Gamification

8.6.1 Insurance Companies Using Gamification Market Trends Analysis (2021-2032)

8.6.2 Insurance Companies Using Gamification Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Gamification in Clinical Trials

8.7.1 Gamification in Clinical Trials Market Trends Analysis (2021-2032)

8.7.2 Gamification in Clinical Trials Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Healthcare Gamification Market Segmentation By End Use

9.1 Chapter Overview

9.2 Enterprise-Based

9.2.1 Enterprise-Based Market Trends Analysis (2021-2032)

9.2.2 Enterprise-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Consumer-Based

9.3.1 Consumer-Based Market Trends Analysis (2021-2032)

9.3.2 Consumer-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Healthcare Gamification Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.2.3 North America Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.2.4 North America Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.2.5 North America Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.2.6.2 USA Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.2.6.3 USA Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.2.7.2 Canada Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.2.7.3 Canada Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.2.8.2 Mexico Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.2.8.3 Mexico Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3 Europe

10.3.1 Trends Analysis

10.3.2 Europe Healthcare Gamification Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.3.3 Europe Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.4 Europe Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.5 Europe Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.6 Germany

10.3.6.1 Germany Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.6.2 Germany Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.6.3 Germany Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.7 France

10.3.7.1 France Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.7.2 France Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.7.3 France Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.8 UK

10.3.8.1 UK Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.8.2 UK Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.8.3 UK Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.9 Italy

10.3.9.1 Italy Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.9.2 Italy Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.9.3 Italy Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.10 Spain

10.3.10.1 Spain Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.10.2 Spain Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.10.3 Spain Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.11 Poland

10.3.11.1 Poland Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.11.2 Poland Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.11.3 Poland Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.12 Turkey

10.3.12.1 Turkey Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.12.2 Turkey Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.12.3 Turkey Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.3.13 Rest of Europe

10.3.13.1 Rest of Europe Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.3.13.2 Rest of Europe Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.3.13.3 Rest of Europe Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Healthcare Gamification Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.4.3 Asia Pacific Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.4 Asia Pacific Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.5 Asia Pacific Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.6.2 China Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.6.3 China Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.7.2 India Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.7.3 India Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.8.2 Japan Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.8.3 Japan Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.9.2 South Korea Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.9.3 South Korea Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4.10 Singapore

10.4.10.1 Singapore Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.10.2 Singapore Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.10.3 Singapore Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4.11 Australia

10.4.11.1 Australia Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.11.2 Australia Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.11.3 Australia Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.4.12 Rest of Asia Pacific

10.4.12.1 Rest of Asia Pacific Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.4.12.2 Rest of Asia Pacific Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.4.12.3 Rest of Asia Pacific Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Trends Analysis

10.5.2 Middle East and Africa Healthcare Gamification Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.5.3 Middle East and Africa Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.5.4 Middle East and Africa Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.5.5 Middle East and Africa Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.5.6 UAE

10.5.6.1 UAE Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.5.6.2 UAE Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.5.6.3 UAE Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.5.7 Saudi Arabia

10.5.7.1 Saudi Arabia Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.5.7.2 Saudi Arabia Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.5.7.3 Saudi Arabia Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.5.8 Qatar

10.5.8.1 Qatar Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.5.8.2 Qatar Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.5.8.3 Qatar Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.5.9 South Africa

10.5.9.1 South Africa Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.5.9.2 South Africa Healthcare Gamification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

10.5.9.3 South Africa Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.5.10 Rest of Middle East & Africa

10.5.10.1 Rest of Middle East & Africa Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.5.10.2 Rest of Middle East & Africa Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.5.10.3 Rest of Middle East & Africa Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Healthcare Gamification Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

10.6.3 Latin America Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.6.4 Latin America Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.6.5 Latin America Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.6.6.2 Brazil Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.6.6.3 Brazil Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.6.7.2 Argentina Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.6.7.3 Argentina Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

10.6.8 Rest of Latin America

10.6.8.1 Rest of Latin America Healthcare Gamification Market Estimates and Forecasts, by Type (2021-2032) (USD Billion)

10.6.8.2 Rest of Latin America Healthcare Gamification Market Estimates and Forecasts, by Application (2021-2032) (USD Billion)

10.6.8.3 Rest of Latin America Healthcare Gamification Market Estimates and Forecasts, by End Use (2021-2032) (USD Billion)

11. Company Profiles

11.1 Fitbit

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product/ Services Offered

11.1.4 SWOT Analysis

11.2 Ayogo Health.,

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product/ Services Offered

11.2.4 SWOT Analysis

11.3 Mango Health

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product/ Services Offered

11.3.4 SWOT Analysis

11.4 EveryMove

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product/ Services Offered

11.4.4 SWOT Analysis

11.5 Akili Interactive Labs,

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product/ Services Offered

11.5.4 SWOT Analysis

11.6 Bunchball

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product/ Services Offered

11.6.4 SWOT Analysis

11.7 CogniFit

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product/ Services Offered

11.7.4 SWOT Analysis

11.8 Microsoft

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product/ Services Offered

11.8.4 SWOT Analysis

11.9 Nike

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.10 Google

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

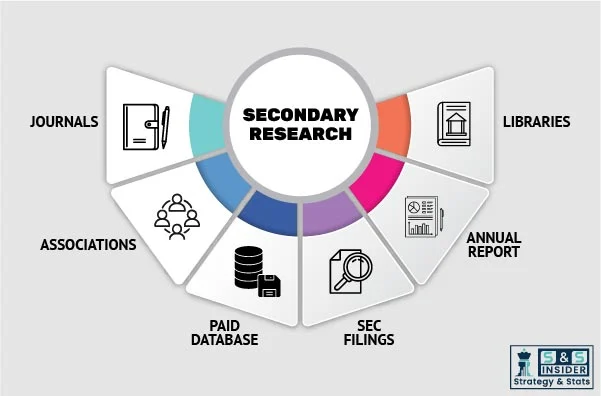

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Exercise Game

Serious Game

Casual Game

By Application

Education/Training of Physicians

Education/Training of Hospital Staff

Commercial Gains for Patients

Pharmaceutical Sales Training

Insurance companies using Gamification

Gamification in Clinical Trials

By End Use

Enterprise Based

Consumer Based

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g., Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players